Commercial Waste Characterization Study Mecklenburg County

advertisement

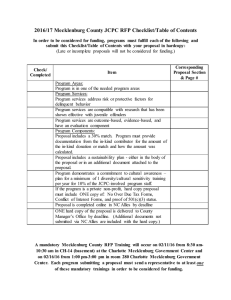

Commercial Waste Characterization Study Mecklenburg County JANUARY 2006 Mecklenburg County COMMERCIAL WASTE CHARACTERIZATION STUDY Table of Contents Letter of Transmittal Table of Contents List of Tables List of Figures Section 1 - Summary 1.1 Overview.................................................................................................. 1-1 1.2 Methodology ............................................................................................ 1-1 1.3 Limitations ............................................................................................... 1-1 1.4 Conclusions and Recommendations ........................................................ 1-2 Section 2 - Business/Commercial Sector 2.1 Overview.................................................................................................. 2-1 2.1.1 Large Companies ......................................................................... 2-1 2.1.2 Employee Size ............................................................................. 2-2 2.2 Conclusion ............................................................................................... 2-3 Section 3 - Counties with Similar Commercial Sectors 3.1 Overview.................................................................................................. 3-1 3.1.1 King County, Washington ........................................................... 3-1 3.1.2 Hennepin County, Minnesota ...................................................... 3-1 3.1.3 Wake County, North Carolina ..................................................... 3-1 3.1.4 Ramsey County, Minnesota ......................................................... 3-2 3.1.5 Palm Beach County, Florida ........................................................ 3-2 3.2 Results...................................................................................................... 3-4 Section 4 - Preliminary Waste Characterization 4.1 Methodology ............................................................................................ 4-1 4.2 Results.................................................................................................... 4-13 Section 5 - Commercial Waste Disposal Quantities 5.1 Overview.................................................................................................. 5-1 5.2 Methodology ............................................................................................ 5-1 5.3 Results...................................................................................................... 5-3 5.4 Conclusion ............................................................................................... 5-5 B1603 Table of Contents Section 6 - Recommendations 6.1 Overview.................................................................................................. 6-1 6.2 Recommendations.................................................................................... 6-1 6.2.1 Food Waste .................................................................................. 6-1 6.2.2 Uncoated OCC............................................................................. 6-2 6.2.3 Untreated Wood Waste................................................................ 6-2 6.2.4 Film Plastics................................................................................. 6-2 6.2.5 Other Ferrous ............................................................................... 6-2 6.3 Follow-Up Study Recommendations....................................................... 6-3 List of Tables 1-1 1-2 2-1 2-2 2-3 3-1 3-2 4-1 4-2 4-3 4-4 5-1 5-2 6-1 6-2 Comparison of Commercial Waste Characterization ......................................1-2 Mecklenburg County, Solid Waste Disposal Rates by Industry Sector...........1-5 Mecklenburg County, Largest Companies (by Employee Count)...................1-2 Mecklenberg County Employee Range (by Number of Establishments) ................................................................................................2-3 Mecklenberg County, Largest Industries (by Employee Count) .....................2-4 Mecklenberg County, County Commercial Sector Comparisons, Number of Employees by Industry Sector.......................................................3-3 Mecklenburg County, County Populations......................................................3-4 King County, Washington, Commercial Waste Characterization (by weight) .............................................................................................................4-3 Hennepin County, Minnesota, Commercial Waste Characterization (by weight) .......................................................................................................4-6 Wake County, North Carolina, Commercial Waste Characterization (by weight) .......................................................................................................4-9 Comparison of Commercial Waste Characterization ....................................4-14 Mecklenburg County, Solid Waste Disposal Rates by Industry Sector...........5-3 Industry Sector Abbreviation Key ...................................................................5-6 Mecklenburg County, Commercial Waste Characterization ...........................6-1 Mecklenburg County, Commercial Waste Characterization by Employment Sector..........................................................................................6-3 List of Figures 5-1 Mecklenburg County, Solid Waste Daily Disposal Rates by Industry Sector ...............................................................................................................5-4 5-2 Mecklenburg County, Solid Waste Annual Disposal Quantities by Industry Sector .................................................................................................5-5 ii B1603 Table of Contents This report has been prepared for the use of Mecklenburg County for the specific purposes identified in the report. Use of the report and its contents for other purposes is prohibited without prior approval of Mecklenburg County. B1603 iii Section 1 SUMMARY 1.1 Overview R. W. Beck, Inc. was retained by Mecklenburg County (County) to conduct a "paper study" to develop a quantitative and qualitative description of Mecklenburg County's commercial waste stream. The objectives included estimating the relative contribution of commercial solid waste by business type, projecting the overall composition of the commercial solid waste disposed, and providing recommendations on materials to target through diversion programs. 1.2 Methodology To conduct the commercial waste characterization study the R.W. Beck project team: Characterized the County's business/commercial sector including the types of businesses and number of employees; Identified a set of counties with similar business/commercial sectors; Developed a preliminary commercial waste characterization by using existing commercial waste characterization data from similar counties; Estimated the quantities of waste disposed by business sector; and Developed recommendations for additional diversion targets and follow up investigations. 1.3 Limitations The commercial waste characterization study should be considered a planning study that provides an estimated quantitative and qualitative characterization of the County commercial waste stream. No actual field studies were conducted to adjust and/or confirm the estimates. It should be noted that our analysis has not included the estimated quantities of construction and demolition materials disposed. The County programmatically manages these materials separately from other commercial waste sources. The commercial waste characterization was developed by comparing and adjusting existing commercial waste characterizations from counties with similar business sectors. These existing characterizations -- for Hennepin, King, and Wake Counties -were conducted using industry-accepted field sorting and analytical techniques. The reliability of the County commercial waste characterization estimate is tied directly to B1603 Section 1 the similarity of the business sectors and their waste management practices of the three counties selected for comparison. As for the estimated disposal quantities of the County commercial sector, the estimates rely on per-employee estimates by business sector that were generated by the California Integrated Waste Management Board (CIWMB). These estimates were based on a comprehensive set of more than 1200 generator-based field sorts used to statistically estimate per employee business sector disposal rates. The per-employee disposal rates were then applied to the County employee counts by business sector. The limitations of this approach are related to the extent of the similarities and differences between business sector activity in California as compared to the County. Generally speaking, California has aggressive materials diversion programs. No field data presently exists for the County to compare per-employee disposal patterns with the CIWMB-generated information. Overall the study outcomes offer a reasonable estimate of the commercial quantities disposed and the relative composition of the County’s disposed commercial solid waste. 