2009-2011 RESEARCH WITH INDUSTRY STRATEGY

advertisement

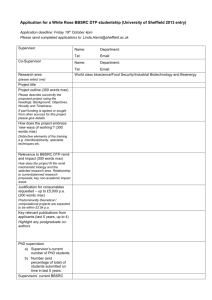

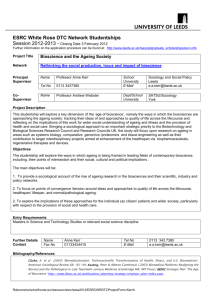

2009-2011 RESEARCH WITH INDUSTRY STRATEGY Introduction BBSRC supports a broad research base in microbial, plant and animal sciences, ranging from studies at the molecular to whole organism and population level. The remit also embraces engineering and technological approaches necessary to develop new procedures to investigate and analyse biological systems, as well as the application of those approaches to derive commercial benefit from biological understanding. The Age of Bioscience, BBSRC Strategic Plan for 2010-2015 identifies three strategic priorities: Food Security, Bioenergy and Industrial Biotechnology, and Basic Bioscience Underpinning Health. Alongside these priorities, it also outlines three enabling themes critical for our vision for UK bioscience: Knowledge Exchange, Innovation and Skills, Exploiting New Ways of Working and Partnerships. The focus of this Research with Industry Strategy is to identify and describe research areas within BBSRC’s Strategic priorities and enabling themes, where investments can make a significant impact in underpinning the research needs of industry in the coming decade. BBSRC wishes to encourage academic researchers and companies to engage in collaborative research programmes in these priority areas. BBSRC research underpins the needs of a wide range of industrial sectors. However, five primary industrial sectors are substantial beneficiaries of BBSRCfunded research, although overlap and sub-sectors exist. BBSRC User Industry Sectors Agriculture The UK agricultural industry includes diverse sub-sectors such as farming, agrochemical, plant and animal breeding, and animal health. Overall agriculture has been declining in importance in GDP terms over the last 50 years when farm-gate sales totalled some £14 billion. In 2007, agriculture contributed £5.8 billion to the UK economy and provided 1.7% of the UK’s workforce1. Food and Drink The food and drink industry is the largest manufacturing sector in the UK, with a turnover of £72.7 billion in 2 2007 . The UK was the 7th largest food and drink manufacturing industry in the world in 2007 and the world's 9th largest exporter of food and drink in 20073, with total food and drink exports worth £11.5 billion4. 5 UK food and drink exports grew to £13.6 billion in 2008 , a third consecutive year of record performance. Research capacity is limited in this sector due to intense competition where, apart from a small number of large companies, the sector is dominated by small companies operating on low margins. Biotechnology The UK biotechnology industry is widely recognised as one of the most advanced in the world. However, growth in the sector has declined as the economic downturn has negatively impacted investment in UK biotechnology companies. Medical biotechnology activity in other parts of the European Union has increased over the past few years and, while the UK is still in the lead, the UK’s share of the total number of biotherapies in clinical development in the EU has dropped from 46% in 2002 to 24% in 2007 and the proportion of small companies (with a market capitalisation of less than £25m) within the UK biotech sector has increased as a number of the larger companies have been acquired by pharmaceutical companies6. Pharmaceuticals The UK pharmaceutical industry is one of the UK’s most successful industries, accounting for £17.2 billion of 1 https://statistics.defra.gov.uk/esg/publications/auk/2007/default.asp Office of National Statistics, Annual Business Inquiry 3 CIAA, 2008 Data & Trends Report 4 Food from Britain, 2008 Export Brief 5 Leatherhead Food International, May 2009 6 http://www.bioindustry.org/biodocuments/BIGTR2/BIGT_Review_and_Refresh.pdf 2 1 exports in 2008 and generating a trade surplus in pharmaceuticals of £6.0 billion. In 2007, the pharmaceutical industry invested £4.5 billion in R&D in the UK, representing over a quarter of all UK Business R&D spend7. In 2007, the UK received 25% of all pharmaceutical industry R&D spending in Europe and 20% of the world’s 8 top-selling medicines in 2006 were discovered and developed in Britain . Chemicals The UK is the world’s seventh largest chemicals producer; UK sales alone in this industry exceed £60 billion, with exports worth £43 billion. This is one of our most high-value manufacturing sectors, employing around 200,000 people with a trade surplus of around £6.5 billion. Global Industrial Biotechnology sales are currently estimated at £35-53 billion, which represents 3-4% of the global chemical industry sales (£1.25 trillion in 2008). This market is estimated to grow to £150–360 billion by 2025 in the chemical sector alone. 9 The Research with Industry Strategy has been coordinated with other strategies and initiatives within BBSRC, including: • Technology Strategy: Technologies needed by research knowledge providers • Sustainable Bioenergy Centre Initiative • Responsive Mode Priorities The Research with Industry Strategy is embedded in BBSRC’s overarching strategy and its particular alignment with the BBSRC Strategic Plan is depicted in Figure 1. Figure 1. Alignment with BBSRC Strategic Plan Alignment of Research with Industry Strategy Priorities (shown in green) with the BBSRC Strategic Plan Priorities and Enabling Themes. 