Awareness and Impact of Globalization of Life Insurance in India

advertisement

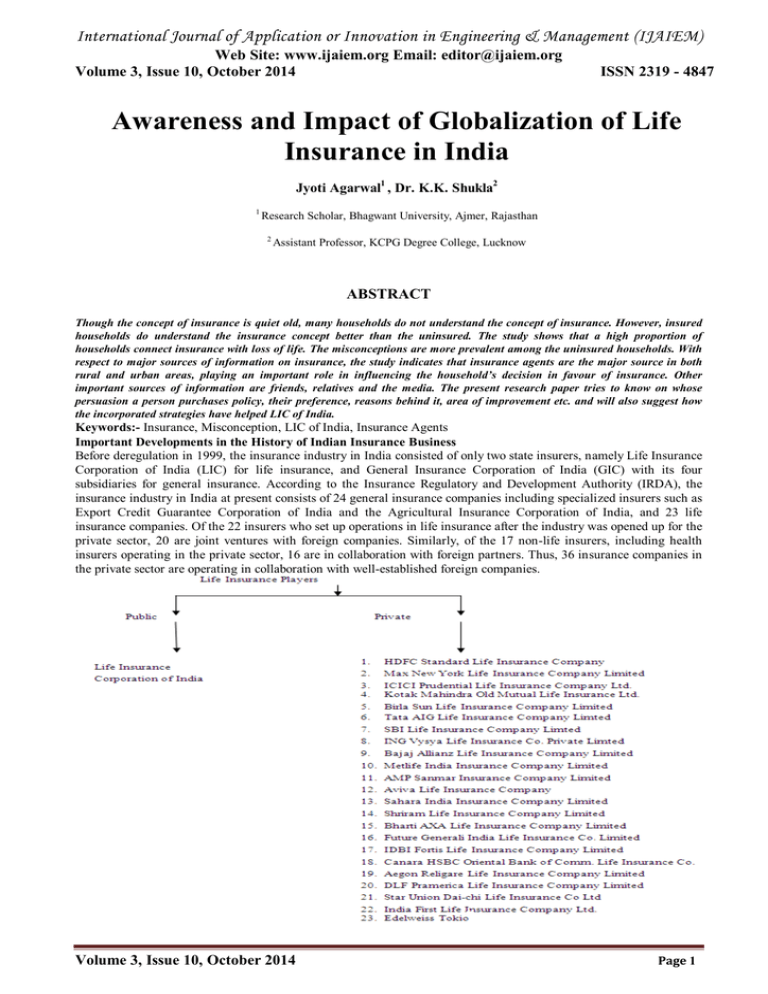

International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 Awareness and Impact of Globalization of Life Insurance in India Jyoti Agarwal1 , Dr. K.K. Shukla2 1 Research Scholar, Bhagwant University, Ajmer, Rajasthan 2 Assistant Professor, KCPG Degree College, Lucknow ABSTRACT Though the concept of insurance is quiet old, many households do not understand the concept of insurance. However, insured households do understand the insurance concept better than the uninsured. The study shows that a high proportion of households connect insurance with loss of life. The misconceptions are more prevalent among the uninsured households. With respect to major sources of information on insurance, the study indicates that insurance agents are the major source in both rural and urban areas, playing an important role in influencing the household’s decision in favour of insurance. Other important sources of information are friends, relatives and the media. The present research paper tries to know on whose persuasion a person purchases policy, their preference, reasons behind it, area of improvement etc. and will also suggest how the incorporated strategies have helped LIC of India. Keywords:- Insurance, Misconception, LIC of India, Insurance Agents Important Developments in the History of Indian Insurance Business Before deregulation in 1999, the insurance industry in India consisted of only two state insurers, namely Life Insurance Corporation of India (LIC) for life insurance, and General Insurance Corporation of India (GIC) with its four subsidiaries for general insurance. According to the Insurance Regulatory and Development Authority (IRDA), the insurance industry in India at present consists of 24 general insurance companies including specialized insurers such as Export Credit Guarantee Corporation of India and the Agricultural Insurance Corporation of India, and 23 life insurance companies. Of the 22 insurers who set up operations in life insurance after the industry was opened up for the private sector, 20 are joint ventures with foreign companies. Similarly, of the 17 non-life insurers, including health insurers operating in the private sector, 16 are in collaboration with foreign partners. Thus, 36 insurance companies in the private sector are operating in collaboration with well-established foreign companies. Volume 3, Issue 10, October 2014 Page 1 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 a) Life Insurance Corporation of India Life Insurance Corporation was established as a state undertaking on September 1, 1956, with the amalgamation of 245 existing Indian and foreign insurance companies. It entered in the 50th year of its existence on September 1, 2005. LIC has been engaged in the basic mission of reaching out to millions by providing protection through life insurance. LIC has also been playing a dominant role in contributing to the various nation-building efforts through mobilization of household savings. Today, Life Insurance Corporation of India is not just an insurance organization but is a movement in itself. Union Finance Minister P. Childambaram in his speech at the inaugural function of LIC’s Golden Jubilee Celebrations in Luck now on September 1, 2005 had stated that-“In the year 1956, 245 Indian and foreign companies were nationalized and today three letters “LIC”, stands as a synonym for insurance, for service, for excellence in strengthening the economic fibre of this country. I dare to say that no other three letters taken together are more recognised to the length and breadth of India than LIC”. Now an attempt is being made to examine the performance of LIC as under : Year 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 No. of Polices (in lakh) 169.99 196.73 217.12 245.45 269.52 239.68 315.91 382.29 376.13 359.13 388.63 370.38 357.50 367.82 Table – 1 New Business in India-Individual Assurance Sum Assured First Year Premium Income (Rs in Crores) (Rs. in Crores) 91490.94 6026.02 124950.63 9700.98 192572.31 19588.77 179811.17 15976.76 199698.31 17347.62 NA 20653.06 1351392.14 28515.87 3325164.00 56223.56 1733328.00 59996.57 2037531.00 53179.08 2341937.28 71521.90 2677969.60 87012.35 2983246.54 81862.25 3280116.66 76611.50 Percentage of Market Share 100% 99.95 98.65 94.30 87.44 78.07 72.20 82.83 73.93 70.52 73.02 76.92 80.99 83.24 Source : LIC Annual Reports During the year 1999-00, 169.99 lakh policies were sold amounting to Rs. 91490.94 crore and first year premium income of 6026.02 crore. Till this time LIC enjoyed monopoly in the field of life insurance business and this contributed 100% business of life insurance. During 2000-01, LIC touched the level of 196.73 lakh