1.4 Conclusions and Recommendations Provided below are Tables 1-1 and 1-2. Table 1 represents the commercial waste characterization and Table 2 represents a relative comparison of the quantities of materials disposed by industry sector. Table 1-1 Comparison of Commercial Waste Characterization Material Categories Paper Plastic Newsprint (ONP) High Grade Office Magazines/Catalogs Uncoated OCC recyclable Uncoated OCC nonrecyclable Coated OCC Boxboard Mixed Paper - recyclable Mixed Paper nonrecyclable TOTAL PAPER PET Bottles HDPE Bottles PVC Polystyrene 1-2 R. W. Beck Mean Mecklenburg Estimated Tonnage (Mean) 2.6% 3.6% 1.3% 15,762 21,520 7,994 9.0% 54,448 0.5% 0.1% 1.0% 5.0% 2,887 484 6,093 29,957 7.2% 30.3% 0.5% 0.5% 0.0% 0.5% 43,133 182,278 2,769 2,970 58 2,968 Mecklenburg Estimated Tonnage (Low) Mecklenburg Estimated Tonnage (High) 157,945 211,305 B1603 SUMMARY Table 1-1 Comparison of Commercial Waste Characterization Material Categories Film - transport packaging Other Film Other Containers Other non-containers TOTAL PLASTIC Metals Aluminum Beverage Containers Other Aluminum Ferrous Containers Other Ferrous Other Non-Ferrous TOTAL METALS Glass Clear Containers Green Containers Brown Containers Other Glass TOTAL GLASS Organic Yard Waste - Grass and Materials Leaves Yard Waste - woody material Food Waste Wood Pallets Treated Wood Untreated Wood Diapers Other Organic Material TOTAL ORGANIC MATERIALS Problem Televisions Materials Computer Monitors Computer Equipment/Peripherals Electric and Electronic Products Batteries Other TOTAL PROBLEM MATERIALS B1603 Mean Mecklenburg Estimated Tonnage (Mean) Mecklenburg Estimated Tonnage (Low) Mecklenburg Estimated Tonnage (High) 0.2% 5.1% 0.3% 5.7% 12.8% 1,202 30,884 1,984 34,313 77,148 66,814 91,011 0.5% 0.3% 0.8% 5.1% 0.8% 7.5% 1.0% 0.4% 0.6% 0.7% 2.7% 3,046 1,808 4,573 30,909 5,035 45,371 6,038 2,478 3,536 4,106 16,158 26,431 66,332 15,169 16,854 2.4% 14,506 0.0% 10.5% 2.6% 3.7% 6.5% 0.8% 4.2% 0 63,001 15,869 22,361 39,196 5,008 25,356 30.8% 0.0% 0.0% 185,299 0 0 177,272 195,024 0.5% 2,764 0.9% 0.0% 0.7% 5,210 278 4,232 2.1% 12,484 6,019 21,308 R. W. Beck 1-3 Section 1 Table 1-1 Comparison of Commercial Waste Characterization Material Categories HHW Other Waste Latex Paint Oil Paint Unused Pesti/Fungi/ Herbicides Unused Cleaners and Solvents Compressed Fuel Containers Automotive - Antifreeze Automotive - Used oil filters Other TOTAL HHW Textiles Carpet Sharps and Infectious Waste Rubber Construction & Demolition Debris Household Bulky Items Empty HHW Containers Miscellaneous TOTAL OTHER WASTE TOTAL 1-4 R. W. Beck Mean Mecklenburg Estimated Tonnage (Mean) 0.0% 0.2% 0 964 0.0% 0 0.0% 102 0.0% 0.0% 24 0 0.0% 0.2% 0.4% 1.5% 1.8% 0 1,446 2,539 9,121 10,663 0.0% 1.0% 201 6,011 4.0% 1.5% 0.0% 3.5% 13.4% 24,144 8,906 201 21,343 80,590 601,862 Mecklenburg Estimated Tonnage (Low) Mecklenburg Estimated Tonnage (High) 625 5,778 59,229 96,910 B1603 SUMMARY Table 1-2 Mecklenburg County Solid Waste Disposal Rates by Industry Sector Industry Sector Retail Trade Manufacturing Health Care and Social Assistance Accommodation and Food Services Wholesale Trade Finance and Insurance Professional, Scientific, and Technical Services Educational Services Other Services (except Public Administration) Transportation and Warehousing Administrative and Support and Waste Management and Remediation Services Information Real Estate and Rental and Leasing Public Administration Arts, Entertainment and Recreation Utilities Agriculture, Forestry, Fishing and Hunting Mining Management of Companies and Enterprises Grand Total Employee Count 66,021 65,315 50,099 44,892 41,480 37,949 36,620 27,986 24,488 20,792 Disposal Rate lbs/Employee/Day 8.61 7.11 6.90 15.62 4.93 1.64 5.85 4.39 5.50 8.41 Annual Disposal Quantities Tons 103,717 84,721 63,109 127,931 37,332 11,385 39,120 22,444 24,575 31,915 17,924 5.79 18,926 15,733 15,582 13,836 6,303 4,067 3,678 756 162 493,678 6.47 2.60 2.19 6.08 1.64 1.94 9.86 1.64 6.74 18,567 7,385 5,534 6,994 1,220 1,301 1,361 49 607,584 We recommend the County focus the development of additional diversion policies and programs on food waste, untreated wood waste, and film plastics. The Retail Trade, Accommodation and Food Services represent primary sources for additional commercial waste diversion opportunities. The County should give some consideration to conducting commercial generator-based field sorts. These field sorts should be focused upon likely generators of food waste, untreated wood waste, and film plastics. B1603 R. W. Beck 1-5 Section 2 BUSINESS/COMMERCIAL SECTOR 2.1 Overview Mecklenburg County (County) has over 800 various business sectors with approximately 534,850 employees as identified in the InfoUSA data provided by the Charlotte Chamber of Commerce. Historically, the leading businesses and industries have been manufacturing and finance-related, although employment is well distributed. Charlotte-Mecklenburg is one of the nation’s leading distribution and transportation hubs, due to its convenient location at the intersection of Interstate 77 and Interstate 85. In 2003, it was reported that the County was home to over 500 corporate headquarters1. In completing the first task, R.W. Beck used data provided by the Charlotte Chamber of Commerce to derive and summarize the information provided below. The data supplied included a list of businesses located in the County with pertinent information on each of the over 33,000 businesses including but not limited to the number of employees, industry type, and square footage. 2.1.1 Large Companies The County has a number of large local and national businesses within its boundaries, as well as several corporate headquarters. Of the top five County businesses based on number of employees, two are commercial banks with corporate headquarters located within the County. Wachovia Bank has 55 locations in the County and currently employs 11,947. Bank of America has 53 locations, including their corporate headquarters, and presently employees approximately 8,105. The second largest commercial entity located in the County is Presbyterian Hospital of the General Medical and Surgical Hospital business sector. Presbyterian Hospital has over 10,714 employees in 52 different locations within the County. Depicted below in Table 2 -1 is a list of the top 25 largest companies in the County based on the number of employees. 1 Source: Tony Crumbley, Mecklenburg County Chamber of Commerce, telephone interview August 18, 2005. www.charlottechamber.com/content.cfm?category_level_id=133&content_id=190. B1603 Section 2 Table 2-1 Mecklenburg County Largest Companies (by Employee Count) Rank Company Name Employee Size 1 WACHOVIA CORP 11,947 2 PRESBYTERIAN HOSPITAL 10,714 3 BANK OF AMERICA CORP 8,105 4 DUKE ENERGY CORP 6,052 5 BELK INC 3,382 6 CAROLINAS MEDICAL CENTER-MERCY 3,360 7 T J MAXX 3,260 8 US AIRWAYS INC 3,015 9 MERITA BAKERY 3,012 10 UNIVERSITY OF NORTH CAROLINA 3,007 11 KNIGHT PUBLISHING CO 3,007 12 CONTINENTAL GENERAL TIRE INC 3,006 13 ROYAL & SUNALLIANCE USA 3,003 14 SCHNEIDER NATIONAL 3,003 15 BEACON MEDICAL PRODUCTS 3,000 16 SOLECTRON TECHNOLOGY INC 3,000 17 WINN-DIXIE 2,210 18 YMCA 2,170 19 CHARLOTTE POLICE PATROL DIST 1,723 20 DAVIDSON COLLEGE 1,500 21 HERFF JONES CO 1,163 22 PIEDMONT NATURAL GAS CO 1,125 23 PRICEWATERHOUSE COOPERS 1,125 24 GOODWILL INDUSTRIES 1,005 25 CHARLOTTE PIPE & FOUNDRY CO 925 2.1.2 Employee Size Based on the data from InfoUSA, more than 50 percent of the business establishments in the County employ 1-4 individuals as reflected below in Table 2-2. Of the four companies with an employee size over 5,000 identified above in Table 2-1, three have establishments with 5,000 or more employees. An establishment is defined by NAICS as a single physical location. Table 2-2 below characterizes the size of the County’s business establishments by employment range. Of the 33,455 establishments reported in the County, only 707 are establishments with more than 100 employees. 