7 http://www.statistics.gov.uk/pdfdir/berd0109.pdf http://www.abpi.org.uk/publications/pdfs/AnnualReview07.pdf 9 http://www.berr.gov.uk/whatwedo/sectors/chemicals/IBIGT/page44395.html 8 2 The Research with Industry Strategy was developed in consultation with industry and other stakeholders and is overseen by the BBSRC Bioscience for Industry Strategy Panel. The Panel will initiate a review of the Strategy biennially to ensure the state of the science and the research and skills needs of industry are updated. Recognising multidisciplinary research is needed to ensure the applicability of research to industry, many of the priority areas include challenges that require overlap with research funders outside of BBSRC’s remit. Following the publication of the Research with Industry Strategy, work plans will be developed for each priority area in collaboration with other research funders (eg - other Research Councils, the Wellcome Trust) and partners (eg – Regional Development Agencies) to ensure joined-up and effective implementation. Comments on the Strategy or the forthcoming work plans can be submitted to business.unit@bbsrc.ac.uk. A prime concern of the BBSRC industrial user community, particularly the pharmaceuticals and biotechnology sectors, is that BBSRC continues to sustain a high quality bioscience research base in universities and institutes, providing opportunities for collaborations and contracts, licensing and consultancies, as well as a source of highly trained people. While there are many potential areas where increased research activity could underpin the needs of the BBSRC user industries. Priorities in the Research with Industry Strategy have been identified based on an analysis against the following criteria. • Industry Need The priority area must be identified by industry as an opportunity for UKbased companies to derive benefit from BBSRC research investments in the area. • Ability of the Science Base to Deliver The UK science base must have the skills and capacity to deliver research that can address the needs of industry and maintain the standards of quality required for BBSRC funding. The priorities that meet these criteria are identified in the Research with Industry Strategy. For the period of 2009 – 2011, these priorities will guide the focus of industrially-relevant programmes and initiatives in BBSRC to ensure high quality science provides the highest potential impact. 3 Overview Basic Bioscience Underpinning Health Driving advances in fundamental bioscience for better health and improved quality of life across the lifecourse, reducing the need for medical and social intervention. Identifying opportunities to improve the health span of an ageing population by understanding the biological processes involved with ageing, along with the contributions of diet and nutrition, are some of the key challenges facing the biotechnology and pharmaceuticals sectors. In addition, these sectors will continue to be under pressure to produce low-cost and accessible medicines for a global market. The priorities for Biopharmaceuticals Design and Manufacture and Bioscience for Lifelong Health will support these sectors in addressing complex challenges with basic bioscience research. Bioenergy and Industrial Biotechnology Energy and industrial materials from novel biological sources, reducing dependency on petrochemicals and helping the UK to become a low carbon economy. The dwindling supplies and increasing expense of petroleum means the chemicals sector is looking for new opportunities to develop bio-based products with equal or improved functionalities, or for new products altogether. The priority for Biological Systems for Green and Sustainable Chemicals has been identified to underpin industry efforts to find biological solutions for chemical products and processes. Food Security Bioscience for a sustainable supply of sufficient, affordable, nutritious and safe food adapting to a rapidly changing world. The agriculture and food sectors face significant challenges in the years to come to meet the needs posed by an increasing population alongside the effects of climate change leading to reduced reliability of food supply. Two priorities have been identified to underpin industry efforts to address these challenges: Crop Production and Farm Animal Genomics for Health. In addition, elements of the Bioscience for Lifelong Health priority will also address challenges around nutrition. Exploiting New Ways of Working Enabling innovative working practices in an era of rapid technological advancement, the next generation internet, and quantitative and computational approaches to bioscience. All of the industrial sectors BBSRC collaborates with have been engaged in the hightech and increasingly complex digital environment. In order to meet the increasing challenges of operating in this environment, while looking to new technology to advance industry products and processes, three priorities have been identified to stimulate research to address these challenges: Intelligent Storage, Retrieval, and Analysis of Large Datasets, Exploiting Systems Biology and Instrumentation and Measurement: Bioimaging. 4 Table of Contents Basic Bioscience Underpinning Health Bioscience for Lifelong Health..................................................................................... 6 Biopharmaceuticals Design and Manufacture............................................................. 8 Bioenergy and Industrial Biotechnology Biological Systems for Green and Sustainable Chemicals ....................................... 10 Food Security Farm Animal Genomics for Health ............................................................................ 12 Crop Production ........................................................................................................ 13 Exploiting New Ways of Working Intelligent Storage, Retrieval, and Analysis of Large Datasets ................................. 15 Exploiting Systems Biology ....................................................................................... 17 Instrumentation and Measurement: Bioimaging........................................................ 