Research Journal of Applied Sciences, Engineering and Technology 4(20): 3896-3904,... ISSN: 2040-7467

advertisement

Research Journal of Applied Sciences, Engineering and Technology 4(20): 3896-3904, 2012

ISSN: 2040-7467

© Maxwell Scientific Organization, 2012

Submitted: December 18, 2011

Accepted: April 23, 2012

Published: October 15, 2012

A Two-Warehouse Inventory Model with Imperfect Quality and Inspection Errors

Tie Wang

School of Management, Shanghai University, Shanghai, 200444, China

School of Mathematics, Liaoning University, Shenyang, Liaoning 110036, China

Abstract: In this study, we establish a new inventory model with two warehouses, imperfect quality and

inspection errors simultaneously. The mathematical model by maximizing the annual total profit and the

solution procedure are developed. As a byproduct, we correct some technical error in developing the optimal

ordering policies in the above two papers. Moreover, we find a mild condition satisfied by most common

distributions to make the ETPU(y) concavity. The Proposition 1 is used to determine the optimal solution of

ETPU(y).

Keywords: EOQ, imperfect quality, misclassification errors, two-warehouse

INTRODUCTION

The traditional EOQ (economic order quantity)

model is a crucial building block of the deterministic

inventory theory because of its simple and elegant

structure as well as its rich managerial insights. However,

some unrealistic assumptions make it not conform to

actual inventories; the model must be extended or altered.

Porteus (1986) investigated the influence of defective

items on the traditional EOQ model. He assumed that

there is a fixed probability that the process would go outof-control. Rosenblatt and Lee (1986) assumed that the

time between the in-control and the out-of-control state of

a process follows an exponential distribution and that the

defective items are reworked instantaneously. They

suggested producing in smaller lots when the process is

not perfect. In a later study, (Lee and Rosenblatt, 1987)

studied a joint lot sizing and inspection policy for an EOQ

model with a fixed percentage of defective products.

Salameh and Jaber (2000) extended the traditional EOQ

model by accounting for imperfect quality items and

considered the issue that poor-quality items are sold as a

single batch by the end of the 100% screening process.

Along this line, (Papachristos and Konstantaras, 2006)

discussed the non-shortages in inventory models where

the proportion of defective items is a random variable.

They proposed an alternative to the Salameh and Jaber

(2000) by speculating on the timing of withdrawing and

selling the imperfect lot, (Wee et al., 2007) developed an

optimal inventory model for items with imperfect quality

and shortage backordering by assuming that all customers

are willing to wait for new supply when there is a

shortage. (Maddah and Jaber, 2008) rectified a flaw

(Salameh and Jaber, 2000) by the renewal-reward theorem

and leaded to simple expressions of the optimal order

quantity and expected profit per unit time. Chang and Ho

(2010) revisited Wee et al. (2007) and applied the wellknown renewal-reward theorem to obtain a new expected

net profit per unit time and derived the exact closed-form

solutions to determine the optimal lot size, backordering

quantity and maximum expected net profit per unit time

without differential calculus. Khan et al. (2011) explored

an EOQ model with imperfective items and an imperfect

inspection process That is, the inspector may commit

errors while screening. The probability of

misclassification errors is assumed to be known. The

inspection process would consist of three costs:

C

C

C

Cost of inspection

Cost of Type I errors

Cost of Type II errors

(Sarker and Kindi, 2006) developed an inventory

model from the Buyer’s perspective, to determine the

optimal ordering policies in response to a discount offer

settled by the vendor for five possible cases. Goyal and

Jaber (2006) and Cardenas-Barron (2009) extended and

corrected (Sarker and Kindi, 2006). Cardenas-Barron

(2009) investigated an inventory model for imperfective

items under a one-time-only discount, where the

defectives can be screened out by a 100% screening

process and then can be sold in a single batch by the end

of the 100% screening process. The optimal order policies

associated with three kinds of effective times of the

reduced price are obtained. Recently, Yang (2004)

considered two-warehouse models for deteriorating items

with shortages under inflation. Yang (2006) extended the

above study by incorporating partial backlogging and then

compared the two two-warehouse inventory models based

on the minimum cost approach. Zhou and Yang (2005)

presented a two-warehouse inventory model for items

with stock-level-dependent demand rate. Moreover, (Lee

3896

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

and Hsu, 2009) developed a two-warehouse inventory

model for deteriorating items with time-dependent

demand. Chung et al. (2009) investigated a new inventory

model with two warehouses and imperfect quality

simultaneously. The mathematical model by maximizing

the annual total profit and the solution procedure were

developed.

