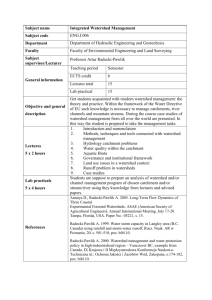

Providing Long-Term Funding for Watershed Management Coquille Watershed Association

advertisement