Multiproduct Firms, Information, and Loyalty ∗ Bharat N. Anand Ron Shachar

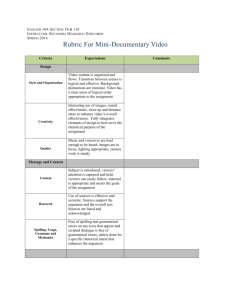

advertisement

Multiproduct Firms, Information, and Loyalty∗

Bharat N. Anand†

Ron Shachar‡

Harvard Business School

Tel-Aviv University

Abstract

The information set of consumers who are uncertain about product attributes is a central

ingredient in the analysis of marketing researchers and the strategies of marketing practitioners.

Here, we suggest that the profile of a multiproduct firm is an important element in the information set about each one of its products. As an example of such profiles, Honda is known to

produce gasoline-efficient cars, whereas Volvo is perceived to focus on safety.

The model includes product differentiation and heterogeneous consumers who are uncertain

about product attributes. Like previous studies, a consumer’s information set for a product

includes noisy signals she obtains about the product’s attributes, and the parameters of her

prior distribution. Unlike previous studies, her prior distribution of a product’s attributes

depends on the firm’s profile (which is defined as the distribution of attributes across the firm’s

products). We show that by revising the information set in this way, one can explain interesting

empirical regularities concerning consumer behavior. For example, the consumer is loyal to a

multiproduct firm even at times that it does not offer a product that matches her preferences

better than competing firms. Our model also offers a parsimonious way of thinking about brand

extension strategies and maps new channels of spillovers within a multiproduct firm.

We estimate the model and test its implications using panel data on television viewing

choices. The estimated model also allows for state dependence parameters and unobserved

heterogeneity. Our structural estimates come from maximizing a simulated likelihood function

and using importance sampling. The empirical results support the model and its implications.

We find that the profile of a multiproduct firm is an important element in the information set

of consumers. Finally, we illustrate the empirical bias in standard choice models that do not

structure the information set as suggested here.

∗

We are grateful to Dmitri Byzalov for outstanding research assistance, and to Luis Cabral, Zvi Eckstein, Tulin

Erdem, Barry Nalebuff, Ariel Pakes, Peter Reiss, Manuel Trajtenberg, and seminar participants at Econometrics in

Tel-Aviv, Marketing Science 2001, Harvard, and Yale for helpful comments.

†

Soldiers Field Road, Boston, MA 02163. Phone: (617) 495-5082; Fax: (617) 495-0355; email: banand@hbs.edu.

‡

Faculty of Management, Tel Aviv University, Tel Aviv, Israel, 69978. Phone: 972-3-640-6311; Fax: 972-3-6405621; email: rroonn@post.tau.ac.il.

1

Key words: multiproduct firms, incomplete information, consumer loyalty, unobserved heterogeneity, brand extensions, television networks.

2

1

Introduction

The information set of consumers who are uncertain about product attributes is a central ingredient

in the analysis of marketing researchers and the strategies of marketing practitioners. Here, we

suggest that the profile of a multiproduct firm is an important element in the information set for

each one of its products.1 For example, consumers are likely to expect that any Volvo automobile

is safer than most cars. We show that by revising the information set to include firms’ profiles, one

can explain interesting empirical regularities concerning consumer behavior. We test our model

using a dataset on television viewing choices and find that the informational role of multiproduct

firms is both statistically and behaviorally significant.

Outline of the Model In today’s economy, virtually no firm produces one product only.2 In

many cases, these firms have distinct profiles. Honda, for example, is known to produce gasolineefficient cars whereas Volvo is perceived to focus on safety. Including a firm’s profile in the information set is ignored by previous studies of brand choice. Yet, these studies reveal key elements of the

information set, such as word of mouth, media coverage, advertising, and previous experience with

a product.3 One avenue through which information flows within a multiproduct firm is revealed

by Erdem (1998). She shows that consuming a product affects a consumer’s information set about

other products of the same firm.4

Although our model differs from previous ones in the structure of the information set, our

setting is somewhat similar to many of these studies. Specifically, we model product differentiation

and heterogeneous consumers who are uncertain about product attributes. Their utility is a function

of the match between their tastes and product attributes. For example, families like vans more

than singles do. In previous studies of multiproduct firms, each firm offers a portfolio of products

at each point in time. In contrast, in the model studied here, at each point in time t there are J

multiproduct firms, and each of them offers a new product. Thus, each product is only consumed

once in the time frame of our study.5

1

pro·file (prfl) n. A set of data portraying the significant features of something; a concise biographical sketch.

(Merriam-Webster’s Collegiate Dictionary, 2001).

2

See Ogiba (1988) and Kesler (1989).

3

See, for example, Eckstein, Horsky, and Raban (1998), Erdem and Keane (1996), Crawford and Shum (2000),

Shachar and Anand (1998), and Anand and Shachar (2001).

4

We highlight the differences between Erdem’s approach and ours later on.

5

Multiple appearances of a product serve studies that focus on dynamic learning from experience, but not ours

which is focusing on the prior distribution. These differences express themselves in the data sets as well. We use data

on purchases of multiple products of the same firm, while previous studies have used data on multiple purchases of

the same product.

3

Following previous studies, we assume that consumers receive unbiased noisy signals on the

attributes of each product. These signals come from previous experience with the good, media

coverage, and other sources. Under these assumptions, a consumer’s expected utility from a product

is a function of these product-specific signals and her prior beliefs about product attributes.

We depart from previous studies by hypothesizing that these prior beliefs depend on the

profile of the multiproduct firm. A firm’s profile is characterized by (a) the mean attributes across

all products that it offers and (b) by the variance of these attributes. Hereafter, we refer to the first

characteristic as the firm’s “image” and to the inverse of the variance as the firm’s “precision.” For

example, if automobiles were to have only one attribute–miles per gallon–then the profile of any

automaker would be completely characterized by the average miles per gallon across all its models

and by the variance of this variable. For any given product, the consumer’s prior distribution of

its attributes will then depend on this overall profile. In particular, the expectation of the prior is

equal to the match between the consumer’s taste and the mean attribute of the firm.

We show that the purchase probability of a product is a function of (a) the match between

the consumer’s taste and the product attributes observed by the researcher, and (b) the match

between the consumer’s tastes and the firm’s image. Notice that the purchase decision depends on

the firm profile even if the individual previously did not consume any of this firm’s products. The

prediction that the purchase probability depends on the firm’s profile differentiates the suggested

model from previous ones. The model, and other testable implications, are presented in section

3 where we show that the effect of a firm’s profile on the purchase probability is not fixed. This

effect should be smaller for consumers who are relatively well-informed about a specific product. It

is also expected to be smaller for better-known products. Finally, the effect should be smaller for

firms with a diverse product profile.

Implications The behavioral and managerial implications of the model are presented in detail in

sections 3 and 6, and briefly here. First, the model introduces a new source of consumer loyalty. As

mentioned above, the purchase probability depends on product attributes and on a firm’s profile.

While the first element is product specific, the second is common to all products of a given firm.

This common element generates loyalty to multiproduct firms.

This loyalty expresses itself in an individual’s tendency to purchase a product from the firm

whose image best fits her taste even when the specific product does not match her preferences

better than the products of competing firms. (We call this phenomenon “excess loyalty.”) For

Although the setting of a firm offering a single product in any period might seem restrictive, it can be reinterpreted

as a multiproduct firm offering a portfolio of products at a point in time, with t indexing the product categories.

4

example, since it is virtually impossible to know whether you like a book before you read it,

individuals frequently make decisions based on a writer’s style. Thus, a consumer who likes Ernest

Hemingway’s no-nonsense writing style–on themes such as war, blood sports, and crime, and about

heroes who confront tremendous odds with “grace under pressure”–is likely to purchase his book

Green Hills of Africa. This consumer would turn out to be surprised. Notice that although such

behavior leads the individual to suboptimal choices in some cases, it is still optimal behavior given

her uncertainty about product attributes.

