Framing the news: An experiment to explore the effects of... on audiences’ propensity to purchase goods and their

advertisement

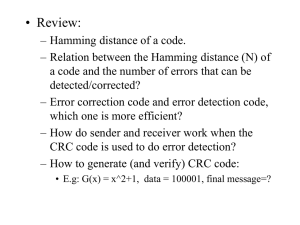

Running head: FRAMING THE NEWS: AN EXPERIMENT 1 Framing the news: An experiment to explore the effects of framed news stories on audiences’ propensity to purchase goods and their perceptions of the economy. by Ashley M. McEntee A Capstone Project Presented to the Faculty of the School of Communication in Partial Fulfillment of the Requirements for the Degree of Masters of Arts in Strategic Communication Supervisor: Dr. Joseph Erba American University April 24, 2014 FRAMING THE NEWS: AN EXPERIMENT 2 COPYRIGHT Ashley M. McEntee 2014 FRAMING THE NEWS: AN EXPERIMENT 3 ABSTRACT What if I told you that the media could have cut the amount of time the United States was in a recession in half? This study aims to understand if there is cause and effect relationship between the valence of a news story and an audience’s propensity to purchase, and their perception of the economy. Between 2007 – 2008 the United States economy went into a recession and Americans started losing their homes and jobs at alarming rates. The general population then turned to media to understand what was happening to them. The worse the recession got, the more news we watched, or was it vice versa? This study sets out to explore if the relationships between media and audiences is a healthy one or one we should start to be concerned about. Between March 17, 2014 – March 25, 2014 I conducted an online experiment with 133 individuals. These individuals were presented one of five stimuli and then asked to complete a questionnaire about their feelings, perceptions, and propensity to purchase. At the end of the study I was able to determine there is no valid relationship that exists between the valence of a news story and an individual’s propensity to purchase, however I was able to determine a relationship between the valence of a news story and an individual’s perception of the economy. The participants of the study showed an inverse relationship between valence and perception. My findings did not align with previous studies or experiments done on this topic. This experiment instead opens up the topic to new questions and concerns about the influence of media on audiences. The inverse relationship discovered suggests a deeper distrust for media in our lives than previous studies and research has examined. FRAMING THE NEWS: AN EXPERIMENT 4 T ABLE OF C ONTENTS Introduction .................................................................................................................................................. 6 Literature Review ......................................................................................................................................... 8 The media as an opinion leader ............................................................................................................... 8 Problems with Financial Reporting.......................................................................................................... 9 Media effects and influence .................................................................................................................. 10 Media shaping perceptions.................................................................................................................... 11 Theory of Framing .................................................................................................................................. 14 Media Frames and Individual Frames ................................................................................................... 15 Media Frames ......................................................................................................................................................15 Individual Frames.................................................................................................................................................16 Framing and Media Effects .................................................................................................................... 16 Research Questions .................................................................................................................................... 19 Hypothesis .................................................................................................................................................. 19 Variables ................................................................................................................................................. 20 Method and Procedure .............................................................................................................................. 21 Overview of Method, Participants and Recruitment ............................................................................ 21 Measurement ......................................................................................................................................... 22 The theory of framing - News Valence ................................................................................................................22 Propensity to purchase and perception of the economy ....................................................................................23 Control Variables .................................................................................................................................................24 Consent/Privacy of Participants ............................................................................................................ 25 Data Storage ........................................................................................................................................... 25 Ethical Concerns ..................................................................................................................................... 25 Validity and Reliability ........................................................................................................................... 26 Results......................................................................................................................................................... 27 Discussion ................................................................................................................................................... 30 Limitations .............................................................................................................................................. 31 Conclusion .................................................................................................................................................. 33 Future research ...................................................................................................................................... 35 Implications of this study ....................................................................................................................... 35 Bibliography................................................................................................................................................ 37 FRAMING THE NEWS: AN EXPERIMENT 5 Appendices ................................................................................................................................................. 40 Stimuli ..................................................................................................................................................... 40 Questionnaire ......................................................................................................................................... 