Why Mortgagors Can’t Get No Satisfaction I. I

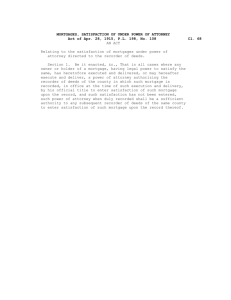

advertisement