Report on Plans and Priorities 2016–17

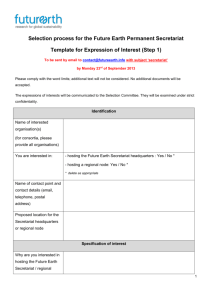

advertisement