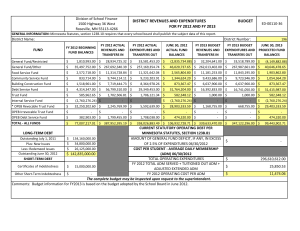

ILLINOIS STATE BOARD OF EDUCATION School Business Services Division

advertisement