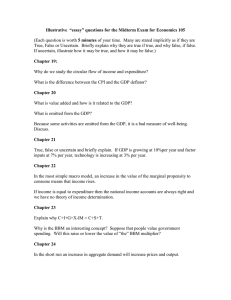

Update of Data on the Maltese Economy Updates to Chapter 1

advertisement

Update of Data on the Maltese Economy Updates to Chapter 1 Comments relating to the data on the Maltese economy and to the contents of the book are to be sent to the author on this email address: linobrig@gmail.com TABLE 1.1 Table 1.1 Shares of Sectors in the GDP of Malta (2010) Value Added Sector Percentage (€ million) 84.7 2 Agriculture and Fishing 176.7 3 Construction and Quarrying 683.3 13 Manufacturing 3309.8 61 Market Services 1191.5 22 Public Sector 5446.0 100 GDP at Basic Prices Source Release 48/2011 and estimates by the authors (see note below) Value Added Private and Public Sectors (€ million) Sector Total Private Public Agriculture & Fishing 102.8 84.7 18.1 Construction & Quarrying 207.6 176.7 30.9 Manufacturing 728.4 683.3 45.2 Services 4261.9 3309.8 952.1 Electricty , gas and Water 145.2 0.0 145.2 GDP at Basic Prices 5446.0 4254.4 1191.5 Source Release 48/2011 and estimates by the authors (see note below) Figure 1.1 Shares of Sectors in the GDP of Malta (2010) Public Sector 22% Agriculture and Fishing 2% Construction and Quarrying 3% Manufacturing 13% Market Services 61% Note: Manufacturing excludes public sector direct involvement, which accounted for about 1 per cent of GDP. Market services also exclude public sector direct involvement in education, health and other services provided by the government, which accounted for about 11 per cent of GDP. The output of the public sector was calculated on the basis of information provided by the NSO and calculations by the author. The public sector includes value added generated by the general government as well as by public corporations. The public sector share shown in Table 1.1 is based on calculations made by the author, and is therefore to be considered as an approximation. The output associated with the general government is mostly in the form of services relating to public administration, defence and compulsory social security, education, health, and other community and social services. The public sector also includes the provision of water, electricity, transport and financial services. A small portion of public sector direct involvement relates to agriculture and manufacturing. This table is subject to change as more information is obtained from the NSO. TABLE 1.2 Table 1.2 Factor Income Shares in the GDP of Malta (2010) Value Added Percent age Factor Income (€ million) Compensation of employees 2,639.5 51 2,806.4 5,446.0 GDP at Basic Prices Source: NSO news release 48/2011 (see note below) Gross operating surplus and mixed income 49 100 Factor Income Shares in the GDP of Malta (2004-2010) 2,004 2,005 2,006 2,007 2,008 Compensation of employees 2,123.5 2,177.8 2,286.1 2,392.3 2,572.0 Gross operating surplus and mixed income 1,763.0 1,968.3 2,082.4 2,332.9 2,589.2 GDP at Basic Prices 3,886.5 4,146.2 4,368.5 4,725.2 5,161.2 Source: NSO news release 48/2011 (see note below) INCOME APPROACH Figure 1.2 Factor Income Shares in the GDP of Malta (2009) Gross operating surplus and mixed income 52% Note: The value of gross operating surplus and mixed income as given in the NSO release is slightly different. The difference relates to taxes net of subsidies which in the figures given here cover products only, whereas in the NSO release these cover production and imports. Compensation of employees 48% 2,009 2,626.7 2,446.5 5,073.2 2,010 2,639.5 2,806.4 5,446.0 TABLE 1.3 Table 1.3 Maltese GDP by Category of Expenditures (2010) PercentExpenditure € million age Consumption expenditure 3,787.4 33.2 1,287.0 11.3 Government current expenditure Capital expenditure 1,022.5 9.0 Exports of goods and services 5,304.4 46.5 Total final expenditure 11,401.3 100.0 Imports of goods and services 5,155.5 45.2 GDP at market prices 6,245.8 54.8 