2-2 R. W. Beck B1603 BUSINESS/COMMERCIAL SECTOR Information for some of the companies as it relates to the number of employees was not available and is identified as such in the table below. Table 2-2 Mecklenburg County Employee Range (by Number of Establishments) Employee Range Number of Establishments 1-4 17,749 5-9 7,080 10-19 3,758 20-49 2,581 50-99 932 100-249 545 250-499 109 500-999 34 1000-4999 16 5000-9999 3 Not Available 648 GRAND TOTAL 33,455 2.2 Conclusion Overall, the business mix in the County is quite diverse. Only the two industry categories of Retail Trade and Manufacturing each comprise more than 10 percent of the total number of employees in the County. The Finance and Insurance industry categories (which would include Wachovia Corp. and Bank America - two of the top five largest companies) comprise only 7 percent of the total number of employees in the County. Table 2-3 below characterizes the number of employees by industry type for all employees within the County. B1603 R. W. Beck 2-3 Section 2 Table 2-3 Mecklenburg County Largest Industries (by Employee Count) Rank Industry Employee Count Percentage of Employed 1 Retail Trade 66,021 12% 2 Manufacturing 65,315 12% 3 Health Care and Social Assistance 50,099 9% 4 Accommodation and Food Services 44,892 8% 5 Wholesale Trade 41,480 8% 6 Construction 41,180 8% 7 Finance and Insurance 37,949 7% 8 Professional, Scientific, and Technical Services 36,620 7% 9 Educational Services 27,986 5% 10 Other Services (except Public Administration) 24,488 5% 11 Transportation and Warehousing 20,792 4% 12 Administrative and Support and Waste Management and Remediation Services 17,924 3% 13 Information 15,733 3% 14 Real Estate and Rental and Leasing 15,582 3% 15 Public Administration 13,836 3% 16 Arts, Entertainment, and Recreation 6,303 1% 17 Utilities 4,067 1% 18 Agriculture, Forestry, Fishing and Hunting 3,678 1% 19 Mining 756 0% 20 Management of Companies and Enterprises 162 0% 534,858 100% Grand Total 2-4 R. W. Beck B1603 Section 3 COUNTIES WITH SIMILAR COMMERCIAL SECTORS 3.1 Overview Using industry quantification data available from the U.S. Census Bureau1 and descriptive demographic information, R.W. Beck compared a potential list of similar local governments to Mecklenburg County to initiate Task 2. Based on discussions with Mecklenburg County staff and available waste characterization data, the list of local governments considered included King County, Washington; Hennepin and Ramsey Counties in Minnesota; Tallahassee, Florida; Fairfax County, Virginia; Indianapolis, Indiana; Nashville, Tennessee; Wake County, North Carolina; and Palm Beach County, Florida. Using general industry mix and demographic information as primary metrics for this comparison, a short list of five U.S. counties were identified for further comparison. A brief descriptive profile of each of the local governments on the short list is provided below. 3.1.1 King County, Washington Historically King County’s economy was centered on forest product manufacturing. More recently, King County has grown into a diversified export based economy. King County historically has had a strong economic standing in the high tech industry as well as the services and trade industry.2 3.1.2 Hennepin County, Minnesota Hennepin County has a diverse industry base. The real estate, finance, healthcare and food service industries are among a few industries with recent employment growth.3 3.1.3 Wake County, North Carolina Wake County has a large research based industry comprised of one of the nation’s largest research parks and three universities. Helping to fuel the thriving retail sales 1 Source: U.S. Census Bureau www.census.gov/index.html 2 Source: Southwest King County Chamber of Commerce website www.swkcc.org/kingcounty.asp 3 Source: Hennepin County Growth Oversight Plan www.co.hennepin.mn.us B1603 Section 3 and entrepreneurial success, are several major industries in pharmaceuticals, computer software and hardware, telecommunications and biotechnology. 4 3.1.4 Ramsey County, Minnesota Ramsey County is home to several Fortune 500 companies and high tech leaders. Ramsey County’s economy is considered increasingly diverse with a wealth of businesses from manufacturing to medical technology. Growth areas for employees include health care, personal care and service, and construction. 5 3.1.5 Palm Beach County, Florida Palm Beach County has a strong retail service and distribution business industry supporting a flourishing tourist industry. Palm Beach’s convenient location is optimal for serving the State of Florida, as well as international clients.6 In order to identify local governments with similar commercial sectors to Mecklenburg County, two factors were considered. The first factor was the business mix for each of the considered counties. Using NAICS industry classification and the number of employees currently employed under each classification, R.W. Beck characterized the business mix for each shortlisted County. The number of employees that fall under 22 industry categories were then estimated. From these employee counts, an estimate was derived for the percentage of employees of the total county workforce that were employed in that industry. Comparing the percentages for the various industry sectors provided a measure of how similar each of the counties were to Mecklenburg County. Table 3-1 illustrates the five counties division of employment through the 22 industry categories and the comparison to Mecklenburg County. The column labeled DIF represents the difference in percentage of employees for the various sectors when compared to Mecklenburg County. The second factor that was taken into account in determining which counties are the most similar was the population data for each county. Table 3-2 shows the list of counties and their estimated population. 4 Source: Wake County Economic Development website www.raleigh-wake.org 5 Source: Saint Paul Area Chamber of Commerce www.saintpaulchamber.com/ed/ramsey_county.asp 6 Source: North Palm Beach Chamber of Commerce http://www.npbchamber.com 3-2 R. W. Beck B1603 COUNTIES WITH SIMILAR COMMERCIAL SECTORS Table 3-1 Mecklenburg County County Commercial Sector Comparisons Number of Employees by Industry Sector INDUSTRY SECTOR MECKLENBURG King County, WA DIF Hennepin County, MN DIF Wake County, NC DIF Ramsey County, MN Palm Beach, FL DIF DIF Retail Trade 66,021 12% 111,870 12% 0.00 97,827 13% 0.00 47352 14% 0.02 32,276 14% 0.02 64,342 14% 0.02 Manufacturing 65,315 12% 105,637 11% 0.01 83,351 11% 0.02 9573 3% 0.09 33,621 15% 0.02 20,727 5% 0.08 Health Care and Social Assistance 50,099 9% 94,392 10% 0.01 93,708 12% 0.03 35078 10% 0.01 0 0% 0.09 59,101 13% 0.04 Accommodation and Food Services 44,892 8% 78,308 8% 0.00 64,236 8% 0.00 29,946 9% 0.00 22,060 10% 0.01 47,776 11% 0.02 Wholesale Trade 41,480 8% 59,489 6% 0.01 57,738 7% 0.00 17685 5% 0.03 16,116 7% 0.01 20,384 4% 0.03 Construction 41,180 8% 50,658 5% 0.02 29,610 4% 0.04 27663 8% 0.00 12,089 5% 0.02 32,409 7% 0.01 Finance and Insurance 37,949 7% 54,121 6% 0.01 75,977 10% 0.03 14233 4% 0.03 15,826 7% 0.00 26,630 6% 0.01 Professional, Scientific, and Technical Services 36,620 7% 74,938 8% 0.01 63,792 8% 0.01 29440 9% 0.02 14,581 6% 0.01 32,633 7% 0.00 Educational Services 27,986 5% 14,406 2% 0.04 9,194 1% 0.04 18202 5% 0.00 8,738 4% 0.01 5,890 1% 0.04 Other Services (except Public Administration) 24,488 5% 45,179 5% 0.00 31,627 4% 0.01 13473 4% 0.01 11,257 5% 0.00 20,444 4% 0.00 Transportation and Warehousing 20,792 4% 45,638 5% 0.01 30,023 4% 0.00 9569 3% 0.01 7,574 3% 0.01 6,231 1% 0.03 Administrative and Support and Waste Management and Remediation Services 17,924 3% 58,393 6% 0.03 52,528 7% 0.03 27955 8% 0.05 17,790 8% 0.04 62,013 14% 0.10 Information 15,733 3% 66,286 7% 0.04 26,233 3% 0.00 15109 4% 0.01 7,837 3% 0.00 12,352 3% 0.00 Real Estate and Rental and Leasing 15,582 3% 23,615 3% 0.00 19,295 2% 0.00 7442 2% 0.01 5,358 2% 0.01 13,577 3% 0.00 Public Administration 13,836 3% 0 0% 0.03 0% 0.03 24007 7% 0.04 0 0% 0.03 0 0% 0.03 Arts, Entertainment, and Recreation 6,303 1% 19,511 2% 0.01 12,351 2% 0.00 4,407 1% 0.00 4,388 2% 0.01 14,246 3% 0.02 Utilities 4,067 1% 868 0% 0.01 3,009 0% 0.00 200 0% 0.01 756 0% 0.00 2,547 1% 0.00 Agriculture, Forestry, Fishing and Hunting 3,678 1% 2,347 0% 0.00 529 0% 0.01 589 0% 0.01 283 0% 0.01 7,381 2% 0.01 Mining 756 0% 558 0% 0.00 0 0% 0.00 222 0% 0.00 0 0% 0.00 0 0% 0.00 Management of Companies and Enterprises 162 0% 23,809 3% 0.03 30,931 4% 0.04 8058 2% 0.02 19,578 9% 0.08 6,213 1% 0.01 0.28 781,959 0.30 340,203 0.37 230,128 0.39 454,896 Grand Total B1603 534,858 930,023 0.45 R. W. Beck 3-3 Section 3 Table 3-2 Mecklenburg County County Populations County Population Mecklenburg County, NC 771,617 Ramsey County, MN 499,498 Wake County, NC 719,520 Hennepin County, MN 1,120,897 Palm Beach, FL 1,243,320 King County, WA 1,777,143 Source: U.S. Census Bureau,2000. 