The above study mentioned did not consider the

inventory model with two warehouses, imperfect quality

and inspection errors simultaneously. Based on

(Chung et al., 2009; Khan et al., 2011), this study tries to

develop an inventory model to incorporate concepts of

two warehouses, imperfect quality and inspection errors

to establish a new economic production quantity model.

Consequently, the inventory model in this study is more

practical than the traditional EOQ model. Of course, this

study generalizes (Chung et al., 2009; Khan et al., 2011).

As a byproduct, we correct some technical error in

developing the optimal ordering policies in the above two

studies.

This study incorporates the concepts of the basic two

warehouses, imperfect quality and inspection errors. The

expected total profit per unit time function ETPU(y) is

concave. The expected total profit per unit time function

ETPU(y) is piecewise concave. Moreover, the expected

total profit per unit time function ETPU(y) in this study is

not piecewise concave in general. In addition, we find a

mild condition satisfied by most common distributions to

make the ETPU(y) concavity. The Proposition 1 is used

to determine the optimal solution of ETPU(y).

NOTATIONS AND ASSUMPTIONS

It is assumed that the retailer owns a warehouse

(denoted by OW) with a fixed capacity of w units and any

quantity exceeding this should be stored in a rented

warehouse (denoted by RW), which is assumed to be

available with abundant space. The transportation cost

which transfers from RW to OW is included in holding

cost of the RW. So it is not considered by our study

separately. At the beginning of the period, the lot size y

enters the system with a purchasing price of c per unit and

an ordering cost of K. Out of these y units, w units are

kept in OW and y-w units in RW. (If y#w, y units are only

kept in OW.) The products of the OW are sold only after

consuming the products kept in RW. All of products

ordered arrive at the same time. They are screened with

unit inspection cost d in the OW and RW simultaneously

by the inspectors. It is assumed that each lot received

contains fixed percentage p of defective items. The

inspection process of the lot is conducted at a rate of x

units/unit time. The inspectors screen out the defective

items from the lot with fixed rate of misclassification.

That is, a proportion m1 of no defective items are

classified to be defective and a proportion m2 of defective

items are classified to be no defective. It is assumed that

p, m1, m2 have independent and identical distribution

function and the probability density functions, f(p), f(m1)

and f(m2) are known. The selling price of good-quality

item classified by the inspectors is s per unit. The

inspection process of the lot is conducted at a rate of x

units per unit time. It is assumed that the items that are

returned from the market are stored with those that are

classified as defective by the inspectors. They are all sold

as a single batch at the end each cycle at a discounted

price of v/unit. After inspection time, no holding cost is

considered for imperfect items classified by inspectors.

This cost was scaled accordingly. There are also no

holding costs for the returned products.

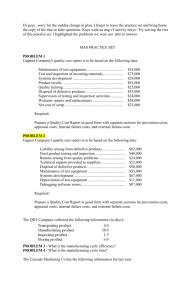

The behavior of the inventory level may be illustrated

in Fig. 1, where T is the cycle length, y (1-p) m1+py (1-m2)

is the number of defective items classified by the

inspectors withdraw from inventory, tR is the total

inspection time of the RW, tw the total inspection time of

the OW and to the time to use up of the RW. Figure 1 and

2 reveal tR = (y-w)/x and tw = w/x.

