Research Journal of Applied Sciences, Engineering and Technology 5(4): 1154-1159,... ISSN: 2040-7459; e-ISSN: 2040-7467

advertisement

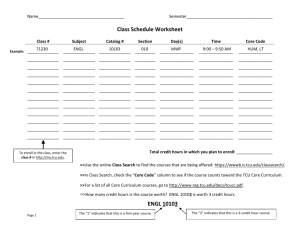

Research Journal of Applied Sciences, Engineering and Technology 5(4): 1154-1159, 2013 ISSN: 2040-7459; e-ISSN: 2040-7467 © Maxwell Scientific Organization, 2013 Submitted: July 09, 2012 Accepted: August 08, 2012 Published: February 01, 2013 A Single-Producer Multi-Retailer Integrated Inventory System with Scrap in Production 1 Singa Wang Chiu, 2Kuo-Tsun Liu, 2Chien-Hua Lee and 2Yuan-Shyi Peter Chiu 1 Department of Business Administration, 2 Department of Industrial Engineering and Management, Chaoyang University of Technology, Taichung 413, Taiwan Abstract: This study determines the replenishment-distribution policy for a single-producer multi-retailer integrated inventory system with scrap rate in production. The objective is to find the optimal lot-size and number of shipments that minimizes the total expected costs for such a specific system. It is assumed that an item is manufactured by a producer and then delivered to its n different retailers for sale. Each retailer has its own annual product demand and the demand will be satisfied by synchronized multiple shipments during each production cycle. Unlike the classic Finite Production Rate (FPR) model assuming perfect production and a continuous inventory issuing policies, the proposed system assumes that there is an inevitable random defective rate in production and all nonconforming items are scrap and delivery of product is under a practical multiple shipment policy. Mathematical modeling is employed and the renewal reward theorem is used to cope with the variable cycle length. Then the expected system cost function is derived and the convexity of this function is proved. Finally, a closed-form optimal replenishmentdistribution policy for such a specific single-producer multi-retailer integrated system is obtained. A numerical example is provided to demonstrate the practical usage of the obtained results. Keywords: FPR model, inventory, manufacturing, multiple retailers, multiple shipments, optimal batch size, scrap INTRODUCTION The purpose of this study is to determine the optimal lot-size and number of shipments that minimizes the total expected cost for a single-producer multi-retailer integrated inventory system with scrap in production. The classic FPR model (also known as the Economic Production Quantity (EPQ) model) assumes a perfect production (Taft, 1918; Nahmias, 2009). However, in a real life manufacturing environment, due to different unpredictable factors it seems to be inevitable to have imperfect production (Hadley and Whitin, 1963; Schneider, 1979; Bielecki and Kumar, 1988; Chern and Yang, 1999; Boone et al., 2000; Teunter and Flapper, 2003; Ojha et al., 2007; Lin et al., 2008; Chiu et al., 2009a, 2012a; Lee et al., 2011; Chen, 2011). Another unrealistic assumption in the classic FPR model is the continuous inventory issuing policy to satisfy product demand. In the real world vendor-buyer integrated system, however, the multiple or periodic deliveries of finished products are often used. Schwarz (1973) first examined a one-warehouse N-retailer deterministic inventory system with the objective of determining the stocking policy that minimizes the long-run average system cost per unit time. The optimal solutions along with a few necessary properties are derived for such a one-retailer and N identical retailer problems. Heuristic solutions for the general problem were also suggested. Goyal (1977) studied the integrated inventory model for the single suppliersingle customer problem. He proposed a method that is typically applicable to those inventory problems where a product is procured by a single customer from a single supplier and an example was provided to illustrate his proposed method. Schwarz et al. (1985) considered the system fill-rate of a one-warehouse N-identical retailer distribution system as a function of warehouse and retailer safety stock. They used an approximation model from a prior study to maximize system fill-rate subject to a constraint on system safety stock. As results, properties of fill-rate policy lines are suggested. They may be used to