Portfolio Media. Inc. | 860 Broadway, 6th Floor | New...

advertisement

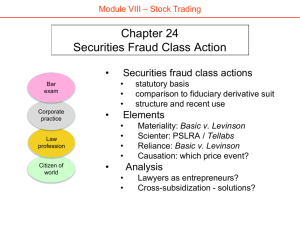

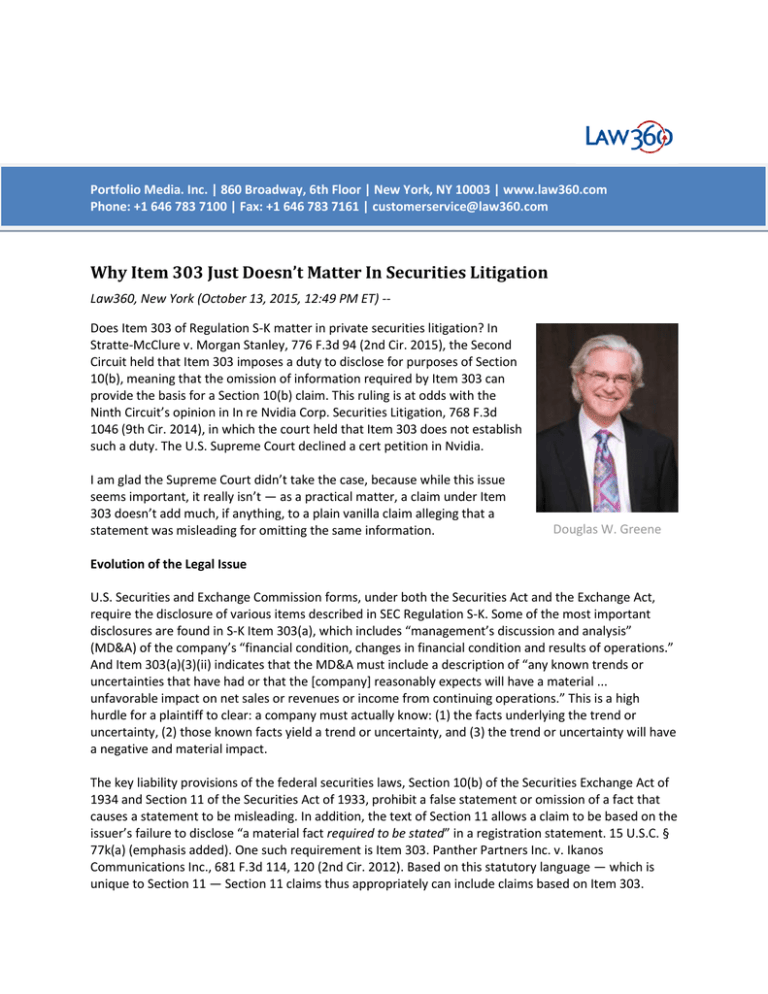

Portfolio Media. Inc. | 860 Broadway, 6th Floor | New York, NY 10003 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | customerservice@law360.com Why Item 303 Just Doesn’t Matter In Securities Litigation Law360, New York (October 13, 2015, 12:49 PM ET) -Does Item 303 of Regulation S-K matter in private securities litigation? In Stratte-McClure v. Morgan Stanley, 776 F.3d 94 (2nd Cir. 2015), the Second Circuit held that Item 303 imposes a duty to disclose for purposes of Section 10(b), meaning that the omission of information required by Item 303 can provide the basis for a Section 10(b) claim. This ruling is at odds with the Ninth Circuit’s opinion in In re Nvidia Corp. Securities Litigation, 768 F.3d 1046 (9th Cir. 2014), in which the court held that Item 303 does not establish such a duty. The U.S. Supreme Court declined a cert petition in Nvidia. I am glad the Supreme Court didn’t take the case, because while this issue seems important, it really isn’t — as a practical matter, a claim under Item 303 doesn’t add much, if anything, to a plain vanilla claim alleging that a statement was misleading for omitting the same information. Douglas W. Greene Evolution of the Legal Issue U.S. Securities and Exchange Commission forms, under both the Securities Act and the Exchange Act, require the disclosure of various items described in SEC Regulation S-K. Some of the most important disclosures are found in S-K Item 303(a), which includes “management’s discussion and analysis” (MD&A) of the company’s “financial condition, changes in financial condition and results of operations.” And Item 303(a)(3)(ii) indicates that the MD&A must include a description of “any known trends or uncertainties that have had or that the [company] reasonably expects will have a material ... unfavorable impact on net sales or revenues or income from continuing operations.” This is a high hurdle for a plaintiff to clear: a company must actually know: (1) the facts underlying the trend or uncertainty, (2) those known facts yield a trend or uncertainty, and (3) the trend or uncertainty will have a negative and material impact. The key liability provisions of the federal securities laws, Section 10(b) of the Securities Exchange Act of 1934 and Section 11 of the Securities Act of 1933, prohibit a false statement or omission of a fact that causes a statement to be misleading. In addition, the text of Section 11 allows a claim to be based on the issuer’s failure to disclose “a material fact required to be stated” in a registration statement. 15 U.S.C. § 77k(a) (emphasis added). One such requirement is Item 303. Panther Partners Inc. v. Ikanos Communications Inc., 681 F.3d 114, 120 (2nd Cir. 2012). Based on this statutory language — which is unique to Section 11 — Section 11 claims thus appropriately can include claims based on Item 303. Panther Partners is the decision that has fueled plaintiffs counsel’s use of Item 303. In Panther Partners, the Second Circuit held that Item 303 required the issuer, Ikanos Communications, to disclose information about a high product defect rate, and that the omission of this information from a registration statement gave rise to a cause of action under Section 11. There are two important facets of the decision that have largely been forgotten. First, the court emphasized Section 11’s language, which isn’t present in the statute or decisions under Section 10(b), that an issuer must disclose “a material fact required to be stated” in a registration statement. Second, the court was troubled by the fact that the company’s risk factor about product defects suggested there were no defects when, in fact, there were: In light of these allegations, the Registration Statement’s generic cautionary language that “[h]ighly complex products such as those that [Ikanos] offer[s] frequently contain defects and bugs” was incomplete