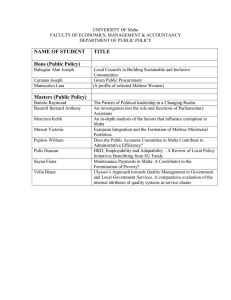

UNIVERSITY OF MALTA FACULTY OF ECONOMICS, MANAGEMENT AND ACCOUTANCY LIST OF DISSERTATION

advertisement

UNIVERSITY OF MALTA FACULTY OF ECONOMICS, MANAGEMENT AND ACCOUTANCY LIST OF DISSERTATION B.A. (HONS.) ACCOUNTANCY DISSERTATION NO. 283 COURSE GROUP: 1992-1994 NAME OF STUDENT DISSERTATION TITLE ABELA Floridia Jonathan Tax Legislation Regulating Investment Income Arising In Malta 284 ABELA Robert Accounting Regulation for Intangible Assets – A Comparative Study 285 AGIUS Robert Accountability and the Accounting System in the Maltese Central Government – Case for Improvement 286 ALDEN Marc Henry Aspects of International Tax Planning with Reference to Malta as an International Offshore Financial Centre 287 ATTARD Anthony University Sports Hall – A Feasibility Study 288 AZZOPARDI Mario Joseph The Introduction of Tax on Capital Gains in Malta – An Analysis and Comparative Study 289 BONAVIA Orland Green Accounting: Its Implications for Malta Companies 290 BUSUTTIL Elaine The Value Added Statement as a Measure of Performance: A Comparison of Seven Local Firms 291 CALAFATO Jeffrey The Failure of the BICAL: Financial and Legal Considerations 292 CARUANA Stephanie Tax Evasion in Malta and the Self-Employed 293 CATANIA Kevin Inland Revenue Investigations 294 CIAPPARA Marisa Introducing Value Added Tax Transitional Problems and their relevance to Malta 295 CLARK Frederick Financial Feasibility of Organising in Malta a renowned Branded Clothing Exhibition 296 CRAIG Alan The Introduction of a Monitoring Body to the Auditing Profession in Malta DISSERTATION NO. 297 NAME OF STUDENT DISSERTATION TITLE FALZON Alessia The Financial Control Function and Internal Control Changes in Selected Maltese Companies: A Comparative Study 298 FARRUGIA Romina The Setting up of an Old People’s Home – Financial Implications 299 FERRY David The Implications of Section 19 of the Taxes Management Act 1994 300 GALDES James The Selection of Statutory Auditors: A Comparison of Foreign and Local Practices 301 GALEA Jozef Wallace The Treatment of Dividends for Income Tax Purposes Under Maltese Legislation with Particular Reference to Recent Legislation 302 GIGLIO Paul The Possible Effects on the Local Offshore Industry resulting from Malta’s Eventual European Union Membership 303 GRECH Roderick Kurt The Financial Implications of Subcontracting Services in Malta 304 MALLIA Kevin Self Employment Scheme (1989) – An Evaluation 305 MANGION Deborah The Offshore Trusts Act, 1988: Its Origin, Development and Future Role 306 MONTEBELLO Therese Listing of Companies on the Local Stock Exchange – The Pros and The Cons 307 SPITERI Brian Treatment of Livestock in Farm Accounting – Accounting Issues and Local Applications 308 SPITERI Patrick Bank Capital Adequacy – A Study on Local Commercial Banks 309 STEVENS Yvette The Feasibility of Setting up A Four Star Hotel in Malta 310 TABONE Miriam Setting Up a Carnival Village in Malta – A Feasibility Study 311 VELLA Valerie The Going Concern Qualification in the Auditor’s Report: A Comparison of the Perceptions of Maltese Auditors and Bankers DISSERTATION NO. 312 NAME OF STUDENT DISSERTATION TITLE VELLA Marco The Fish Farming Industry in Malta – A Viability Study 313 ZAHRA Melanie The Changes in Accounting for Insurance Undertakings brought about by Directive 91/674 EEC and their Relevance to Malta 314 ZAMMIT Glorian The Changing Role of Accounting firms with Particular Reference to Malta