43 FRAMING THE NEWS: AN EXPERIMENT 6 I NTRODUCTION Financial illiteracy, the inability to breakdown the intricacies of personal finance and the economy, is a major issue in the United States (Volpe, 2010). Most people go day to day without realizing where or to whom their money is going, instead they rely on the expertise of their local news or a national broadcast to inform them of the potential ebbs and flows of the economy (Harrington, 1989). This can be shortsighted on behalf of the individual because the viewer does not know what news is omitted from the news story (Harrington, 1989). From 2001 to2005 news conglomerates broadcasted to the world that the United States economy was incredibly healthy (Volpe, 2010). Reports came from every media source in the nation that this was the time to buy a home and there was little, if any, potential risk involved (Volpe, 2010). The subprime mortgage market, generally reserved for consumers with high credit risk, skyrocketed from $190 billion in 2001 to $625 billion in 2005 (Volpe, 2010). The financial crisis of 2007-2008 was due to overinvestment and speculation in real estate. Homeowners who had subprime mortgages out on their houses saw an average of 25-30% increase in their monthly payments. In 2008, foreclosure filings increased 81% and 2.3 million Americans faced losing their home. The media claimed they were unable to see any of this coming (Manning, 2013; Volpe, 2010). Over the course of my literature review I encountered a number of studies that could potentially explain the oversight of the financial crisis, but what I have found most intriguing is the suggestion that media professionals specifically omit important facts from stories in order to highlight ‘softer news’ (Manning, 2013; Kleinnijenhuis, Schultz, Oegema, & van Atteveldt, FRAMING THE NEWS: AN EXPERIMENT 2013). Since media tend to be the key opinion leaders on complex issues like the economy and the stock market, these framed news stories could potentially influence consumer perception on the economy and their viewership’s propensity to purchase (Manning, 2013; Kleinnijenhuis et al., 2013). The objective of this research project will be to attempt to discover if there is any relationship between how news stories about the state of the economy are presented to audiences and the audiences purchasing intentions and perception of the economy. In retrospect, could the media have minimized the widespread panic of a declining economy and market (Manning, 2013; Kleinnijenhuis et al., 2013)? If the media focused more on a potential recovery earlier than 2012, would consumers have felt more comfortable about spending and purchasing goods, thus resuscitating the economy earlier? In the next chapter, I will examine media as an opinion leader on the economy and financial markets, the news effects, influence of media on their audiences, and the theory of framing and how it applies to perceptions and the propensity of audiences to purchase goods. 7 FRAMING THE NEWS: AN EXPERIMENT 8 L ITERAT URE R EVIEW THE M E D I A AS A N O PI N I O N L E AD E R The finance sectors are not the easiest of industries to understand. Finance requires multifaceted levels of thinking including linear and horizontal. The field also requires skill with mathematics and a talent to understand the behavior of numbers. These requirements make finance based fields among the least comprehended by average Americans. Financial illiteracy has been cited as one of the roots of the financial crisis during 2007-2008 (Volpe, 2010). The inability of investors to decipher early information regarding subprime mortgages or financial securities allowed for others (investment advisors, mortgage brokers) to take advantage and expose the investors to higher risk than they would have normally under taken. Since the economy and financial securities are not a salient topics for the general population, it is natural that they seek out sources that can aid them in breaking down the information and making it more concrete (Goidel & Langley, 1995). Therefore, a majority of the general population relies heavily on those who have demonstrated their ability to disaggregate complex topics – the press (Manning, 2013). Journalists who cover economic news are authoritative figures for many financially illiterate Americans (Goidel & Langley, 1995; Manning, 2013). Journalists use schemata or concrete examples throughout their news stories to aid their viewers in understanding how a major bankruptcy or market crash can personally affect their audiences. Audiences assume that journalists are reporting whole stories and the information within those stories is accurate and timely. The news is where homeowners turned to understand why they were losing their FRAMING THE NEWS: AN EXPERIMENT 9 homes or how their mortgage payments could all of a sudden double (Volpe, 2010). “In this respect, economic news coverage serves as a burglar alarm for alerting citizens to both real and perceived economic problems” (Goidel, Procopio, Terrell & Wu, 2010 p. 38). However, journalists face a number of issues when reporting on less salient topics like the economy or the financial markets and thus their stories cannot always be cohesive. P R O BL E M S WITH F I N A N CI AL R E PO R TI N G A major variable in the ability of a journalist to give an accurate and concrete report primarily depends upon the credibility of his or her own sources (Goidel, Procopio, Terrell & Wu, 2010). The financial press relies on financial analysts for accurate information on the state of the economy, company, or industry (Goidel, Procopio, Terrell & Wu, 2010). As communication is not an analyst’s field of expertise, analysts struggle to convey important information about finance to journalists, who tend to have minimal backgrounds in finance. An interview by a financial analyst explained some of the underlying problems he frequently sees with the financial press, “Financial correspondents face several difficulties, (a) they often don’t understand the technical details – especially the risk calculations, hedge etc…, and (b) they often don’t have time to get a grip on the underlying patterns… whole chunks of editorial are simply lifted out of our notes [reports] without much original analysis” (Manning, 2013, p. 179). Thus as their audiences rely upon them, the press relies on the financial analysts to break down complex issues. This transfer of information can deeply suffer from a lack of check and balances (Kleinnijenhuis et al., 2013). FRAMING THE NEWS: AN EXPERIMENT 10 Financial analysts also have a number of objectives when they are approached for news about the economy, their company or status of the market. However, journalists trust that financial analysts are providing the “truth” in their reports, but fail to realize that manipulating numbers and the corresponding explanations for those numbers is just another form of Public Relations (Kleinnijenhuis et al., 2013; Manning, 2013). Inefficient sources for financial press are a large problem when they are the key opinion leaders on the state of the economy to a majority financially illiterate audience. Credibility is a major factor when a large portion of the population depends on you for information that can affect their livelihoods like the increase in interest rates or the possible decline of the real estate industry. It is assumed that barriers like the one addressed in the previous section could have impeded journalists on the reporting of the doomed financial system. They either couldn’t see it, couldn’t sell it, or they were forced to hide it due to outside pressures. However, the more perverse problem with these barriers is that if journalists are not able to report the news as they receive it how do we know what we are being presented in a news broadcast is an accurate picture of the economy. Millions of people are generating opinions and perceptions on this information and that in turn can affect economic behaviors (Goidel & Langley, 1995; Harrington, 1989) MEDIA E F F E C TS AN D I N F L UE N CE A majority of people in the United States suffer from financial illiteracy and when it comes to the economy, audiences rely on media to guide them through the complexities (Volpe, 2010). When journalists prepare a story for their audience they generally rely on tools FRAMING THE NEWS: AN EXPERIMENT 11 of the trade to get their stories air-time. Journalists can utilize a number of techniques like the use of schemata or highlight specific areas of interest (controversy, negative news etc.) that they know will receive the most attention and editors know will be watched or read. When these cropped news stories start to affect the intentions or perceptions of the viewers it is then we need to examine how severe are the effects of the news and are these framed news stories hurting audiences more than helping (Kleinnijenhuis, Schultz, Oegema & van Attenveldt, 2013; Harrington, 1989; Hester & Gibson, R 2003; Manning, 2013; Volpe, 2010). From 2001-2005 journalists sold the market; story after story appeared about great payoffs, high dividends, and