3.2 Results When comparing the five short listed counties to Mecklenburg County, the counties with the most similar commercial sectors overall are King County, Washington and Hennepin County, Minnesota. Similar to Mecklenburg County, the top three industry sectors in King and Hennepin County are Retail Trade, Manufacturing and Health Care and Social Assistance. Though the mix of businesses is similar to Mecklenburg County, King, and Hennepin Counties’ populations were greater than Mecklenburg in 2000. King County had over a million more residents than Mecklenburg County, while Hennepin County had over 300,000 more residents. Ramsey County Minnesota and Wake County North Carolina have two of the three same top industries as does Mecklenburg County. Moreover, Wake County is the closest in population to Mecklenburg County, with a difference of around fifty-two thousand residents. Thus, Wake County also should be considered for comparison. Of the five counties, the County least similar to Mecklenburg County would be Palm Beach County, Florida. Palm Beach has over a half million more residents than Mecklenburg County and has the highest percentage difference by industry sector when compared to Mecklenburg’s business mix. Based on the above, R.W. Beck recommended that Mecklenburg County consider King County, Hennepin County, and Wake County for a direct comparison of the commercial sector. 3-4 R. W. Beck B1603 Section 4 PRELIMINARY WASTE CHARACTERIZATION 4.1 Methodology Per feedback from the Mecklenburg County staff in a September 8 memorandum to R. W. Beck, Mecklenburg County selected the following three local governments and available waste characterizations for use as part of the third task to develop a preliminary waste characterization: King County, Washington; Hennepin County, Minneapolis; and Wake County, North Carolina. These three local governments were selected from a shortlist of local governments considered similar to Mecklenburg County. These local governments have a business mix similar to Mecklenburg County when comparing the number of employees by business sector as reflected in Section 3. Furthermore, all three local governments have had effective commercial recycling programs for more than a decade. For each of these local governments, R.W. Beck was able to obtain applicable commercial waste characterizations. R. W. Beck conducted waste characterizations for both Wake County and the Twin City Metropolitan Area, which includes, Hennepin County, within the last five to seven years. King County completed a waste characterization study in 2000 and shared the results of their study with R. W. Beck. All three studies included field sampling and sorting with the development of waste characterizations for various generators including the non-residential (commercial) waste stream. For Wake County, the commercial waste stream included all commercial establishments, industry, and institutions such as hospitals and schools. The definition of the commercial waste that was used for this study excluded multi-family generated materials even though in many instances solid waste from these generators may be commingled with solid wastes generated by commercial entities. In completing the Wake County study, the results of the commercial waste characterization results were developed both separately and in the aggregate by isolating the unique loads of materials containing primarily construction and demolition materials or industrial byproducts. In completing the Minnesota Statewide Waste Characterization study, the definition of the commercial waste stream used was similar to the Wake County study with the exclusion of multi-family generated materials. Landfill transaction data were reviewed prior to the sorting events and surveys were conducted during the sampling B1603 Section 4 process to assist in excluding the sampling of primarily multi-family, industrial byproducts, and C&D loads. As for King County, the commercial waste stream appears to be more broadly defined than the other two studies. The sampling and sorting methodology appears to have included “mixed loads” of materials as part of the non-residential waste stream results. Mixed loads include both residential and commercially generated materials. However, based on the review of the detailed study, it appears that very few of these types of samples were included as part of the results. Provided below in Tables 4-1 through 4-3 are the commercial waste characterization results from the waste characterization studies for each of these local governments. 4-2 R. W. Beck B1603 PRELIMINARY WASTE CHARACTERIZATION Table 4-1 King County, Washington Commercial Waste Characterization 1 (by weight) Material Categories Paper Plastic Metal B1603 Mean +/- 1 Newspaper 3.5% 0.6% 2 OCC/Kraft 9.0% 1.9% 3 Low Grade Recyclable 6.6% 1.0% 4 High Grade Printing 1.5% 0.4% 5 Computer Paper 0.5% 0.4% 6 Bleached Polycoats 0.4% 0.1% 7 Paper/Other Materials 2.2% 0.6% 8 Other Paper 5.8% 1.0% TOTAL PAPER 29.5% 1 PET #1 Bottles 0.4% 0.1% 2 HDPE #2 Bottles 0.4% 0.1% 3 Other Containers 0.6% 0.1% 4 Polystyrene Foam 0.7% 0.1% 5 Film and Bags 6.2% 1.1% 6 Other Packaging 0.5% 0.1% 7 Plastic Products 1.4% 0.3% 8 Plastic/Other Materials 0.9% 0.3% TOTAL PLASTIC 11.1% 1 Aluminum Cans 0.5% 2 Other Aluminum 0.3% 0.1% 3 Tinned Food Cans 0.9% 0.3% 4 Other Ferrous 3.6% 1.4% 5 Other Nonferrous 0.1% 0.1% 6 Mixed Metals/Materials 1.8% 0.5% TOTAL METALS 7.2% 0.2% R. W. Beck 4-3 Section 4 Table 4-1 King County, Washington Commercial Waste Characterization 1 (by weight) Material Categories Glass Mean +/- 1 Clear Containers 1.2% 0.2% 2 Green Containers 0.4% 0.1% 3 Brown Containers 0.6% 0.1% 4 Other Glass 0.6% 0.4% TOTAL GLASS 2.8% Organics 1 Dimension Lumber 3.0% 1.0% (Wood/ 2 Treated Wood 1.7% 0.9% Yard/ 3 Contaminated Wood 0.4% 0.3% Food) 4 Roofing/Siding 0.1% 0.1% 5 Stumps 0.0% 0.0% 6 Large Prunings 0.4% 0.6% 7 Yard Wastes 4.7% 2.1% 8 Other Wood 5.2% 1.8% 9 Food Wastes 13.4% 2.5% TOTAL ORGANIC MATERIALS 28.9% Other 1 Textiles/Clothes 1.9% 0.6% Organics 2 Carpet/Upholstery 2.5% 1.0% 3 Disposable Diapers 1.3% 0.3% 4 Rubber Products 0.7% 0.4% 5 Tires 0.7% 0.6% 6 Animal Carcasses 0.0% 0.0% 7 Animal Feces 1.0% 0.5% 8 Miscellaneous Organics 1.2% 1.2% TOTAL OTHER ORGANICS 9.3% 4-4 R. W. Beck B1603 PRELIMINARY WASTE CHARACTERIZATION Table 4-1 King County, Washington Commercial Waste Characterization 1 (by weight) Material Categories Mean +/- Other 1 Const/Demo Wastes 2.6% 1.1% Wastes 2 Ashes 0.3% 0.3% 3 Nondistinct Fines 2.5% 1.7% 4 Gypsum Wallboard 1.9% 0.5% 5 Furniture/Mattresses 1.7% 1.2% 6 Small Appliances 0.9% 0.5% 7 Miscellaneous Inorganics 1.2% 0.7% TOTAL OTHER WASTES 11.1% 1 Used Oil 0.0% 0.0% 2 Vehicle Batteries 0.0% 0.0% 3 Household Batteries 0.1% 0.1% 4 Latex Paint 0.0% 0.0% 5 Oil-Based Paint 0.1% 0.2% 6 Solvents/Thinners 0.0% 0.0% 7 Adhesives/Glues 0.1% 0.1% 8 Cleaners and Corrosives 0.0% 0.0% 9 Pesticides/Herbicides 0.0% 0.0% 10 Gas/Fuel Oil 0.0% 0.0% 11 Antifreeze 0.0% 0.0% 12 Medical Waste 0.1% 0.0% 13 Other Hazardous 0.0% 0.0% TOTAL HHW 0.4% HHW 100.3% 1 Based on results from Waste Monitoring Program Report (August 2000) completed by the King County Department of Natural Resources. B1603 R. W. Beck 4-5 Section 4 Table 4-2 Hennepin County, Minnesota Commercial Waste Characterization 1 (by weight) Material Categories Paper Plastic Metals Mean Lower Bound Upper Bound 1 2 Newsprint (ONP) High Grade Office 2.6% 4.2% 1.9% 2.8% 3.5% 6.3% 3 Magazines/Catalogs 2.7% 1.6% 4.2% 4 Uncoated OCC - recyclable 10.2% 8.2% 13.3% 5 Uncoated OCC - nonrecyclable 0.4% 0.3% 0.5% 6 Coated OCC 0.2% 0.1% 0.5% 7 Boxboard 1.5% 1.2% 2.2% 8 Mixed