RANTV SEA I MARINE /ADVISORY

advertisement

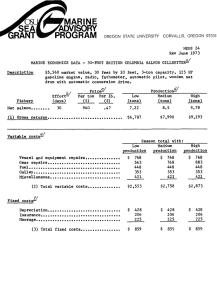

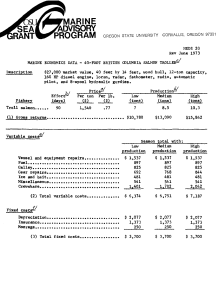

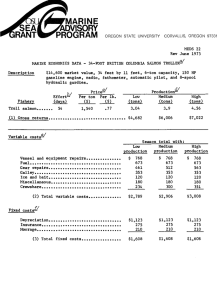

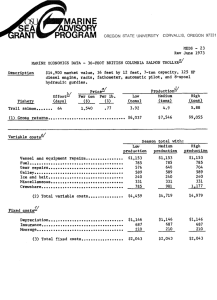

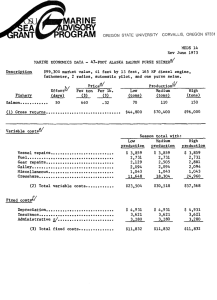

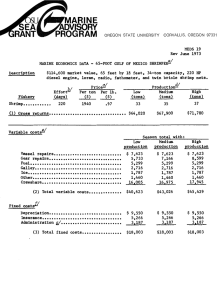

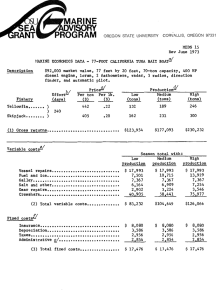

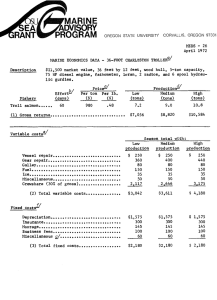

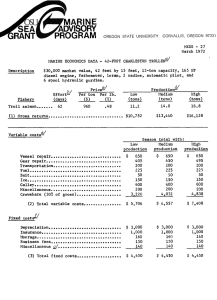

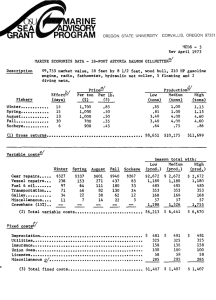

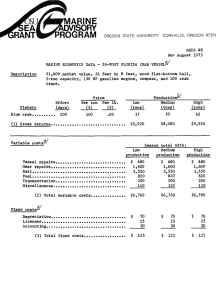

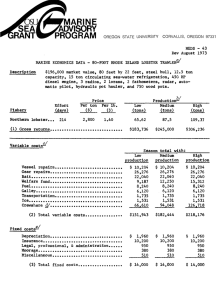

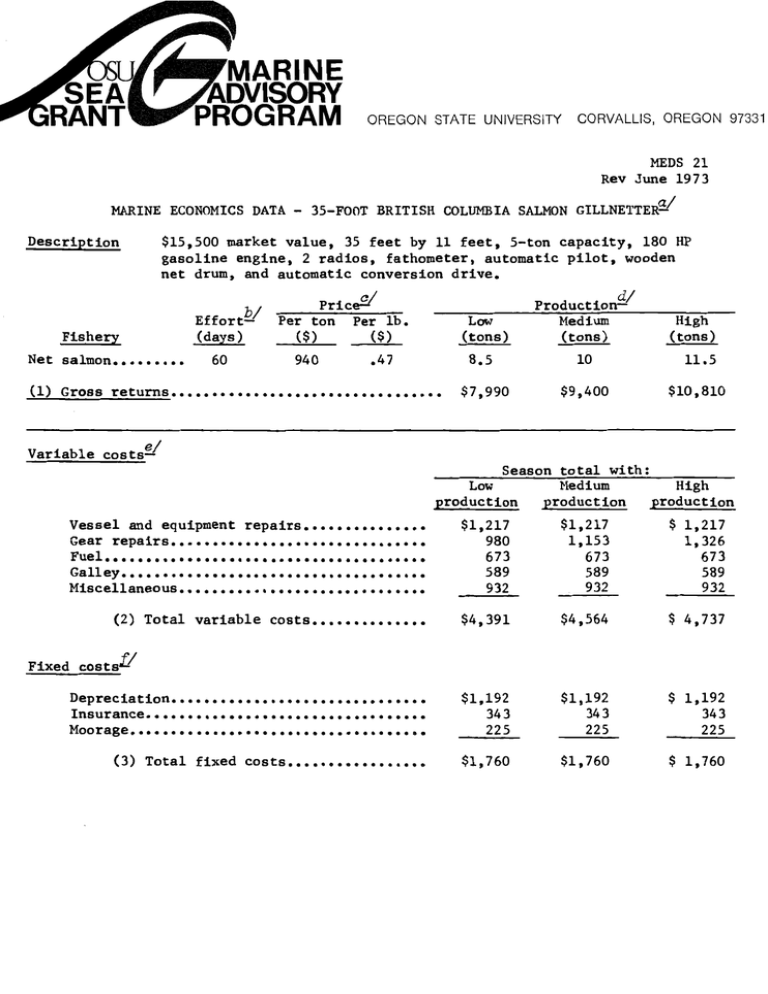

MARINE SEA I /ADVISORY RANTV PROGRAM OREGON STATE UNIVERSITY CORVALLIS, OREGON 97331 MEDS 21 Rev June 1973 MARINE ECONOMICS DATA - 35-FOOT BRITISH COLUMBIA SALMON GILLNETTER-" Description $15,500 market value, 35 feet by 11 feet, 5-ton capacity, 180 HP gasoline engine, 2 radios, fathometer, automatic pilot, wooden net drum, and automatic conversion drive. Productio" Price2t" Fishery Net salmon Effort-i (days) Per ton Per lb. ($) ($) 940 .47 60 (1) Gross returns Low (tons) 8.5 $7,990 Medium (tons) 10 $9,400 High (tons) 11 5 $10,810 Variable costs-" Season total with Low Medium High production production product ion Vessel and equipment repairs Gear repairs Fuel Galley Miscellaneous (2) Total variable costs $1,217 980 673 589 $ 1,217 1,326 673 932 $1,217 1,153 673 589 932 $4,391 $4,564 $ 4,737 $1,192 343 225 $1,192 343 225 $ 1,192 343 $1,760 $1,760 $ 1,760 589 932 Fixed costsl" Depreciation