no foreseeable downside to a bullish market (Volpe, 2010). People invested in the stock markets at alarming rates; those who were not at all familiar with the nuances of the stock markets became avid day traders while others invested their life savings (Manning, 2013; Volpe, 2010). People were making money. However, there was evidence that a decline was on the horizon and it was never highlighted in the news the same way as the upside. This cropped reality created a dangerous perception for the unknowing investor (Hester & Gibson 2003; Volpe, 2010). MEDIA S H A PI N G PE R C E P TI O N S To understand how media can shape the perceptions of the economy we need to understand from where perceptions stem. Perceptions are evaluations made about foreign variables using familiar attributes (Youngkee, 2008). Perceptions do not necessarily represent reality but mostly reflect a perceived reality – a reality one believes they see (Youngkee, 2008). FRAMING THE NEWS: AN EXPERIMENT 12 Mass media can mold consumer sentiment or perception by “pegging” complex issues to ‘newsworthy’ stories (Blood & Phillips, 1995; Harrington, 2001). The majority of news stories are negative in nature, because negativity, controversy, and tragedy receive higher ratings/readership. The Institute of Applied Economics found in 1984 that 95% of economic statistics were positive and nearly 85% of news stories were negative in nature (Institute of Applied Economics, 1984; Blood & Philips, 1995). An abundance of negative broadcasting could lead to negative perceptions and thus influence the intentions or perceptions of an audience (Thompson, 2009). During the 2007-2008 financial crisis, editors and news organizations could not get enough of finance. Story lines of disgraced CEO’s like Bernie Madoff, who was convicted of a Ponzi scheme, played out in headlines, and the failure of Lehman Brothers, the fourth largest investment bank in the United States, became dinner table conversation. Negative headlines began to shake investor confidence (Blood & Philips, 1995), after being inundated with negativity, audiences begin questioning the markets’ stability and subsequently selling off stock or decreasing household spending (Blood & Philips, 1995; Hester & Gibson, 2003; Thompson, 2009). Not to say that a news story can cause a recession, but “In an economic crisis the condition may be extreme debts, the cause can be a massive short selling by investment banks, and the booster could be a news hype” (Kleinnijenhuis, Schultz, Oegema & van Attenveldt, 2013, p. 14). A great example of media influence on viewership perceptions and intentions occurred on September 13, 2007 when Robert Peston, the Business Editor of BBC News, made headlines with his reporting on the financial problems of Northern Rock bank (Hester & Gibson, 2003; FRAMING THE NEWS: AN EXPERIMENT 13 "Rush on northern," 2007). Peston’s reports have been directly attributed to the run on the bank. According to BBC news on September 14, 2007 customers withdrew around 4-5% of its deposits after his news broke (Kleinnijenhuis, Schultz, Oegema & van Attenveldt, 2013; "Rush on northern," 2007). Peston had directly influenced the state of Britain’s economy (Hester & Gibson, 2003). In 1990, a Washington Post media critic questioned if the economy was suffering from ‘media malady’ (Kurtz, H. 1990; Wu, Stevenson, Hsiao-Chi & Guner, 2002). His argument was that the amount of media attention paid to a future recession caused an actual downturn in the economy. A decade later, in 2000, the Economist also suggestively questioned this theory, by publishing a report on the number of times the word ‘recession’ appeared in the New York Times and Washington Post. The term ‘media malady’ became so widely recognized it became a term in the American population’s vernacular. It was perceived that the weakened economy was due to the media’s obsession with negative news (Wu, Stevenson, Hsiao-Chi & Guner, 2002). This tactic of repetition in the media demonstrates characteristics of the agenda setting communications theory. The amount of which the media focuses on a particular issue, like the recession, can affect how much an audience pays attention to the issue and scales its importance (Behr & Iyengar, 1985; Hester & Gibson, 2003). Majority of the population builds their knowledge about the economy from two sources; 1) their personal experiences and 2) journalists (Volpe, 2010). When the media is faced with a number of barriers like complex information, wayward sources, a fickle editor, ratings and the potential to create market panic, we as communications researchers need to look closer at what and more importantly how, journalists are presenting news stories to their FRAMING THE NEWS: AN EXPERIMENT 14 audiences (Harrington, 1989; Hester & Gibson, 2003; Kleinnijenhuis, Schultz, Oegema & van Attenveldt, 2013; Manning, 2013; Volpe, 2010). As I mentioned earlier, we see facets of agenda setting in the repetition of the word ‘recession’ in the 1990’s but we should also investigate what aspects of framing are present in these stories as well (Hester & Gibson, 2003). T H E O RY OF F R AM I N G By definition framing is an action by which we highlight particular attributes of an issue or topic and omit others (Entman, 1993; Borah, 2011; Tweksburg & Scheufele, 2009). This can be a conscious effort or not (Entman, 1993). An easier way to imagine framing is to conceptualize the process of ‘cropping’ a picture; when you crop something you remove pieces of the picture in order to highlight a specific section. Framing can be a useful tool to increase the salience of complex topics like finance, subprime real estate mortgages, or the state of the economy. Journalists use framing to grab readers attention in headlines by highlighting the most attractive or most controversial parts of a story. Teachers use framing as a tool when they are trying to build upon their students’ current knowledge base. During my review of the literature on framing, two core disciplines are cited as the foundation from which the theory of framing stems; psychology and sociology (Borah, 2011; Entman, 1993; Tweksburg & Scheufele, 2009). These particular disciplines will help explain how we can determine an audience’s perception of a topic, in this case, the state of the economy, and how it can be easily manipulated. The way I defined framing above was by using the schema of ‘cropping’. Schemata are psychological tactics used to produce frames (Entman, 1993). A schema is a known object or FRAMING THE NEWS: AN EXPERIMENT 15 reference used to describe (or understand) an unknown object or reference. By using schemata humans are able to recall something familiar and build upon it to explain something unfamiliar. This is a common tactic teachers use to build upon their students’ current knowledge base. Erving Goffman in 1974, considered to be one of the most influential contributors to the theory of framing, notes that schema are the primary frameworks to learning (Goffman, 1974). Goffman’s concept of framing relied heavily on sociological norms, but my study will be more focused on the psychological impacts of framing. M E D I A F R AM E S AN D I N D I V I D U AL F R AM E S When discussing the psychological impacts of framing we need to understand there are two key concepts of frames within this theory. One side, media frames, references the constructed frame by the media (e.g. when a story highlights a particular facet and omits others). The other side, individual frames, are already constructed frames within an individual’s mind that one uses to decipher information. Entman (1993) describes individual frames as “information processing schemata” and media frames as “attributes of the news itself” (p.7). All the research previously done on framing is an attempt to understand the relationship between these two concepts (Scheufele, 1999). M EDI A F R A M ES Entman (1993) suggests that media frames are an essential part to conveying the news, “To frame is to select some aspects of a perceived reality and make them more salient in a communicating text, in such a way as to promote a particular problem definition, causal interpretation, moral evaluation, and/or treatment recommendation” (p. 52). The framing of FRAMING THE NEWS: AN EXPERIMENT 16 events in the media aid in the ability for the audience to understand them. Again, in reference to complex topics like the subprime