A consumer’s excess loyalty is explained in previous studies by including an unobserved

individual-firm match parameter. Thus, while the traditional approach leaves the explanation

of loyalty in a “black box”, we present a behavioral foundation for such loyalty. Our explanation,

based on the informational role of multiproduct firms, thus contrasts with the traditional statistical

solution (unobserved heterogeneity) to explain excess loyalty. The behavioral and statistical sources

of loyalty have different managerial implications.

Note that our model includes both sources of loyalty (behavioral and statistical) as well as

state dependence parameters. Each of these sources can generate consumer loyalty. In section 4,

we demonstrate how these different sources can be distinguished using a panel dataset.

The second implication of the model relates to the issues of brand extensions and brand

alliances. In section 6, we illustrate the consequences of extension decisions on a firm’s market

share. When considering an extension, a brand manager is concerned typically about the spillover

effects on the firm’s other products. It turns out that these spillover effects are richer than one

might expect. Consider the following case. A firm adds a new product that does not change its

image. While it may seem that such a change should not affect the market share of the firm’s other

products, we show that it does. The reason is that such a change increases the firm’s precision,

and as a result, consumers place less weight on the signals they receive on each product. Thus, our

model offers a parsimonious way of thinking about brand extensions and brand alliances–in terms

of their effect on the mean and variance of a firm’s profile–and maps new channels of spillovers.

Third, we also illustrate the empirical bias in standard choice models that results from not

including the firms’ profiles in the information set. Our Monte Carlo experiments, using a specific

and reasonable set of parameters, reveal that this bias is significant. The estimate of the consumer

taste parameter is downward biased by about 40%.

Empirical Application Even though our model is relevant to several markets, it describes the

media and entertainment industries particularly well. In the last decade the television, movie, music,

5

publishing, and new media industries have been growing rapidly.6 The relevant characteristics of

these industries, as described in detail later, are: (1) consumers are bound to be uncertain about

product attributes (because of constant changes in product attributes); (2) there is high product

differentiation; (3) heterogeneity in consumer preferences is large; and (4) multiproduct firms with

distinct profiles happen to be the norm in these markets.7 Thus, the setting of our model, while

relevant to many industries, is especially germane here, and might be useful to researchers and

practitioners seeking to understand consumer choices and firms’ strategies.

Since the model is especially relevant to the entertainment industry, we test the model based

on data from the television industry. By using a panel dataset on television viewing choices from

1995 and data on show attributes, we estimate the model and test its implications. In our application, the products are television shows and the major multiproduct firms are the four national

television networks.8 We describe the datasets in section 2 and estimate the model and test its

implications in section 4.

The relevance of the model and of the various applications detailed above depends on its

empirical validity. The results, presented in section 5, show that the data support the model.

Specifically, our non-structural estimation finds that firms’ images affect product viewing choices.

It turns out that this effect is as important as the effect of product attributes themselves. This

evidence suggests that the new source of information introduced in this study is both statistically

significant and behaviorally important.

Our structural estimation, based on maximum simulated likelihood methods, reveals that

these results hold even when all the restrictions of the model are imposed. For example, one

restriction concerns the distribution of the unobserved signals on show attributes. This and other

restrictions require multivariate integration of the likelihood function. To deal with the resulting

complexity, we employ importance sampling.

The structural estimation reveals substantial heterogeneity across viewers and networks in

6

See the survey of technology and entertainment in the November 21, 1998 issue of The Economist.

These include, among others, Disney, AOL, NBC, Penguin Books, Julia Roberts, and Harrison Ford. Disney, for

example, is family-oriented and thus avoids controversial shows even on ABC, the television network that it acquired.

8

Mankiw (1998) presents the network television industry as a good example of an industry with established

multi-product firms. He, like others, refers to such firms as “brands”, and writes: “Establishing a brand name–and

ensuring that it conveys the right information–is an important strategy for many businesses, including TV networks.”

Furthermore, he reproduces a New York Times article (September 20, 1996) that reads: “In television, an intrinsic

part of branding is selecting shows that seem related and might appeal to a particular certain audience segment.

It means ‘developing an overall packaging of the network to build a relationship with viewers, so they will come to

expect certain things from us,’ said Alan Cohen, executive vice-president for the ABC-TV unit of the Walt Disney

Company in New York.” These quotes suggest that the television industry seems to be appropriate to examine the

empirical questions at hand.

7

6

the precision and/or number of signals they obtain about product attributes. For example, we

find that people are better informed about shows on ABC and NBC. Our estimation also reveals

that the informative role of firms’ profiles is substantial. Specifically, when forming their expected

utilities, individuals place the same weight on this information as on all the signals they receive

about the products. Notice that this is consistent with the non-structural results.

Using our structural estimates and two different measures of loyalty, we find that the informational source of loyalty is more important than that due to unobserved heterogeneity.

Related Literature One of the closest studies to ours is Erdem (1998). She examines the extent

to which a consumer’s perception of product quality is affected by his experience with other products

of the same firm. Her paper follows theoretical studies that have focused on the informational role

of multiproduct firms, referred to there as “umbrella brands” (Wernerfelt [1988], Montgomery and

Wernerfelt [1992], and Cabral [2001]). While these studies focus on experience goods, our model

is relevant mostly to products that have at least one non-experience attribute.9 A consumer who

knows the attributes of such a product is assumed to be certain about her utility from the good.

For example, many consumers buy a computer without testing it first.10 The difference between the

focus of previous studies and ours expresses itself in the modeling approaches. Erdem shows that

a consumer’s perception of product quality depends on his experience with other products of the

same firm. Our model predicts that the purchase decision depends on the firm’s image even if the

individual did not consume any of this firm’s products previously. Indeed, in the relevant markets

for our model, consumers often have an informed perception of a firm’s offering even without direct

experience. They may have gained this information through word of mouth or media coverage. For

example, most consumers are aware of the differences between Japanese and Swedish auto makers

even without having driven any such cars.

The second, and related, difference between Erdem’s study and ours is that her study focuses

on the role of firms as signals of product quality. In our setting, the signals convey information

both on the vertical attributes of a product as well as on its horizontal characteristics.11 Over

9

These types of products are sometimes called “search goods”.

The products in our data set, television shows, cannot be categorized as pure “search goods”, because even a full

description of the products cannot resolve all of the uncertainty that an individual has about her utility. However,

it is clearly the case that information about the products’ attributes decreases consumers’ uncertainty. For example,

the uncertainty that an individual faces about a show’s attributes decreases when she knows its cast demographics.

These attributes allow us to apply our model to the television data.

11

The terms vertical and horizontal differentiation are often used in the industrial organization literature. While

all consumers have either positive or negative tastes for the vertical attributes of a product, some have positive, and

others negative, tastes for horizontal attributes.

10

7

time, product diversity has been dramatically increasing in many markets. This factor is likely

to intensify consumer uncertainty about the horizontal attributes of products. As a result, the

informational role of firms as signals of these attributes has increased as well.

Sullivan (1990) is the first to present non-experimental evidence for spillovers in umbrellabranded products. She provides a methodology to analyze spillovers and uses it to measure two

instances of spillover effects. Her study shows that negative spillovers resulted from the Audi

5000’s problems with sudden acceleration and that positive spillovers resulted from Jaguar’s first

major model change in 17 years. Sullivan’s approach elegantly exploits cases in which one can easily

identify a unique event. Our methodology does not require such natural experiments. Furthermore,

while she uses aggregate data, we use individual level panel data that allows us to account for

individual-specific effects.

The flow of information between a firm and its products has been examined using experimental data. Morrin (1999) shows that brand extensions can modify the perceived profile of

a multiproduct firm. Simonin and Ruth (1998) and Park and Srinivasan (1994) demonstrate a

similar phenomenon with respect to brand alliances.