policies amounting to Rs. 124950.63 crore. In this year first year premium income was Rs. 9700.98 crore. With the entry of private life insurance players the share of LIC fell from 100% to 99.95% in 2000-01. In the year 2001-02 LIC issued 217.12 lakh policies which collected a sum of Rs. 192572.31 crore and attracted the first year premium of Rs. 19588.77 crore. The share of LIC in the life insurance sector in this year stood at 98.65%. The year 2002-03 experienced a mixed performance as 245.45 lakh polices were sold during this period against 217.12 in the year 20 01-02 but the collection was less than the previous year as it stood at Rs. 179811.17 crore as against Rs. 192572.31 crore in 2001-02. During the period 2004-05 LIC could sell only 239.68 lakh policies. During the year 2010-11 though its number of sold policies reduced to 370.38 in comparison to 388.63 of previous year, its collection increased to 2677969.60, first year premium to 87012.35 and market share to 76.92. Again in the year 2011-12 its number of sold policies further reduced to 357.50 but it managed to increase its market share to 80.99. In the year 2012-13 LIC managed to increase its number of sold policies to 367.82, collection to 3280116.66 and market share to 83.24 with a slight decrease in first year premium to 76611.50 in comparison to 81862.25 in the previous year. Insurance Scenario in India and Other Countries For 2009, which is the latest year for which data are available, some pointers are: (i) The share of the Indian life insurance sector in the global market was 2.45 percent; Volume 3, Issue 10, October 2014 Page 2 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 (ii) The share of Indian non-life insurance premium in the global non-life premium was as low as 0.46 per cent; (iii) In life insurance business India ranked ninth among 156 countries; and (iv) In non-life insurance business India ranked 26th among the same countries. There are other pointers as well (IRDA, 2009 - 10), namely: (i) the Indian life insurance industry recorded a premium income of Rs 2,65,450 crore in 2009–10 as against Rs 2,21,785 crore in the previous year; (ii) in the life insurance sector, the share of the private sector in total premium income was approximately 30 per cent in both 2008–09 and 2009–10; (iii) while LIC, which represents the public sector, registered a growth of 19.69 per cent in 2009–10 over 2008–09, the growth of the private sector was higher at 23.06 per cent during this period; (iv) the gross direct premium income of the non-life insurance sector in India was Rs 30,351.83 crore in 2008–09 and Rs 34,620.45 core in 2009–10;and (v) in the non-life insurance industry, the share of the public sector in gross direct premium income was approximately 59 per cent in both 2008–09 and 2009–10. Moreover, while the public sector registered a growth of 14.49 per cent in 2009 -10, the growth in private sector gross direct premium income was lower at 13.44 per cent. According to the study, India’s insurance market has grown over the past six years. Liberalisation of the sector has enabled the entry of a number of new players who have contributed to the growth, (over 40 per cent per annum), by enhancing product awareness and promoting consumer education and information. However, the market is still in a nascent stage. Insurance Penetration and Density in India Two important indicators of the level of development of the insurance sector in any country are: (i) Level of insurance penetration which is measured as the percentage of insurance premium in gross domestic product (GDP); and (ii) Insurance density ratio (wherein insurance density is defined as the per capita expenditure on insurance premium and is directly correlated with per capita GDP). Both insurance penetration and density have increased significantly over the years, especially with the opening up of the insurance industry to the private sector. However, the increase has been marginal as far as the non-life insurance sector is concerned. While the density of life insurance in India grew from US1$ 9.1 in 2001 to US$ 47.7 in 2009, the density in the non-life insurance industry for the same period grew from US$ 2.4 to US$ 6.7. Advertising initiatives were limited to the print and electronic media, which mainly promoted LIC’s products as being tax saving tools for salaried individuals. According to consumer feedback, the problem has been exacerbated due to: • agents’ inability to clearly explain the features of the products; • lengthy documents that are not user friendly; and • the perception that agents are only concerned with their commissions. The survey tried to find out from the respondents that on whose persuasion they have purchased the particular insurance policy held by them at that time. For this