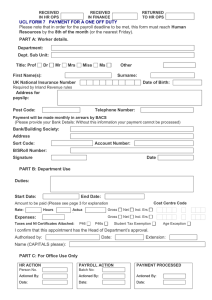

Resources PART A: Worker details. Department:

advertisement

RECEIVED

IN HR OPS

RECEIVED

IN FINANCE

RETURNED

TO HR OPS

UCL FORM 7 PAYMENT FOR A ONE OFF DUTY

Please note that in order for the payroll deadline to be met, this form must reach Human

Resources by the 8th of the month (or the nearest Friday).

PART A: Worker details.

Department:

Dept. Sub Unit:

Title: Prof

Dr

Mr

Mrs

Miss

Ms

Other

First Name(s):

Surname:

UK National Insurance Number

Date of Birth:

Required by Inland Revenue rules

Address for

payslip:

Post Code:

Telephone Number:

Payment will be made monthly in arrears by BACS

(Please provide your Bank Details: Without this information your payment cannot be processed)

Bank/Building Society:

Address

Sort Code:

Account Number:

B/SRoll Number:

Signature

Date

PART B: Department Use

Duties:

Start Date:

End Date:

Cost Centre Code

Amount to be paid (Please see page 3 for explanation

Rate:

Hours

Actual

Expenses:

Taxes and NI Certificates Attached:

P46

Gross

Net

Incl. Ers

Gross

Net

Incl. Ers

P46s

Student Tax Exemption

Age Exception

I confirm that this appointment has the Head of Department’s approval.

Authorised by:

Date:

Extension:

Name (CAPITALS please):

PART C: For Office Use Only

HR ACTION

PAYROLL ACTION

Person No.

Batch No:

PAYMENT PROCESSED

Actioned By:

Actioned By:

Actioned By:

Date:

Date:

Date:

CONFIDENTIAL

EQUAL OPPRTUNITIES CLASSIFICTION FORM

Surname:

First Name(s):

Date of Birth:

Department:

UCL has a commitment to ensuring that external workers are engaged on the basis of merit,

regardless of ethnic origin, sex or disability. Monitoring enables us to see what is happening in

practice, to assess the impact of our equal opportunities policy and its implementation, and to set

any targets for improvements, and measure and publish progress. To enable us to do this, and to

make the exercise successful, we rely on all workers to supply the following details, which will be

treated in the strictest confidence. Once we have updated our database with this information we will

destroy all completed forms. In order to ensure confidentiality please fold the form in half and

staple.Thank you for your co-operation.

Choose the appropriate box to indicate your cultural background.

Ethnic Group

White – British

White – Irish

White – Other

M/R White & Black Caribbean

M/R White & Black African

M/R White & Asian

Mixed Race - Other

Asian/Asian British-Indian

Asian/Asian British-Pakistani

Asian/Asian British-Bangladeshi

Asian/Asian British-Other

Black/Black British-Caribbean

Black/Black British-African

Black/Black British-Other

Chinese

Any Other

Information refused

Sex

Male

Female

Nationality

Do you have a disability?

('A physical, sensory or mental impairment which has a substantial and long-term adverse

effect on (a person's) ability to carry out normal day-to-day activities' (defined by the

Disability Discrimination Act 1995)

Yes

No

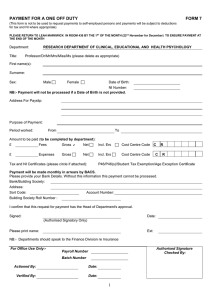

PAYMENT CALCULATION

Please tick the appropriate box on the form to indicate the payment calculation required.

GROSS

This is the amount due to the payee (the person to receive payment) before any deductions are

made for tax and National Insurance (NI)

Payment will be made gross and the payee will pay have tax and NI where appropriate.

Department’s charge: FEE/EXPENSE + ERS NI

e.g. £500 plus £64 (ERS NI @12.8%) Total £564

Payee will receive £500 less Tax and NI. Estimated net £378

NET

The payment will be increased to cover the payee’s tax and NI so that the payee will receive(‘take

home’) the full fee/expense stated on the form

Department’s charge: FEE/EXPENSE + PAYEE’S TAX & NI + ERS NI

e.g. £500 plus £122 plus £64 Total £686.

Payee will receive £500

INCL. ERS (inclusive of all employers payroll costs)

This box should be ticked when the employer has a set amount of money which should cover the

fee/expense and the employer’s NI. Payee would pay their own tax and NI where appropriate.

e.g. Total amount available £500.00

Employer’s national insurance = £57.00, therefore Fee = £443.00

Department’s charge: FEE/EXPENSE + ERS NI

e.g. £443 plus £57 Total £500

Payee will receive £443 less Tax and NI. Estimated net £342

All these figures are for illustration purposes only as they will vary dependant on the tax and

NI status of the employee.

COST CENTRE CODE

The current payroll system requires an 8 character cost code.

The eight digits required are: The Account Code (4 characters)

The Source Code (1 character)

The Analysis Code (3 characters)

Popular Analysis Codes

5A0 - Non Clinical Academic

5A1 - Clinical Academic

5A2 - Part-Time Teaching

5A3 - Tutorials

5A4 - Visiting Lecturers

5A5 - Examiners Fees

5AE - Academic Related

5AU - Student Demonstrators

5B0 - Technical Staff

5C0 - Clerical Staff

5C3 - Non Student Casuals

5C4 - Miscellaneous Casuals

5C9 - Student Assistants