Montserrat’s Financial Sector Blondelle O’Garro Financial Officer

advertisement

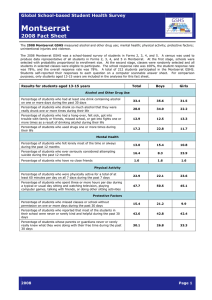

Montserrat’s Financial Sector Blondelle O’Garro Financial Officer Financial Services Commission Content • • • • • Background Overview of Current Sector Statistics Challenges Current Focus A Little Background • Before 1995 (pre volcano), Montserrat’s financial sector serviced a population of approx 11,000 people • The sector then comprised of 3 domestic banks, 1 cooperative credit union, 1 building society, approx 16 offshore (international) banks and several long term insurers • This changed in June 1995 when continuous increasing volcanic activity began Background cont’d • There was colossal destruction and devastation for up to two years after the start of volcanic activity resulting in two thirds of the island becoming uninhabitable • In this destruction we lost our capital (town) and with it our Government Headquarters, hospital, airport and seaport, schools, banks, etc – basically our economy was brought to a standstill • Montserrat however is one of the five dependent territories in the Caribbean (the others being, Anguilla, Tortola (BVI), Turks & Caicos and Cayman Islands) Background cont’d • During the activity, approx half of the population migrated to England and some to other Caribbean islands • As a result we now have a population of approx 5000 people (as at last census in May 2011) Overview of Current Sector • As at December 2011 our financial sector comprised of 4 international banks, 2 domestic banks, 1 cooperative credit union, 3 long term insurers, 2 money remitters and 1 building society • This sector is regulated by the Financial Services Commission (FSC) with the exception of the domestic banks which are supervised and regulated by the Eastern Caribbean Central Bank (the ECCB) • The FSC regulates the domestic banks for anti-money laundering only • The FSC is a single regulatory unit and is a statutory body • The FSC’s authority comes from the Financial Services Act 2010 and the entities mentioned above are regulated and supervised under the International Banking and Trust Act 2006, the Proceeds of Crime Act 2010, the Anti Money Laundering and Counter Financing of Terrorism Act and Regulations 2010, the Money Services Business Act 2009, the Cooperative Societies Act 2010 and the Insurance Act 2001. Statistics Institutions Capital US$ Assets US$ Loans US$ International Banks 100,591,761 943,928,889 118,521,048 Domestic Banks 5,194,815 162,894,074 26,086,667 Non-Bank Financial Institutions 7,450,866 30,623,885 19,503,541 1,137,446,848 164,111,256 Total 113,237,442 Challenges • The main challenge in Montserrat is obtaining and retaining skilled labour • Not many persons, even school leavers, wish to enter the financial sector • Another challenge faced in tiny economies such as Montserrat is objectivity – it is difficult especially within the financial institutions for employees to remain objective when one is dealing with a mother, brother, cousin, friend of a cousin, or friend of a parent Challenges cont’d • Of the two domestic banks 1 is a branch of a foreign owned bank and the other is an indigenous bank to Montserrat • The foreign owned bank has no assets in Montserrat and the Government owns more than 50% of the indigenous bank • Political interference is common and can often complicate • Although Montserrat is now in the process of trying to rebuild; Cont’d • And with investment opportunities now becoming available with the new town and sea port proposals many Montserratians are still hesitant and will only invest at late stages if at all, other investment opportunities are virtually nonexistent on the island with the exception of term deposits at the commercial banks • The financial institutions are mainly deposit taking, savings, loans and mortgages and other standard facilities • New innovations would be difficult in our current economic climate • Complying with international requirements and/or standards Current Focus • Montserrat is a member of the Caribbean Financial Action Task Force (CFATF) and was evaluated in February 2010 • The CFATF evaluates the legal framework, in particular anti-money laundering and counter financing of terrorism, of a country against its 40+9 Recommendations and we are currently ensuring that all requisite legislation is in place and recommendations are satisfied for the follow up process • Also the OECD evaluated Montserrat in November 2011 and we are actively trying to ensure that all requirements are met in that regard, also for the follow up process Current Focus cont’d • On 3rd January 2012, the Commissioner of the FSC was appointed Registrar of Companies, Trade Marks and Patents • Part of our focus is to not only learn the systems and processes within the Registry, but to also get that office to be efficient and compliant with current standards and regulations • With that in mind, the International Business Companies Act and the Companies Act will be merged in the near future • As the function of this additional office is now covered by some of the deployed FSC staff, capacity building although not immediate will have to explored Cont’d • Ensuring the legislative framework iro financial sector is completed and meets with international standards • Prepare to increase the scope of the financial sector with new business such as mutual funds, international insurance (captives, protected cell companies) • Completing the process for the FCAU to become a member of the Egmont Group which is important for the exchange of information in investigation of suspicious activity reports within the sector. Thank You