mortgage crisis, Entman (1993) suggests that media frames are essential for a journalist so they can convey information about these topics in a way that their audience will understand. However, contrary to how essential Entman (1993) makes the media frame sound, they can also carry an “intent” or motive from the sender subconsciously or not (Scheufele 1999; Gameson 1989). This becomes more evident in studies like Manning (2013) where media frames were omitting important warnings to the public of a potential recession. The journalists interviewed in this case, Manning (2013), cited that they omitted these warnings because they did not want to cause pre-mature collapsing of banks. I N DI V I DU A L F R AM E S On the other side of the spectrum, individual frames are the internal constructs of an individual’s mind; how we break down incoming information. We carry internal frames in order to better understand and process new information (Entman, 1993). F R AM I N G AN D M E D I A E F F E C TS Framing in the psychological discipline is to understand how the human brain is going to interpret a third party messages. Framing media effects is how media professionals use their knowledge of individual frames to create media frames in an attempt to produce a specific perception or decision that is beneficial to themselves and not necessarily the individual (Kahneman & Tversky, 1984; de Vreese, 2005). By understanding the most used “norms” of one’s audience (norms are common concepts that a large number of individuals use as their individual frames) media can then control the individuals understanding of a concept or story FRAMING THE NEWS: AN EXPERIMENT 17 (Goffman, 1974; Entman, 1993; Heath & Heath 2007; Tweksburg & Scheufele, 2009). Less cynically, by understanding both media and individual frames media can also convey very complicated topics to people with little to know knowledge of said topic (e.g. subprime mortgages). Journalists/Media cannot take full responsibility for the manipulation of their communications, as there are other factors at play. They actually rely on the framed explanations that come from their sources and aid in their ability to understand the complex nuances of such things like commercial mortgage backed security loans or financial derivatives (Entman, 1993; Harrington, 1989). It can then be assumed that most stories that reach the American public about more complex or non-salient topics have been framed more than once or ‘double cropped’; once for the journalist, and once for the population. This is where the importance of my experiment and research question becomes evident. A number of studies have expanded upon the definition of framing by examining how different presentations of identical scenarios can influence your evaluations of the scenario (Entman, 1993). The most widely cited psychological experiment of framing comes from Kahneman and Tversky (1984). In the experiment, the authors frame one topic in two different ways; by highlighting and omitting different attributes of the scenario or problem. During the experiment Kahneman & Tversky (1984) found that participants could be manipulated to select a particular answer given the wording of the question. For example, the solution to one problem posed by the above experiment focused on the number of people that will die, the other solution focused on the number of people that will live. In each solution the same number of people will die and live, however, the participants of this study selected the choice FRAMING THE NEWS: AN EXPERIMENT that was worded to seem that more people will live. By producing this result, Kahneman & Tversky (1984) were able to prove we can manipulate the decision making processes. This experiment is the platform for my research and experiment. 18 FRAMING THE NEWS: AN EXPERIMENT 19 R E S E AR CH Q UE S TI O N S In prior chapters I discussed how media can use different tools in order to disseminate information to their audiences. Tools like framing. In this study I explored five news stories framed in a variety of valences (extremely negative, mildly negative, mildly positive, extremely positive, and neutral) and if those frames affect an audience’s perception on the economy and their propensity to purchase. Previous studies about framing in the news have been heavily dominated by content analysis; 61.5% of published literature on framing is a result of a content analysis compared to only 19.8% of literature that has been derived from experiments (Bohar, 2011). RQ: How does the valence of news affect the audience’s propensity to purchase and perception about the economy? H Y PO TH E S I S H.1: Participants who are exposed to an extremely negative news story about the economy will have less a propensity to purchase than those exposed to an extremely positive news story about the economy. H.2: Participants who are exposed to an extremely negative news story about the economy will have a more pessimistic view of the economy than those exposed to an extremely positive news story about the economy. FRAMING THE NEWS: AN EXPERIMENT 20 V ARI A BL E S My independent variable for the experiment is the valence of the news story. I researched and selected five news stories with different valences (extremely negative, mildly negative, mildly positive, extremely positive, and control) from real online news outlets in the United States. The stories were chosen based on the tone and subject of the article, and the verbiage used in the headlines. The news stories were to be originally be pre-tested by faculty and peers, but due to time restrictions were not. This will be discussed more in my limitations section. The dependent variable(s) are the audience’s propensity to purchase and their perception of the economy. The experiment consisted of issuing a questionnaire inquiring about the participants feelings toward their stimulus (treatment condition), their future plans for investments or purchasing, and their overall perception of the United States economy. FRAMING THE NEWS: AN EXPERIMENT M ETHOD AND OVERVIEW OF 21 P ROC EDURE M E T H O D , P A R TI CI P AN TS AN D R E C R UI TM E N T The experiment was conducted online by building the stimuli and questionnaire into Qualtrics, an online data collection provided by American University. Qualtrics allows the researcher (myself) to equally distribute the five stimuli to any participant that clicks on the link to participate in my experiment. After being exposed to the stimulus, the participant was asked to complete a questionnaire. The entire experiment lasted approximately eight minutes for each participant. After preparing the online experiment, I recruited participants online to participate. This experiment did not call for a specific sample or participant, thus I was able to obtain a convenient sample. Any person (over the age of 18 years old) I was able to make contact with over email or Facebook, had the opportunity to participate in this study. Additionally, I requested friends and family to forward along the survey to their social circles. The recruitment process consisted of a mass e-mailing to my contacts and posting the link to the experiment on my Facebook page. Once the participant consented to participate in the experiment, the Qualtrics software conducted a simple randomization operation to equally distribute the five stimuli to participants. I received 136 responses during March 17, 2014 – March 25, 2014. This met my goal of 24 participants per stimulus. FRAMING THE NEWS: AN EXPERIMENT 22 M E AS U RE M E N T In order to complete the experiment I had to conceptualize three items that were to be measured in this experiment, they were: 1) news story valence and 2) perception, propensity to purchase, and 3) controls. THE T H EO R Y O F F R A MI N G - N E W S V A L EN C E I obtained all of my news stories from multiple online news sources. Each stimulus consisted of the first three paragraphs of the published news stories. The subjects of the stories varied because it was very important to this experiment to maintain a high level of external validity. I did not want to fabricate and manipulate the stories for each condition. The news stories selected were all related to the health of the U.S. economy (unemployment rates, the stock market, the price of oil, and economic growth indicators). One exception, the control group, was given a story that had no reference to the state