In another study somewhat similar to ours, Moshkin and Shachar (2001) show that state

dependence can be due to asymmetric information and search cost. The main difference between

their study and the one presented here is in the aim of the study: they focus on state dependence,

which is a specific aspect of loyalty. State dependence is defined as repeat purchase in sequential

periods. We, on the other hand, focus on loyalty across any two periods (not necessarily sequential

ones). This difference then expresses itself in the modeling approaches.12

A brief description of the datasets in section 2 is used to motivate the description of the

model in section 3. There, we describe the structure of the consumer’s information set and the

implications of the model. Section 4 discusses estimation issues, and the results are presented in

section 5. In section 6, we examine several applications of the model. Section 7 concludes.

2

Data

Although the setting of the model is not industry-specific, we start by presenting the data. This

approach is intended to make the presentation of the model intuitive.

Our data include television viewing choices, viewers’ demographic characteristics, and show

12

For example, while the information set in Moshkin and Shachar (2001) depends on the previous purchase, ours

does not. Also, their model focus on asymmetric information, while ours on the informational role of multi-product

firms.

8

(product) attributes. The first two, from Nielsen Media Research, are described first. Show attribute data, created specially for this study, are described subsequently.

2.1

The Nielsen Data

We obtained data on individuals’ viewing choices and characteristics from Nielsen Media Research,

which maintains a sample of over 5,000 households nationwide.13 Nielsen installs a People Meter

(NPM) for each television set in the household. The NPM uses a special remote-control to record

arrivals and departures of individual viewers, as well as the channel being watched on each television

set. Although criticized frequently by the networks, Nielsen data still provide the standard measure

of ratings for both network executives and advertising agencies.

Although the NPM is calibrated for measurements each minute, the data available to us

provide quarter-hour viewing decisions, measured as the channel being watched at the midpoint of

each quarter-hour block. The Nielsen data set records specific viewing choices for the four major

networks only: ABC, CBS, NBC, and FOX.

We focus on viewing choices for network television during prime time, 8:00 to 11:00 PM,

using Nielsen data from the week starting Monday, November 6, 1995. Thus, we observe viewers’

choices in 60 time slots. Figure 1 provides the prime-time schedule for the four networks over

this week. This study confines itself to East coast viewers, to avoid problems arising from ABC’s

Monday night programming.14 Finally, we eliminate from the sample viewers who never watched

television during weeknight prime time and those younger than six years of age. From this group,

we randomly selected individuals with a probability of 0.5, giving us 1675 viewers. The other 1556

are kept for predictive validation.

Nielsen also reports the age and the gender of each individual, and the income, education,

cable subscription, and county size for each household. The definitions and summary statistics of

the variables that we create appear in table 1.

2.1.1

Show Attributes

We have coded the show attributes for the relevant week based on prior knowledge, publications

about the shows, and viewing each one of them. Following previous studies, we categorize shows

13

Using 1990 Census data, the sample is designed to reflect the demographic composition of viewers nationwide.

The sample is revised regularly, ensuring, in particular, that no single household remains in the sample for more than

two years.

14

ABC features Monday Night Football, broadcast live across the country; depending on local starting and ending

times of the football game, ABC affiliates across the country fill their Monday night schedule with a variety of other

shows. Adjusting for these programming differences by region would unnecessarily complicate this study.

9

based on their genre and their cast demographics. Rust and Alpert (1984) present five show

categories–action drama, psychological drama, comedies, movies, and sport–and show that viewers differ in their preferences over these categories. We use the following categories: situation

comedies, also called sitcoms (31 shows fall into this category), action dramas (10 shows), and

romantic dramas (7 shows). The base group includes news magazines and sports events, which

Goettler and Shachar (2002) found to be similar.

Shows also were characterized by their cast demographics. Shachar and Emerson (2000)

demonstrate that the demographic match between an individual and a show’s cast plays an important role in determining viewing choices. For example, younger viewers tend to watch shows with

a young cast; older viewers prefer an older cast. We use the following categories: Generation-X,

if the main characters in a show are older than 18 and younger than 34 (21 shows fall into this

category); Baby Boomer, if the main show characters are older than 35 and younger than 50 (12

shows); Family, if the show is centered around a family (11 shows); African-American (7 shows);

Female (15 shows); and Male (22 shows).

Table 2 and figure 2 illustrate the differences in show attributes across each of the four

networks. One can see, for example, that FOX is more likely to air romantic dramas centered

around Generation-X characters, whereas ABC is more likely to offer male-starring or family sitcoms

catering to baby boomers. These statistics highlight the differences in the network profiles.

3

The Model

We start by describing the setting of the model. Then, we introduce the utility function and the

information set of the individual. Last, we present several implications of the model setup.

3.1

The setup

There are J multiproduct firms. In each period t, each firm offers a single product. Each product of

firm j is offered only once within the studied time frame. In the empirical example are 4 television

networks, with each network broadcasting only one show within each time slot t. Thus, in the

empirical example J = 4; a period, t, is also called a time-slot and lasts 15 minutes; and a product

is a television show.

There are I individuals who are indexed by i. They face J + 1 mutually exclusive and

exhaustive alternatives. The (J + 1)’th alternative is the no-purchase option. In each period t,

individual i makes a choice, Ci,t , from among these J + 1 options indexed by j. Thus, Ci,t = j

10

when individual i chooses alternative j at time t.

Since each product is offered only once, individuals cannot learn from experience about

product attributes within the studied time frame.15 Although the setting–of a firm offering a

single product in any period–might seem restrictive, it can be reinterpreted as a multiproduct

firm offering a portfolio of products at a point in time, with t indexing the product categories.

3.2

The utility

The utility from the first J alternatives is:

Ui,j,t = Xj,t β i + (ηj,t + εi,j,t ) + αi,j + δ i,j,t I{Ci,t−1 = j}

(1)

The first element of the utility represents the match between the product’s attributes, Xj,t ,

and the individual’s preferences, β i .16 The parameter vector β i is a function of observable and

unobservable individual characteristics. The specifics of Xj,t and β i for the television example

are presented in detail in section 4.1. For example, the interaction Xj,t β i includes the element

ActionDramaj,t · (β Male

AD · Malei ), where ActionDramaj,t is a binary variable equal to one if the

show on network j in period t is an action drama, and zero otherwise; and the binary variable

Malei is equal to one if individual i is male, and zero otherwise. If men like action dramas, the

parameter β Male

AD would be positive.

The utility is also a function of the products’ attributes not observed by the researcher. These

are represented by the second element of the utility–(η j,t + εi,j,t ). Common unobserved effects are

captured by the parameter η j,t , while transitory and personal effects are represented by the random

variable εi,j,t . Specifically, since some of the attributes are unobserved by the researcher, some of

the match elements will be unobserved as well. The parameter ηj,t can be thought of as the mean

(across individuals) of these unobserved matches and εi,j,t can be thought of as the deviations from

that mean. Another interpretation of the parameter ηj,t is the quality of the product. Since the

term “quality” might be misleading when describing television shows, we henceforth use the term

“unexplained popularity” to describe this parameter.17

15

Consequently, our setting is different from previous studies which examined the role of uncertainty on product

attributes (Eckstein, Horsky, and Raban 1988, Erdem and Keane 1996, Erdem 1998, and Crawford and Shum 2000).

In these studies, each product was offered multiple times within the studied time frame, therefore the researchers

focused on the dynamic learning of consumers through their experience with the product. Here, instead, consumers

can rely on the profile of the multiproduct firm to resolve their uncertainty on product attributes.

16

The variable Xj,t is a K-dimensional row-vector; and the parameter β i is a K-dimensional vector.

17

In the industrial organization literature the element Xj,t β i is called “the horizontal dimension of utility”, and

η j,t “the vertical dimension”.