they were given two options. Option-I suggests that they have purchased the insurance policy on their own knowledge and Option-II relates to the information provided to them through relation basis including insurance agents, friends, relatives, etc. However, 20 persons i.e. 4.71% did not show any response. Thus the survey brought into light the fact that most people are self driven and have good knowledge about insurance sector when it comes to purchase of insurance policy. Knowledge about Life Insurance Policy Parameters No. of respondents Percentage of respondents Self awareness 271 63.76 Relation basis 134 31.53 No response 20 4.71 Knowledge about Insurance Policy Volume 3, Issue 10, October 2014 Page 3 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 Self awareness 63.8% No response 4.7% Relation basis 31.5% (ii) Preference for Life Insurance Sector The research survey also tried to find out the preferred sector by the respondents for getting the life insurance cover. Of the two sectors i.e. Public sector, which includes the Life Insurance Corporation of India, and the Private Sector Life Insurance Companies, 77.18% respondents showed their liking for the LIC while 19.29% preferred the Private Sector Life Insurance Companies. The survey thus produces the result that still the majority of people favour the public sector life insurance company LIC, to the private sector life insurance companies. Preference for Life Insurance Sector Parameters No. of respondents Percentage of respondents Public Sector (LIC) 328 77.18 Private Sector 82 19.29 Cannot Say 15 3.53 Preference for Life Insurance Sector Public Sector (LIC) 77.18% Cannot Say 3.53% Private Sector 19.29% (iii) Reason for Preference to LIC/Private Sector Life Insurance Company It was thought necessary to find out the main reason behind opting the particular sector of life insurance, i.e. public sector or private sector by the respondents. The research survey provided the fact that in the field of Public Sector Life Insurance Company, LIC "Trust" was the dominant factor responsible for its preference as of the 328 respondents who showed their preference for LIC, 64.33% responded for the "Trust" it enjoyed in the minds of general public. On the other hand in case of private sector life insurance companies it was "large range of policies" which attracted the people towards it as it got 41.46% responses from the total respondents of 82 people who showed their preference for private sector life insurance companies. Reason for Preference to LIC/Private Sector Volume 3, Issue 10, October 2014 Page 4 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 Parameters Public Sector ISSN 2319 - 4847 Private Sector No.of respondents Percentage of respondents No. of respondents Percentage of respondents Convenient to approach 57 17.38 22 26.83 Trust 211 64.33 21 25.61 Past experience 41 12.50 4 4.88 Large range of policies 18 5.49 34 41.46 Any other reason 01 0.30 01 1.22 Total 328 100 82 100 Reason for Preference to LIC/Private Sector Public Sector Private Sector 70 60 50 40 30 20 10 0 Convenient to approach Trust Past experience Large range of policies Any other reason (iv) Reason for Opting Life Insurance Policy The survey brings into light the important fact that be it public sector or private sector life insurance company people have gone for them mainly for getting the benefits of both the protection as well a security as 49.70% respondents in case of LIC and 46.35% respondents in case of private sector life insurance companies have voted for preferring insurance policy that could provide the benefits of security cum investment returns. Reason for Opting Life Insurance Policy Parameters Public Sector Private Sector No. of respondents Percentage of respondents No. of respondents Percentage of respondents Investment 37 11.28 12 14.63 Security 128 39.02 32 39.02 Both 163 49.70 38 46.35 Total 328 100 82 100 Volume 3, Issue 10, October 2014 Page 5 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 Reason for Opting Life Insurance Policy Public Sector Private Sector 60 50 40 30 20 10 0 Investment Security Both (v) Area of Improvement for LIC The entry of private sector life insurance players in the insurance industry has put enormous pressure on the public sector Life Insurance Corporation of India and has been adopting new methods of marketing to maintain its competing position in the market. The research survey tried to find out from the respondent the areas of improvement for LIC. Majority of respondents were still of the opinion that LIC should improve its services (33.94%) besides increasing internet connectivity (22.59%), enhancing office efficiency (20.94%) and employing young people (19.53%) in order to retain its position and continue to be market leader in future times to