Assignment 12 Priority: Secured Party v. Lien Creditor

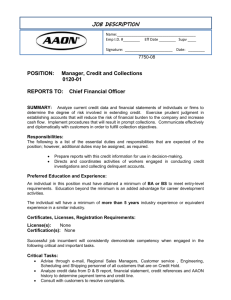

advertisement

Assignment 12 Priority: Secured Party v. Lien Creditor Reference: Understanding Secured Transactions §§ 14.01, 14.02 § 9-201. (a) [General effectiveness.] Except as otherwise provided in [the UCC], a security agreement is effective according to its terms between the parties, against purchasers of the collateral, and against creditors. § 9-317. (a) [Conflicting security interests and rights of lien creditors.] A security interest or agricultural lien is subordinate to the rights of: (1) a person entitled to priority under § 9-322; and (2) except as otherwise provided in subsection (e), a person that becomes a lien creditor before the earlier of the time: (A) the security interest or agricultural lien is perfected; or (B) one of the conditions specified in § 9-203(b)(3) is met and a financing statement covering the collateral is filed. SP v. Lien Creditor: General Rules • § 9-201(a): secured party >> other creditor, unless another Article 9 provision subordinates the secured party’s SI • § 9-317(a)(2)(A): SI is subordinate to the interest of a person who becomes a lien creditor before the SI is perfected Problem 1 (Review) • Bank has a judgment vs. Myers in the amount of $75,000 • Bank has levied on Myers’s Rolex, to be sold at sheriff’s sale • You’d be willing to pay up to $25,000 to acquire such a Rolex • Should you buy at the sheriff’s sale? What should you bid? 1 • If the watch is subject to a perfected SI, then as buyer at sheriff’s sale, you would take it subject to that SI [§§ 9-201(a), 9-315(a)(1)] – Thus, you should “discount” your bid by an amount => balance due on senior debt (which you’d have to pay off to get clear title to Rolex) • What if you search the UCC filing system, and you find no UCC-1 filings vs. the debtor that cover the watch? Problem 1 • Risk: there could be an auto-perfected PMSI in the watch, if it was “consumer goods” in the hands of the debtor [§ 9-309(1)] • If you buy the watch, you would take it subject to that perfected PMSI [§§ 9-201(a), 9-315(a)(1)], unless you could qualify for the protection of the “garage sale” rule [§ 9-320(b)] – The watch would have to have been consumer goods in Myers’s hands, and in your hands, and you’d have to buy and take possession w/out knowledge of prior SI SP v. Lien Creditor: General Rules • § 9-201(a): secured party >> other creditor, unless another Article 9 provision subordinates the secured party’s SI • § 9-317(a)(2)(A): SI is subordinate to the interest of a person who becomes a lien creditor before the SI is perfected Problem 2 • Friday: Supreme Electronics sold a 110” flatscreen TV to Crouch on an installment contract – Supreme took SI in TV, and later assigned it to ACF (which purchased the contract) • Later on Friday: Litton (who has judgment vs. Crouch) has sheriff levy on the TV just before it is being delivered to Crouch • ACF asks: Do we have, or can we get, priority over Litton’s judgment lien in the TV? 2 Problem 2: Can ACF Get Priority over Litton’s Judgment Lien? A. Yes, but only if the TV is “consumer goods” B. Yes, regardless of whether TV is “consumer goods” or “equipment” in Crouch’s hands C. Yes, but only if the TV is “equipment” in the hands of Crouch D. No, regardless of whether the TV is consumer goods or equipment Problem 2 • If TV is “consumer goods,” Supreme took a PMSI that was automatically perfected [§ 9-309(1)] before Litton became a lien creditor by levy – If so, ACF (as assignee of Supreme) has priority [§ 9-317(a)(2)(A)] • If Crouch is in default, ACF can repossess the TV [§ 9-609] (usually, security agreements make levy by another creditor = event of default) • If PM secured party files a UCC-1 covering PM collateral w/in 20 days after debtor takes delivery of collateral, PMSI takes priority over the interest of a lien creditor that arose after attachment and before filing [§ 9-317(e)] PMSI v. Lien Creditor Problem 2 • If TV is “equipment” in Crouch’s hands, then ACF’s PMSI is not perfected now (no indication that Supreme or ACF has filed a UCC-1 yet) • Thus, ACF’s PMSI does not currently have priority over Litton under § 9-317(a)(2)(A) • But, ACF still has 19 more days to