provide managerial insight into system optimization and as the basis for heuristics. Banerjee (1986) studied a joint economic lot-size model for purchaser and vendor, with the focus on minimizing the joint total relevant cost. He concluded that a jointly optimal ordering policy, together with an appropriate price adjustment, could be economically beneficial for both parties, but definitely not disadvantageous to either party. Studies have since been carried out to address various aspects of vendor-buyer supply chain optimization issues (Kim and Hwang, 1988; Banerjee and Burton, 1994; Parija and Sarker, 1999; Cetinkaya and Lee, 2000; Yao and Chiou, 2004; Hoque, 2008; Sarker and Diponegoro, 2009; Chiu et al., 2011, Corresponding Author: Yuan-Shyi Peter Chiu, Department of Industrial Engineering and Management, Chaoyang University of Technology, Taichung 413, Taiwan 1154 Res. J. Appl. Sci. Eng. Technol., 5(4): 1154-1159, 2013 n Fig. 1: On-hand inventory of perfect quality items in the producer side 2012b). Because little attention has been paid to the area of deriving the joint replenishment-distribution policy for a single-producer multi-retailer FPR model with scrap in production, this study intends to bridge the gap. MODELING AND ANALYSIS This study considers a single-producer N-retailer integrated inventory system with scrap. It is assumed that the manufacturing process in producer’s side may randomly produce an x portion of defective items at a production rate d. All items produced are screened and unit inspection cost is included in unit production cost C. All nonconforming items are assumed to be scrap; they are discarded at the end of production. Under the normal operation, to prevent shortages from occurring, the constant production rate P satisfies (P-d-λ)>0 or (1x-λ/P)>0 and d can be expressed as d = Px. Unlike the classic FPR model assuming a continuous issuing policy for meeting demand, this research considers a multi-shipment policy. It is also assumed that the finished items can only be delivered to retailers if the whole lot is quality assured at the end of production. Each retailer has its own annual demand rate λi. Fixed quantity n installments of the finished batch are delivered to multiple retailers synchronously at a fixed interval of time during the downtime t2 (Fig. 1). Cost parameters used in this study are as follows: the unit production cost C, unit disposal cost CS, the production setup cost K, unit holding cost h, the fixed delivery cost K1i per shipment delivered to retailer i, unit holding cost h2i for item kept by retailer i and unit shipping cost Ci for item shipped to retailer i. Additional notation is listed as follows: Q = = Number of fixed quantity installments of the finished batch to be delivered to retailers for each cycle, a decision variable (to be determined) m = Number of retailers = The production uptime for the proposed t1 system H = Maximum level of on-hand inventory in units when regular production process ends t2 = Time required for delivering all quality assured finished products to retailers tn = A fixed interval of time between each installment of finished products delivered during production downtime t2 T = Production cycle length I (t) = On-hand inventory of perfect quality items at time t Ic (t) = On-hand inventory at the retailers at time t TC (Q, n) = Total production-inventory-delivery costs per cycle for the proposed system E [TCU (Q, n)] = Total expected production-inventorydelivery costs per unit time for the proposed system From Fig. 1, the following equations can be directly obtained: T t1 t2 t1 T (1) Q H P Pd Q (2) 1 x (3) 1 x 1 t 2 nt n Q P H P d t1 P d m i Q 1 x Q P (4) (5) (6) i 1 The on-hand inventory of scrap items during production uptime t1 is: dt1 Pxt1 xQ. (7) Cost for each delivery is: Production lot size per cycle, a decision variable (to be determined) 1155 m K i 1 1i 1 m Ci iT n i 1 (8) Res. J. Appl. Sci. Eng. Technol., 5(4): 1154-1159, 2013 Total production-inventory-delivery cost per cycle TC (Q, n) consists of the setup cost, variable production cost, disposal cost, fixed and variable delivery cost, holding cost during production uptime t1 and holding cost for finished goods kept by both the manufacturer and the customer during the delivery