and, consequently, did not fulfill Ikanos’s duty to inform the investing public of the particular, factually-based uncertainties of which it was aware in the weeks leading up to the Secondary Offering. Id.at 122. I could make a strong argument that the driver of the court’s decision was a false or misleading risk factor, and Item 303 was just the way the court articulated its conclusion. As I’ve written, courts are often troubled by boilerplate risk factors, especially those that cast as hypothetical risks that have materialized. In Nvidia, plaintiffs alleged that several of Nvidia’s SEC filings contained materially false and misleading statements because they omitted information relating to a defect in Nvidia’s graphics processing unit (GPU) chips. Plaintiffs also argued that certain omissions in filing statements were actionable under Section 10(b) because the chip defects constituted a “known trend” under Item 303 — but did not present this theory in the complaint itself. The district court found that plaintiffs had pled “at least one” material misrepresentation — a risk factor saying that defects “might occur,” which falsely suggested that Nvidia was not already aware of the same defect in other products. The district court did not inquire into whether any of the other specific statements were also materially misleading. Nonetheless, the district court dismissed the complaint on the ground that plaintiffs had failed to plead scienter. The district court opinion only mentioned Item 303 briefly, as it was not (yet) a centerpiece of the plaintiffs’ theory. Before the Ninth Circuit, the plaintiffs argued that the district court should have considered scienter in the context of Item 303, focusing on whether the defendants had acted with scienter in violating that rule. The Ninth Circuit rejected this line of argument on the ground that Item 303 does not establish an independent duty of disclosure for the purposes of Section 10(b). The Ninth Circuit did not consider whether plaintiffs had successfully pled a material misrepresentation (as the district court had found), focusing instead on scienter, and affirming the district court’s judgment on this ground. Shortly thereafter, the Second Circuit, in Stratte-McClure, held that Item 303 does establish an independent duty of disclosure for purposes of Section 10(b). The court began with the cardinal rule that silence, absent a duty to disclose, is not actionable, and such a duty is created when a company omits facts that make a statement misleading. 768 F.3d at 101-02. The court then grappled with whether omission of facts required to be disclosed under Item 303 creates a duty of disclosure for purposes of Section 10(b). In analyzing this issue, the court relied on the Panther Partners holding, though the court compared Section 10(b)’s requirements to Section 12(a)(2) of the 1933 Act, which does not contain Section 11’s unique statutory language, i.e., Section 11 makes actionable not just a false or misleading statement, but also a failure to disclose “a material fact required to be stated” in a registration statement. The court’s comparison of Section 10(b) to Section 12(a)(2) instead of to Section 11 resulted in a large legal leap. The court in Panther Partners stated that “[o]ne of the potential bases for liability under §§ 11 and 12(a)(2) is an omission in contravention of an affirmative legal disclosure obligation” (i.e. making actionable the omission of “a material fact required to be stated” in a registration statement). 