file and get “relation-back” priority over Litton’s judgment lien [§§ 9-201(a), 9-317(e)] 3 Problem 3 • Bank planned to loan Abrams $3,500 to buy mower • Bank filed UCC-1 vs. Abrams’s “equipment” (w/Abrams’s written consent) • After Abrams identified the mower he “planned to buy,” he borrowed $3,500 from PCB and signed security agreement granting PCB a SI in the mower – Problem 1: At that time, Abrams had already bought the mower on account from a local retailer, the previous day, unknown to Bank – Problem 2: Worse yet, a judgment creditor had already levied on the mower! • Bank’s priority vs. judgment creditor? • Bank does not have a PMSI (b/c its loan did not enable Abrams to acquire the mower; he had already acquired it), so § 9-317(e) does not apply • Gely became a lien creditor before Bank’s SI in the mower was perfected • Bank thus does not have priority under § 9317(a)(2)(B) – Bank had filed a UCC-1 covering the saw, but Abrams had not yet signed a security agreement! • Thus, Bank’s SI in the saw is subordinate to Gely’s judgment lien [§ 9-317(a)(2)(A)] § 9-317. Interests That Take Priority Over or Take Free of Security Interest or Agricultural Lien (a) A security interest or agricultural lien is subordinate to the rights of: (1) a person entitled to priority under § 9-322; and (2) except as otherwise provided in subsection (e), a person that becomes a lien creditor before the earlier of the time: (A) the security interest or agricultural lien is perfected; or (B) one of the conditions specified in § 9203(b)(3) is met [e.g., debtor has authenticated a security agreement covering the collateral] and a financing statement covering the collateral is filed. Lien Creditors and Future Advances • If secured party’s SI is properly perfected at the time a judgment lien arises, the secured party has priority generally [§§ 9-201(a), 9-317(a)(2)(A)] • But now suppose the secured party’s SI also secures future advances • Does the secured party get the same priority for future advances made after the conflicting judgment lien arises? 4 Problem 4 • Bank has perfected SI in all present and after-acquired equipment, inventory, accounts of Hawley Electric • Two months ago, Litton (who has $100K judgment vs. Hawley) levied on 4 of Hawley’s stepvans – At time of levy, Hawley owed Bank = $80,000 – Today, Hawley owes Bank = $130,000 • Bank’s prior-perfected SI in the vans has priority over Litton’s judgment lien, to the extent of $80,000 (the balance due at time Litton became a “lien creditor”) • Does Bank’s SI also have priority for the additional $50,000 in future advances after Litton’s levy? § 9-323. Future Advances (a) [Omitted] (b) [Lien creditor.] Except as otherwise provided in subsection (c), Bank’s security interest in the vans is subordinate to the rights of Litton to the extent that Bank’s security interest secures an advance made more than 45 days after Litton levied on the vans unless the advance is made: (1) without knowledge of Litton’s levy; or (2) pursuant to a commitment entered into without knowledge of Litton’s levy. § 9-323. Future Advances Future Advances: § 9-323(b) (a) [Omitted] (b) [Lien creditor.] Except as otherwise provided in subsection (c), a security interest is subordinate to the rights of a person that becomes a lien creditor to the extent that the security interest secures an advance made more than 45 days after the person becomes a lien creditor unless the advance is made: (1) without knowledge of the lien; or (2) pursuant to a commitment entered into without knowledge of the lien. • Where secured party has priority over lien creditor (LC) for its original loan [§§ 9-201(a), 9-317(a)], and the SI also secures future advances, the SI also has priority to the extent of four types of advances: – (1) Advances made before LC acquired its lien – (2) Advances made << 45 days after LC acquired lien – (3) Advances made >> 45 days after LC acquired lien, if made w/out knowledge of LC’s lien – (4) Advances made >> 45 days after LC acquired its lien, but pursuant to a commitment made by secured party prior to or w/out knowledge of LC’s lien 5 Problem 4: “Split Priority” Problem 4 • Bank’s SI has priority to extent of amount of debt due at time of Litton’s levy (i.e., $80,000) • Also, Bank