THE IMPACT OF TAXES AND SOCIAL SPENDING ON INEQUALITY

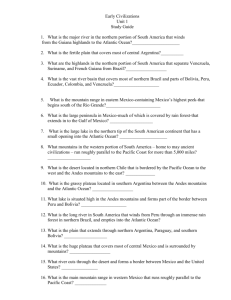

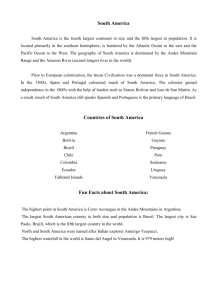

advertisement