THE MODEL

From the above assumptions about the model and

Fig. 1 and 2, we know the consumption process continue

at the demand rate until the end of cycle time T. Due to

inspection error, some of the items used to fulfill the

demand are defective. These defective items are later

returned to the inventory. To avoid shortages, it is

assumed that the number of no defective items at least

equal to the adjusted demand, that is the sum of the actual

demand and items that are replaced for ones returned

(pm2y) from the market over T.

Thus,

y y (1 p)m1 yp(1 m2 ) DT pm2 y

y (1 p)(1 m2 ) DT

So, for the limit case, the cycle length can be written as:

3897

T

y (1 p)(1 m2 )

D

(1)

It should note here that this behavior was suggested

by Khan et al. (2011).

Define NR(y, p) and NO(y, p) as the number of no

defective items with respect to warehouses RW and OW,

respectively. There are two cases occur.

Case 1: Suppose y<w. Then

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

Fig. 1: The model of products in stock of two warehouses if t0$ tw

Fig. 2: The model of products in stock of two warehouses if tO< tw

No( y , p) y y (1 p)m1 yp(1 m2 )

(2)

To avoid shortages, it is assumed that NO(y, p) are at

least equal to, the sum of the actual demand during

3898

times y/x and items that are replaced for ones

returned from the market during time T, that is:

No( y, p) D

y

ypm2

x

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

Substituting (2) into (3). We have:

(1 p)(1 m1 )

ETPU ( y ). E[

D

.

x

About the computations of ETPU(y) there are

two cases to occur.

Case 2: Suppose y$w. Then:

Case (I): Suppose y<w.

N R ( y , p) y w ( y w)(1 p)m1

( y w) p(1 m2 )

(3)

N o (Y , P) w w(1 P)m1 wp(1 m2 )

(4)

This case is same to the model presented in

Khan et al. (2011) study. But, there is a

mathematical error in (2) of their paper for

holding cost per cycle, so the total cost per

cycle, the total profit per cycle, average profit

per cycle and optimal order size. The corrected

total cost per cycle should be

TC1(y) = procurement cost + screening cost +

holding cost:

To avoid shortages, it is assumed that NR(y, p)

and NO(y, p) are at least equal to, the sum of the

actual demand during times tR and tw and items

that are replaced for ones returned from the

market during time t0 and T-tO that is:

N R ( y , p) Dt R ( y w) pm2

K cy dy cr y (1 p)m1 ca ypm2 hw [

(5)

N o ( y , p) Dt 0 wpm2

TP

]

T

( y Dt y y (1 p)m1 yp(1 m2 ))

Dt y2

2

(T t y )

ypm2

T ].

2

(8)

(6)

Since ty = y/x, (8) can be written as follows:

Substituting (4) and (5) in (6) and (7) and

replacing tR and tw by (y-w)/x, respectively. We

have:

TC1( y ) K cy dy cr y (1 p)m1 ca ypm2

2(m1 p) 2 p(m1 m2 ) pm2 y 2 p(1 m1)m2

hw y 2

x

2D

2 (1 p)(1 m1)(1 p)(1 m1) pm2

D

D

(1 p)(1 m1 )

x

The total profit per cycle can now be written as

the difference between the total revenue and the

total cost per cycle, that is:

Combining the above arguments, we conclude:

(1 p)(1 m1 )

D

x

(9)

(7)

TP1( y ) TR( y ) TC1( y ) sy (1 p)(1 m1 )

sypm2 vy (1 p)m1 vyp {K cy dy

All of products are stored in OW and RW,

respectively and screen them in OW and RW

simultaneously at the same time. In addition,

TR(y) denote the sum of total sales revenue of no

defective quality classified by the inspectors,

imperfect quality items classified by the

inspectors and returned items per cycle; TC(y),

TP(y) and ETPU(y) denote the sum of total cost

per cycle and the profit per cycle and average

profit per cycle, respectively.