of the economy and focused on the voting of District of Columbia to decriminalize marijuana. To create the stimuli I chose the first three paragraphs of each published news story, because reporters or journalists write in the “inverted pyramid” style and include majority of the story’s highlights in those paragraphs. Also, I did not want my participants to be have to read an entire news story in order to participate. I was concerned the longer the story, the more participants would discontinue the experiment. I lightly manipulated the wording of the stories in order to create a clear line of delineation between the varying degrees of valence; Extremely Negative, Mildly Negative, Mildly Positive, Extremely Positive and Control. I FRAMING THE NEWS: AN EXPERIMENT 23 determined the valence of each story by using the previous research done by Kleinnijenhuis, J., Schultz, F., Oegema, D., & van Atteveldt, W. (2013) and Kahneman and Tversky (1984). P R O P EN SI T Y T O P U R CH AS E AN D P E R C EP T I O N O F T HE E CO N O M Y The audience’s propensity to purchase and perception of the economy was measured by way of issuing participants a short news story to read followed by an online questionnaire. The questionnaire hosted a 5-point Likert Scale system and a few multiple choice questions to determine the participant’s characteristics. I chose a 5-point scale because I observed in previous studies that a 7-point scale became too diluted and a 3-point scale seemed too aggressive when discussing perceptions. Kahneman and Tversky (1984) used between two and four multiple choice answers during their research, and I felt that their method was leading the participants too much. The measures were scored on a 5-point scale with strongly disagree/very unlikely scored as a one and strongly agree/very likely being as five. Propensity to purchase was measured with five questions asking the participants to weight how likely they are to spend money one specific items (e.g. How likely are you to increase your overall investment in the stock market? Or, how likely are you to go to vacation?). Responses ranged from (1) very unlikely to (5) very likely. Perception of the economy was measured with four questions asking the participants to weight how they feel about the current state of the economy (e.g. Given the above story, how do you believe the U.S. economy is performing so far this year? and The U.S. economy is slowly recovering) Though different scales, responses were still scored from (1) much weaker/strongly disagree to (5) much stronger/strongly agree. FRAMING THE NEWS: AN EXPERIMENT 24 In reviewing previous experiments regarding perception and behavior, it was common to find the “Strongly Disagree to Strongly Agree” Likert Scale. Majority of the questions in my questionnaire are based on those findings. My topic has not been heavily researched and the amount of experiments related to my research question and dependent variables are low to non-existent. A number of my questions were inspired by other studies on perception (see Seate, A., Harwood, J., & Blecha, E. (2010)). C O N T R O L V AR I A BL E S In order to further understand the direct relationship between my independent and dependent variables, I tested for a number of controls. The controls were used to help to establish who my participants were, and if they have any particular experience or knowledge that could explain their answers, aside from the stimulus. The experiment tested for the amount of finance and economic knowledge each participant had (e.g. I have a background in Finance, or I know how to solve for the Income Elasticity of Demand). The participants were asked to answer either Yes or No. I also tested for how much media and what kind of media each participant consumed (e.g. How many news outlets will you review prior to drawing conclusions about a breaking story? Or, when I am looking for news about how the stock market performed today I will refer to a major news outlet for that information). Responses were scored again from (1) one outlet/strongly disagree to (5) five or more outlets/strongly agree. Finally, the experiment tested participants’ opinion on the use of media as a tool to obtain information regarding the economy. In my literature review I mention that financial illiteracy is a major problem, and I wanted to explore if participants agreed that the media was FRAMING THE NEWS: AN EXPERIMENT 25 helpful to those who knew little or nothing about the economy. Responses were scored again from (1) one strongly disagree to (5) strongly agree. Because my sample was a convenient sample, I needed to establish the demographic of my participants. I generated seven questions asking them their age, gender, ethnicity, highest level of schooling, income level, political affiliation and the state in which they currently reside. C O N S E N T /P RI V A CY OF P A R TI CI P AN TS I obtained consent from each participant using American University standard consent form off of the IRB website. Even though my method was not formally approved by the IRB, due to time restrictions, I wanted to make sure each participant was aware of what they were participating in. Within the form participants were told that there were no risks in participating in this study and that individuals will remain anonymous because data will only be compiled in the aggregate. Prior to starting the questionnaire or stimuli, participants were asked to read the consent form and then forced to acknowledge they were willing participants and over the age of eighteen. D A T A S TO R A G E My data was initially stored on the Qualtrics website. From there I downloaded the data onto my personal Dropbox. No one had access to the data set except myself and my faculty advisor. No one has reviewed the data set except myself and my faculty advisor. E T H I C AL C O N CE RN S I do not expect there to be any ethical concerns with this research project. FRAMING THE NEWS: AN EXPERIMENT V AL I D I TY AN D 26 R E L I A B I L I TY Since I issued the same questionnaire with the same grading system to every participant I am confident that my measures will be reliable and consistent. However, according to SPSS my internal reliability factor was low because each question was testing something different. In this case I need to look at each questions as its own dependent variable. The validity of the experiment is somewhat of a concern as experimental research on this subject is minimal. I wanted to maintain a high level of external validity by using real stories but it became difficult to find various valences. After manipulating the stories slightly, I was able to increase my internal validity and give up a little external validity. FRAMING THE NEWS: AN EXPERIMENT 27 R ESULTS RQ: How does the valence of news affect the audience’s propensity to purchase and perception about the economy? Participants were randomly assigned one of five Treatment Conditions and the ANOVAs showed no statistically significant difference among means for each Treatment Condition and the propensity to purchase. However, the ANOVA did show that there was statistical significance between Treatment Condition and perception of economy. The significance was not in the direction of my hypothesis but suggested an inverted relationship between Treatment Condition and perception. To explore the results I ran one-way ANOVA tests in SPSS version 22 to analyze the data followed by a Tukey post-hoc test to explore the differences. These analyses allowed me to discover any statically significance between my conditions and the dependent variables. H.1: Participants who are exposed to an extremely negative news story about the economy will have less a propensity to purchase than those exposed to an extremely positive news story about the economy. The dependent variable was being operationalized by a five items; none of which reported any significance. The most desirable question of the group Question #3 attempted to operationalize the participants’ propensity to purchase non-essential goods. Question #3 reported the following results: The valence of the news story did not affect the participants propensity to purchase (F(4,123) = .18, p > .05. FRAMING THE NEWS: AN EXPERIMENT 28 Although not significant, participants reported the highest propensity to purchase for the control news story (M=3.12, SD=.15) and the lowest propensity to purchase for the mildly