An Empirical Cross-Section Analysis of Stock Returns

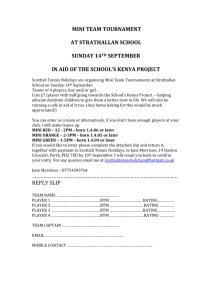

advertisement