11

The other elements in the utility concern its dynamic features. Specifically, the third element

of the utility, αi,j , represents the unobserved match between individual i and firm j. This parameter

is one of the sources of consumer loyalty to a multiproduct firm. It is the only element in the utility

that does not change over time (and thus does not have an index t). It appears in individual

i’s utility with each of the products offered by firm j. A positive αi,j increases individual i’s

propensity to purchase each one of firm j’s products. Earlier, we referred to this unobserved

heterogeneity parameter as a “black box” explanation for loyalty because it represents a statistical

(not behavioral) solution to account for consumer loyalty to a firm.

The fourth and last component of utility, δi,j,t I{Ci,t−1 = j}, represents the state dependence

in choices. The indicator function I{·} is equal to one if the individual purchased the product

offered by firm j in the previous period. The parameter δ i,j,t is a function of observable and unobservable individual characteristics, product attributes, and time. There are various reasons for state

dependence. For example, after getting used to a firm’s product, an individual might find it easier

or cheaper to use the subsequent product offered by the same firm. Previous studies of television

viewing choices find strong evidence of state dependence even when unobserved heterogeneity is

accounted for.18 Thus, we include this element in order to avoid misspecification of the utility. The

specifics of δ i,j,t for the television example are presented in detail in section 4.1. For example, δ i,j,t

includes the element δ F emale (1 − Malei ). If the tendency of women to flip channels were less than

for men, the parameter δF emale would be positive.

Both αi,j and δ i,j,t leads to consumer loyalty. However, while the effect of state dependence

is limited to two sequential periods, the unobserved individual-firm match leads to loyalty in any

two periods.

The utility from the outside (non-purchase) alternative is:

γ

γ + (η J+1,t + αi,J+1 + εi,J+1,t ) + δ out,i I{Ci,t−1 = (J + 1)}

Ui,J+1,t = Yi,t

(2)

γ

is a vector of individual i’s observable characteristics, and the remaining elements are

where Yi,t

18

In the television industry this well known phenomenon is called the “lead-in effect.” Darmon (1976) introduces

the concept of channel loyalty and Horen (1980) estimates a lead-in effect, both using aggregate ratings models. Rust

and Alpert (1984) use individual-level data to estimate an audience flow model, in which viewers are described as

being in one of five states according to: whether the television was previously on or off; if it was on, whether it was

tuned to the same channel as the current viewing option; and whether this option is the start or continuation of a

show. Shachar and Emerson (2000) allow state dependence to vary across shows and across demographically defined

viewer segments. Goettler and Shachar (2002) demonstrate that the cost of switching remains when unobserved

heterogeneity is accounted for.

12

analogous to those defined earlier for the J alternatives.19 Thus, the outside utility is a function

of the individual’s observed and unobserved characteristics and state dependence.

3.3

Information set

The individual is uncertain about Xj,t and η j,t . The dynamic nature of the modern economy makes

it difficult for consumers to stay informed about the attributes of all the alternatives. Today,

product diversity is constantly increasing, and new products are introduced often.20 The television

industry experiences these changes as well. Each fall, the networks introduce new shows and change

the time at which many veteran shows are aired. This, obviously, makes it difficult for viewers to

stay informed about the shows that appear on a specific time slot for all the networks. While some

information on the attributes of television shows is available in daily newspapers, many other show

attributes remain unclear.

Uncertainty about Xj,t and ηj,t leads to uncertainty about (η j,t +Xj,t β i ). Since this expression

represents the contribution of product attributes to utility, we term it “attribute utility”. We denote

this element as ξ i,j,t ≡ ηj,t + Xj,t β i .

A consumer’s information set includes (a) a prior distribution of products’ attributes, and

(b) product-specific signals such as media coverage, word-of-mouth, and previous experience with

the good. We depart from previous studies by hypothesizing that the prior beliefs depend on the

profile of the multiproduct firm. Specifically, the prior distribution of individual i on ξ i,j,t is:21

ξ i,j,t ∼ N(µi,j ,

1

ς µi,j

)

(3)

where, by definition,22

µi,j ≡ Et [ξ i,j,t ] = Et [η j,t ] + Et [Xj,t ]β i

(4)

and

1

= Vt [ξ i,j,t ]

ς µi,j

The multiproduct firm’s profile for individual i is characterized by two parameters: (1) µi,j

19

These characteristics might change over time for reasons that would become clear in Section 4.

For example, even in a small country like Israel, there are 3000 new products in the supermarkets every year

(Ha’aretz, November 1998).

21

We actually assume that both η j,t and Xj,t follow a normal distribution, and present the resulting distribution

for the “attributes utility”.

22

Et [·] is the expected value across time slots.

20

13

and (2) ς µi,j .

We assume that Et [ηj,t ], Et [Xj,t ] and Vt [ξ i,j,t ] are known to all consumers. In other words,

while the individual is uncertain about product attributes, she knows the profile of each firm. For

example, while most consumers do not know exactly the attributes of each automobile offered by

Honda, they know that Honda tends to produce gasoline-efficient cars.23

Consumers also get product-specific signals through word-of-mouth, media coverage, previous

experience with the good, and advertising. Since we do not observe these signals, we can model

them as a single signal instead of multiple signals without loss of generality. Specifically, the signal

that individual i receives on the product offered by firm j at period t is:

Si,j,t = ξ i,j,t + ωi,j,t

(5)

ω i,j,t ∼ N(0, ς ω1 )

(6)

where

i,j

The unbiased signal is assumed to be noisy, because none of these sources of information is

precise. For example, even viewing previous episodes of a show does not provide exact information

on the current one, because the focus of the show varies from week to week. While in one episode

the plot is centered on romantic issues, the next one might be focused on career matters.

We allow the precision of the signal, ς ωi,j , to differ across individuals, i, and firms, j. Differences in ς ωi,j across the firms may result from differences in the number of signals individuals

receive, since the products of some firms simply may be more well-known than of others. Intuitively, if

1

ςω

i,j

= 0 (i.e., the signal is not noisy), then exposure to a signal resolves all uncertainty

about product attributes. If ς ωi,j > 0, by contrast, an individual who is exposed to such a signal

would still not be sure about what the product attributes are.24

23

Similarly, consider the attributes of newspapers (these may include, for example, the amount of space devoted

to sensational news items or “trash”, and the amount of investigative reporting). While the level of each attribute

may differ with each daily edition of the newspaper, it is still the case that The New York Times has an image that

is quite different from The New York Post. In this example, a newspaper is the multiproduct firm and each issue of

the newspaper is a product. Similarly, consider movie stars (where the movie star is the analog of the multiproduct

firm, and each movie is a product). Although most movie stars have acted in movies of different genres, it is still

the case that most movies in which Bill Murray participates are quite different from Sylvester Stallone’s, resulting in

distinct images of actors.

24

For example, an individual may know that E.R. is a popular drama set in the emergency room of a hospital,

but may know nothing else about the show (e.g., the cast demographics, the show’s time slot, the degree of action or

romantic content, etc.).

14

3.4

Expected utility

Having described the setup of the model, the utility function, and the consumer’s information set,

we are ready to solve the expected utility. Since the only element in the utility that the individual

is uncertain about is her “attribute utility”, ξ i,j,t , we start by solving the expected attribute utility.

Individual i updates her prior using the signal to form a posterior distribution of the attributeutility, ξ pi,j,t ∼ N(µpi,j,t , ς p1 ). The mean, µpi,j,t , and precision, ς pi,j , of this posterior distribution are

i,j

given by:25

µpi,j,t =

1

ς pi,j

h

i

0

ς µi,j µi,j + ς ωi,j Si,j,t

ς pi,j = ς µi,j + ς ωi,j

(7)

(8)

0

where Si,j,t

is the realization of the signal. The precision of the posterior, ς pi,j , is the sum of the

precision of each source of information. More importantly, the expected attribute-utility, µpi,j,t , is

0 , and the mean of the firm’s

a weighted combination of the product-specific signal realization, Si,j,t

profile for individual i, µi,j . The weight on each element is a positive function of its precision. For

example, the weight on µi,j , which we denote by θi,j , is

ςµ

i,j

ω

ςµ

i,j +ς i,j

θi,j ≡

(9)

The more precise is the product-specific signal, the less important is a firm’s profile in determining

the expected attribute-utility from the product.