Paper - recyclable 6.1% 4.6% 7.5% 9 Mixed Paper - nonrecyclable 7.3% 5.8% 9.2% TOTAL PAPER 35.1% 30.2% 40.8% 1 2 PET Bottles/Jars - clear PET Bottles/Jars - colored 0.3% 0.1% 0.2% 0.1% 0.4% 0.1% 3 Other PET 0.0% 0.0% 0.1% 4 HDPE Bottles - natural 0.3% 0.2% 0.5% 5 HDPE Bottles - colored 0.1% 0.1% 0.2% 6 PVC 0.0% 0.0% 0.1% 7 Polystyrene 0.8% 0.6% 1.0% 8 Film - transport packaging 0.6% 0.4% 0.9% 9 Other Film 3.0% 2.5% 3.9% 10 Other Containers 0.3% 0.2% 0.5% 11 Other non-containers 6.7% 5.2% 8.6% TOTAL PLASTIC 12.3% 10.3% 14.8% 1 2 Aluminum Beverage Containers Other Aluminum 0.4% 0.6% 0.4% 0.4% 0.6% 0.8% 3 Ferrous Containers 0.7% 0.5% 1.4% 4 Other Ferrous 2.6% 1.9% 3.8% 5 Other Non-Ferrous 0.0% 0.0% 0.1% TOTAL METALS 4.4% 3.5% 6.1% 4-6 R. W. Beck B1603 PRELIMINARY WASTE CHARACTERIZATION Table 4-2 Hennepin County, Minnesota Commercial Waste Characterization 1 (by weight) Material Categories Glass Organic Materials Problem Materials HHW B1603 Mean Lower Bound Upper Bound 1 2 Clear Containers Green Containers 0.9% 0.4% 0.7% 0.2% 1.3% 0.6% 3 Brown Containers 0.4% 0.2% 0.6% 4 Other Glass 1.1% 0.6% 1.8% TOTAL GLASS 2.7% 2.0% 3.9% 1 2 3 Yard Waste - Grass and Leaves Yard Waste - woody material Food Waste 1.3% 0.0% 10.8% 0.9% 0.0% 8.2% 2.1% 0.0% 14.2% 4 Wood Pallets 7.9% 5.4% 11.6% 5 Treated Wood 4.1% 2.9% 6.5% 6 Untreated Wood 3.5% 2.2% 5.5% 7 Diapers 0.3% 0.2% 0.4% 8 Other Organic Material 1.5% 1.0% 2.1% TOTAL ORGANIC MATERIALS 29.5% 25.1% 35.0% 1 2 3 Televisions Computer Monitors Computer Equipment/Peripherals 0.0% 0.0% 0.4% 0.0% 0.0% 0.1% 0.0% 0.0% 0.5% 4 Electric and Electronic Products 1.1% 0.6% 1.5% 5 Batteries 0.0% 0.0% 0.1% 6 Other 0.1% 0.0% 0.3% TOTAL PROBLEM MATERIALS 1.7% 0.9% 2.1% 1 2 Latex Paint Oil Paint 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 3 Unused Pesti/Fungi/Herbicides 0.0% 0.0% 0.0% 4 Unused Cleaners and Solvents 0.1% 0.0% 0.2% 5 Compressed Fuel Containers 0.0% 0.0% 0.0% 6 Automotive - Antifreeze 0.0% 0.0% 0.0% 7 Automotive - Used oil. filters 0.0% 0.0% 0.0% 8 Other 0.0% 0.0% 0.1% TOTAL HHW 0.1% 0.1% 0.2% R. W. Beck 4-7 Section 4 Table 4-2 Hennepin County, Minnesota Commercial Waste Characterization 1 (by weight) Material Categories Other Waste Lower Bound Upper Bound 1 2 3 Textiles Carpet Sharps and Infectious Waste 1.5% 2.8% 0.0% 1.0% 1.7% 0.0% 1.9% 4.2% 0.0% 4 Rubber 0.8% 0.4% 1.4% 5 Construction & Demolition Debris 2.1% 1.2% 3.5% 6 Household Bulky Items 2.7% 1.9% 4.4% 7 Empty HHW Containers 0.1% 0.1% 0.2% 8 Miscellaneous 4.2% 3.0% 5.8% TOTAL OTHER WASTE 14.2% 11.0% 18.2% TOTAL 1 Mean 100.0% Based on results from Minnesota Statewide Waste Characterization Study (May 2000) completed by R. W. Beck for the Minnesota Pollution Control Agency and Solid Waste Management Coordinating Board. 4-8 R. W. Beck B1603 PRELIMINARY WASTE CHARACTERIZATION Table 4-3 Wake County, North Carolina Commercial Waste Characterization 1,2 (by weight) Material Categories Paper Plastic B1603 Mean Lower Bound Upper Bound 1 2 Newspaper Magazines 1.5% 1.0% 1.0% 0.6% 2.2% 1.5% 3 High Grade/ Office 4.2% 2.7% 6.1% 4 Recyclable OCC and Kraft Bags 7.7% 5.7% 10.1% 5 Non-Recyclable OCC 0.8% 0.4% 1.4% 6 Uncoated Boxboard 1.3% 0.8% 1.8% 7 Mixed Recyc Paper 2.0% 1.4% 2.8% 8 Non-Recyclable Paper 5.5% 3.8% 7.5% TOTAL PAPER 24.1% 18.8% 29.9% 1 2 #1 PET Soft Drink Cont. >or= 1 liter #1 PET Soft Drink Cont. < 1 liter 0.0% 0.2% 0.0% 0.1% 0.1% 0.2% 3 #1 PET Custom Bottles. >or= 1 liter 0.0% 0.0% 0.0% 4 #1 PET Custom Bottles. < 1 liter 0.1% 0.1% 0.1% 5 #1 PET Jar and Cont. 0.0% 0.0% 0.0% 6 #1 PET Subtotal 0.3% 0.2% 0.4% 7 #2 HDPE Natural Bottles 0.2% 0.1% 0.2% 8 #2 HDPE Pigmented Bottles 0.1% 0.1% 0.2% 9 #2 HDPE Tubs/Cont. 0.1% 0.1% 0.2% 10 #2 HDPE Subtotal 0.4% 0.2% 0.5% 11 #3 PVC Bottles 0.0% 0.0% 0.0% 12 #3 PVC Tubs/Cont. 0.0% 0.0% 0.0% 13 #3 PVC Subtotal 0.0% 0.0% 0.0% 14 #4 LDPE Bottles 0.0% 0.0% 0.0% 15 #4 LDPE Tubs/Cont. 0.0% 0.0% 0.0% 16 #4 LDPE Subtotal 0.0% 0.0% 0.0% 17 #5 PP Bottles 0.0% 0.0% 0.0% 18 #5 PP Tubs/Cont. 0.0% 0.0% 0.1% 19 #5 PP Subtotal 0.1% 0.0% 0.1% 20 #6 PS Bottles/Cont. 0.0% 0.0% 0.0% 21 #7 Other Plastic Bottles/Cont. 0.0% 0.0% 0.0% 22 Other Plastic Products 7.3% 4.9% 10.2% 23 Film/Wrap/Bags 5.9% 4.2% 7.8% TOTAL PLASTIC 13.9% 10.3% 18.0% R. W. Beck 4-9 Section 4 Table 4-3 Wake County, North Carolina Commercial Waste Characterization 1,2 (by weight) Metals Glass Material Categories Mean Lower Bound Upper Bound 1 2 Aluminum Beverage Containers Ferrous Food 0.3% 0.4% 0.2% 0.2% 0.4% 0.6% 3 Other Ferrous Scrap 8.9% 5.2% 13.5% 4 Other Non-Ferrous Scrap 0.3% 0.2% 0.4% TOTAL METALS 9.9% 6.2% 14.3% 1 2 Clear Green 0.6% 0.2% 0.4% 0.1% 0.9% 0.3% 3 Blue 0.0% 0.0% 0.0% 4 Brown 0.5% 0.3% 0.9% 5 Other Mixed Cullet 0.1% 0.1% 0.2% TOTAL GLASS 1.5% 0.9% 2.2% Yard Waste 0.9% 0.5% 1.5% Food Waste Non-Treated Wood 6.9% 18.2% 4.3% 11.2% 10.0% 26.5% 4 Treated Wood 5.1% 3.0% 7.7% 5 Diapers 0.6% 0.3% 1.0% 6 Other Organic Material 2.6% 1.1% 4.7% TOTAL ORGANIC MATERIALS 34.3% n/a n/a All Electrical and Household Appl Computer Equipment Other Durables 0.3% 0.7% 1.7% 0.2% 0.4% 0.8% 0.5% 1.2% 2.8% TOTAL PROBLEM MATERIALS 2.7% n/a n/a 1 2 Automotive Products Paints and Solvents 0.3% 0.1% 0.2% 0.0% 0.5% 0.1% 3 Pesticides, Herbicides & Fungicides 0.0% 0.0% 0.0% 4 Household Cleaners 0.0% 0.0% 0.0% 5 Batteries (lead -acid) 0.0% 0.0% 0.0% 6 Batteries (other) 0.0% 0.0% 0.0% 7 Other (HHM containers w/prod inside) 0.0% 0.0% 0.0% 8 Light Bulbs 0.0% 0.0% 0.1% TOTAL HHM 0.4% n/a n/a Organic 1 Materials 2 3 Problem 1 Materials 2 3 HHM 4-10 R. W. Beck B1603 PRELIMINARY WASTE CHARACTERIZATION Table 4-3 Wake County, North Carolina Commercial Waste Characterization 1,2 (by weight) Material Categories Other Waste TOTAL Mean Lower Bound Upper Bound 1 2 3 Textiles and Leather Sharps Rubber 0.9% 0.0% 0.5% 0.5% 0.0% 0.3% 1.3% 0.0% 0.7% 4 Construction & Demolition Debris 9.6% 4.9% 15.5% 5 Other Inorganic 2.2% 1.1% 3.8% TOTAL OTHER WASTE 13.2% n/a n/a 100.1% Based on results from Waste Characterization Study (June, 1999) completed by R. W. Beck for Wake County Solid Waste Management Division. 2 N/A refers to the lower and upper ranges not being available because the material categories are composed of modified material subcategories. 1 B1603 R. W. Beck 4-11 Section 4 R.W. Beck compared the three commercial waste characterizations provided above to assess the variability of the commercial waste stream. The intent was to identify values that may represent a preliminary commercial characterization for Mecklenburg County. Because the three characterization studies reflected some differences in the material categories, some of the material subcategories had to be reordered into other material categories to ensure compatible comparisons. The Hennepin County categories were selected as the base set of categories because the breadth of the list of material categories was adequate to provide compatibility between the results. The following adjustments were made to the subcategories for each of the characterizations. The following categories were combined: Hennepin County: “PET Bottles/Jars – clear” and “PET Bottles/Jars – colored” were combined into one sub-category, “PET Bottles”. “HDPE Bottles – natural” and “HDPE Bottles – colored” were combined into one sub-category, “HDPE Bottles”. The means (averages) of the following sub-categories were reordered as follows: King County: Computer Paper was added to High Grade Office under “Paper”. Bleached Polycoats were added to Mixed Paper – nonrecyclable under “Paper”. Paper/Other Materials were added to Mixed Paper – nonrecyclable under “Paper”. Other Paper was added to Mixed Paper – nonrecyclable under “Paper”. Other Packaging was added to Other non-containers under “Plastic”. Plastics/Other Materials were added to Other non-containers under “Plastic”. Mixed Metals/Materials were added to Other Non-Ferrous under “Metals”. Dimension Lumber, Contaminated Wood, Roofing/Siding, Large Prunings, and Other Wood were moved from “Organics (Wood/Yard/Food) to Other Organic Material under “Organic Materials”. Disposable Diapers were moved from “Other Organics” to Diapers under “Organic Materials”. Tires were moved from “Other Organics” to Rubber under “Other Waste”. Animal Feces were added to Other Organic Material under “Organic Materials”. Ashes, Nondistinct Fines, and Misc. Inorganics were moved from “Other Wastes” to Miscellaneous under “Other Waste”. 