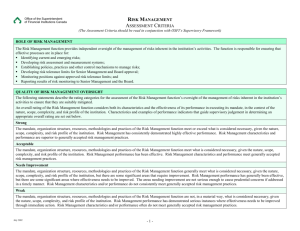

Office of the Superintendent of Financial Institutions Canada 2006-2007 to 2008-2009

advertisement