come. Areas of Improvement for LIC Parameters No. of respondents Percentage of respondents In terms of service 140 32.94 Increase internet connectivity 96 22.59 Office efficiency 89 20.94 Employ dynamic people 83 19.53 Any other 08 1.88 No response 09 2.12 Areas of Improvement for LIC In terms of service 32.94% Increase internet conn 22.59% Any other 1.88% Office efficiency 20.94% Employ dynamic people 19.53% No response 2.12% (vi) Areas of Improvement for Private Life Insurance Companies The private sector life insurance companies are the new entrants in the field of insurance business in India and their journey is mere 5 years old. Since they are new they do not face the type of problems being faced by public sector Volume 3, Issue 10, October 2014 Page 6 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 company, LIC, as their offices are well maintained and decorated, are closely linked with internet facilities, have employed young attractive workforce and are providing better customer services. As per the survey 56.48% of the respondent said that the private sector companies should promote confidence building measures and 33.88% respondents were of the view that these companies do not disclose all the relevant information related to the policy to them. This is indeed a serious situation and needs to be looked up and act accordingly and timely. Areas of Improvement for Private Life Insurance Companies Parameters No. of respondents Percentage of respondents Improve public confidence 240 56.48 Disclose all information 144 33.88 Both 27 6.35 Any other 06 1.41 No response 08 1.88 Areas of Improvement for Private Life Insurance Companies Improve public confide 56.47% Both 6.35% Any other 1.41% No response 1.88% Disclose all informati 33.88% Conclusion The study focused on awareness parameters such as life insurance, health insurance and general insurance, as well as the socio-economic characteristics of insured and uninsured households as defined in this study. The study also examined insurance awareness with regard to rights and duties and the grievance and dispute resolution mechanism. It covered major states and union territories in India and attempted to bring out zonal, interstate, and insured–uninsured comparisons of various awareness parameters. Socio-economic Profile of the Insured and Uninsured Households The results of the study suggest that a higher proportion of insured households are both salaried and regular wage earners or are self employed. In contrast, the proportion of labourers is greater among the uninsured households. The study also revealed that average annual income, expenditure and savings of insured households are significantly higher than that of their uninsured counterparts. As expected, the urban households were found to be better off than the rural households. Policy Recommendations The research findings have brought out the fact that people are not able to clearly comprehend the extent of coverage being offered under particular insurance plans, resulting in low insurance penetration and this has varied economic and sociological explanations such as: (i) low propensity for life insurance whereby one-fourth of the households did not consider life insurance as important; (ii) affordability, due to which 56.2 per cent of the uninsured households indicated that insurance is ‘too expensive’; (iii) availability and range of insurance products, wherein 29.0 per cent of uninsured households felt there is a limited range of insurance products and services; (iv)nearly 10.0 per cent of the households felt that insurance services are poor; and (v) the major determining factor being lack of awareness of life insurance across both rural and urban parts of the country, even though a third of the uninsured households agreed to opt for insurance if it is linked to a credit facility. Volume 3, Issue 10, October 2014 Page 7 International Journal of Application or Innovation in Engineering & Management (IJAIEM) Web Site: www.ijaiem.org Email: editor@ijaiem.org Volume 3, Issue 10, October 2014 ISSN 2319 - 4847 References [1] Pre-launch Survey Report of Insurance awareness Campaign Sponsored By Insurance Regulatory and Development Authority. [2] Hogarth, Jeanne M. (2006): ‘Financial Education and Economic Development’ paper prepared for Improving Financial Literacy, International Conference hosted by the Russian G8 Presidency in co-operation with the OECD, 23–30November. [3] IRDA (2010): Annual Report, Insurance Regulatory and Development Authority, India. [4] OECD (2006): Summary Records of a Conference on Financial Education, India, 21–22 September. [5] NCAER (2008): ‘How India Earns, Spends and Saves’, a Max New York Life–NCAER Study. [6] www.licindia.com [7] www.irdaindia.org Volume 3, Issue 10, October 2014 Page 8