Industry Canada 2007–2008 Estimates Report on Plans and Priorities

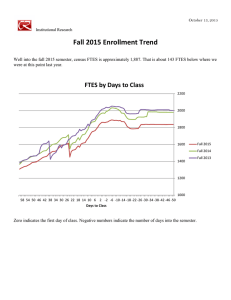

advertisement