19 5 Bioscience for Lifelong Health This priority will focus on underpinning user needs in two key research areas of Diet and Health and Healthy Ageing. DIET AND HEALTH This area focuses on the substantial opportunities for innovative bioscience research that exist across the food supply chain to meet the challenge of delivering a healthier diet to consumers. It covers interventions within the entire food chain from primary production, through to food manufacture and processing to the retailer and includes an increased understanding of the effects of food in terms of human physiology, energy intake and an understanding of human behaviour towards food related to health. This research will help to deliver greater food security by ensuring a supply that is not only sufficient, but also safe and nutritious. UK Industry Need Diet and Health is now a primary driver for all businesses in the food supply chain, from primary producers to retailers. The UK has a large number of companies engaged in food production, but because it consists of mostly SMEs, it is challenging to introduce new technology in the sector. The industry has limited capacity to conduct its own research and relatively few large industrial food research laboratories remain. The industry is served by the Food Research Associations (Campden BRI and Leatherhead) in providing contract research services, but in areas of more basic research there is scope for improved linkages with centres of academic excellence coupled with mechanism to disseminate the results of innovative research to the companies. Science to Meet the Need There are a number of strong centres of excellence in the diet and health research community in the UK, with many world-leading researchers and engagement of the academic community with the industrial sector through collaborative research. BBSRC and other funders have invested in strategic research relevant to diet and health that is interdisciplinary in nature, bringing together biosciences, physical sciences and engineering. This investment has facilitated advancements in research relating to an improved understanding of healthier diets and bioactives in food that benefit health. Impact BBSRC recognises that increased investment in research activity relating to diet and health will underpin the needs of the food industry to fulfil the increasing appetite of the public for healthier foods and help the UK to remain internationally competitive in this sector. Through gaining an improved understanding of the interactions between diet and health, the food industry will develop new products in the long term that address the increasing demands of the consumer for a healthier diet throughout the lifespan, and in turn address public health issues. Examples of Current BBSRC Activity Diet and Health Research Industry Club (DRINC) DRINC is a £10M, 5-year partnership between BBSRC, EPSRC, MRC and a consortium of leading food and drink companies aimed at improving our understanding of healthier diets and increasing our knowledge of the health benefits of bioactives in food. 6 HEALTHY AGEING The aim of this priority is to increase underpinning research that will inform strategies for improving health span during ageing and thus minimise the need for health and social care. BBSRC has invested substantially in this area, which encompasses underpinning research to gain an understanding of the biology of ageing: how it is modulated by diet, physical activity and developmental factors; the risk factors of the ageing process on frailty and poor health; and the identification of the fundamental research needed to improve physical and mental wellbeing of the aged. UK Industry Need By 2051, 40% of the UK population will be over 50 and 1 in 4 over 65. The need for quality research in healthy ageing impacts a number of UK industries, including pharmaceutical, food, healthcare and insurance. Industrial research excels in the areas of drug discovery and development, food, health and well-being, but industry has identified a gap between exploratory basic research at cellular level and implementation at personal and population levels where there is scope for improved linkages with the strong UK academic base in healthy ageing. Science to Meet the Need BBSRC contributes to a number of Cross-Research Council multidisciplinary activities in ageing including the ESRC-led New Dynamics of Ageing, the MRC-led Lifelong Health and Wellbeing initiative and the BBSRC Centre for Integrated Systems Biology of Ageing and Nutrition (to which EPSRC contributes). Recent advances in BBSRC research on ageing include a systems biology approach that increases the understanding of cellular ageing, identifying an experimental ageing system in flies, and improving the understanding of mechanisms that lead to ageing of the immune system. BBSRC is working closely with other national and international bodies to draw on a broad range of knowledge and experience to ensure relevance and usefulness of the funded research. The focus is on understanding the fundamental biological mechanisms underlying the ageing process. Approaches will be multidisciplinary, using integrative or systems biology approaches and will lead to the development of new tools and technologies. Impact The outcomes of this research will underpin the biological mechanisms underlying the ageing process and strategies for improving health span during ageing, and thus lead to a decreased need for health and social care. The research into healthy ageing will have enormous social and economic impacts on UK industry such as the development of novel drugs and new interventions to slow or modify the ageing process. Examples of Current BBSRC Activity The proposed Research and Technology Club in Healthy Ageing A cross-Research Council club in healthy ageing is proposed to underpin research into healthy ageing that will provide social and economic gains for the UK. The club will work closely with other cross-Research Council activities in ageing to ensure a complementary focus of research. There has been a high level of interest from both industry and academia for the proposed club. 7 Biopharmaceuticals Design and Manufacture Biopharmaceuticals are large and complex molecules which require sophisticated manufacturing methods. This priority aims to address the research challenges faced by companies in improving the design and advancing the manufacture of biopharmaceuticals. In