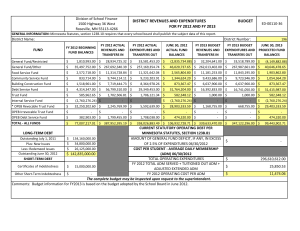

ILLINOIS STATE BOARD OF EDUCATION 217/785-8779

advertisement