Kansas Extension Service Administrative Handbook

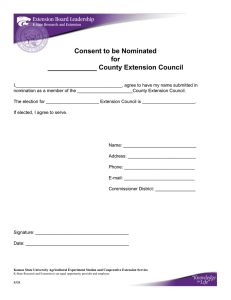

advertisement