this context, biopharmaceuticals include therapeutic proteins (antibodies, cytokines etc), megamolecular complexes (viruses, plasmids, multicomponent assemblies), and cell therapeutics (stem cells, differentiated cells and tissues). UK Industry Need The number of licensed biopharmaceuticals is forecast to grow at a rate of around 20% per annum, an increase stemming from the demonstrable ability of biologicals to address unmet clinical needs. There is consequently an increasing requirement to get new therapies to the market and clinic as quickly as possible. However, there are major problems in designing and producing biopharmaceuticals in sufficient quantities in a pure and well characterised state at a reasonable price. The development phase is currently slow, expensive and complicated and, since speed to market is vital, there is a need for new tools and methods which will contribute to accelerating development, including designing molecules for manufacturability. Within the area of cell therapeutics there are many SMEs which help to keep the UK at the forefront of this area. Special consideration needs to be given to these companies to enable them to engage with the academic community. Science to Meet the Need BBSRC and other funders have increased investment in strategic research relevant to the manufacture of biopharmaceuticals. These investments have facilitated advancements in research relating to understanding the bioscience underpinning bioprocessing and developing improved tools for bioprocessing. The research investments are relevant to bioprocesses based on microbial cell fermentation or mammalian cell culture in addition to emerging biological products based on stem cells and tissue engineering. These advancements have positioned the research community to address new challenges in cell therapeutics and formulation and downstream processing. In addition, genomic, proteomic and RNAi methods are identifying biological molecules that are rapidly achieving proof of concept in therapeutic disease models. Additional research has the potential to aid the development of these molecules as medicines, including formulation and chemical modification to modulate properties. Impact It is foreseen that 50% of the top 100 drugs will be biological medicines in 2014, with 7 of the top 10 drugs (by sales) being biological medicines10. Clearly this is an area which is growing rapidly, but there has been a lack of scientific research to bolster this growth. The support of research in this area will underpin the needs of the pharmaceutical and biotechnology sectors, with an impact on bioprocesses at all scales of operation, from the small amounts required for preclinical studies through to post-licence bulk manufacture. Research using a systems approach where it is desirable, will help eliminate the bottleneck in the development of biological medicines and contribute to the development of a vibrant biopharmaceutical community. The result would be an increased chance of projects reaching the marketplace and decreasing the time to marketplace. The pharmaceutical companies 10 Evaluate Pharma report, published June 2009 8 and biotechnology companies in the UK will extend their product portfolio and generate valuable intellectual property, and the public will have access to biological medicines sooner and at a lower price. Examples of current BBSRC activity Bioprocessing Research Industry Club (BRIC) BRIC is a £14M, 5-year partnership between BBSRC, EPSRC and a consortium of leading companies (£1M) to support innovative bioprocessing-related research, including that needed for the manufacture of complex biopharmaceuticals. Its themes are Bioscience underpinning bioprocessing – improving understanding to enhance bioprocessing and Improved tools for bioprocessing. The bioscience theme includes work on microbial fermentation and mammalian cell culture, growth of stem and tissue cells in vitro, and improved understanding of the properties of proteins. The tools theme includes high throughput process technologies, effective modelling, analytical methodologies for bioprocessing, and improved downstream processing. The Club also interfaces with the bioProcessUK KTN, which facilitates innovation and knowledge transfer in the field of bioprocessing by providing networking opportunities for all the stakeholders in bioprocessing in the UK. 9 Biological Systems for Green and Sustainable Chemicals This priority encompasses a broad commitment in BBSRC to support the innovation of biological processes, technologies and products that will replace the UK’s requirements for petrochemicals with green and sustainable sources of energy and chemicals. This commitment covers the whole of the supply chain and numerous sources of biomass, including algal biomass, agricultural residues, biological components of waste, and other plant materials. UK Industry Need The research and industrial communities in this area are emerging, but strong interest from both the UK industrial and political communities to succeed in replacing petrochemicals has accelerated the interest in building an integrated and coherent research-industry network to address research needs. There is potential for significant advances in each stage of the supply chain, and industry is particularly interested in ensuring the scalability and cost-effectiveness of promising new technologies. Research in this area will only be effective in the context of sustainability and will require interfaces with chemical, physical, environmental and social sciences to understand the underpinning life cycle analyses behind energy and chemicals production from an economic and environmental viewpoint. Science to Meet the Need While the focus on development of biofuels has spurred research advances, the potential for developing other sustainable products to replace petro-chemical products is similarly attractive. Focus on non-food, waste and algal sources of biomass using a systems biology approach where this is