681 F.3d at 120. But, in fact, only Section 11, and not Section 12(a)(2), contains that provision. Instead, Section 12(a)(2), like Section 10(b), imposes liability for a false or misleading statement, and doesn’t contain the alternative basis of liability for a failure to disclose “a material fact required to be stated ....” As a result, Stratte-McClure doesn’t fairly portray the rationale for the holding in Panther Partners. Nevertheless, the court in Stratte-McClure supplied a separate basis, grounded in Section 10(b)’s requirement of a false or misleading statement, for concluding that Item 303 supplies a duty to disclose that can be actionable under Section 10(b): Due to the obligatory nature of [Item 303], a reasonable investor would interpret the absence of an Item 303 disclosure to imply the nonexistence of “known trends or uncertainties ... that the registrant reasonably expects will have a material … unfavorable impact on … revenues or income from continuing operations.” … It follows that Item 303 imposes the type of duty to speak that can, in appropriate cases, give rise to liability under Section 10(b). 776 F.3d at 102 (citations omitted). In other words, a company that fails to disclose information required to be disclosed by Item 303 has misled investors by creating an impression of a state of affairs (that there are no materially negative trends or uncertainties) that differs from the one that actually exists (that there are such trends or uncertainties). Thus, what the court implicitly held is that an Item 303 omission makes the whole set of the company’s affirmative statements misleading. Item 303’s Lack of Practical Impact The Item 303 issue is certainly interesting. My colleagues and I have had lively discussions about the questions it raises. But we keep concluding that it doesn’t really add anything. We first reached this conclusion in a roundabout way in a case a few years ago. There were two offerings at issue, and just after Panther Partners, plaintiffs counsel featured the Item 303 allegations. We drafted a detailed motion to dismiss section on the Item 303 issue. As we evaluated our arguments in light of the page limit, we kept shortening the Item 303 argument. In the end, we decided that the Item 303 claim was redundant: the court wasn’t going to deny the motion to dismiss under Item 303 without also finding that the plaintiffs had sufficiently pleaded a false statement and scienter, because the plaintiffs challenged many statements and pleaded scienter using the same allegations that formed the basis of the Item 303 claim. So in the filed version of the motion, the argument became a fraction of the size of the original one. And in the reply brief, the Item 303 argument was in a short footnote. Since then, the plaintiffs bar’s focus on the issue, and various court decisions, and even a cert petition, have kept me rethinking the importance of Item 303 to securities claims. But I haven’t changed my view that Item 303 is redundant: very rarely, if ever, would there be an omitted fact that gives rise to an Item 303 claim without also rendering false or misleading one or more challenged statements; and the knowledge required under Item 303 is at least as great as is necessary to establish scienter. Even under Section 11, where the unique statutory language allows for a claim, Item 303’s multiple knowledge requirements, if appropriately applied, make the claim difficult to plead and prove. The Nvidia case provides a good illustration. Recall that the plaintiffs alleged that Nvidia made false statements related to a defect in its GPU chips, and argued that the chip defects constituted a known trend under Item 303. The complaint challenged many statements, and the district court concluded that “at least one” was misleading as a result of the defects: “Our core businesses are continuing to grow as the GPU becomes increasingly central to today’s computing experience in both the consumer and professional market segments.” “Fiscal 2008 was another outstanding and record year for us. Strong demand for GPUs in all market segments drove our growth. Relative to Q4 one year ago, our discrete GPU business grew 80%.” “As we have in the past, we intend to use this [R&D] strategy to achieve new levels of graphics, networking and communications features and performance and ultra-low power designs, enabling our customers to achieve superior performance in their products.” “[W]e believe that close relationships with OEMs, ODMs and major system builders will