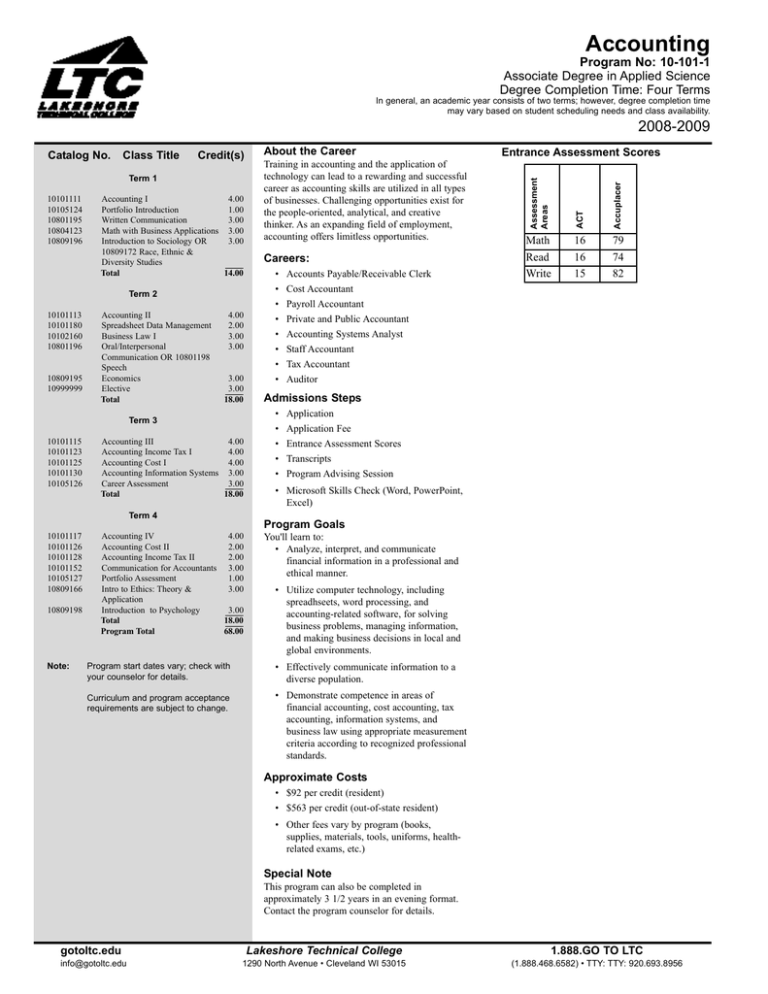

Accounting Program No: 10-101-1 Associate Degree in Applied Science

advertisement

Accounting Program No: 10-101-1 Associate Degree in Applied Science Degree Completion Time: Four Terms In general, an academic year consists of two terms; however, degree completion time may vary based on student scheduling needs and class availability. 2008-2009 Term 1 10101111 10105124 10801195 10804123 10809196 Accounting I 4.00 Portfolio Introduction 1.00 Written Communication 3.00 Math with Business Applications 3.00 Introduction to Sociology OR 3.00 10809172 Race, Ethnic & Diversity Studies Total 14.00 Term 2 10101113 10101180 10102160 10801196 10809195 10999999 Accounting II Spreadsheet Data Management Business Law I Oral/Interpersonal Communication OR 10801198 Speech Economics Elective Total 4.00 2.00 3.00 3.00 3.00 3.00 18.00 Term 3 10101115 10101123 10101125 10101130 10105126 Accounting III 4.00 Accounting Income Tax I 4.00 Accounting Cost I 4.00 Accounting Information Systems 3.00 Career Assessment 3.00 Total 18.00 Term 4 10101117 10101126 10101128 10101152 10105127 10809166 10809198 Note: About the Career Training in accounting and the application of technology can lead to a rewarding and successful career as accounting skills are utilized in all types of businesses. Challenging opportunities exist for the people-oriented, analytical, and creative thinker. As an expanding field of employment, accounting offers limitless opportunities. Careers: • • • • • • • • Accounts Payable/Receivable Clerk Cost Accountant Payroll Accountant Private and Public Accountant Accounting Systems Analyst Staff Accountant Tax Accountant Auditor Entrance Assessment Scores Accuplacer Credit(s) ACT Class Title Assessment Areas Catalog No. Math Read Write 16 16 15 79 74 82 Admissions Steps • • • • • Application Application Fee Entrance Assessment Scores Transcripts Program Advising Session • Microsoft Skills Check (Word, PowerPoint, Excel) Program Goals Accounting IV 4.00 Accounting Cost II 2.00 Accounting Income Tax II 2.00 Communication for Accountants 3.00 Portfolio Assessment 1.00 Intro to Ethics: Theory & 3.00 Application Introduction to Psychology 3.00 Total 18.00 Program Total 68.00 You'll learn to: • Analyze, interpret, and communicate financial information in a professional and ethical manner. • Utilize computer technology, including spreadhseets, word processing, and accounting-related software, for solving business problems, managing information, and making business decisions in local and global environments. Program start dates vary; check with your counselor for details. • Effectively communicate information to a diverse population. Curriculum and program acceptance requirements are subject to change. • Demonstrate competence in areas of financial accounting, cost accounting, tax accounting, information systems, and business law using appropriate measurement criteria according to recognized professional standards. Approximate Costs • $92 per credit (resident) • $563 per credit (out-of-state resident) • Other fees vary by program (books, supplies, materials, tools, uniforms, healthrelated exams, etc.) Special Note This program can also be completed in approximately 3 1/2 years in an evening format. Contact the program counselor for details. gotoltc.edu Lakeshore Technical College 1.888.GO TO LTC info@gotoltc.edu 1290 North Avenue • Cleveland WI 53015 (1.888.468.6582) • TTY: TTY: 920.693.8956 Transfer agreements are available with the following institutions: Capella University Cardinal Stritch University Franklin University Lakeland College Marian College MSOE Rader School of Business Silver Lake College UW-Platteville UW-Stout IMPORTANT: For more information on these agreements, visit gotoltc.edu/transfer. 