4-12 R. W. Beck B1603 PRELIMINARY WASTE CHARACTERIZATION Gypsum Wallboard was moved from “Other Waste” to Construction & Demolition Debris under “Other Waste”. Furniture/Mattresses were moved from “Other Wastes” to Household Bulky Items under “Other Waste”. Small Appliances were moved from “Other Wastes” to Electric and Electronic Products under “Problem Materials”. Household Batteries were moved from “HHW” to Batteries under “Problem Materials”. Adhesives/glues were moved from “HHW” to Other under “HHW”. Medical Waste was moved from “HHW” to Sharps and Infectious Waste under “Other Waste”. Wake County: Plastics #5 PP Subtotal was moved to Other Containers under “Plastic”. Automotive Products were moved from “HHM” to Other under “HHW”. Paints and Solvents were moved from “HHM” to Oil Paint under “HHW”. In addition, when comparing the results between the three studies for the material categories of “untreated wood” and “construction & demolition materials” much variability exists. To promote compatibility between the results from the studies, R.W. Beck adjusted the following: For the King County results, the estimated percentage of materials comprising the dimensional lumber category was removed from the Other Organic Materials category and placed in the Untreated Wood category. Without this change, the Untreated Wood category was represented by 0% as the mean. With this change, the Untreated Wood category was adjusted to 3%. For the Wake County results, both the Untreated Wood category and Construction & Demolition Materials category were adjusted downwardly to reflect the estimated percentage that these material categories comprised of the commercial waste stream, without the sampled loads comprised exclusively of construction and demolition materials. This adjustment was needed to address the variability in these categories resulting from the large quantities of construction and demolition materials entering the Wake County disposal facility at the time the study was conducted. As a result, the Untreated Wood category was reduced from a mean of 18.2% to 13.0% and the Construction & Demolition Materials category was reduced from a mean of 9.6% to 5.4%. 4.2 Results The mean for the categories and subcategories was calculated for each of the three waste characterizations to compare the results. The mean percentage by weight for each of the material categories and subcategories was then applied to the total quantities of commercial MSW disposed as reported by Mecklenburg County for B1603 R. W. Beck 4-13 Section 4 fiscal year 2003-2004. The estimated quantities of commercial MSW disposed was approximately 601,900 tons. Table 4-4 below reflects the results from applying the percentages by weight for the material categories to the tonnage disposed. Table 4-4 Comparison of Commercial Waste Characterization Material Categories Paper Plastic Metals Glass Newsprint (ONP) High Grade Office Magazines/Catalogs Uncoated OCC recyclable Uncoated OCC nonrecyclable Coated OCC Boxboard Mixed Paper - recyclable Mixed Paper nonrecyclable TOTAL PAPER PET Bottles HDPE Bottles PVC Polystyrene Film - transport packaging Other Film Other Containers Other non-containers TOTAL PLASTIC Aluminum Beverage Containers Other Aluminum Ferrous Containers Other Ferrous Other Non-Ferrous TOTAL METALS Clear Containers Green Containers Brown Containers Other Glass TOTAL GLASS 4-14 R. W. Beck Hennepin 1 Avg. King1 Avg. Wake1 Avg. Mean Mecklenburg Estimated Tonnage (Mean) 2.6% 4.2% 2.7% 3.5% 2.0% 0.0% 1.8% 4.5% 1.3% 2.6% 3.6% 1.3% 15,762 21,520 7,994 10.2% 9.0% 8.0% 9.0% 54,448 0.4% 0.2% 1.5% 6.1% 0.0% 0.0% 0.0% 6.6% 1.1% 0.0% 1.6% 2.3% 0.5% 0.1% 1.0% 5.0% 2,887 484 6,093 29,957 7.3% 35.1% 0.4% 0.4% 0.0% 0.8% 0.6% 3.0% 0.3% 6.7% 12.2% 8.4% 29.5% 0.4% 0.4% 0.0% 0.7% 0.0% 6.2% 0.6% 2.8% 11.1% 5.8% 26.2% 0.6% 0.7% 0.0% 0.0% 0.0% 6.2% 0.1% 7.6% 15.1% 7.2% 30.3% 0.5% 0.5% 0.0% 0.5% 0.2% 5.1% 0.3% 5.7% 12.8% 43,133 182,278 2,769 2,970 58 2,968 1,202 30,884 1,984 34,313 77,148 0.4% 0.6% 0.7% 2.6% 0.0% 4.4% 0.9% 0.4% 0.4% 1.1% 2.7% 0.5% 0.3% 0.9% 3.6% 1.9% 7.2% 1.2% 0.4% 0.6% 0.6% 2.8% 0.6% 0.0% 0.7% 9.2% 0.6% 11.0% 0.9% 0.5% 0.8% 0.4% 2.5% 0.5% 0.3% 0.8% 5.1% 0.8% 7.5% 1.0% 0.4% 0.6% 0.7% 2.7% 3,046 1,808 4,573 30,909 5,035 45,371 6,038 2,478 3,536 4,106 16,158 Mecklenburg Estimated Tonnage (Low) Mecklenburg Estimated Tonnage (High) 157,945 211,305 66,814 91,011 26,431 66,332 15,169 16,854 B1603 PRELIMINARY WASTE CHARACTERIZATION Table 4-4 Comparison of Commercial Waste Characterization Material Categories Organic Yard Waste - Grass and Materials Leaves Yard Waste - woody material Food Waste Wood Pallets Treated Wood Untreated Wood Diapers Other Organic Material TOTAL ORGANIC MATERIALS Problem Televisions Materials Computer Monitors Computer Equipment/Peripherals Electric and Electronic Products Batteries Other TOTAL PROBLEM MATERIALS HHW Latex Paint Oil Paint Unused Pesti/Fungi/ Herbicides Unused Cleaners and Solvents Compressed Fuel Containers Automotive - Antifreeze Automotive - Used oil filters Other TOTAL HHW B1603 Hennepin 1 Avg. King1 Avg. Wake1 Avg. Mean Mecklenburg Estimated Tonnage (Mean) 1.3% 4.7% 1.2% 2.4% 14,506 0.0% 10.8% 7.9% 4.1% 3.5% 0.3% 1.5% 0.0% 13.4% 0.0% 1.7% 3.0% 1.3% 8.3% 0.0% 7.2% 0.0% 5.4% 13.0% 0.9% 2.9% 0.0% 10.5% 2.6% 3.7% 6.5% 0.8% 4.2% 0 63,001 15,869 22,361 39,196 5,008 25,356 29.5% 0.0% 0.0% 32.4% 0.0% 0.0% 30.5% 0.0% 0.0% 30.8% 0.0% 0.0% 185,299 0 0 0.4% 0.0% 1.0% 0.5% 2,764 1.1% 0.0% 0.1% 0.9% 0.1% 0.0% 0.6% 0.0% 2.0% 0.9% 0.0% 0.7% 5,210 278 4,232 1.7% 0.0% 0.0% 1.0% 0.0% 0.1% 3.5% 0.0% 0.4% 2.1% 0.0% 0.2% 12,484 0 964 0.0% 0.0% 0.0% 0.0% 0 0.1% 0.0% 0.0% 0.0% 102 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 24 0 0.0% 0.0% 0.1% 0.0% 0.1% 0.2% 0.0% 0.6% 1.0% 0.0% 0.2% 0.4% 0 1,446 2,539 Mecklenburg Estimated Tonnage (Low) Mecklenburg Estimated Tonnage (High) 177,272 195,024 6,019 21,308 625 5,778 R. W. Beck 4-15 Section 4 Table 4-4 Comparison of Commercial Waste Characterization Material Categories Other Waste Textiles Carpet Sharps and Infectious Waste Rubber Construction & Demolition Debris Household Bulky Items Empty HHW Containers Miscellaneous TOTAL OTHER WASTE Hennepin 1 Avg. King1 Avg. Wake1 Avg. Mean Mecklenburg Estimated Tonnage (Mean) 1.5% 2.8% 1.9% 2.5% 1.2% 0.0% 1.5% 1.8% 9,121 10,663 0.0% 0.8% 0.1% 1.4% 0.0% 0.8% 0.0% 1.0% 201 6,011 2.1% 2.7% 0.1% 4.2% 14.2% 4.5% 1.7% 0.0% 4.0% 16.1% 5.4% 0.0% 0.0% 2.5% 9.8% 4.0% 1.5% 0.0% 3.5% 13.4% 24,144 8,906 201 21,343 80,590 601,862 TOTAL 1 Mecklenburg Estimated Tonnage (Low) Mecklenburg Estimated Tonnage (High) 59,229 96,910 Represent modified commercial waste characterizations based on previous studies. The commercial characterization results and its variability can be measured by reviewing the confidence intervals/standard deviations for each of the material categories and subcategories. For purposes of our preliminary comparison, we have not evaluated the statistical significance between the means of the material categories when comparing the three studies. However, we have provided a mean tonnage and upper and lower bound tonnage estimates using the high and low means from the three studies for the primary material categories. These values do reflect a preliminary range of quantities by material category. Comparing statistical significance is problematic based on limited available data. An alternative approach would be to review the upper and lower confidence intervals for all of the subcategories and establish a percentage by weight range for each subcategory by selecting the absolute number representing the highest upper and lowest lower bound for each individual subcategory. The results would reflect a greater level of variability at the materials subcategory level than what is now shown now in Table 4-4. This approach would have limited value because the ranges would be so large that they would provide little useful information. Another alternative approach would be to determine statistical significance at the primary material category level only and use the median as the measure at the material subcategory level. Unfortunately, the King County results did not include standard deviations by primary material category to allow one to compare and determine statistical significance between the results for all three studies. 