Then,

hw y 2

2

2(m1 p) pm2 2 p(m1 m2 )

D

cr y (1 p)m1 ca ypm

(1 p)(1 m1)((1 p)(1 m1 ) pm2 )

D

hw

(10)

y 2 p(1 p)(1 m1)m2

2D

To obtain the exact closed-form solution to

determine the optimal lot size without

differential calculus, we can use the renewalreward theorem to derive the expected net

profit per unit time ETPU1(y) as the following:

TP(y) = TP(y). ! TC(y)

TR( y ). sy (1 p)(1 m1 ) sypm2 )

3899

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

TC A ( y ) K cy dy cr y (1 p)m1 ca ypm2

TP ( y ) E[TP1 (Y )

ETPU1( y ) E 1

T E [T ]

( y w) 2 2(m1 p) p(m1 m2 ) m1 p

[

2

x

(1 p)(1 m1 )(1 p)(1 m1 ) 2 pm2 )

]

D

hR

s1 E[ p])(1 E[m1] ( s ca ) E[ p]E[m2 ]

(v cr )(1 E[ p]) E[m1] vE[ p] (d c)

D

1 E[ p]1 E[m1]

w2

((1 p)m1 p(1 m2 ))

x

w((1 p)(1 m1 pm2 )(2 y w)(1 p)(1 m1 )

]

2D

w 2 pm2 (1 P)(1 m1 )

hw [

]

2D

hw [

2( E[m1 ] E[ p] E[ p]) E[ p]E[m2 ]

{

hw y

KD

y (1 E[ p])(1 E[m1 ])

2

[D

2 E[ p]( E[m1 ] E[m2 ])

x (1 E[ p])(1 E[m1 ])

E[(1 p) 2 ](1 E[m1 ])2 E[ p(1 p)]E[m2 ]

}

1 E [ p]

G

C ( yH )

y

Case B: Suppose tO<tw. Then

TCB(y) = procurement cost + screening cost +

holding cost:

(11)

K cy dy cr y (1 p)m1 ca ypm2 hR [

Equation (10) and (11) are corrected total profit per

cycle and expected annual profit for Eq. (6) and (9)

in Khan et al. (2011). Note that when m1 = m2 = 0,

Eq. (11) gives the exact expression for Eq. (8) of

Chung et al. (2009) as:

ETPU1 ( y ) D

s(1 E[ p] vE[ p] (d c)

1 E [ p]

2 E [ p]

KD

h y

E[1 p]2

w D

(

1

[

]

2

(

1

[

])

1 E[ p]

y

E

p

x

E

p

(12)

Which is same to the Eq. (6) presented in (Maddah

and Jaber, 2008).

Case (II): Suppose y$w. There are two cases to be

discussed.

Case A: Suppose tO$tw. Then

TCA(y) = procurement cost + screening cost +

holding cost:

K cy dy cr y (1 p)m1 ca ypm2 hR [

Dt

2

(14)

DR2

2

( y w) pm2

tO

2

y w Dt R ( y w)(1 p)m1 ( y w) p(1 m2 )

(t O t R )]

2

( y w Dt R )t R

D( t w t O ) 2

( w D(t w t O ))(t w t O )

2

w D(t w t O ) w(1 p)m1 wp(1 m2 ))

(T t w )

2

wpm2

(T t O )]

2

hw [ wt O

(15)

Since tO = (y-w) (1-p) (1-m1)/D, tR = (y-w)/x, tw = w/x

and T = y (1-p)(1-m1)/D, (15) can be written as

follows:

TC B ( y ) K cy dy cr y (1 p)m1 ca ypm2

( y w) 2 2(m1 p) p(m1 m2 ) m1 p

[

2

x

(1 p)(1 m1 ((1 p)(1 m1 ) 2 pm2 )

]

D

hR

w 2 2(1 p)m1 p(1 m2 ) p

(

2

x

w((1 p)(1 m1 )(2 y w) ypm2 ))(1 p)(1 m1 )

]

2D

2

w pm2 (1 p)(1 m1 )

hw [

]

2D

hw [

2

R

( y w) pm2

to

2

y w Dt R ( y w)(1 p)m1 ( y w) p(1 m2 )

(tO t R )]

2

( y w Dt R )t R

So, we conclude:

hw [ wt w ( w w(1 p)m1 wp(1 m2 ))(t O t R )