10101111 Accounting I 10101152 Communication for Accountants 10804123 Math w Business Apps ...provides the learner with the skills to understand accounting principles and procedures useful in any business, including the accounting cycle for a service enterprise and a merchandising enterprise, special journals, and ledgers, accruals and deferrals, depreciation, inventories, the voucher system, payroll, and accounting principles and concepts. ...prepares the learner to meet the specific, rigorous communication demands of accounting professionals for business writing, business presentations, and interpersonal skills, including the ability to develop the ability to organize and present ideas clearly; develop arguments; apply communication strategies; utilize various mediums for visual aids; and listen, speak, and write effectively to be a more competent business communicator. ...covers real numbers, basic operations, linear equations, proportions with one variable, percents, simple interest, compound interest, annuity, apply math concepts to the purchasing/buying process, apply math concepts to the selling process, and basic statistics with business/consumer applications. 10101113 Accounting II ...provides the learner with the skills to transition to more advanced accounting courses with emphasis given to notes and interest; partnerships; corporations; and manufacturing accounting with additional accounting reports for management, creditors, and investors. PREREQUISITE: 10101111 Accounting I PREREQUISITES: 10101115 Acctg III; 10101125 Acctg Cost I; 10801195 Writ Comm or 10801195TV Writ Comm ITV; 10801196 Oral/Inter Comm or 10801196OL Oral/Inter Comm or 10801198 Speech and CONDITION: 101011 Acctg Admission Req Met 10101180 Spreadsheet Data Management 10101115 Accounting III ...introduces the learner to intermediate accounting concepts, principles, and applications, including financial statements, temporary investments, receivables, equities, current liabilities, fixed assets, and bonds. PREREQUISITE: 10101113 Accounting II and Microsoft Word and PowerPoint skills or equivalent 10101117 Accounting IV ...expands the learner's ability to understand intermediate accounting concepts, principles, and applications, including intangible assets, long-term investments, corporate taxes, leases, pensions, and stockholders' equity. PREREQUISITE: 10101115 Accounting III 10101123 Accounting Income Tax I ...introduces the learner to the federal income tax laws and their underlying principles, including such topics as gross income (inclusions and exclusions), deductions and exemptions, tax forms and schedule, and the computation of taxes. 10101125 Accounting Cost I ...provides the learner with the skills to understand cost accounting for manufacturing enterprises, including budgets, concepts, cost reports, job-order costing, process costing, joint products, and byproducts. ...provides the learner with the skills to operate an IBM personal computer using Excel spreadsheet software and solve accounting and business problems using spreadsheet-advanced functions on microcomputers. PREREQUISITES: 10101111 Accounting I and Microsoft Excel skills or equivalent 10102160 Business Law I ...provides the learner with the skills to summarize the American legal system; diagram the state/federal court systems; evaluate dispute resolution methods; sequence the civil litigation process; summarize the administrative agencies; differentiate civil and criminal law; apply theories of negligence, intentional tort, and product liability; summarize elements of a contract; assess the validity of a contract; assess third-party rights and available remedies; and analyze warranties. 10105124 Portfolio Introduction ...prepares the student to develop a personal and professional portfolio, to identify self-awareness through various self-assessments and apply these results to the workplace and other environments, to write goal statements and understand their value, to develop an individual history of events and achievements, and to identify significant learning experiences throughout the student's life. 10105126 Career Assessment PREREQUISITE: 10101111 Accounting I 10101126 Accounting Cost II ...expands the learner's ability to understand accounting for manufacturing enterprises, including factory overhead, material costs, labor costs, standard