time t2. Therefore, TC (Q, n) is: m m i 1 i 1 TC Q, n CQ K CS xQ n K1i Ci iT H dt1 n 1 1 m Tt2 h Tt1 t1 Ht2 h2i i 2n n 2 2 i 1 (12) Because the scrap rate x during production is assumed to be a random variable with a known probability density function. In order to take the randomness of scrap rate into account, the expected values of x can be used in the cost analysis. Substituting all parameters from Eq. (1) to (11) in TC (Q, n) and with further derivations the expected cost E [TCU (Q, n)] can be obtained as follows: m m m K n K1i i CS E x i i 1 i 1 i 1 Q 1 E x 1 E x 1 E x m E TCU Q, n E TC Q, n E T C i i 1 m hQ i n 1 i 1 Ci i 2 2 P 1 E x n i 1 m m hQ i i 1 1 E x 1 m P i i 1 m m h2i i Q 1 E x h2i iQ 1 1 n 1 i 1 i 1 m 2 n P n 2 i i 1 Fig. 2: On-hand inventory in m retailer sides DERIVATION OF THE OPTIMAL SOLUTIONS Total delivery costs for n shipments in a cycle are: m n K 1i i 1 m C i 1 i i T (9) The variable holding costs for finished products kept by the manufacturer, during the delivery time t2 where n fixed-quantity installments of the finished batch are delivered to customers at a fixed interval of time, are as follows (Chiu et al., 2009b): (10) Tt m i 1 2i 2 E TCU Q, n Q 2 Q n 2 E TCU Q, n Qn 2 E TCU Q, n Qn Q 0 2 E TCU Q, n n n 2 From Eq. (13), one obtains: The variable holding costs for finished products kept by the customer during the delivery time t2, are as follows (Fig. 2 and Appendix for details): h Proof of convexity: For the proof of convexity of E [TCU (Q, n)], one can use the Hessian matrix equations (Rardin, 1998) and verify whether the following condition (Eq. (14) holds: (14) n 1 h Ht2 2n 1 2 (13) i 2 T t1 n m m m m h i h i K n K1i i n 1 i 1 i 1 i 1 i 1 Q 2 P 1 E x n 2 Q 2 1 E x m m h2i i h2i i 1 E x 1 1 n 1 i 1 i 1 m n 2 P n 2 i i 1 E TCU Q, n (11) 1156 1 E x 1 m P i i 1 (15) Res. J. Appl. Sci. Eng. Technol., 5(4): 1154-1159, 2013 m m 2 K n K1i i i 1 3 i 1 Q 1 E x 2 E TCU Q , n Q 2 E TCU Q , n n m m i 1 i 1 K1i i Q 1 E x (16) n* m 1 E x 1 Q m 2 h2 i i h i m P 2n i 1 i 1 i i 1 (17) 2 E TCU Q , n n 2 m m 1 E x Q 1 3 h2 i i h i m n P i 1 i 1 i i 1 (18) m E TCU Q, n Qn m K 1 Q 1 E x 2n i 1 2 1i i 1 i m 1 E x 1 m h h i m 2 2i i P i 1 i 1 i i 1 (19) Substituting Eq. (16), (18) and (19) in Eq. (14) one has: 2 E TCU Q, n Q 2 Q n 2 E TCU Q, n Qn m 2 E TCU Q, n 2 K i Q Qn i 1 0 2 E TCU Q, n n Q 1 E x n 2 (20) Equation (20) is resulting positive, because K, λ, (1-E [x]) and Q are all positive. Hence, E [TCU (Q, n)] is a strictly convex function for all Q and n different from zero. Therefore, the convexity of E [TCU (Q, n)] is proved and there exists a minimum of E [TCU (Q, n)]. Derivation of the optimal policy: To determine jointly the replenishment-distribution policy for the proposed single-producer multi-retailer integrated inventory system with scrap, one can solve the linear system of Eq. (15) and (17) by setting these partial derivatives equal to zero. Further derivations one obtains: It is noted that although in real-world situation the number of deliveries takes integer values only, Eq. (22) results in a real number. In order to find the integer value of n* that minimizes the expected system cost, two adjacent integers to n must be examined respectively (Chiu et al., 2009b). Let n+ denote the smallest integer greater than or equal to n (derived from Eq. (22)) and n- denote the largest integer less than or equal to n. Substitute n+ and n- respectively in Eq. (21), then applying the resulting (Q, n+) and (Q, n-) in Eq. (13) respectively. By selecting the one that gives the minimum long-run average cost as the optimal replenishment-distribution policy (Q*, n*). A numerical example demonstrating their practical usages is provided in next section. NUMERICAL EXAMPLE Assume a producer can manufacture a product at an annual rate of 60,000 units. Annual demands λi of this item from 5 different retailers are 400, 500, 600, 700 and 800 respectively (total demand is 3000/year). There is a random scrap rate during production uptime which follows a uniform distribution over the interval (0, 0.3). Values for additional parameters are: h K C CS K1i * = Unit holding cost per item at the producer side, $20 per item per year = $35000 per production run = $100 per item = $20, disposal cost per scrap item = The fixed