0

= ξ i,j,t + ω0i,j,t , where ω 0i,j,t is the realization of ω i,j,t , we can rewrite equation (7)

Since Si,j,t

as:

µpi,j,t =

where

£

¤

θi,j µi,j + (1 − θ i,j ) ξ i,j,t + ω 0i,j,t

ω i,j,t ≡

·

ςω

i,j

µ

ς i,j +ς ω

i,j

¸

(10)

ω̃ i,j,t

The researcher does not observe ω 0i,j,t . It is distributed normally with mean 0 and variance σ 2ω0 ,i,j ≡

ςω

i,j

µ

2

(ς i,j +ς ω

i,j )

25

.

See DeGroot [1989].

15

Both θi,j and σ2ω0 ,i,j can be considered as measures of how ill-informed the individual is. Each

of these parameters is a negative function of the precision of the signal, ς ωi,j . For example, whenever

the signal is noisy ( ς ω1 > 0), we get that θi,j > 0, and thus, the individual relies on the firm’s

i,j

profile when forming her expected attribute-utility. In contrast, whenever the signal is not noisy

( ς ω1 = 0), it follows that θi,j = σ2ω0 ,i,j = 0 and thus, µpi,j,t = ξ i,j,t . In other words, when the signal is

i,j

not noisy, the individual is fully informed, and thus, her expected attribute utility is equal to her

actual attribute utility. Thus, the full information model is nested within our model.

Using (4), we can rewrite the individual’s expected attribute-utility as:

­

®

µpi,j,t = θi,j Et [ηj,t ] + (1 − θi,j ) ηj,t + hθ i,j Et [Xj,t ] + (1 − θi,j ) Xj,t i β i + ω 0i,j,t

(11)

and her expected utility as:

®

­

E[Ui,j,t ] = θi,j Et [ηj,t ] + (1 − θi,j ) ηi,j + hθi,j Et [Xj,t ] + (1 − θ i,j ) Xj,t i β i

(12)

+ ω 0i,j,t + εi,j,t

+ αi,j + δ i,j,t I{Ci,t−1 = j}

In the next subsection, we derive the implications of this model. In order to assess their

novelty, we compare them to the implications of a model that differs from the suggested model in

one aspect–a consumer’s information set is not a function of multiproduct firms’ profiles. In other

1

), where µ0i,j and ς µ,0

words, the prior distribution is ξ i,j,t ∼ N(µ0i,j , ς µ,0

i,j are not a function of

i,j

the firm’s profile. It is easy to show that in such a case, the expected utility is:

E[Ui,j,t ] = ηj,t + Xj,t β i + α1i,j + εi,j,t + ω 1i,j,t + δ i,j,t I{Ci,t−1 = j}

where

α1i,j

3.5

=

αi,j + µ0i,j

and

ω 1i,j,t

=

"

ς ωi,j

ω

ς µ,0

i,j + ς i,j

#

(13)

ω i,j,t

Implications

We describe below the implications for an individual’s purchase probability, which is directly related

to her expected utility.

The first implication is that the purchase probability of a product is a function of the multiproduct firm’s profile. Since the profile is a function of the set of products offered by the firm,

16

this means that the attributes of any product offered by a firm will affect the demand for any

other product produced by this firm.26 This first implication highlights the spillover effects within

a multiproduct firm. The magnitude of the spillover effects is determined by θi,j (see equation

10). Notice that the spillover effect varies across individuals and firms. Specifically, the effect is

a negative function of the precision of the product-specific signals, ς ωi,j , and a positive function of

the precision of the firm, ς µi,j . In other words, the spillover effects are large for firms that offer

a homogenous line of products and small for (a) individuals who received many signals and (b)

products that are well known.

The second implication is that the inclusion of the multiproduct firm profile in the information

set leads to consumer loyalty. The expected utility (equation 12) includes the element θi,j Et [Xj,t ]β i

that does not vary over time (since Et [Xj,t ] is the same in every period). It appears in individual

i’s utility for each product offered by firm j. Thus, a positive match between the firms’ image

and the consumers’ taste (Et [Xj,t ]β i > 0) increases her propensity to purchase each one of this

firm’s products. We term this source of loyalty “informational attachment”. This loyalty expresses

itself in an individual’s tendency to purchase a product from the firm whose image best fits her

taste even when the specific product does not match her preferences better than the products of

the competing firms. (One might also term this phenomenon “excess loyalty”27 ). Notice that the

benchmark model seems to include a similar attachment element, αi,j + µ0i,j . However, while in

the benchmark model the α and µ cannot be distinguished empirically, one can separate these two

effects using the approach presented here (as illustrated in section 4.4). Thus, while the benchmark

model leaves the explanation of loyalty in a “black box,” we present a behavioral foundation for

such loyalty. Our explanation, based on the informational role of multiproduct firms, contrasts

with the traditional statistical solution (unobserved heterogeneity) to explain excess loyalty.

4

Estimation and identification issues

We start by specifying the exact functional forms used in the estimation. Then we construct the

likelihood function and, finally, we discuss the sources of identification of the model’s parameters.

26

Thus, when a firm replaces some of its products with new ones that differ in their attributes from the previous

ones, it is altering its image and, therefore, affecting the demand to each one of its existing products. As an illustration,

Julia Roberts’s image as an actress in “light” movies may have changed after Mary Reilly.

27

Recall that the model includes additional sources of loyalty: (a) the unobserved individual-firm match, αi,j , and

(b) the state dependence parameters, δ i,j,t .

17

4.1

4.1.1

Functional form and structure

Utilities

The following equations present each of the elements in the utility for the television example and

specify its full structure.

Attribute utility We formulate the attribute utility as:

ηj,t + Xj,t β i = η j,t + β Gender I{the gender of viewer iand show j, t is the same}

+β Age0 I{the age group of viewer i and show j, t is the same}

+β Age1 I{the distance between the age group of viewer i and the cast of show j, t is one}

+β Age2 I{the distance between the age group of viewer i and the cast of show j, t is two}

+β F amily I{ilives with her family and show j, t is about family matters}

+β Race Incomei I{one of the main characters in show j, t is African American}

+Sitcomj,t (β Sitcom Yiβ + viSitcom )

+ActionDramaj,t (β AD Yiβ + viAD )

+RomanticDramaj,t (β RD Yiβ + viRD )

where Yiβ is a vector of individuals’ observable characteristics that include T eensi , GenerationXi ,

BabyBoomeri , Olderi , F emalei , Incomei , Educationi , F amilyi , and Urbani . These variables are

defined in the appendix. The parameters viSitcom , viAD , and viRD capture unobserved individual

tastes for sitcoms, action dramas, and romantic dramas, respectively.

The first six β parameters capture the effect of cast demographics on choices. As mentioned

above, previous studies demonstrated that viewers have a higher utility from shows whose cast

demographics are similar to their own. Thus, we expect to find that: (1) β Age0 > β Age1 > β Age2 ,

(2) β Gender > 0, (3) β F amily > 0 and (4) β Race < 0. We use individuals’ income as a proxy

for her race, since information on race is not included in our data set.28 The taste for different

show categories is a function of observed (Yiβ ) and unobserved (viSitcom , viAD , viRD ) individual

28

The proportion of African-Americans in the highest income category is disproportionately low, while it is disproportionately high in the lowest income category. This relationship persists for all income categories in between

as well (U.S. Census Bureau 1995). Nielsen designed the sample to reflect the demographic composition of viewers

nationwide and used 1990 Census data to achieve the desired result. We found that the income categories and the

proportion of African-Americans in the Nielsen data closely match those in the U.S. population (National Reference

Supplement 1995). Although our data set does not include information about race, Nielsen has it and reports its

aggregate levels.