(13)

( w w(1 p)m1 wp(1 m2 ))

wpm2

(T t O )

(T t O )]

2

2

TC2 ( y ) TC A ( y ) I [ t) t

Since tO = (y-w) (1-p) (1-m1)/D, tR = (y-w)/x, tw = w/x

and T = y(1-p)(1-m1)/D, (13) can be written as

follows TCA(y):

hR

w

]

TC B ( y ) I [ tO t w ]

K cy dy cr y (1 p)m1 ca ypm2

3900

( y w) 2 2(m1 p) p(m1 m2 ) m1 p

[

x

2

(16)

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

(1 p)(1 m1 )((1 p)(1 m1 ) 2 pm2 )

]

D

w2

hw I [ tO t w ] [

((1 p)m1 p(1 m2 ))

x

w((1 p)(1 m1 ) pm2 (2 y w)(1 p)(1 m1 )

]

2D

2( E[m1 ] E[ p]) E[ p]( E[m1 ] E[m2 ]

hR w

E (1 p) 2 E (1 m1 ) 2 ]

E[ p(1 p) E[m2 ]

2

)

(1 E[ p])(1 E[m1 ]

1 E [ p]

hw w 2 E[(1 p) 2 [ E[(1 m1 ) 2 ] Ep(1 p) E[m2 ]

(

(1 E[ p])(1 E[m1 ])

2

1 E [ p]

E[ p(1 p) I [ tO t w ] ]E[m2 ]

1 E [ p]

KD

1

{ (

y (1 E[ p])(1 E[m2 ])

w 2 2(1 p)m1 p(1 m2 ) p

hw I [ tO tw ] [

(

2

x

w((1 p)(1 m1 )(2 y w) ypm2 ))(1 p)(1 m1 )

]

2D

(17)

w 2 pm2 (1 p)(1 m1 )

hw [

]

2D

2( E[m1 ] E[ p]) E[ p]( E[m1 ] E[m2 ]

Note that when m1 = m2 = 0, TCA(y) = TCB(y) and (17)

will be reduced to Eq. (13) presented in Chung et al.

(2009).

E[m1 ]E[ p]

hR w 2

[D

x (1 E[ p])(1 E[m1 ]

2

Consequently:

(1 E[ p]) E[m1 ] E[ p](1 E[m2 ]

x (1 E[ p])(1 E[m1 ]

E[ pI [ tO t w ] E[m2 ]

E[ p(1 p) E[m2 ]

D

2 x (1 E[ p])(1 E[m1 ]

2(1 E[ p])

hw y 2

[

2

hR

E[(1 p) 2 ]E[(1 m1 ) 2

]) y [

2(1 E[ p](1 E[m1 ])

2

2( E[m1 ] E[ p]) E[ p]( E[m1 ] [m2 ])

E[m1 ]E[ p]

D

x (1 E[ p](1 E[m1 ]

2 m1 p p m1 m2 m1 p

hR

x

(1 p)(1 m1 )(1 p)(1 m1 ) 2 pm2 )

D

y w2

2

w2

((1 p)m1 p(1 m2 ))

x

hw I[ tO t w ]

w((1 p)(1 m1 ) (2 y w)(1 p)(1 m1 )

2D

w2 2(1 p)m1 p(1 m2 ) p

2

x

hw I[ tO t w ]

w((1 p)(1 m )(2 y w) ypm ))(1 p)(1 m )

1

2

1

2D

w2 pm2 (1 p)(1 m1)

hw

2D

E[(1 p) 2 E[(1 m1 ) 2

E[ p(1 p) E[m2 ]

2

]

(1 E[ p])(1 E[m1 ])

1 E [ p]

hw w 2 [ D

TP2 ( y ) TR( y ) TC2 ( y ) sy (1 p)(1 m1 )

sypm2 vy (1 p)m1 vyp {K cy dy

cr y (1 p)m1 ca ypm2

E[m1 ] E[ p]

x (1 E[ p](1 E[m1 ])

E[(1 p) 2 ]E[(1 m1 ) 2

E[ p(1 p) E[m2 ]

2

(1 E[ p])(1 E[m1 ])

1 E [ p]

J

I ( yL)

y

Note that when m1 = m2 = 0, Eq. (19) gives the

corrected expression for Eq. (18) of Chung et al.