desirable, has the potential to reduce concerns regarding sustainability and UK strengths in plant breeding, biocatalysis and bioprocessing can make producing energy and chemicals from these sources cost-effective. Microbial processes, in particular, are offering solutions for efficient conversion of biomass to fuels and high-value co-products. Impact The global chemicals sector generates over £1.25 trillion in sales every year. In the past decade, it has grown in value by more than 60%, and at least 5% of chemicals sold in Europe will involve the use of biotechnology.11 The application of technology developed in this area will underpin the needs of the pharmaceutical and chemical sectors, as well as potential applications in the food and cosmetic industries for flavourings and fragrances. The chemicals sector is likely to be the primary outlet where innovation in the production of high value speciality organics will be important, given the increase in competition in bulk chemicals from other parts of the world. Examples of Current BBSRC Activity Sustainable Bioenergy Centre The Centre represents a £27M investment that increases UK bioenergy research capacity. It brings together six world-class research groups to create a network with expertise and specialist resources that span the bioenergy pipeline from growing biomass to fermentation for biofuels. Ensuring that bioenergy is economically, environmentally and socially sustainable is core to the Centre's programmes. Life cycle analysis embeds this across the portfolio. 11 http://www.berr.gov.uk/whatwedo/sectors/chemicals/IBIGT/page44395.html 10 Fifteen leading industrial associates bring business expertise and perspectives, and support totalling around £7M. This will help ensure that research outputs are translated into practical applications as quickly as possible. Integrated Biorefining Research and Technology Club A £6M, 5-year partnership between BBSRC, EPSRC and a consortium of leading companies aimed at developing biological processes and feedstocks to reduce our current dependence on fossil fuels as a source of chemicals, materials and fuel. The Club interfaces with the KTN's wider Integrated Biorefinery Technologies Initiative (IBTI) to ensure research is translated from R&D through to demonstration and deployment. 11 Farm Animal Genomics for Health This priority focuses on the substantial opportunities afforded by the increasing accessibility of genomic information of farmed animals and associated pathogens, to better understand the biological basis of traits, leading to a more sustainable farm animal industry with improved farm animal production, animal health and welfare, and reduced environmental footprint. Research underpinning farm animal health in this way is critical to ensuring future food security. UK Industry Need The UK has a very high proportion of the leading companies in animal breeding and animal health. Companies based in the UK are the global leaders in the breeding of dairy cows, pigs, broiler chickens, turkeys and ducks. These companies have a successful history of innovation and effective technology transfer. However, as pressures increase on the food supply chain, improvements in animal health and productivity will be required to ensure a secure supply of animal products. An improved understanding of the basic biology of difficult-to-measure traits will allow breeders to incorporate more molecular and quantitative approaches to selection, thereby enabling adoption of more balanced breeding goals, increasing productivity and reducing environmental impact. A focus on translation from animal health to breeding research and to industry will ensure effective use of research results. Science to Meet the Need The selective breeding of farm animals has historically been based on quantitative genetics. Latterly, however, genomics and new approaches have changed the way in which research is conducted and as a result, animal breeding is becoming increasingly complex. The UK has a strong research base in animal genetics/genomics of farmed livestock species and in animal health, and there are now substantial opportunities to expand knowledge of genetic control of traits, including those that are difficult to measure, such as quality of produce and disease resistance. The capacity and skills are available within the research base to utilise increased investment. In particular, new opportunities could be realised through better collaboration, for example, between the different research groups working on host and pathogen genomics. Impact Low cost genotyping and associated knowledge will allow breeding companies to increase substantially their use of molecular information in selection decisions. Reducing the disease burden on farm animal populations will increase productivity, improve animal welfare, and contribute to improved food quality and safety. Technological advances will also facilitate the development of a more sustainable farm animal industry, reducing the environmental footprint and improving the efficiency and success of livestock and animal health companies. Examples of Current BBSRC Activity Industrial Partnership Awards: Combating Endemic Diseases of Farmed Animals for Sustainability Initiative Ten projects, funded at a value of £11.2M including £1.45M to support Industrial Partnership Awards, are aimed at generating underpinning scientific knowledge that will improve animal health and welfare. The projects will enable the more effective, sustainable management of diseases, with the emphasis on control rather than treatment, while avoiding or reducing negative environmental impacts and helping to maintain the competiveness of the UK’s animal production industries. 