18

characteristics. Each of these interactions between show category and individual characteristics

is captured through a unique parameter. For example, the interaction between an Action Drama

emale

. All other parameters are denoted accordingly.

show and a female viewer is captured via β FAD

While we can, theoretically, estimate an η j,t for each time slot-alternative combination (subject to one normalization), we choose to fix the “unexplained popularity” parameter (η) for the

duration of each show. Consequently, a half-hour show and a two hour movie both have one η

parameter. Given our intent in uncovering fundamental attributes of the shows, this is a natural

restriction.

State dependence parameters The utility presented in equation (1) included a state dependence element, δ i,j,t I{Ci,t−1 = j}. Here we specify the structure of δ i,j,t and extend the state

dependence to include another element. Specifically, we formulate the state dependence in the

network utility as:

δ i,j,t I{Ci,t−1 = j}

+ δ InP rogress I{Ci,t−1 6= j}I{The show on j started at least 15 minutes ago}

where

δ δ X + vδ

Yiδ δ Y + Xj,t

i

+δ

F irst15 I{The show on j started within the past 15 minutes}

δ i,j,t =

+δ Last15 I{The show on j is at least one hour long and will end within 15 minutes}

+δ Continuation I{The show on j started at least 15 minutes ago}

where the observed variables included in Yiδ are T eensi , GenerationXi , BabyBoomeri , Olderi ,

δ inF emalei , F amilyi , and cable subscription status (Basici and P remiumi ), and the vector Xj,t

cludes the following show categories: Sitcomj,t , ActionDramaj,t , RomanticDramaj,t , NewsMagazinej,t

and Sportj,t . The binary variable Basici is equal to one for the one third of the population that

has access to basic cable offerings only, and the binary variable P remiumi is equal to one for the

one third of the population that has both basic and premium cable offerings. The binary variable

Sportj,t is equal to one for the sport shows (Monday Night Football on ABC and Ice Wars on CBS),

and the binary variable NewsMagazinej,t is equal to one for news magazines (e.g., 48 Hours on

CBS).

We allow the state dependence parameters to vary across age groups, gender, and family

status because previous studies (Bellamy and Walker 1996) find preliminary evidence suggesting

differences in the use of the remote control across these groups. We also allow these parameters to

19

differ across individuals for unobserved reasons through viδ .

These parameters can differ across show types as well. For example, we may expect δ to be

smaller for sports shows, since there is no clear plot in these shows when compared with dramas.

Finally, we allow the state dependence parameters to depend on time. Specifically, we expect

δ to be low in the first 15 minutes of a show, since the viewers have not had enough time to “get

hooked” by the show. For the same reason, we expect the state dependence to be high during the

last 15 minutes of a show. Furthermore, we expect that the state dependence is higher during a

show than between shows (δ Continuation > 0). Last, δ InP rogress applies to individuals who were not

watching network j in the previous time slot. Since the tendency to tune into a network to watch a

show that has already been running for at least 15 minutes should be lower than for a show which

has been on the air for less than 15 minutes, δInP rogress is expected to be negative.

We formulate the state dependence parameters in the outside utility as:

δ out,i I{Ci,t−1 = (J + 1)} =

Yiδ δ Y + viδ

+δout + δ Hour I{The time is either 9:00 PM or 10:00 PM}

+δF OX10:00 I{Ci,t−1 = F OX}I{The time is 10:00 PM}

I{Ci,t−1 = (J + 1)}

Individual characteristics (Yiδ δ Y + viδ ) are included in exactly the same way for the outside

alternative because they are meant to represent behavioral attributes intrinsic to individuals. Since

the outside alternative includes the option to watch non-network shows, we allow the state dependence parameters to change “on the hour”. Notice that many non-network shows end on the hour,

and thus we expect the δ to be lower at that time (δ Hour < 0). Furthermore, since FOX ends its

national broadcasting at 10:00 PM our data cannot distinguish between viewers who stayed with

FOX thereafter and those who chose the outside alternative. Thus, we expect δ F OX10:00 to be

positive.

Outside alternative Other than the standard observable individual characteristics (age,

gender, income, education, family status, and area of residence), the vector Yiγ includes the variables Basici , P remiumi , Alli , and Samei,t . The cable subscription status is included here since

the outside alternative includes the option of watching non-network shows–viewers with basic or

premium cable have a larger variety of choices, which can lead to a higher utility. The variable

Alli is equal to the average time the individual watched television during the previous days of the

20

week, and Samei,t is equal to the average time she watched television in the corresponding time

slot, t, during the previous days of the week. Individuals’ tendencies to watch television cannot be

fully explained by their demographic characteristics. Thus, their prior viewing habits (Alli , and

Samei,t ) and the personal unobserved parameters αi,J+1 are designed to capture other sources of

such differences. We allow αi,J+1 to differ across different hours of the night. Furthermore, since

our data set starts on Monday, the variables Alli , and Samei,t , based on viewing habits in the previous days of the week, have missing values for this day. We include specific parameters to account

for this: γ Monday8:00 is added to the outside utility for the first hour on Monday night prime time,

and γ Monday9:00 and γ Monday10:00 are defined analogously.

Finally, although we can, in principle, estimate η J+1,t for each of the 60 time slots of the

week, we impose the following restriction:

η J+1,t = η J+1,t+12 = η J+1,t+24 = ηJ+1,t+36 = ηJ+1,t+48 for t = 1, ..., 12.

This implies that the outside utility between 8:00 and 8:15, for example, is the same across all the

nights of the week. This allows us to identify the expected increase in the outside utility during

the night, but with 12 parameters instead of 60.

4.1.2

The profile of a multiproduct firm

The prior distribution was defined in (4) by two parameters µi,j ≡ Et [ξ i,j,t ] and

1

ςµ

i,j

= Vt [ξ i,j,t ].

T

T

P

P

(η̂j,t + Xj,t · β̂ i ) and ς̂ µi,j =

These parameters are estimated as follows: µ̂i,j = T1

ξ̂ i,j,t = T1

t=1

t=1

µ

i2 ¶−1

T h

P

1

. In other words, we use the empirical moments of ξ̂ i,j,t to estimate the

ξ̂ i,j,t − µ̂i,j

T −1

t=1

expectation and variance of ξ i,j,t .

It is known in the television industry that programming between 10:00 and 11:00 PM is

somewhat different than that between 8:00 and 10:00 PM. For example, the networks do not

schedule any sitcoms after 10:00 PM. Since this strategy is well-known, viewers are likely to have

different prior beliefs about the scheduling for these two parts of the night. Therefore, we set two

prior distributions for each network. Each one of these priors depends only on the shows scheduled

during the relevant part of the night.29

29

That is, for example, for shows aired between 8:00 to 10:00 PM, µ̂8−10

=

i,j

all the time slots between 8:00 and 10:00 PM during the week.

21

1

40

P

t²t8−10

ξ̂ i,j,t , where t8−10 is the set of

4.1.3

Density functions

We assume that the εi,j,t are drawn from independent and identical Weibull (i.e., independent type

I extreme value) distributions. As McFadden (1973) illustrates, under these conditions the viewing

choice probability is multinomial logit.

Define the vector vi as (αi,ABC , αi,CBS , αi,NBC , αi,F OX , αi,OU T,8:00 , αi,OU T,9:00 , αi,OU T,10:00 ,

viSitcom ,

m

m

m

viAD , viRD , viδ , ς m

i,ABC , ς i,CBS , ς i,NBC , ς i,F OX ). That is, vi represents all the unobserved

personal parameters of the model. Define the joint density function of this vector by φ(v). Following

Kamakura and Russell (1989), this function is assumed to be discrete. Specifically, vi = vk with

probability PKexp(λk )

k=1

exp(λk )

for all k. This means that we allow the population to be divided into K

different unobserved segments. The number of types K is determined using various information

criteria.