(2009) as:

(18)

ETPU 2 ( y ) D

To obtain the exact closed-form solution to determine

the optimal lot size, we can use the renewal-reward

theorem to derive the expected net profit per unit

time ETPU2(y) as:

hR w( D

hw w

s(1 E[ p]) vE[ p] (d c)

(1 E[ p])(1 E[m1 ]

E[(1 p) 2 ]

2 E [ p]

)

x (1 E[ p])(1 E[m1 ] (1 E[ p])

E[(1 p) 2

KD

1

{ (

y 1 E[ p])

(1 E[ p]

hR w 2

E[(1 p) 2 ]

2 E [ p]

[D

]

x (1 E[ p]) (1 E[ p])

2

TP2 ( y ) E[TP2 ( y )]

T

E[T ]

s(1 E[ p](1 E[m1 ]) ( s ca ) E[ p]E[m2 ])

ETPU 2 ( y ) E

D

(19)

hw w 2 [ D

(v cr )(1 E[ p]) E[m1 ] vE[ p] (d c))

1 E[ p])1 E[m1 ])

y

3901

E [ p]

E[(1 p) 2 ]

])

x (1 E[ p]) 2(1 E[ p])

hR

E[1 p) 2

2 E [ p]

[D

]

x (1 E[ p]) (1 E[ p]

2

(20)

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

E[ pI [ tO tw ] ] EpI

Combining (11) and (20), we have:

ETPU1 ( y )

ETPU ( y )

ETPU 2 ( y )

if y w

(21),(22)

if y w

E[ pF (1

Dw

]

x ( y w )(1 p )

]

Dw

]

x ( y w)(1 p)

Taking derivative of ETPU2(y) with respect y gives:

and,

ETPU1(w) = ETPU2(w)

(23)

ETPU1 ( w) C 2 GH

When the two terms related to y in (11) are equal,

implying:

y1*

G

H

2 KD

(1 E[ p])(1 E[m1 ]

2( E[m1 ] E[ p])

Dw

)]

x ( y w)(1 p)

J

dETPU 2 ( y )

2

2

x (1 E[ p]( y w)

y

p

Dw

)]

DwE[m2 ]E

f (1

1

1 p

x ( y w)(1 p)

L

y

2 x 2 (1 E[ p](1 E[m1 ]( y w) 2

DwE[m2 ]E[ pf (1

Using the arithmetic geometric mean inequality

(AM-GM) theorem:

lim

Dw

DwE[m2 ]E pf 1

x

(

y

w

)(

1

p

)

x (1 E[ p])( y w) 2

(25)

J

y2

(28)

Let m1 = m2 = 0, (28) gives the exact expression for

(25) of Chung et al. (2009) as:

The (23) is the corrected mathematical expression for

(10) of (Khan et al., 2011). Note that when m1 = m2 =

0, (23) gives the exact expression for (24) of (Chung

et al., 2009) as:

p

Dw

DwE[m2 ]E

f 1

p

x

y

w

p

(

)(

)

1

1

1

L 0.

y

2 x 2 (1 E[ p])(1 E[m1 ]( y w) 2

and (11) reduces to equality, that is, the maximum

profit is:

2 KD

[

]

2

E

p

hw [ D

E (1 p) 2

x

dETPU 2 ( y )

dETPU 2 ( y )

0 lim

L 0.

y 0

dy

dy

Hence there must exit a root for d ETPU2(y)/dy = 0 at

least, so y2* must satisfy the following equation:

(24)

ETPU 1* ( y )C 2 GH

(27)

From the assumptions about the system parameters,

we know:

y 0

2 E[ p]( E[m1 ] E[m2 ]) E (1 p) 2 ](1 E[m1 ])

E[ p]E[m2 ]

2 E[ p(1 p)]E[m2 ]

hw [ D

x (1 E[ p])(1 E[m1 ])

1 E [ p]

y1**

[ m1 1

2 E [ p]

KD

h w

E (1 p) 2 ]

R D

1 E [ p]

2 x (1 E[ p]

1 E[ p]

y2**

.

