Actors in buildings renovation: banks as change agents? Davide Maneschi

advertisement

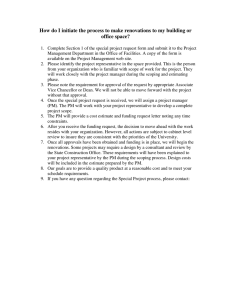

Actors in buildings renovation: banks as change agents? Davide Maneschi Dept. of Development and Planning, Aalborg University 2011-10-20 – ICP PhD Workshop, Valletta, Malta maneschi@plan.auu.dk Context • Climate change/emissions reduction • New buildings only 1% • Energy renovations necessary to achieve climate change goals • In DK up to 800 bn DKK • About 1 house/apt every 10 mins • Collective effort Energy efficient renovations • Uptake depends on (amongst others): – Technical and legal feasibility – Cost-efficiency • Includes energy prices, renovations prices, costs of money – Availability of capital – Knowledge/Awareness/Interest • Recent research stressed role of social and professional networks Hypothesis • Banks can enable, inform and persuade clients about energy efficient renovations and contribute to overcoming barriers to renovations Banks • Intermediary function: 1. Collect and provide capital 2. Advise and provide market knowledge Investigation 1. Analysis of product offering of Swedish and Danish banks 2. Retrofitting case study to analyze role of banks Preliminary findings • Local banks more likely to offer specific loans for renovations: – Three local DK banks – One commercial bank in Sweden • In the case study bank appeared to have scarce understanding of renovations practices and investments Preliminary findings (2) • Some products include advise on how to perform renovations – i.e. not only loaning money, also persuasion and information Preliminary findings (3) • Limited offering can be explained by: – Banks limited knowledge of the industry: • how to be sure loan is spent for energy renovations? • what is energy efficient renovation investment and what is not? • how to evaluate projects? Preliminary findings (4) • Core skills and vision: – Lack of skills within banks - as opposed to e.g. skills in real estate markets; – (Big) banks do not see themselves as actors in the issue of buildings renovation – CSR more focus on direct impacts as opposed to impacts of investments • Demand/markets (?) Discussion • Banks’ perception own role • What’s in it for the banks? – Loans for renovations can be new, although small in size, business areas for banks Discussion (2) • Lack of networks and skills main obstacles keeping banks from being change agents: • Government/local authorities can work to bring actors together