Source: NSO news release 48/2011 Maltese GDP by Category of Expenditures (2004-2010) EXPENDITURE APPROACH 2,004 2,005 2,006 2,007 Personal consumption expenditure 3,047.1 3,224.9 3,342.1 3,424.9 Government current expenditure 933.5 940.8 1,011.7 1,041.9 Gross capital formation 684.7 912.4 1,034.1 1,207.0 Exports of goods and services 3,552.8 3,700.3 4,388.7 4,892.8 Total final expenditure 8,218.1 8,778.5 9,776.5 10,566.7 Imports of goods and services 3,727.8 3,957.0 4,707.0 5,104.2 4,490.3 4,821.4 5,069.6 5,462.5 GDP at market prices Taxes on products 635.6 713.2 753.2 800.2 Subsidies on products 31.9 37.9 52.2 62.9 GDP at Basic Prices 3,886.5 4,146.2 4,368.5 4,725.2 Source: NSO news release 48/2011 Figure 1.3a Components of the Maltese Total Final Expenditure (2010) Consumption expenditure 33% Exports of goods and services 47% Capital expenditure 9% Government current expenditure 11% Figure 1.3b Import Content of Total Final Expenditure (2010) GDP at market prices 55% Imports of goods and services 45% 2,008 2,009 2,010 3,690.0 3,704.4 3,787.4 1,216.4 1,239.4 1,287.0 1,200.1 945.2 1,022.5 5,020.4 4,540.9 5,304.4 11,126.9 10,429.9 11,401.3 5,223.1 4,579.2 5,155.5 5,903.8 5,850.7 6,245.8 828.6 797.5 820.4 86.0 20.1 20.5 5,161.2 5,073.2 5,446.0 TABLE 1.4 Table 1.4 Three Methods of Measuring Personal Income (2010 - € million) Measured Directly Measured Indirectly How Allocated Income from employment 2,640 Net National Income 4 Consumption Expenditure 3787 Other household factor income (selfemployment, rents, interest and dividends) 931 Less retained income by corporations and by government 590 Income tax and national insurance contributions 584 Transfers from local and foreign sources 1129 Transfers from local and foreign sources 1129 Savings 329 4,700 Personal Income 543 Personal Income 4,700 Personal Income Sources: Income from employment and consumption expenditure: NSO news release 48/2011 Savings, Income tax and transfers are assumed by the author using plausible estimates Other household factor income and retained income are residuals Note: Data for personal income and its components are not published by the NSO. Table 1.4 contains figures relating to personal income tax, transfers, retained corporate income and savings, which are assumed by the present author on the basis of plausible estimates. Figure 1.4 Personal Income and National Income 5,000 4,000 3,000 2,000 Transfers Retained income Other household factor income Other household factor income Income from employment Income from employment 1,000 0 Personal Income National Income (€ million) Income from employment Other household factor income Tranfers / retained income Transfers Personal Income National Income 2,640 2,640 931 931 1129 590 Retained income TABLE 1.5 Table 1.5 Nominal and Real GDP (€ million) with base year = 2004 GDP at Current GDP at constant Annual growth Annual growth rate GDP deflater Prices 2004 Prices rate of GDP in of GDP in real (base 2004) (€ million) (€ million) nominal terms (%) terms (%) Year 2004 4490.3 100.0 4,490.3 2005 4821.4 102.5 4,702.1 2006 5069.6 105.6 4,800.5 2007 5462.5 108.9 5,013.8 2008 5903.8 111.9 5,277.3 2009 5850.7 114.8 5,098.6 2010 6245.8 118.2 5,284.7 Source: NSO news release 48/2011. Deflator is adjusted (see note) - - 7.4 4.7 5.1 2.1 7.8 4.4 8.1 5.3 -0.9 -3.4 6.8 3.7 Nominal and Real GDP (€ million) with base year = 2000 GDP at Current GDP deflater GDP at constant Prices (base 2000) 2000 Prices 2004 4490.3 111.0 2005 4821.4 113.9 2006 5069.6 117.3 2007 5462.5 121.0 2008 5903.8 124.2 2009 5850.7 127.4 2010 6245.8 131.2 Source: NSO news release 48/2011 . 