costing, direct costing, marketing costs, break-even analysis, differential costs, and capital expenditures. ...prepares the student to develop a career plan, write a resume, create a cover letter, prepare for an interview, search for work on the Internet, adapt a resume for an electronic scan, and post a resume and cover letter on the Internet. PREREQUISITE: Accuplacer Math minimum score of 79 or Equivalent or 10804100 Math Proficiency 10809166 Introduction to Ethics: Theory and Application ...provides a basic understanding of the theoretical foundations of ethical thought. Diverse ethical perspectives will be used to analyze and compare relevant issues. Students will critically evaluate individual, social and/or professional standards of behavior, and apply a systematic decision-making process to these situations. 10809195 Economics ...provides the participant with an overview of how a market-oriented economic system operates, and it surveys the factors which influence national economic policy. Basic concepts and analyses are illustrated by reference to a variety of contemporary problems and public policy issues. Concepts include scarcity, resources, alternative economic systems. growth, supply and demand, monetary and fiscal policy, inflation, unemployment and global economic issues. 10809196 Sociology - Intro ...introduces students to the basic concepts of sociology: culture, socialization, social stratification, multiculturalism, and the five institutions, including family, government, economics, religion, and education. Other topics include demography, deviance, technology, environment, social issues, social change, social organization, and workplace issues. 10809198 Intro to Psychology ...introduces students to a survey of the multiple aspects of human behavior. It involves a survey of the theoretical foundations of human functioning in such areas as learning, motivation, emotions, personality, deviance and pathology, physiological factors, and social influences. It directs the student to an insightful understanding of the complexities of human relationships in personal, social, and vocational settings. COREQUISITE: 10105124 Portfolio Introduction 10105127 Portfolio Assessment PREREQUISITE: 10101125 Accounting Cost I ...prepares the student to identify what they have learned throughout the program, write career goals, re-examine their resume, research and collect project samples of their achievements, and analyze their achievements within the college core abilities and program outcomes. 10101128 Accounting Income Tax II ...expands the learner's ability to comprehend the principles of income tax law and calculate federal income tax for businesses using tax forms and for businesses using tax forms and practical problems. PREREQUISITES: 10101111 Accounting I and 1010 1123 Accounting Income Tax I PREREQUISITES: 10105124 Portfolio Assessment and 10105126 Career Assessment 10801195 Written Communication 10101130 Accounting Information Systems ...introduces the learner to current accounting information systems theory, procedures, and methods designed to communicate financial data and report financial information; system analysis and design related to manual and computerized systems; internal control; flow charting; form design; and procedure writing. PREREQUISITE: 10101113 Accounting II ...teaches the writing process, which includes prewriting, drafting, revising, and editing. Through a variety of writing assignments, the student will analyze audience and purpose, research and organize ideas, and format and design documents based on subject matter and content. Keyboarding skills are required for this course. It also develops critical reading and thinking skills through the analysis of a variety of written documents. 10801196 Oral/Interpersonal Comm ...provides students with the skills to develop speaking, verbal and nonverbal communication, and listening skills through individual speeches, group activities, and other projects. LTC is an equal opportunity/access employer and educator. Revised 12-1-07