4.1.4

Normalizations

Since we have five alternatives in each time slot, we can only identify four αs. Thus, we normalize

αk,ABC = 0 for each type k.

Since we include all the age categories in Yiβ , one needs to normalize the viSitcom , viAD , viRD

for one of the unobserved types, therefore we set vkSitcom =vkAD = vkRD = 0 for k = 1. Also, since

all the age categories are included in Yiγ , one needs to normalize the αi,J+1 for one of the types;

we do so by setting αk,J+1,8:00 =αk,J+1,9:00 =αk,J+1,10:00 = 0 for k = 1. Similarly, since all the age

categories are included in Yiδ , one needs to normalize the viδ for one of the types; to do so, we set

vkδ = 0 for k = 1.

To normalize one of the ηJ+1,t , we set η J+1,8:00 = 0. Finally, since we include all the show

δ , we need to normalize one of them, therefore we set δ

categories in Xj,t

NewsMagazine = 0.

Since all the age categories are included in Yiγ , one needs to normalize the η j,t of one of the

shows, therefore we set η of FOX’s X Files to be equal to zero. Furthermore, since we estimate the

ηj,t for each show, we are required to normalize one of the β Age parameters, and the β Sitcom , β AD

eens

eens

eens

and β RD for one age group. We do so by setting β Age2 = β TSitcom

= β TAD

= β TRD

= 0.

Finally, we cannot estimate all K values of λk (which determine the size of the types).

Therefore, we set λk = 0 for k = 1.

4.2

The likelihood function

For the econometrician, the viewing choice is probabilistic, since we do not observe εi,j,t . Furthermore, since the εi,j,t are independent over time, the conditional probability of each viewer’s

22

history of choices for the entire week, Ci = (Ci1 , . . . , CiT ), is simply the product of the conditional

probabilities of each of the choices made at each quarter-hour. That is, for a type k person,

f1 (Ci |Wi ; vk , ω 0i , Ω) =

J

P

[I{Ci,t = j} exp(U i,j,t (Ci,t−1 , Wi,j,t , vk , ω 0i,j,t , Ω))]

T

Y

j=1

t=1

J

P

j=1

(14)

exp(U i,j,t (Ci,t−1 , Wi,j,t , vk , ω 0i,j,t , Ω))

where Wi,j,t is a vector of all the observable variables in the model (that is, Xj,t and Yi ); Wi =

S

j,t Wi,j,t ; Ω is the vector of the parameters common to all individuals (that is η j,t , β Gender , β Age0 ,

β Age1 , β Age2 , β F amily , β Race , β Sitcom , β AD , β RD , δ Y , δ X , δ F irst15 , δ Last15 , δ Continuation , δ InP rogress ,

S

δ out , δ Hour , δ F OX10:00 , and γ); ω0i = j,t ω 0i,j,t and U i,j,t (·) ≡ Ui,j,t (·) − εi,j,t . Specifically,

U i,j,t (·) =

1

ς pi,j

h

i

ς µi,j µi,j + ς ωi,j ξ i,j,t + ω 0i,j,t + αi,j

+ δ i,j,t I{Ci,t−1 = j}

(15)

+ I{Ci,t−1 6= j}I{The show on j started at least 15 minutes ago}δ InP rogress

Since we do not observe each viewer’s type and signals, we integrate out unobservable parameters

and variables. The resulting marginal distribution is

0

f2 (Ci |Wi ; Ω , Pω ) =

Z X

K

exp(λk )

pω (z)dz

f1 (Ci |Wi ; vk , z, Ω) PK

k=1 exp(λk )

k=1

(16)

where Ω0 includes Ω, the vk s, and the λs; and pω (z) is the density function of the true distribution

of the ω 0i,j,t , Pω .

Notice that for individual i the variable ω 0i,j,t is constant for the duration of each show. Thus,

the integral over z represents 64 integrals for the 64 shows in the week for each individual. Finally,

notice that since the ω 0i,j,t are show specific, each one of them appears in at most 8 time slots.

Thus, none of the integrals should include the entire history of viewing choices. For example, on

Wednesday between 10:00 and 11:00 PM, each of the three major networks airs a one-hour show.

Thus, the integrals of the ω 0i,j,t of these shows apply only to the choice probabilities of that hour.

We rewrite the likelihood following this simplification in the most compact way.

23

4.3

Simulating the marginal probability

Since ω 0i,j,t is normally distributed, the integral in equation (16) does not have a closed-form solution.

A consistent and differentiable simulation estimator of f2 (·) is

R

K

1 XX

exp(λk )

fˆ2 (Ci |Wi ; Ω0 , PωR ) =

f1 (Ci |Wi ; vk , zr , Ω) PK

,

R r=1

k=1 exp(λk )

(17)

k=1

where the z’s are randomly drawn from the population density, PωR . The Maximum Simulated

Likelihood (MSL) estimator is

Ω̂MSL = argmax

I

X

i=1

h

i

log fˆ2 (Ci |Wi,j,t ; Ω0 , PωR ) ,

(18)

where I denotes the number of individuals. As explained in McFadden (1989) and Pakes and

Pollard (1989), the R variates for each individual’s ω must be independent and remain constant

throughout the estimation procedure. A drawback of using MSL is the bias of Ω̂MSL due to the

logarithmic transformation of f2 (·). Despite this bias, the estimator obtained by MSL is consistent

if R → ∞ as I → ∞, as detailed in Proposition 3 of Hajivassiliou and Ruud (1994). To attain

negligible inconsistency, Hajivassiliou (1997) suggests increasing R until the expectation of the score

function is zero at Ω̂MSL .30 In our case, this is achieved at R = 400.

In order to reduce the variance of fˆ2 (·), we employ importance sampling as described in the

MC literature (see Rubinstein 1981). Our importance sampler is similar to the one used in Berry,

Levinsohn, and Pakes (1994). We draw the z’s from a multivariate normal approximation of each

person’s posterior distribution of z, given some preliminary MSL estimate of Ω, and appropriately

weight the conditional probabilities to account for the oversampling from regions of z that lead to

higher probabilities of i’s actual choices.

4.4

Identification

We start by considering the identification of a model with full information (that is, under the

assumption that

1

ςω

i,j

= 0 for all i and j). This discussion illustrates which parameters can be

identified without the restrictions and additional variables of the partial information model.

30

We simulate all stochastic components of the model to construct an empirical distribution of the score function

at Ω̂MSL . A quadratic form of this score function is asymptotically distributed χ2 with degrees of freedom equal to

the number of parameters estimated.

24

4.4.1

Identification of a model with full information

The parameters β Gender , β Age0 , β Age1 , β Age2 , β F amily , β Race , β Sitcom , β AD , β RD are identified by

the correlation between Xj,t · Yiβ and viewer choices. For example, if (conditional on all other

elements of the model) the proportion of females, among viewers who watch romantic dramas, is

emale

higher than the proportion of males, then the estimate of females’ taste for such shows, β FRD

,

would be higher than males’, β Male

RD .

The unobserved tastes for show categories (the parameters viSitcom , viAD , viRD ) are identified

by viewer choice histories over show types. To clarify, assume there are no observed individual

characteristics, Yi . Now, consider the case when, on a particular evening, a network switches from

a sitcom to a drama (as CBS does at 9:00 PM on Wednesday). Then, if (conditional on all other

elements of the model) a large proportion of viewers that were watching CBS were found to switch

to a different network that airs sitcoms (indeed, 32 percent of the CBS viewers switched to the

ABC sitcom), then we identify an unobserved segment who likes sitcoms.

