Treasury Board of Canada Secretariat 2006–07 Departmental Performance Report

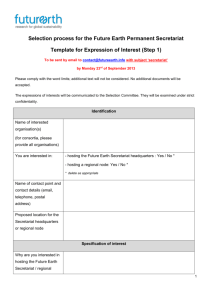

advertisement