4044.0 4234.8 4323.4 4515.5 4752.8 4591.9 4759.5 GDP deflater (base 2004) GDP at constant 2004 Prices 100.0 102.5 105.6 108.9 111.9 114.8 118.2 4490.3 4702.1 4800.5 5013.8 5277.3 5098.6 5284.7 Figure 1.6 GDP at Current and Constant Prices 6500 6000 5500 5000 4500 4000 2004 2005 GDP at Current Prices 2006 (€ million) 2007 2008 2009 GDP at constant 2004 Prices 2010 (€ million) Note: The NSO news release presents a GDP deflator with base year 2000. The GDP deflator with base year 2004 was computed by the present author, retaining the proportional changes of the deflator with 2000 as base year Figure 1.5 Figure 1.5 The Circular Flow of Income (2010 - € million) Personal income Personal tax and NI contributions Disposable income Savings Consumption expenditure Government expenditure Investment expenditure Exports of goods and services Total final expenditure Imports of goods and services GDP at market prices Net expenditure taxes GDP at basic prices Net factor income from abroad GNI at basic prices Depreciation Net national income at basic prices Retained income by corporations Factor income earned by households Transfers to households Personal income 2010 4700.4 584.0 4116.4 329.0 3787.4 1287.0 1022.5 5304.4 11401.3 5155.5 6245.8 0.8 6245.0 -433.9 5811.1 851.3 4959.8 590.0 4369.8 1129.0 5498.8 Source EST EST EST EST NSO NSO NSO NSO NSO NSO NSO NSO NSO NSO NSO NSO NSO EST EST EST EST Sources: Data marked as NSO: NSO news release 48/2001 Data marked as EST: Estimated by the author The flow Personal savings €329m Injections Leakages Gross investment expenditure €1022m Government current expenditure Exports of goods and services €5304m €1287m Personal income tax €584m Disposable personal income €4076m €4116m Consumer expenditure (market prices( €3787m Total final expenditure Imports €5155m €11401m Personal income Gross factor income generated in Wages Malta (€ andMillion) salaries= 2,531 Sectoral shares of GDP Agriculture Construction andand Fishing Quarrying =(€75million) = 128 €4700m Transfers to households €1129m Gross factor income Other factor income= Wages and2,441 salaries Total = 4972 Other factor income Factor income to households Total GDP at market prices € 5,446 m €3571m Retained company income, €590m taxed at 35% = €206.5m Net National €3784mm income GNI at basic prices €4161m €5012m Depreciation €851 €6246m € 2,640 m € 2806 m Net investment and employment income from abroad – €434m GDP at basic prices €5446m Net expenditure taxes €800m Sectoral shares in GDP Agriculture and Fishing Construction/quarrying Manufacturing Services Government Total € 85 € 177 € 683 € 3,309 € 1,192 € 5,446 GDP, GNI AND NNI The Relation between GDP and GNI (€ million) From GDP to NNI Gross domestic product at market prices 2004 4,490.3 2005 4,821.4 2006 5,069.6 2007 5,462.5 2008 5,903.8 2009 5,850.7 2010 6,245.8 Net factor income from abroad (see below) Gross national income (market prices) -55.9 4,434.4 -217.9 4,603.5 -186.0 4,883.5 -218.7 5,243.8 -239.5 5,664.3 -421.3 5,429.4 -433.9 5,811.9 Depreciation (Fixed Capital Consumption) Net national income (market prices) 666.4 656.3 722.8 750.3 792.1 828.4 851.3 3,768.0 3,947.3 4,160.8 4,493.5 4,872.2 4,601.0 4,960.6 Net Expenditure taxes Net national income (basic prices) 603.8 675.3 701.1 737.3 742.6 777.4 799.9 3,164.2 3,272.0 3,459.7 3,756.2 4,129.6 3,823.5 4,160.8 Source: NSO news release 48/2011 Net Factor Income from Abroad (€ million) 2004 24.9 2005 26.8 2006 28.1 2007 36.0 2008 36.3 2009 35.9 2010 35.7 Comp. of employees paid to the rest of the world 12.7 17.5 31.0 32.7 31.0 24.8 25.1 Taxes on production & imports paid to EU Institutions 13.9 22.6 21.9 24.9 27.5 20.6 20.4 3.0 4.3 9.2 8.2 6.0 10.8 19.7 Property income received from the rest of the world 756.3 947.1 1,434.3 1,937.5 2,174.9 1,616.9 1,611.0 Property income paid to the rest of the world 813.5 1,156.0 1,604.8 2,142.9 2,398.2 2,039.5 2,054.9 Total -55.9 -217.9 -186.0 -218.7 -239.5 -421.3 -433.9 Comp. of employees received from rest of the world Subsidies received from the Institutions of the EU Source: NSO news release 48/2011