12 Crop Production The Crop Production priority responds to the challenges facing agriculture in the context of food security, climate change and environmental sustainability. It covers innovative underpinning research to allow the sustainable exploitation of cultivated plants and the translation of basic science to enable its application to agricultural crops and production systems to meet these challenges. UK Industry Need A complex mixture of factors will place increasing stress on the crop production industry in coming years and there will need to be significant technological advances in order to meet the challenges ahead. Ensuring food security will mean increasing the productivity of crops in a sustainable way whilst also responding to changes in market forces. There will be an increasing demand for crops that can produce healthier foods as well as feedstocks for chemical and energy production. Important factors will include the effects of climate change that will bring extremes of temperature, changes in water availability and altered pest and disease pressures. Varieties and crop species that are able to thrive under these conditions will be required, but they must also contribute to production systems that are more environmentally sustainable, including reduced GHG emissions. This will mean improved resource use efficiency and less intensive, more integrated husbandry practices. Furthermore, crop production relies intrinsically on healthy soils and their restoration and preservation must be achieved through better understanding of soil structure and function. Meeting these needs will only be possible using a systems biology approach. Science to Meet the Need The UK has the strongest plant molecular biology community within Europe. It also has a well developed capability in genomics and a large number of institutes, including Rothamsted Research, John Innes Centre, Institute of Biological, Environmental and Rural Studies and the Scottish Crop Research Institute. This priority takes forward elements of the strategy for crop science set out in the crop science review and will also build on BBSRC’s earlier investments through responsive mode grants, core funding of institutes and managed initiatives such as innovation in crop science, Renewable Agricultural Materials LINK Programme and Systems Approaches to Biological Research (SABR). Rapid advances in fundamental understanding of plant sciences driven by genomic, proteomic and metabolic information now permit both transgenic and non transgenic approaches to meeting the challenges faced by industry. Impact We rely on crops for an ever increasing variety of food, fibre, chemical and fuel products. By supporting research and knowledge transfer in the area of crop improvement we will continue to build on the world–leading capabilities of the plant science base in the UK. This will ensure that UK industry continues to lead at the forefront of innovative crop improvement. Advances in this area will be especially important in the context of food security and will help the international community to meet the demand for a 50% increase in global food production by 2030. Progress in crop improvement will also reduce our dependence on petrochemicals by increasing the availability of novel chemical and fuel feedstocks from plants. These advances will be balanced with more sustainable production practices that enhance and protect natural resources. 13 Examples of Current BBSRC Activity Crop Improvement Club BBSRC is initiating a Research and Technology Club in the area of crop improvement. The value of cereal production alone is worth over £2.5bn per year in the UK and we are net exporters of wheat, barley and oilseed rape. The Club will bring industry together with the research base to support excellent quality, industrially relevant research on these important crops, helping to bring improvements in quality and productivity. Food Security Roadmap for Research In the region of 50 % of BBSRC’s funding each year is spent on food-related research. With increasing threats to global food security from environmental, social and economic perspectives, this research is increasingly important. BBSRC is leading the development of a cross-council programme on food security with other funders and a significant element of this programme will focus on crop production. LINK Programmes The BBSRC supports projects in both the Sustainable Arable Programme and the Renewable Agricultural Materials Programme. LINK delivers high quality, precommercial research in collaboration with two or more academic and industrial partners. LINK is a very valuable component in the translation of strategic and applied science into practical solutions. 14 Intelligent Storage, Retrieval, and Analysis of Large Datasets This priority includes the development and harmonisation of e-tools that facilitate the storage, retrieval, integration, and analysis of large amounts of data through the development of new biologically-relevant software concomitant with the development of a mixed economy of computing infrastructure. UK Industry Need Genomic, proteomic and metabolomic techniques are advancing our understanding of cell biology, while data from other sources including cellular images, organ structure and function, and species morphology and geographic distribution have led to an unprecedented amount of diverse information. Biological research has become a greater data-intensive science, challenged in recent years by a very significant growth in its volume and variety. These data have also become globally distributed. There is clear benefit for the UK life science industry in exploiting the richness of both their own data and that which is remotely available. Consequently, there is an increasing demand from the research community, both in academia and industry, to be able to share and query remote data and improve the ability of researchers to analyse large datasets. This is underpinned by the need for more robust data with harmonised standards allowing for their interoperability. Furthermore, visualisation tools for data quality should prove to be an advantage and favour data sharing between Academia and Industry. Science to Meet the Need The development of e-tools and better integration of the ‘omics’ advances (genomics, proteomics, metabolomics) offer the potential for more predictive biology with the prospect of “in silico” modelling of all types of biological systems. Opportunities for an improved handling of large biological datasets exist at every stage of the process; from the need for increased storage capacity, especially since we are moving toward more spatial and temporal measurements, to the development of computational tools and approaches for interrogating biological data. In particular, the development of tools for biologists to facilitate data curation and mining is essential. Also needed are better integrated solutions for the visualisation of more complex data if the UK is to benefit from the semantic web revolution and web2.0. Impact The development of practical tools for biologist to better handle large datasets would increase data robustness, interpolation and facilitate sharing. These outcomes have the potential to increase our knowledge of complex biological traits, thus increasing drug development opportunities via more targeted approaches while reducing costs. These include benefits to the pharmaceutical industry for detailed analysis of 3D protein structure and molecular function and better understanding of molecular interactions and host response to pathogens. The increased understanding of complex biological traits have the potential to decrease time to market in drug development, increase throughput in field trial and therefore decrease costs. Examples of Current BBSRC Activity Bioinformatics and Biological Resources Fund The aim of the Bioinformatics and Biological Resources (BBR) Fund is to support the establishment, maintenance and enhancement of resources required by bioscientists. It is intended that the Fund will support high quality community BBR’s of strategic relevance to BBSRC that are necessary to underpin the UK’s international quality bioscience. Twenty-two projects have been funded through the first two calls of the 15 BBR, totalling approximately £13M, the majority of which were to support einfrastructures underpinning the UK biosciences. ELIXIR - European Life Sciences Infrastructure for Biological Information ELIXIR is a proposed pan-European research infrastructure to provide coordinated and sustainable support for biological information. The Project seeks to marry the sustainable delivery of activities currently supported through EMBL-EBI with other related major national data infrastructures. BBSRC coordinates the Funding Strategy work package for this ESFRI preparatory project, launched in November 2007. In August 2009, BBSRC announced £10M (derived from additional budget allocation from BIS) for developing the existing data resources and IT infrastructure of EMBL-EBI for 2010-2015, and towards its planned role as the central hub of the emerging European ELIXIR Project. The successful EBI Industry Partners Programme, which has run for 12 years, provides specialist workshops, standards-based activities and precompetitive research and development opportunities for large multinational companies in pharmaceutical, biotech, agricultural, nutrition, personal care and medical devices industries. Training is also offered to SMEs. Tools and Resources Development Fund The Tools & Resources Development Fund (TRDF) is intended to support small or short-duration, pump priming research projects and / or to bring together communities for collaborative purposes. Proposals generally involve the development of a novel technology or method to tackle a biological challenge within the BBSRC remit, but can also involve community networking for the development of standards and to facilitate data sharing. Interdisciplinary and multidisciplinary approaches are strongly encouraged. 16 Exploiting Systems Biology ‘Systems biology’ describes an approach in which experimental biology is integrated with mathematical or computational modelling, which can then be used to test hypotheses and predict outcomes before any practical experimentation is performed. In its fullest expression, systems biology integrates information across different levels of biological organisation to explain the dynamics of biological function at all levels from molecules through to cells and to whole organisms and populations. UK Industry Need One of the goals of systems biology is to discover new emergent properties that may arise from studying the “system” as a whole, leading to a more rapid and deeper understanding of how the “system” is controlled or regulated. This level of understanding will facilitate the exploitation of biological systems in a wide range of applications. Whilst it would be unwise to be prescriptive at this stage and define precise areas in which a systems approach could be most usefully applied to meet industry needs, it is important to enable closer cooperation with UK companies, to ensure the commercial potential of a systems approach is realised. Science to Meet the Need The focus of bioscience research over much of the last decade has been reductionist, focusing largely on the structure and activity of macromolecules that make up cells. However, deeper understanding of complex living systems afforded by our improving knowledge of eg genomes and the subsequent development of genomic and proteomic technologies can only be achieved through the application of mathematical and computational modelling techniques to quantitative experimental data. Since 2004/5, BBSRC has invested substantially in research, training, infrastructure and resources for cross-disciplinary studies in systems biology, which has enabled the UK to become a major international leader in this area. This investment has included the establishment (with EPSRC) of six Centres for Integrative and Systems Biology in UK universities and six major research projects to act as focal points for the expertise in UK systems biology. All of the Centres and projects have recognised interactions with biotechnology, pharmaceutical, agrochemical, and