(26)

This is same to the result obtained by Maddah and

Jaber (2008).

Note that,

E [ p]

hw w2 D

x (1 E[ p])

2 E [ p]

hR

D

2 x (1 E[ p])

E[(1 p) 2

1 E[ p]

(29)

Taking derivative of ETPU2(y) with respect y again

gives:

2

d ETPU 2 ( y )

dy 2

Dw

E[ p(1 p) I [ tO t w ] ] E p(1 p) I m1 1

x

(

y

w

)(

1

p

)

E (1 p) 2 ]

2(1 E[ p]

2

Dw

DwE [m2 E pf 1

x ( y x )(1 p)

x (1 E[ p])( y w) 3

p

Dw

DwE[m2 ]E

f 1

x ( y x )(1 p)

1 p

2

3

2

y ( y w)

2 x (1 E[ p])(1 E[m1])

3y w

Dw

)

E p(1 p) F (1

x ( y w)(1 p)

1

J

2 3 2

y

y

and

3902

Dw

p

f 1

)]

x ( y w)(1 p)

1 p

2 x 2 (1 E[ p])(1 E[m1 ])( y w) 2

DwE[m2 ]E

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

p

Dw

)]

f ' (1

1 p

x ( y w)(1 p)

2

4

x (1 E[ p]( y w)

D 2 w 2 E[m2 ]E

1

y

p

Dw

D2 w2 E [m2 ]E

f ' 1

2

x ( y w)(1 p)

(1 p)

3

3

2 x (1 E[ p])( y w)

(30)

From the (30), we can not determine the conavity of

ETPU2(y). But, we notice that d2 ETPU2(y)/dy2<0

when f’(x)#0. This condition is satisfied for many

usually used distributions such as normal

distribution, exponential distribution and uniform

distribution and so on.

In the following discussion, we assume f’(x)#0. Note

that I>0 and J>0 because of hR is more than hw. Both

ETPU1(y) and ETPU2(y) are concave. So, y1* and y2*

are the possible optimal solutions for ETPU(y). Let

yopt* represent the optimal solution of ETPU(y).

Because y1*<w and y2*$w must be satisfied, so we

have the following proposition.

Proposition 1: Under f’(x)#0 three cases may occur:

C

if y1*<w and y2*$w, then yopt* = y1* or y2* such that

ETPU (yopt*) = max{ ETPU1(y1*), ETPU2(y2*)}

C

C

if y1*<w and y2*<w, then yopt* = y1*

if y1*$w and y2*$w, then yopt* = y2*

CONCLUSION

This study incorporates the concepts of the basic two

warehouses, imperfect quality and inspection errors to

generalize Chung et al. (2009) and Khan et al. (2011).

The expected total profit per unit time function ETPU(y)

in Salameh and Jaber (2000) is concave. The expected

total profit per unit time function ETPU(y) in Chung et al.

(2009) is piecewise concave. However, the expected total

profit per unit time function ETPU(y) in this study is not

piecewise concave in general. But, we find a mild

condition satisfied by most common distributions to make

the ETPU(y) concavity. The Proposition 1 is used to

determine the optimal solution of ETPU(y).