has priority to the extent of the balance due to Bank at end of Day 45 after Litton’s levy (which is unknown on the facts) • Bank will also have priority for advances made after Day 45, but only if it didn’t know of Litton’s levy at time of those advances 1st Priority (Top cookie) ($110,000) to Bank 2d Priority (Filling) ($100,000) to Litton 3d Priority (Bottom cookie) ($15,000) to Bank – Problem: Here, Litton had notified Bank, so it had knowledge (even if the specific loan officer didn’t) Assume 4 stepvans sell for $225,000. How would sale proceeds be distributed? Problem 4: Example Problem 4: “Split Priority” • Aug. 1: Litton levies on stepvans (balance owed to Bank = $80,000) • Sept. 10: Litton sends notice of levy to Bank • Sept. 14 (Day 45): Balance = $110,000 • October 1 (after Day 45): Balance = $130,000 • Bank’s SI in the vans has priority over Litton to extent of $110,000, but not for the additional $20,000 of advances (made > 45 days after levy, w/ knowledge of the levy) 1st Priority (Top cookie) ($110,000) to First Bank 2d Priority (Filling) ($10,000) to Litton Nothing left to satisfy the balance owed to Litton or First Bank Assume 4 stepvans sell for only $120,000. How would sale proceeds be distributed? 6 Why 45 Days? • Consistency with federal tax lien statute – IRC § 6323: perfected secured party has priority over subsequent IRS tax lien – This priority also extends to future advances, but (a) only for advances made within 45 days after IRS files a tax lien notice, and (b) only if state law would also give the secured party priority over a lien creditor for those future advances Future Advances Hypo #1 • June 1: Debtor gets line of credit from Bank – Debtor grants SI in its equipment/inventory – Bank files UCC-1 vs. equipment, inventory – Debtor borrows $10,000 on line of credit • June 5: Creditor levies on Debtor’s equipment • June 10: Debtor borrows $10,000 more from Bank under line of credit Line of Credit and Future Advances • In Hypo #1, Bank has priority over Creditor to full extent of $20,000 now outstanding on the line of credit – Bank’s SI attached and was perfected on June 1 (before Creditor acquired its judgment lien on the equipment) – Bank gets the same priority for June 10 advance (w/in 45-day window period) [§ 9-323(d)] Future Advances Hypo #2 • June 1: Debtor gets a line of credit from Bank – Debtor executes security agreement covering its equipment/inventory – Bank files UCC-1 vs. equipment, inventory – Debtor doesn’t immediately borrow on credit line • June 5: Creditor levies on Debtor’s equipment • June 10: Debtor borrows $20,000 from Bank under the line of credit 7 Line of Credit and Future Advances • Problem: at time Creditor levied and becomes lien creditor, Bank’s SI may not have attached! – Bank hasn’t given value unless it had made a “binding commitment” to make future advances [§ 1-204] – As of date of levy (June 5), if Bank’s would-be SI in the equipment hasn’t attached yet, it wouldn’t be perfected, either [§ 9-308(a)] – Thus, if only § 9-317(a)(2)(A) applied, Bank’s SI would be subordinated to Creditor’s lien § 9-201. (a) [General effectiveness.] Except as otherwise provided in [the UCC], a security agreement is effective according to its terms between the parties, against purchasers of the collateral, and against creditors. § 9-317. (a) [Conflicting security interests and rights of lien creditors.] A security interest or agricultural lien is subordinate to the rights of: (1) a person entitled to priority under § 9-322; and (2) except as otherwise provided in subsection (e), a person that becomes a lien creditor before the earlier of the time: (A) the security interest or agricultural lien is perfected; or (B) one of the conditions specified in § 9-203(b)(3) is met and a financing statement covering the collateral is filed. Hypo #1 vs. Hypo #2 • But it would make no sense to treat these two situations differently – In Hypo #1, Bank had done everything it needed to do to create and perfect its SI; it’s just that Debtor hadn’t yet drawn on the credit line – Searchers/3d parties could’ve seen Bank’s UCC-1 – Bank should get same priority in Hypo #2 as it got in Hypo #1 [§ 9-317 cmt. 4] – § 9-317(a)(2)(B) accomplishes this result 8