instrumentation or computer hardware/software companies. Impact Research is at an early stage but is expected to contribute to benefits such as the more rapid and efficient identification of novel drugs either by improved understanding of what to target in the biological system or by elimination of candidates at an earlier stage of development, reducing attrition rates in clinical trials and improving cost efficiency. Additional benefits should also include improved prediction of candidate drugs and improved biomanufacturing processes and products through understanding how the biomanufacturing process is controlled. The large Pharmaceutical companies are likely to be the first and largest beneficiaries of systems biology and are already showing strong interest in the development of systems biology in the science base. In the agricultural sector, increased understanding of plant responses to changing environmental conditions will improve yield and quality as well as improving control strategies for pests and disease, and therefore will contribute to the food security agenda. 17 Examples of Current BBSRC Activity Industry engagement with Centres for Integrative and Systems Biology BBSRC and EPSRC provided funding of £40M to establish six Centres for Integrative and Systems Biology that were awarded in 2005 and 2006. As part of this initiative, Centres were required to develop strong links with the private sector and to date industry have participated in collaborative research activities, development of innovation centres and sponsorship of research chairs. Systems Approaches to Biological Research Initiative BBSRC and EPSRC also cosponsored a £26M initiative to establish a range of systems biology research projects that focused on 1) systems approaches to studying strategically important biological problems across the range of BBSRC’s remit, integrating experimental and predictive approaches, and 2) e-Tools to support systems biology research. To encourage private sector engagement in systems biology projects, applicants demonstrated interactions with specific companies in their research projects. The projects funded via this initiative involve interaction with a wide range of companies covering the pharmaceutical, agrochemicals, software and instrumentation sectors. 18 Instrumentation and Measurement: Bioimaging Instruments and measurements encompass a broad part of BBSRC’s remit, but the current need articulated from industry in this area is in bioimaging, although expansion to other tools in this area could be considered in the future. As highlighted by BBSRC Tools and Resources Strategy, bioimaging focuses on the development of technologies that span the entire length scale - all the way from single molecules and single cells through to tissues and organs, living organisms and finally the environment they inhabit. The scope of bioimaging includes in vitro through to in vivo functional and mechanistic studies, and the means to obtain complex and quantitative data sets during in vivo studies with appropriate spatial and temporal resolution. UK Industry Need Costs to develop and bring to market technologies in bioimaging are very high and could prohibit the growth of the industry. Industry has expressed a need for the development of molecular tools that could further enhance the bioimaging field since bioimaging is now at the forefront of diagnostic (animal, plant, water and human diagnostic), rendering the imaging market very competitive. Specific development in functional imaging, quantification and novel labelling technologies are therefore needed. In addition, Industry is looking to better understand the requirements of biologists to develop responsive products and appropriate tools for research. Science to Meet the Need Future development of the bioimaging field requires the development of new imaging tools and techniques throughout the imaging supply chain from molecular and cell biology to mechanical and acoustic methods. These encompassed the development of novel contrast agents and biomarkers at the cellular level to the development of spatial and temporal acquisition methods for molecular, cellular, organ and whole organism image acquisition. These developments often require a multidisciplinary approach and promote cross-disciplines interactions. Impact Research in this area is ultimately expected to contribute to a better understanding of molecular and cellular interactions at both organ and organism levels but also develop further understanding of biological interaction within the environment. This increased understanding of biological systems will lead to new drug discoveries and therapies using a targeted approach in both animals and plants. A highlight of this area is that it promotes the development of non-invasive, non-destructive technologies, such as telemetry, that address the 3R’s of animal use in research (replacement, refinement, reduction). Examples of Current BBSRC Activity Technology Development Research Initiative BBSRC ran two calls to the Technology Development Research Initiative (TDRI) through the Spending Review 2004 period, awarding £17.6M to 30 projects. BBSRC contributed £13M to the call; EPSRC provided £4.6M in co-funding. The TDRI priorities identified key technological bottlenecks for the bioscience research community. The overall aim of the initiative was to build a multidisciplinary community of researchers working with technology developers (either academically- or commercially-based) together to develop and advance technology development for the biosciences. The 19 outputs from this initiative have the potential to be the next generation of analytical biotechnology, of significant relevance to the UK bio-industries. Investing in the Knowledge Base During the period 2003-2008, BBSRC invested nearly £27 million in 80 projects in technology development related to bioimaging, and there is now a need to focus on the translation of results from this research to industry. 20