NOTATIONS

D

w

z

y

c

K

s

v

Number of units demanded per year

Storage capacity in OW, fixed

Storage capacity in RW

Order quantity

Unit variable cost

Fixed ordering cost

Unit selling price of items of good quality

Unit selling price of defective items, v<c

3903

x

Screening rate

d

Unit screening cost

hR,hw Holding cost for items in the RW and OW,

respectively, hR$hw

T

The cycle length

Probability of Type I error (classifying a no

m1

defective item as defective)

Probability of Type II error (classifying a defective

m2

item as no defective)

p

Probability that an item is defective

Inspection time of the RWtwinspection time of the

tR

OW

Time to use up of the RW

tO

f(p) Probability density function of p

f(m1) Probability density function of m1

f(m2) Probability density function of m2

BR1 Number of items that are classified as defective in

rented warehouse

Number of items that are classified as defective in

B01

own warehouse

BR2 Number of defective items that are returnedfrom

the market in rented warehouse

Number of defective items that are returnedfrom

B02

the market in own warehouse

Cost of accepting a defective item

ca

Cost of rejecting a non defective item

cr

TR(y) The sum of total revenue of good quality and

imperfect quality items per cycle

TC(y) The sum of total costs per cycle

yopt* He optimal solution such that ETPU (yopt*) will be

a maximum

REFERENCES

Cardenas-Barron, L.E., 2009. Optimal ordering policies

in response to a discount offer: Corrections. Int. J.

Prod. Econ., 122: 518-527.

Cardenas-Barron, L.E., 2009. Optimal ordering policies

in response to a discount offer-Extensions. Int. J.

Prod. Econ., 122: 774-782.

Chang, H.C. and C.H. Ho, 2010. Exact closed-form

solutions for optimal inventory model for items with

imperfect quality and shortage backordering. Omega,

38: 233-237.

Chung, K.J., C.C. Her and S.D. Lin, 2009. A twowarehouse inventory model with imperfect quality

production processes. Comput. Ind. Eng., 56: 193197.

Goyal, S.K. and M.Y. Jaber, 2006. A note on Optimal

ordering policies in response to a discount offer. Int.

J. Prod. Econ., 112: 1000-10001.

Khan, M.V., M.Y. Jaber and M. Bonney, 2011. An

Economic Order Quantity (EOQ) for items with

imperfect quality and inspection errors. Int. J. Prod.

Econ., 133: 113-118.

Res. J. Appl. Sci. Eng. Technol., 4(20): 3896-3904, 2012

Lee, C.C. and S.L. Hsu, 2009. A two-warehouse

production model for deteriorating inventory items

with time-dependent demand. Eur. J. Oper. Res., 194:

700-710.

Lee, H.L. and M.J. Rosenblatt, 1987. Simultaneous

determination of production cycles and inspection

schedules in a production system. Mgt. Sci., 33:

1125-1136.

Maddah, B. and M.Y. Jaber, 2008. Economic order

quantity for items with imperfect quality: Revisited.

Int. J. Prod. Econ., 112: 808-815.

Papachristos, S. and I. Konstantaras, 2006. Economic

ordering quantity models for items with imperfect

quality. Int. J. Prod. Econ., 100: 148-154.

Porteus, E.L., 1986. Optimal ordering policies in

response to a discount offer: Corrections. Oper. Res.,

18: 137-144.

Rosenblatt, M.J. and H.L. Lee, 1986. Economic

production cycles with imperfect production

processes. IEEE Trans., 18: 48-55.

3904

Salameh, M.K. and M.Y. Jaber, 2000. Economic

production quantity model for items with imperfect

quality. Int. J. Prod. Econ., 64: 59-64.

Sarker, B.R. and M.A. Kindi, 2006. Optimal ordering

policies in response to a discount offer. Int. J. Prod.

Econ., 100: 195-211.

Wee, H.M., J. Yu and M.C. Chen, 2007. Ptimal inventory

model for items with imperfect quality and shortage

backordering. Omega, 35: 7-11.

Yang, H.L., 2004. Two-warehouse inventory models for

deteriorating items with shortages under inflation.

Eur. J. Oper. Res., 157:344-356.

Yang, H.L., 2006. Two-warehouse partial backlogging

inventory models for deteriorating items under

inflation. Int. J. Prod. Econ., 103: 362-370.

Zhou, Y.W. and S.L. Yang, 2005. A two-warehouse

inventory model for items with stock-level-dependent

demand rate. Int. J. Prod. Econ., 95: 215-228.