positive news story (M=2.96, SD=.15) Overall, the ANOVAs revealed no statistical significance between the condition and the propensity to purchase, thus rendering the hypothesis invalid. H.2: Participants who are exposed to an extremely negative news story about the economy will have a more pessimistic view of the economy than those exposed to an extremely positive news story about the economy. Of the six items used to operationalize H.2, two were found to be statistically significant. The valence of the news story did affect the participants perception of the state of unemployment (F(4,120) = 3.56, p < .01). Participants reported the most optimistic perception for the state of unemployment for the extremely negative news story (M=4.61, SD=.29) and the lowest perception for the state of unemployment for the extremely positive news story (M=3.33, SD=.18). This did not validate my hypothesis, but did validate there is a significant relationship between stimuli and perception. To further explore this relationship I performed a post-hoc Tukey test to determine which stimuli showed the most significance. The treatment conditions: extremely negative, extremely positive, and mildly positive were significant at the .05 level. FRAMING THE NEWS: AN EXPERIMENT 29 The valence of the news story also affected the participates overall perception of the economy (F(4,120) = 4.43, p < .01. Participants reported the most satisfaction with the mildly negative news story (M=2.88, SD=.18). Participants reported the least satisfaction with the extremely positive news story (M=2.04, SD=.18). This did not validate my hypothesis, but did validate there is a significant relationship between stimuli and perception. Following these results, I conducted a second post-hoc Tukey test to determine which treatment conditions provided the most significance. In regards to their overall satisfaction with the state of the economy, participants who receive the mildly positive and extremely positive frames had a .05 significance level. Additional Results: In addition to testing extremes, I did also test mildly negative, mildly positive, and neutral frames. Other than the significant relationship between the perception of economy and mildly positive condition addressed above, the other valences did not have an effect on the participants’ propensity to purchase or perception. In my methods section I mention asking participants whether or not they believed media to be a useful tool for those that know little or nothing about the economy. Of 132 participants that completed this question 26% did not agree, 40% remained neutral, and 32% did agree. It seems that majority of the individuals do view media as a useful medium to receive information about finance and the economy. This finding is concerning given the journalistic struggles to convey complicated topics, like the stock market and the state of the economy, to the general public (Goidel & Langley, 1995; Manning, 2013). FRAMING THE NEWS: AN EXPERIMENT 30 D ISC USSION This study explored whether valence of a news story about the economy could influence the propensity to purchase and ones perception of the economy. Findings offer little to no evidence that the valence of a news story can affect ones propensity to purchase. However, results did suggest there is a significant relationship between the valence of a news story about the economy and ones perception of the economy. However, that relationship proved to be the opposite of my hypothesis (ex. An extremely negative frame resulted in a more optimistic perception on the state of the economy). The findings regarding the propensity to purchase are not surprising. This dependent variable (propensity to purchase) has never been studied within the theoretical framework of framing. However, the reasoning behind the decision to test this variable stemmed from research regarding the housing bubble and the onslaught of media attention that it received. As I stated in the beginning of the study, between 2001 – 2005 the news ran various stories about the strength of the United States economy and that buying a home on a subprime mortgage had little no potential down side (Volpe, 2010). In his research, Volpe suggests that this reporting drove consumers to take out subprime mortgages because of their inability to comprehend the potential downfalls. Contradictory to Volpe’s observations, I was unable to prove that media can manipulate the propensity to purchase no matter the valence of the story or the complexity of the topic (in this case the economy). The other dependent variable explored in this experiment was the perception of the economy. This second dependent variable “perception” has been studied more within the theory of framing than the propensity to purchase. With this variable, I was able to find FRAMING THE NEWS: AN EXPERIMENT 31 statistically significance, primarily relating to participants’ perception of the state of unemployment and their overall satisfaction with the economy. However, contradictory to prior research on the theory of framing, my participants actually showed signs of a reverse relationship rather than a direct relationship between valence and perception. When the participants were exposed to an extremely negative story their cognitive processes lead them to select that they were more optimistic about unemployment/state of the economy. A similar scenario also occurred with those who saw an extremely positive frame; the mean of their selections was the lowest or the least optimistic with the economy. L I M I T A TI O N S This study sought to expand upon the current collection of experiments and knowledge about the relationships between framing, perception, and purchasing. However, there are a number of limitations to the findings. I found that the most critical limitation to the experiment was the sophistication of my participants, over 86.00% had completed higher education; 50.00% of my participants had received their bachelors’ degrees and 36.10% of the participants had received their graduate or other professional degree. This limitation is significant because previous research has shown that individuals with a higher degree of education, compared to those with little or no education, do not react similarly to frames and are not influenced by them as easily. Another second variable that limited my research and results is that the treatment conditions (stimuli) were not pre-tested. Given the short period of time to conduct the experiment, it was necessary to start the questionnaire as soon as possible. If I had had more FRAMING THE NEWS: AN EXPERIMENT 32 time to pre-test the stimuli I might have been able to find more suitable or aggressive frames to influence the participants’ questionnaire answers. The last limitation I found had to do with the “Consent to Participate” form on the first page of my questionnaire. The form states that the individual agrees to participate in a study to research news and the propensity to purchase. In my results, I found no significance between my treatment condition and the propensity to purchase; however, I did find significance between the treatment condition and the unnamed variable, perception of the economy. This result could be described by the Hawthorne effect, which states that if a participant knows they are being studied they will answer or act differently than if they were not aware. In this study, participates knew I was testing for the propensity to purchase, but did not know I was testing their perceptions as well. FRAMING THE NEWS: AN EXPERIMENT 33 C ONCLUSION My results are interesting because they are the opposite of what has been discovered previously about news frames and perception. Blood & Philips (1995) proved through a timeseries analysis that negative adjectives that described the economy within news stories was directly linked to the tone of consumer sentiment. These results also challenged Kleinnijenhuis, J., Schultz, F., Oegema, D., & van Atteveldt, W. (2013), which conducted a case study that was able to contradict the efficiency market hypothesis (EMH) when it discovered that news stories about “credit crisis” affected the value of particular stocks and indirectly the perception of the economy by the investors. The platform for my research was the experiment of framing done by Kahneman and Tversky (1984). According to their research, people are usually faced with two choices