Insurance Moorage (3) Total fixed costs 225 Opportunity costs/' (4) Operator's labor (30% of gross) (5) Operator's management (10% of gross) (6) Total investment ($15,500 @ 7%) Low production Medium production High production $2,397 $2,820 $3,243 799 940 1,081 1,085 1,085 1,085 $1,839 $3,076 $4,313 754 1,991 3,228 -1,357 -684 -11 Summary Return to labor, management, and investment (1 less 2 and 3) Return to labor and management (1 less 2, 3, and 6) Return to investment (1 less 2, 3, 4, and 5) W 2/' Original data developed by British Columbia Department of Fisheries and Forestry, 1968. Vessel characteristics, costs, landings, and price have been adjusted to reflect changes since the original data were developed. Actual days at sea. Prevailing prices during the 1972 season. Low and high are 15% below and above medium. Costs that vary with fishing effort. May include unpaid crew, operator, and family labor. Some costs, such as gear repair and crewshare, also vary with production. Costs that do not vary with fishing effort. Opportunity cost of labor is the estimated value of this operator's time, or what could have been earned working for someone else. Opportunity cost of management is the estimated value of this operator's management (decision-making and risk), or what could have been earned managing another similar business. Opportunity cost of investment Is the estimated fair return to total Investment in the business, regardless of the actual amount of debt.