delivery cost per shipment for retailer i, they are $ 100, 200, 300, 400 and 500, respectively $480,000 E [TCU (3122,5) = $460,408] $460,000 m E [TCU (Q*, n*)] Q (22) 2 K n K1i i i 1 i 1 m 2 m 1 m 1 E x 1 E x K h2i i h i m P i 1 i 1 i i 1 m m m h i m 1 i 1 h2i i h i 1 E x K1i i 1 i 1 i 1 P P m h i n 1 2 m 1 i 1 h 1 E x h2i i h i 1 E x n i 1 P i 1 P m 2 h E x 1 2i i i 1 m n i i 1 m (Q*, n*) = (2961,5) $440,000 (Q*, n*) = (2815,5) $420,000 $400,000 $380,000 $360,000 0 0.05 0.10 0.15 0.20 0.25 0.30 x (21) and Fig. 3: Variation of random scrap rate effects on the (Q*, n*) policy and E [TCU (Q*, n*)] 1157 Res. J. Appl. Sci. Eng. Technol., 5(4): 1154-1159, 2013 h2i = unit holding cost for item kept by retailer i, they are $75, 70, 65, 60 and 55 per item, respectively Ci = unit transportation cost for item delivered to retailer i, they are $0.5, 0.4, 0.3, 0.2 and 0.1, respectively From Eq. (21), (22) and (13), one obtains the optimal number of delivery n* = 5, the optimal replenishment lot size Q* = 3122 and total expected cost E [TCU (Q*, n*)] = $ 460,408. It is noted that number of delivery should practically be an integer number while Eq. (22) results 5.39, by applying the aforementioned (Q, n+) and (Q, n-) in Eq. (13) respectively, one finds the optimal number of delivery n* = 5. Variation of random scrap rate effects on the optimal (Q*, n*) policy and on the system cost E [TCU (Q*, n*)] are depicted in Fig. 3. It is noted that as the random scrap rate x increases, the value of the system cost E [TCU (Q*, n*)] increases significantly. CONCLUDING REMARKS (A2) nI t n D1 I1 t n n n 1 h21 I1 t n 1 1 2 2 2 nI 2 t1 n D2 I 2 t n n n 1 h22 I 2 tn 2 2 2 (A3) n Dm I m t n n n 1 nI t h2m I m tn m 1 2 2 2 m n Di I i t n n n 1 nI t h2i I i tn i 1 2 2 2 i 1 m h 2i i 1 2 n Di I i t n n n 1 I i t n nI i t1 Because n installments (fixed quantity D) of the finished lot are delivered to customer at a fixed interval of time tn, one has the following: nI i (A4) Di i t n I i (A5) i where, Ii denotes number of left over items for each retailer after demand during each fixed interval of time tn has been satisfied (Fig. 2). Eq. (A3), the retailers’ holding cost during t2 becomes: 1 m 2 h2i Di Ii t2 n 1 Iit2 i t1 2 i 1 1 m 2 h2i i tn I i t2 i t1 t2 i t1 2 i 1 1 m Tt h2i i 2 i t1 T 2 i 1 n (A6) REFERENCES ACKNOWLEDGMENT The authors appreciate National Science Council of Taiwan for supporting this research under grant number: NSC 99-2410-H-324-007-MY3 (3/3). APPENDIX From Fig. 1, n installments (fixed quantity D) of the finished lot are delivered to customer at a fixed interval of time tn, one has: H n t2 n From Fig. 2, the computations of retailers’ holding cost during t2 (Eq. (11)) are as follows: t1 In real world business environments, it is common to have a producer supplied a product to its multiple retailers. In such a specific internal supply chains, management would like to figure out a best replenishment-distribution policy in order to minimize total system costs. This study investigates the optimal replenishment-distribution policy for such a singleproducer multi-retailer integrated inventory system with scrap rate in production. Mathematical modeling and analysis are used. The renewal reward theorem is employed to cope with the variable cycle length (due to the randomness of scrap rate in production). The long-run expected production-inventory-delivery cost per unit time for the proposed system model is derived and its convexity is proved. Then, a closed-form solution of the optimal replenishment-distribution policy for such a single-producer multi-retailer integrated system is obtained. Effects of various scrap rates on the optimal solution are also examined. One interesting topic for future research will be to investigate the effect of rework on the optimal replenishment-distribution policy in such a specific supply chains. Di tn (A1) Banerjee, A., 1986. A joint economic-lot-size model for purchaser and vendor. Decision Sci., 17(3): 292-311. Banerjee, A. and J.S. Burton, 1994. Coordinated vs. independent inventory replenishment policies for a vendor and multiple buyers. Int. J. Prod. Econ., 35: 215-222. Bielecki, T. and P.R. Kumar, 1988. Optimality of zeroinventory policies for unreliable production facility. Oper. Res., 36: 532-541. Boone, T., R. Ganeshan, Y. Guo and J.K. Ord, 2000. The impact of imperfect processes on production run times. Decis. Sci., 31(4): 773-785. Cetinkaya, S. and C.Y. Lee, 2000. Stock replenishment and shipment scheduling for vendor managed inventory systems. Manage. Sci., 46(2): 217-232. Chen, C.T., 2011. Dynamic preventive maintenance strategy for an aging and deteriorating production system. Exp. Syst. Appl., 38(5): 6287-6293. 