when making a decision on something; retain the status quo or accept an alternative. In majority of scenarios the participant will chose the status quo. In this study, the extremes were an alternative, and the status quo would have been the opposite of that. Kahneman and Tversky (1984) built their frames to test their research questions. However, in this experiment, I found it crucial to maintain a high level of external validity by using current news headlines and real news stories. The fabricated frames of Kahneman and Tversky (1984) lacked external validity but maintained high internal validity. This experiment was able to prove a direct relationship between frames and the participants’ decisions making processes. However, real frames taken from a variety of news outlets with little to no manipulation did not receive the same outcome as the fabricated frames of previous experiments. My research concluded with an indirect relationship, and thus this leads me to FRAMING THE NEWS: AN EXPERIMENT 34 wonder if experiments with fabricated frames are truly showing a significant relationship or a fictitious one that only exists within the actual experiment. In conclusion I was not able to draw any causal relationship between the treatment condition and my first dependent variable; propensity to purchase. I believe that the experiment could work but I do not believe that my stimuli were strong enough to change a participants will or want. Since I used real headlines and news stories, I was unable to create a “shock” factor that might be strong enough to influence an individual to choose a particular answer. Also, a number of my questions had a negative undertone or connotation, according to Kahneman and Tversky (1984) status quo is usually the easiest answer for participants, then given the current rebound of the economy some of my participants may have found it faux pas to strongly agree or disagree with any question that was too negative or too enthusiastic about the current fragile economy. Although minuet, some of my conditions were strong enough to form a causal relationship between the valence of a news story and ones perception of the economy and perception of the current state of unemployment. The relationship, although not the exact relationship I was looking to validate in my H2, was statistically significant and showed that the conditions (extremely negative, extremely positive, and mildly positive) directly affected the answers the participants chose regarding their perception of current state of unemployment and their perception of the overall state of the economy. These results lead me to wonder if fabricated frames in an experimental environment truly provide accurate evidence of a relationship between framing and perception. Since majority of research regarding framing and consumer sentiment/perception is qualitative it is FRAMING THE NEWS: AN EXPERIMENT 35 interesting that my results have contradicted one of the most widely cited experiments on the topic. Nonetheless, previous research and my research show that framed news stories can affect the perception or choices of the audience. However, to what degree we can influence these perceptions, and the direction of the perception, seems to be an issue for further investigation. F U T U RE RE S E A R CH With keeping in mind the previously addressed limitations to both my study and other research regarding this topic, there are a number of avenues future research can take to explore this topic in more depth. One suggestion would be to compare the framing effects of a fabricated frame versus a real news story. This research could shed more light on whether or not the fabricated frames are not fairly representing news stories and thus reporting a relationship that might not exists in the real world. A second experiment could also be done sampling a less educated or a lower income population. Given the fact that 86% of participates of this study held higher education degrees, could have been a limiting factor in measuring the effects of the frames. It would be of more importance to explore these effects on a less educated population. I M PL I C A TI O N S O F T H I S S T UD Y The significant level of financial illiteracy in the United States is nothing to brush aside. If the majority of the population does not understand their own mortgages then how do we ever expect to avoid another recession (or depression)? This study set out to add a growing catalogue of information regarding economic news, framing, and the effects on audiences. If FRAMING THE NEWS: AN EXPERIMENT majority of individuals are receiving their financial information, according to my research 67% of participants, from a major news outlet, then we should be more concerned with how and what information they are receiving. We have sat by too long and watched media manipulate their stories for the sake of headlines. Previous research (and to some extent my research) has shown that these manipulations (frames) do have an effect on audiences. It is time to start holding media accountable and questioning their motives. Hopefully, this research and further research, will force some to reintroduce journalistic ethics. 36 FRAMING THE NEWS: AN EXPERIMENT 37 B IBLIOGRAPHY Volpe, Ronald P,PhD., C.F.P., & Mumaw, K. (2010). Mortgage meltdown reveals importance of financial literacy education. Journal of Personal Finance, 9, 61-77. Manning, P. (2013). Financial journalism, news sources and the banking crisis. Journalism, 14(2), 173-189. Harrington, D. E. (1989). Economics News on Television: The determinants of coverage. Public Opinion Quarterly, 53(1), 17-40. Goidel, R. K., Langley, R. E. (1995). Media coverage of the economy and aggregate economic evaluations: Uncovering evidence of indirect media. Political Research Quarterly, 48, 16. Goidel, R.K., Procopio S., Terrell D., Wu D. H. (2010). Sources of Economic News and Economic Expectations American Politics Research,38: 759-777. Blood, D. J., & Phillips, P. B. (1995). Recession headline news, consumer sentiment, the state of the economy and presidential popularity: A time-series analysis 1989-1993. International Journal of Public Opinion Research, 7(1), 2-22. Kleinnijenhuis, J., Schultz, F., Oegema, D., & van Atteveldt, W. (2013). Financial news and market panics in the age of high-frequency sentiment trading algorithms. Journalism, 14(2), 271-291. Institute of Applied Economics (1984). Network Television Coverage of Economic News. Mimeography, New York. Ghosh, C., Guttery, R. S., & Sirmans, C. F. (1997). The effects of the real estate crisis on institutional stock prices. Real Estate Economics, 25(4), 591-614. Williams, W. S. (1992). FOR SALE! Real Estate Advertising & Editorial Decisions About Real Estate News. Newspaper Research Journal, 13(1/2), 160-168. Hester, J. B., & Gibson, R. (2003). The economy and second-level agenda setting: A time-series analysis of economic news and public opinion about the economy. Journalism and Mass Communication Quarterly, 80(1), 73-90. Rush on northern rock continues . (2007, September 15). BBC News. Retrieved from http://news.bbc.co.uk/2/hi/business/6996136.stm Thompson, P. A. (2009). Market Manipulation? Applying the Propaganda Model to Financial Media Reporting. Westminster Papers in Communication & Culture, 6(2), 73-96. FRAMING THE NEWS: AN EXPERIMENT 38 Behr, R., & Iyengar, S. (1985). Television News, Real-World Cues, and Changes in the Public Agenda. Public Opinion Quarterly, 49(1), 38-57. Goffman, E. (1974). Frame analysis: An essay on the organization of experience. New York: Harper & Row. Wu, H., Stevenson, R. L., Hsiao-Chi, C., & Güner, Z. (2002). The conditional impact of recession news: A time-series analysis of economic communication in the United States 1987-1996. International Journal of Public Opinion Research, 14(1), 19-36. Kim, J., Kim, H., & Cameron, G. T. (2012). Finding Primary Publics: A Test of the Third-Person Perception in Corporate Crisis Situations. Journal of Public Relations Research, 24(5), 391-408. Youngkee, J. (2008). The asymmetry in economic news coverage and its impact on public perception in South Korea. International Journal of Public Opinion Research, 20(2), 237-249. Kahneman, D., &Tversky, A. (1984). Choice, values, and frames. American Psychologist, 39, 341350. Borah, P. (2011). Conceptual Issues in Framing Theory: A Systematic Examination of a Decade's Literature. Journal of Communication, 61(2), 246-263. Scheufele, D. A. (1999). Framing as a theory of media effects. Journal Of Communication, 49(1), 103. Tewksbury, D., & Scheufele, D. A. (2009). News framing theory and research. In J. Bryant & M. B. Oliver (Eds.), Media Effects Advances in Theory and Research, (pp. 17-33). New York: Routledge. Entman, R. M. (1993). Framing: Toward clarification of a fractured paradigm. Journal of Communication, 43(4), 51-58. de Vreese, C. H. (2005). News framing: Theory and typology. Information Design Journal & Document Design, 13(1), 51-62. Chong, D., & Druckman, J. N. (2007). A Theory of Framing and Opinion Formation in Competitive Elite Environments. Journal of Communication, 57(1), 99-118. Gamson, W. A. (1989). News as framing: Comments on Graber. American Behavioral Scientist, 33,157–166. Heath, D., & Heath, C. (2007). Made to stick. New York: Random House. FRAMING THE NEWS: AN EXPERIMENT 39 Seate, A., Harwood, J., & Blecha, E. (2010). 