DANIEL ROBERT MULLINS Addresses/Phones/Current Appointments Home: 5234 Windmill La

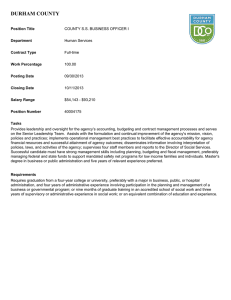

advertisement