allow us to better anticipate and address customer needs with future generations of our products.” “The growth of GPUs continues to outpace the PC market. We shipped 42 percent more GPUs this quarter compared to the same period a year ago, resulting in our best first quarter ever. … We expect this positive feedback loop to continue to drive our growth.” “In the past, we have discovered defects and incompatibilities with customers’ hardware in some of our products. Similar issues in the future may result in delays or loss of revenue to correct any defects or incompatibilities.” “If our products contain significant defects our financial results could be negatively impacted, our reputation could be damaged and we could lose market share.” In a statement disclosing the defects: “We are evaluating the potential scope of this situation, including the nature and cause of the alleged defect and the merits of the customer’s claim, and to what extent the alleged defect might occur with other of our products.” This list of challenged statements illustrates that companies affirmatively say many things on the subject matter of an omission sufficient to yield an Item 303 claim. Indeed, it’s hard to imagine a case in which an issue is so major as to require Item 303 disclosure but isn’t something about which the company has spoken. And given that is the case, and Item 303’s disclosure requirements are infused with knowledge requirements, it also would be an anomalous case in which there is an Item 303 violation but not scienter. For example, if a company violates Item 303 by not disclosing that its biggest customer is switching suppliers next quarter, and proceeds to say things about its business and financial outlook as it of course would, it has made misleading statements with intent to defraud. The Item 303 claim adds nothing. Stratte-McClure, on its face, is an anomalous case. After concluding that Morgan Stanley had a duty to disclose certain facts about subprime lending that were likely to cause material trading losses, the court concluded that the failure to disclose those facts wasn’t done with scienter. The analysis is fact-specific and technical. Suffice it to say that I could easily rewrite the opinion, using the court’s own scienter analysis, to conclude that no disclosure was required under Item 303 in the first place — it’s really a matter of six of one, half a dozen of another. Why, then, have plaintiffs counsel pushed Item 303 claims so hard? I believe it’s mostly to combat the cardinal rule that silence, absent a duty to disclose, is not misleading. Companies omit thousands of facts every time they speak, and it’s relatively easy for a plaintiff to identify omitted facts — but it’s analytically difficult work, and often unsuccessful, to challenge affirmative statements. Another important reason is defendants’ attack on the fraud-on-the-market presumption of reliance over the past several years — first to the legitimacy of Basic v. Levinson, which gave rise to securities class actions, and now to its viability in specific cases under the price-impact rule of Halliburton II. Claims of pure omission under Item 303 arguably would fall under the Affiliated Ute presumption of reliance, rather than under Basic, which would make class certification easier and more certain. But the court’s reasoning in Stratte-McClure that an Item 303 violation makes what the company said misleading would make the claim a statement-based claim that would be evaluated under Basic, not Affiliated Ute. Whatever the reason, I hope parties and courts don’t waste time litigating over Item 303 further. It just doesn’t matter. —By Douglas W. Greene, Lane Powell PC Doug Greene is a shareholder in Lane Powell’s Seattle office. He is also chairman of the firm’s director and officer liability and securities litigation practice groups. This article first appeared on Lane Powell's blog, D&O Discourse. The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice. All Content © 2003-2015, Portfolio Media, Inc.