4-16 R. W. Beck B1603 Section 5 COMMERCIAL WASTE DISPOSAL QUANTITIES 5.1 Overview The purpose of this section is to provide a preliminary commercial waste quantification by business category for Mecklenburg County (“the County”). R.W. Beck (“Beck”) was able to determine estimates of solid waste disposed by each business type in the County using a database developed from a 1999 study conducted by the California Integrated Waste Management Board (“CIWMB”). The CIWMB database is comprised of disposal rate estimates grouped by Standard Industrial Classification (“SIC”) business groupings. The CIWMB study randomly collected 1,207 samples of commercial waste generator locations in order to calculate the disposal rates for each SIC business grouping. Beck conducted research to identify other viable sources of waste disposal information by business type, but to date, Beck has not identified other potentially useful sources for generation rate estimates that are compatible with the data available for Mecklenburg County. To date, the 1999 CIWMB study is the most recent study of its kind that presents data that fits with R.W. Beck’s estimation methodology. The CIWMB groupings consist of one or more SIC codes that have been grouped together in a discretionary fashion by CIWMB. A key assumption associated with the disposal rates is that businesses belonging to a particular employment category generate waste at a similar rate. This is the basis for the methodology developed by R.W. Beck to produce estimates of total waste generated by employment sector. 5.2 Methodology The following is a complete delineation of the methodology employed to develop waste disposal estimates for Mecklenburg County. 1. County employment data was extracted from the Info USA database, and then tallied and divided into 20 North American Industry Classification System (“NAICS”) Industry Sectors. For the purposes of computing Task 5 estimates, these categories were redistributed back into sub-sectors in order to match the NAICS sub-sectors with the SIC classifications as specified by CIWMB. R.W. Beck then catalogued a database of all NAICS sub-sector employment totals. 2. Each SIC business sector, which is the level of aggregation at which the disposal rate data was available, was allocated to its appropriate NAICS sector and sub-sector. This was accomplished through the use of the CIWMB SIC B1603 Section 5 business sector list, along with Internet cross-reference sources that tie SIC and NAICS codes together. 3. Based on the allocation in Step 2, a weighted average of tonnage disposed per employee per year was computed for each NAICS grouping. This was based on the assignment of each SIC business sector disposal rate to one or more corresponding NAICS sub-sectors. The percentage of total employees in each sub-sector was the basis for this weighted average. A weighted average provides a more precise estimate of aggregate disposal, because it takes employee distribution into account at the most specific level possible. 4. The disposal estimates computed in Step 3 were then extrapolated to a tons disposed per year by employment sector using the employee totals catalogued in Step 1. The disposal rates presented in the Results Section below are estimates of waste disposal for the County by employment sector (which are simply the aggregation of a specific set of NAICS codes) on an annual basis. The results of R.W. Beck’s analysis must be tempered with the following caveats: Synchronization of SIC business groupings as grouped by the CIWMB data source and NAICS codes involved a certain amount of judgment. While R.W. Beck has adhered to the cross-reference Internet sources wherever possible, certain SIC codes have been excluded from CIWMB’s analysis. In these cases, the most appropriate substitute has been used to designate the associated NAICS grouping. In other cases, SIC business groupings as defined by CIWMB were inclusive of SIC codes that were cross-referenced to belong to slightly different NAICS groupings. Judgment calls have been made with respect to these instances, so as to ensure that the most sensible business grouping disposal rate estimate was used in each case. NAICS employment data provides a range of employee count for each specific business. In order to perform the analysis, averages of each work area range were used to compute aggregated estimates of employment counts by sector. To the extent that these averages overrepresented or underrepresented the true employment totals in the County, the results below must be interpreted as an approximation of waste disposed on average. The CIWMB disposal rates are drawn from an empirical study performed in a specific region of the nation. This study employed a relatively large sample size, and contains reasonable groupings of businesses from which to determine generation rates. While the reported generation rates resulting from the CIWMB study are an appropriate proxy for use in the County, it cannot be known for certain whether this data is representative of actual waste generation behavior in Mecklenburg County. An empirical study would need to be conducted in order to take regional factors that may be indigenous to Mecklenburg County into account, some of which may ultimately impact the results. 5-2 R. W. Beck B1603 COMMERCIAL WASTE DISPOSAL QUANTITIES 5.3 Results Table 5-1 presents the results of the analysis by NAICS industry sector with employee counts and lists associated disposal rates and projected annual disposal quantities. As evidenced by the results in Table 5-1, the industry sector with the highest disposal rate is Accommodation and Food Services. It is logical that this industry sector would have a high disposal rate, due to the type of work activity associated with this industry and the amount of waste employees in this sector produce while completing these activities. Even though the Accommodation and Food Services sector does not have the largest labor force, it is estimated to be the largest generator of solid waste due to the level of its per employee disposal rate. Table 5-1 Mecklenburg County Solid Waste Disposal Rates by Industry Sector INDUSTRY SECTOR Retail Trade Manufacturing Health Care and Social Assistance Accommodation and Food Services Wholesale Trade Finance and Insurance Professional, Scientific, and Technical Services Educational Services Other Services (except Public Administration) Transportation and Warehousing Administrative and Support and Waste Management and Remediation Services Information Real Estate and Rental and Leasing Public Administration Arts, Entertainment and Recreation Utilities Agriculture, Forestry, Fishing and Hunting Mining Management of Companies and Enterprises Grand Total Employee Count 66,021 65,315 50,099 44,892 41,480 37,949 36,620 27,986 24,488 20,792 Disposal Rate lbs/Employee/Day 8.61 7.11 6.90 15.62 4.93 1.64 5.85 4.39 5.50 8.41 Annual Disposal Quantities Tons 103,717 84,721 63,109 127,931 37,332 11,385 39,120 22,444 24,575 31,915 17,924 5.79 18,926 15,733 15,582 13,836 6,303 4,067 3,678 756 162 493,678 6.47 2.60 2.19 6.08 1.64 1.94 9.86 1.64 6.74 18,567 7,385 5,534 6,994 1,220 1,301 1,361 49 607,584 The average disposal rate for commercial waste was calculated at 6.74 lbs/employee/day. Figure 5-1 graphically depicts the comparison between the various B1603 R. W. Beck 5-3 Section 5 industry sector disposal rates. Disposal rates range from 1.64 to 15.62 lbs/employee/day. Figure 5-1 Mecklenburg County Solid Waste Daily Disposal Rates by Industry Sector 18.00 Generation Rate (lbs/Employee/Day) 16.00 14.00 12.00 10.00 8.00 6.00 4.00 2.00 Industry Sector Figure 5-2 depicts the estimated quantities disposed by industry sector. Note that the Accommodations and Food Service sector also is estimated to dispose of more lbs/day of materials than other industry sectors. However, the relative order of the other industry sectors varies as a function of both the number of employees and the employee disposal rate. 5-4 R. W. Beck B1603 Management Utilities Finance Agriculture Public Administration Real Estate Educational Services Wholesale Trade Other Services Administrative Technical Services Arts Information Health Care Manufacturing Transportation Retail Trade Mining Food Services 0.00 COMMERCIAL WASTE DISPOSAL QUANTITIES Figure 5-2 Mecklenburg County Solid Waste Daily Disposal Quantities by Industry Sector 800,000 Solid Waste Disposal (lbs/day) 700,000 600,000 500,000 400,000 300,000 200,000 100,000 Management Utilities Agriculture Mining Public Administration Arts Real Estate Finance Information Administrative Educational Services Other Services Transportation Wholesale Trade Technical Services Health Care Manufacturing Retail Trade Food Services 0 Industry Sector 5.4 Conclusion The