1158 Res. J. Appl. Sci. Eng. Technol., 5(4): 1154-1159, 2013 Chern, C.C. and P. Yang, 1999. Determining a threshold control policy for an imperfect production system with rework jobs. Nav. Res. Log., 46(2-3): 273-301. Chiu, S.W., K.K. Chen and J.C. Yang, 2009a. Optimal replenishment policy for manufacturing systems with failure in rework, backlogging and random breakdown. Math. Comput. Model. Dyn., 15(3): 255-274 Chiu, S.W., H.D. Lin, C.B. Cheng and C.L. Chung, 2009b. Optimal production- shipment decisions for the finite production rate model with scrap. Int. J. Eng. Model., 22: 25-34 Chiu, Y.S.P., F.T. Cheng and H.H. Chang, 2010. Remarks on optimization process of manufacturing system with stochastic breakdown and rework. Appl. Math. Lett., 23(10): 1152-1155. Chiu, Y.S.P., S.C. Liu, C.L. Chiu and H.H. Chang, 2011. Mathematical modelling for determining the replenishment policy for EMQ model with rework and multiple shipments. Math. Comput. Model., 54(9-10): 2165-2174. Chiu, Y.S.P., K.K. Chen and C.K. Ting, 2012a. Replenishment run time problem with machine breakdown and failure in rework. Exp. Syst. Appl., 39(1): 1291-1297. Chiu, S.W., Y.S.P. Chiu and J.C. Yang, 2012b. Combining an alternative multi-delivery policy into economic production lot size problem with partial rework. Exp. Syst. Appl., 39(3): 2578-2583. Goyal, S.K., 1977. Integrated Inventory Model for a Single Supplier-Single Customer Problem. Int. J. Prod. Res., 15: 107-111. Hadley, G. and T.M. Whitin, 1963. Analysis of Inventory Systems. Prentice-Hall, Englewood Cliffs, New Jersey. Hoque, M.A., 2008. Synchronization in the singlemanufacturer multi-buyer integrated inventory supply chain. Eur. J. Oper. Res., 188(3): 811-825. Kim, K.H. and H. Hwang, 1988. An incremental discount pricing schedule with multiple customers and single price break. Eur. J. Oper. Res., 35(1): 71-79. Lin, H.D., Y.S.P. Chiu and C.K. Ting, 2008. A note on optimal replenishment policy for imperfect quality EMQ model with rework and backlogging. Comput. Math. Appl., 56(11): 2819-2824. Lee, T.J., S.W. Chiu and H.H. Chang, 2011. On improving replenishment lot size of an integrated manufacturing system with discontinuous issuing policy and imperfect rework. Am. J. Ind. Bus. Manage., 1(1): 20-29. Nahmias, S., 2009. Production and Operations Analysis. McGraw-Hill Co. Inc., New York. Ojha, D., B.R. Sarker and P. Biswas, 2007. An optimal batch size for an imperfect production system with quality assurance and rework. Int. J. Prod. Res., 45(14): 3191-3214. Parija, G.R. and B.R. Sarker, 1999. Operations planning in a supply chain system with fixed-interval deliveries of finished goods to multiple customers. IIE Trans., 31(11): 1075-1082. Rardin, R.L., 1998. Optimization in Operations Research. Prentice-Hall, New Jersey, pp: 919, ISBN: 0023984155. Sarker, B.R. and A. Diponegoro, 2009. Optimal production plans and shipment schedules in a supply- chain system with multiple suppliers and multiple buyers. Eur. J. Oper. Res., 194(3): 753-773. Schneider, H., 1979. The service level in inventory control systems. Eng. Costs Prod. Econ., 4: 341-348. Schwarz, L.B., 1973. A simple continuous review deterministic one-warehouse N-retailer inventory problem. Manage. Sci., 19: 555-566. Schwarz, L.B., B.L. Deuermeyer and R.D. Badinelli, 1986. Fill-rate optimization in a one-warehouse Nidentical retailer distribution system. Manage. Sci., 31(4): 488-498. Taft, E.W., 1918. The most economical production lot. Iron Age, 101: 1410-1412. Teunter, R.H. and S.D.P. Flapper, 2003. Lot-sizing for a single-stage single-product production system with rework of perishable production defectives. OR Spectrum, 25(1): 85-96. Yao, M.J. and C.C. Chiou, 2004. On a replenishment coordination model in an integrated supply chain with one vendor and multiple buyers. Eur. J. Oper. Res., 159: 406-419. 1159