'He was Framed!' Framing Criminal Behavior in Sports News. Communication Research Reports, 27(4), 343-354. Kurtz, H. (1990). Is the economy suffering from media malady?. Washington Post, October 28, H1. FRAMING THE NEWS: AN EXPERIMENT 40 A PPENDICES S TI M UL I #1 Extremely Negative Dow suffers worst week since 2011 The Dow dropped nearly 320 points last Friday, or almost 2%. The S&P 500 and Nasdaq fell more than 2%. CNNMoney's Tech 30 index also fell about 2%, despite a jump in shares of Microsoft (MSFT, Fortune 500) following strong quarterly sales and earnings. The losses come at the end of the worst week for stocks in recent memory. The Dow tumbled more than 3.5%, its worst week since November 2011. The S&P 500 slid more than 2.6%, logging its biggest weekly decline since May 2012. Meanwhile, the Nasdaq tumbled almost 2.7%, its first weekly decline of the year and the worst since August. All three indexes are now in negative territory for the year. #2 Mildly Negative Ukraine Crisis Affects Oil Prices Oil prices jumped nearly $2 a barrel last Monday as Russia's military advance into Ukraine raised fears of economic sanctions against one of the world's major energy producers. By early afternoon in New York, benchmark U.S. crude for April delivery was up $1.80 to $104.39 a barrel. Brent crude, a benchmark for international varieties of crude, was up $1.97 to $111.04 on the ICE Futures exchange in London. Oil rose, while gold and stock markets sank in response to developments in Ukraine. Russian troops controlled all Ukrainian border posts on the strategic peninsula of Crimea. European and U.S. officials warned Russia against escalating the crisis. FRAMING THE NEWS: AN EXPERIMENT 41 #3 Mildly Positive Data Suggests Economy Is Gaining Strength U.S. factory activity rebounded last month from an eight-month low and consumer spending increased more than expected in January, suggesting the economy was regaining some strength after abruptly slowing in recent months. The signs of a comeback, also evident in a surprise gain in construction spending, should bolster the Federal Reserve's resolve to keep scaling back its massive monetary stimulus. Reports from automakers also showed sales edged up from January's weather-depressed levels. In a separate report, the Commerce Department said consumer spending increased 0.4 percent in January after a 0.1 percent gain in December. Economists had predicted that consumer spending, which accounts for more than two-thirds of the economic activity in the United States, would rise only 0.1 percent #4 Extremely Positive U.S. Sales of new homes jump 15.0 percent in February to fastest pace in more than 5 years U.S. sales of new homes rebounded in February to the fastest pace in more than five years, offering hopes that housing is regaining momentum after a slowdown last year caused by rising interest rates. The Commerce Department says sales of new homes increased 15.0 percent in February to a seasonally adjusted annual rate of $468,000. That was the fastest pace since July 2008. It came as a surprise to economists who had been forecasting a sales drop, in part because of a belief that activity would be held back by bad winter storms in many parts of the country. FRAMING THE NEWS: AN EXPERIMENT 42 #5 Neutral Story D.C. council votes to ease marijuana laws The District of Columbia Council voted to significantly ease marijuana laws in the nation’s capital on Tuesday. By a near unanimous vote, the council decided to lessen penalties for public and private consumption of marijuana and decriminalize the possession of small quantities of the drug. While the move puts Washington, D.C.’s laws on marijuana among the most lenient in the nation, the bill’s proponents did not get everything they wanted. Originally, advocates had lobbied for a bill that would have significantly loosened laws for public consumption of marijuana and lessened penalties even more. The approved legislation moves the possession of an ounce or less or marijuana from a criminal offense – which came with six months in jail or a $1,000 fine – to a civil offense that comes with a fine of $25. FRAMING THE NEWS: AN EXPERIMENT 43 Q UE S TI O N N AI RE How likely are you to increase your investments in the stock market this year? Very Unlikely - - - Very Likely How likely are you to go on a weeklong vacation this year? Very Unlikely - - - Very Likely How frequently do you plan to purchase non-essential goods this year (new clothes, accessories etc.) Never - - - Daily If you saw a news story from your favorite news outlet and it showed you a story that a particular company you own stock in was going bankrupt, how likely are you to sell off the stock? Very Unlikely - - - Very Likely How likely are you to apply for a loan this year? Very Unlikely - - - Very Likely The above story made me feel nervous about my financial security. Strongly Disagree - - - Strongly Agree FRAMING THE NEWS: AN EXPERIMENT 44 The above story made me feel worried about the future of the economy. Strongly Disagree - - - Strongly Agree Given the above story, how well do you believe the US economy is performing this year? Much Weaker - - - Much Stronger The US economy is slowly recovering. Strongly Disagree - - - Strongly Agree Unemployment is the lowest it has been in years. Strongly Disagree - - - Strongly Agree Overall how satisfied are you with the state of the US economy? Very dissatisfied - - -Very satisfied How many news outlets will you review prior to drawing conclusions about a breaking story? 1 - - - 5 or more When you see a headline in a major news publication that says “ECONOMIC DISASTER IMMINENT” you believe it. Strongly Disagree - - - Strongly Agree FRAMING THE NEWS: AN EXPERIMENT 45 When I am looking for news about how the stock market did today I will go to a news outlet for that information. Strongly Disagree - - - Strongly Agree I would rather watch or read my favorite news outlet for a story on the unemployment rate than go to the Bureau of Labor and Statistics website. Strongly Disagree - - - Strongly Agree I would rather watch or read my favorite news outlet for a story on the Treasury rates than go to the U.S. Department of Treasury website. Strongly Disagree - - - Strongly Agree My favorite news outlet provides unbiased, truthful, and accurate information about the state of the economy. Strongly Disagree - - - Strongly Agree I have a background in finance Yes No I understand what a spot price is Yes No FRAMING THE NEWS: AN EXPERIMENT 46 I have a background in economics. Yes No I know how to solve for the Income Elasticity of Demand Yes No Reports from the media on the economy do not affect me because all of my investments are secure. Strongly Disagree - - - Strongly Agree News outlets are a useful medium for those unfamiliar with the nuances of finance and economics. Strongly Disagree - - - Strongly Agree Please provide your age _____________ Please name the State you currently reside ______________ Please select your gender Male Female FRAMING THE NEWS: AN EXPERIMENT Please select your ethnicity White/Caucasian Black/African American Asian Latino Native American Other What was the last year you completed in school? No schooling High school Associate’s Bachelor’s Graduate or professional school Where do you fall on this political view spectrum? Extremely Conservative - - - Extremely Liberal What is your annual income? < 50,000 51,000-75,000 76,000 – 120, 000 121,000 – 200,000 200,000 < 47