historical data received from Mecklenburg County depicted the estimated quantities of commercial solid waste disposed in 2004 at 601,925 tons of waste. Using the calculated disposal rates for Task 5, R.W. Beck estimated a disposed quantity of approximately 607,584 tons of commercial solid waste. This small difference is the likely result of the use of empirically estimated per-sector disposal rates and estimated employment size for the various industry sectors. It should be noted that our analysis has not included the estimated quantities of construction and demolition materials disposed. This portion of the solid waste stream was excluded from these estimates because the County programmatically manages these materials separately from other commercial waste sources. This analysis has provided a systematic approach to estimating commercial waste disposal by isolating employment sectors and extrapolating quantities using empirically validated generation rate estimates. These estimates, along with the waste composition estimates, provided in earlier tasks of this study, should serve to guide the County in determining future areas of focus for commercial waste reduction and recycling programs. B1603 R. W. Beck 5-5 Section 5 Table 5-2 Industry Sector Abbreviation Key Abbreviations Administrative Agriculture Arts Educational Services Finance Food Services Health Care Information Management Manufacturing Mining Other Services Public Administration Real Estate Retail Trade Technical Services Transportation Utilities Wholesale Trade 5-6 R. W. Beck Industry Sector Administrative and Support and Waste Management and Remediation Services Agriculture, Forestry, Fishing and Hunting Arts, Entertainment and Recreation Educational Services Finance and Insurance Accommodation and Food Services Health Care and Social Assistance Information Management of Companies and Enterprises Manufacturing Mining Other Services(except Public Administration) Public Administration Real Estate and Rental and Leasing Retail Trade Professional, Scientific and Technical Services Transportation and Warehousing Utilities Wholesale Trade B1603 Section 6 RECOMMENDATIONS 6.1 Overview In Section 4, the composition of Mecklenburg County’s commercial waste stream was projected based on data from selected communities. The results of this analysis identified the following materials as the five most prevalent in the County’s solid waste stream: Table 6-1 Mecklenburg County Commercial Waste Characterization Material 1 Estimated Tons Disposed per Year Food waste 63,001 Uncoated OCC 54,448 Untreated wood waste 39,196 Film plastics 32,0861 Other ferrous 30,909 Includes transport packaging film and other film plastics From a technical standpoint, all of these materials, when relatively free of contaminants, have recovery and recycling potential. The recovery potential for each of these materials is discussed below, as well as R. W. Beck’s recommendations on which of these materials should be the focus of future County efforts to reduce and recycle commercial solid waste. 6.2 Recommendations 6.2.1 Food Waste Many U.S. communities have established commercial food waste composting programs, as well as some have established residential food waste recycling programs. Food waste can be used in farming applications or composted on site or centrally, via various methods including in vessel or vermi-composting for a variety of applications. In addition, some food from commercial sources is fit for human or animal consumption and can be diverted for such purposes, thereby being diverted from the B1603 Section 6 waste stream. R. W. Beck recommends food waste as an appropriate target for additional efforts by Mecklenburg County to reduce and recycle business waste. We recommend that the County investigate associated issues, barriers, opportunities and potential strategies for County implementation. 6.2.2 Uncoated OCC Markets for uncoated OCC are currently very strong and are expected to remain strong. It is likely that the above estimate for OCC in the County waste stream is high, given that the data from the three comparison communities were obtained in 1999 and 2000 when markets were not as favorable. Given this information, and that Mecklenburg County has a business recycling ordinance that specifies the recycling of OCC to promote recovery and recycling of this material, we do not recommend OCC as a target for additional County waste reduction efforts. However, we encourage the County to monitor existing OCC recycling efforts and enforce the existing business recycling ordinance. 6.2.3 Untreated Wood Waste Untreated wood waste such as pallets, crates, and wood scrap can be recovered and recycled via chipping for use in landscaping and ground cover applications, chipping for fuel use, and in making furniture and other wood products (such as finger jointed lumber and wall board). The extent to which such activities occur is largely driven by the economics associated with disposal of these materials. We recommend that clean wood waste be targeted by future County business waste recycling programs. 6.2.4 Film Plastics Increasingly, a number of U.S. communities and some states, such as Rhode Island, are targeting film plastics for recycling from both commercial and residential sources. Film plastics include grocery bags, trash bags, storage bags, pallet wrap, and other sheet fiber plastic. Residential plastic film targeted for recovery and recycling is typically plastic grocery bags, which are often collected through grocery stores. Certain companies making plastic lumber products, such as Trex, claim that they cannot get enough supply of film plastics and are actively seeking more of film plastics. Given the amount of film plastics in the waste stream, and the market demand for this material, R. W. Beck recommends that Mecklenburg County give consideration to targeting this material for recovery in its business waste recycling program. This material in particular, would merit further study to determine key sources, quality concerns, barriers and specific opportunities prior to establishing any program for recovery and recycling. 6.2.5 Other Ferrous This is a catch-all category for ferrous materials that may or may not be recyclable, depending on the materials that are commingled with the ferrous metal. Items in this category include ferrous metal besides containers, such as clothes hangers, sheet metal 6-2 R. W. Beck B1603 RECOMMENDATIONS products, etc. Given the market value of ferrous metals and the extent to which businesses routinely recycle such metal, the opportunity to capture substantial additional ferrous metals for recycling due to new program efforts is likely to be limited. Therefore, we do not recommend this material as a target for the county’s business recycling program at this time. In Section 5, two employment sectors were identified as being the largest sources of waste generated by commercial businesses, based on the number of employees by industry sector and estimated tons per employee for each sector. These are as follows: Table 6-2 Mecklenburg County Commercial Waste Characterization by Employment Sector Employee Sector Annual Estimated Disposed Tonnage Accommodation and Food Services 127,931 Retail Trade 103,717 Retail Trade and Accommodation and Food Service sectors are primary generators of food waste and plastic film. R. W. Beck recommends that the County focus its target of opportunities to reduce and recycle the target waste materials mentioned above from these sources. In addition, two other sectors—Educational Services, and Health Care and Social Assistance—often have food service establishments thereby making them appropriate targets for food waste recycling programs. These institutions generate substantially less waste than those mentioned above, but may be more receptive to participating in waste reduction and recycling programs. For these reasons, we recommend including them along with Accommodation and Food Services and Retail Trade (food retail in particular) to recycle food waste. 6.3 Follow-Up Study Recommendations Based upon the analysis completed above, the planning level results should be confirmed through field studies. We would recommend that the County conduct generator-based field audits for targeted businesses. Specifically, conducting waste audits for a sampling of businesses in the Retail Trade and Accommodation and Food Services should be considered. B1603 R. W. Beck 6-3