The δ parameters are identified by the conditional state dependence–that is, by the share

of viewers who remain with an alternative over two sequential time slots, conditioning on Xj,t . For

example, we find that female viewers like to watch romantic shows. If one of the networks switched

from a romantic show to an action drama (e.g., CBS on Wednesday at 10:00 PM)–which female

viewers dislike–and many female viewers did not switch to the network that aired romantic shows,

then that would be an indication of a positive δ.

The parameter αi,j is identified by the history of viewer choices of networks. That is, if

a segment of viewers spent most of its time watching the shows on network j independent of the

characteristics of these shows, then we identify an unobserved segment whose αi,j with this network

is positive.31

Finally, the parameter η j,t is identified by the aggregate ratings, conditional on the show’s

characteristics.

4.4.2

Identification of a model with partial information

The partial information model imposes some restrictions on the parameters and introduces new

explanatory variables. These identify the information set parameters. We start by discussing the

31

As discussed in the literature, there are various sources of identifying δ separate from α. See Chamberlain (1985)

and Shachar (1994). The outside alternative provides us with an additional identifying source. When turning on the

television, the individual’s “state” (lagged choices) does not attach her to any network. Thus, her viewing choice is

influenced by α (and show characteristics), but not by δ.

25

estimation of the prior distribution parameters and proceed (in the next subsection) by presenting

the identification of the signals’ parameters.

Recall that the estimation of the prior distribution parameters was already discussed in subsection 4.1.2. Once the parameters β and η are identified, we also have all the variables which are

a function of them, i.e., ξ i,j,t , µi,j and ς µi,j .

Since one of the advantages of our model is the empirical distinction between αi,j and µi,j , it

T

P

is worth clarifying the identifying source of this distinction. In the model we set µ̂i,j = T1

ξ̂ i,j,t =

t=1

¶

µ

T

T

1 P

1 P

η̂

+

Xj,t β̂ i ). Thus, the identification of µi,j is based on the introduction of a new

j,t

T

T

t=1

t=1

P

explanatory variable–the mean offering of each network (for example, T1 t Xj,t for network j).

The following exercise might shed some additional light on the distinction between the two

sources of loyalty, αi,j and µi,j . Assume that we estimate the benchmark model (that does not

include the multiproduct firm profile in the information set). Since we have a long panel for each

viewer, we can estimate an individual—firm match parameter for each combination of individual

and firm. We denote this “fixed effect” as Li,j and note that it has 6700 different values (i.e.,

JI). After we estimate Li,j using the benchmark model, we can run the following regression:

P

Li,j = aj +b( T1 t Xj,t )+εL

i,j . We estimate the parameters aj and b and then calculate the predicted

value of the error term, ε̂L

i,j . We can now separate between the observed individual—network match,

1 P

b̂( T t Xj,t ), and the unobserved match, ε̂L

i,j . In the estimation of our model (versus the benchmark

model) this separation between the observed match, µi,j , and the unobserved match, αi,j , is built

into the likelihood function, because the model includes the multiproduct firms’ profiles in the

information set.

In other words, µi,j is identified by the loyalty of viewer i to network j correlated with the

attributes of i and j, whereas αi,j is identified by non-systematic (random) loyalty.

Precision of information signals We are now ready to discuss the identification of the precision

of the product-specific signals, ζ ωi,j .

Notice that ζ ωi,j enters the likelihood via U i,j,t in (15) in two places. First, it determines the

relative weight on ξ i,j,t versus µi,j . Second, it determines the variance of ω 0i,j,t (via pω (•) in equation

(16)). It follows that ζ ωi,j has two sources of identification. The first is the effect of firms’ profiles

on product choices. If the individual were fully informed, she would base her product choices on

show attributes only, and place zero weight on the network images. When the individual places

zero weight on a network’s image, θi,j = 0 and from equation (9) we get that

1

ζω

i,j

= 0, that is, the

signal is not noisy. Conversely, the stronger the effect of the networks’ image on product choices,

26

the smaller the estimate of ζ ωi,j . Notice that this source of identification relies on observed product

and firm attributes.

The second source of identification relies on the variance of ω 0 . In the model, the larger the

variance of ω 0i,j,t , the smaller the correlation between product attributes and choices.32 Since the

variance ω 0i,j,t is a function of ζ ωi,j , the correlation between choices and product attributes assists us

in identifying the precision of the product-specific signal.

5

Results

Our model has various implications (for example, relating to the variance of the unobservables)

which assist in its empirical identification. Before estimating the structural model that incorporates all these implications, we first examine a simpler version of the model that embodies a key

implication–specifically, that product purchase probabilities depend not only on product attributes

but also on the profile of firms. Recall that we have offered two measures of how ill-informed the

individual is: θ and the variance of ω0 . In the non-structural estimation, we show only that θ is

positive and statistically different from zero.33

5.1

Non-structural estimation

We estimate a simple version of the model described earlier in order to focus on the role of firm

profiles on product choices. This model differs from the one presented earlier in the following

ways: (1) the structure of the δ and γ parameters is simpler, and there are no show-specific η 34 (2)

ω 0i,j,t = 0, and (3) instead of imposing any structure on θi,j as in (9), we estimate it directly as a

free parameter θ. Thus, the mean posterior is:

µpi,j,t =

¶

µ

T

P

θ[ T1

Xj,t ] + (1 − θ)Xj,t β

(19)

t=1

As demonstrated in section 3, the full information model predicts that θ = 0, whereas the partial

information model implies that θ 6= 0.

32

An easy way to think about this effect is by analogy with a simple regression model. Consider the case where

Yi = α + βXi + εi . We know that the larger the variance of εi , the smaller the observed correlation between Yi and

Xi . ω 0i,j,t plays a role in our model similar to the role of εi in this simple regression.

33

(1) We estimate our model using Gauss 4.0 on a Pentium Pro processor.

(2) The number of unobserved segments K–determined by minimizing the Bayes Information Criterion (BIC)–in

both the structural and non-structural model is 5.

(3) All estimated parameters which are not reported here are posted on: http://www.tau.ac.il/~rroonn/Vitae.html

34

Specifically, we estimate only three δ parameters (δ 0 , δ Continuation , and δOutside ) and we do not estimate a

separate γ for every 15 minutes (η J+1,t = η for every t).

27

Our estimate of θ is 0.56 and is significantly different from zero (at the 0.01 significance level),

easily rejecting the hypothesis that individuals are fully informed. This result implies that individuals use the image of the networks to resolve some of their uncertainty about product attributes.

In fact, the coefficient estimates suggest that the effect of the firm attributes is larger than the

effect of show attributes on utilities. The following simple example illustrates the magnitude of the

impact of network profiles on choices. For individuals who most prefer sitcoms in our sample, the

probability of watching the ABC sitcom Grace Under Fire is 0.11. If ABC were to replace all its

action dramas with sitcoms, that individual’s probability of watching this same show would instead

have been 0.16.35

Notice that the parameter θ is identified directly from the correlation between viewing choices

and the average firm µi,j . It therefore serves as a simple test that can be conducted by any researcher

to assess the role of uncertainty and the importance of firm profiles on product choices. The

structural estimation that follows identifies the parameters of the information set by exploiting

all the implications of the model rather than a single one. That is, it ensures that additional

restrictions imposed by the theory are satisfied (for example, θ depends on the variance of the

underlying show attributes). Furthermore, the estimates of the utility parameters and information

set allows us to conduct various counterfactual simulations as part of several applications.

5.2

Structural estimation

In this section, we first present the estimates of the parameters of the utility. Following that, we

present the estimates of the parameters of the information set.

The integral in equation (17) is evaluated numerically using importance sampling with 400

points from a Sobol sequence, as detailed in section 4.3. The (asymptotic) standard errors are

derived from the inverse of the simulated information matrix.36

We report the results for a model with 5 segments (K = 5) in tables 3(a)-3(f). The number

of unobserved segments was determined by minimizing the Bayes Information Criterion (BIC).

The largest segment consists of about 41% of the population, while the proportion of the smallest

segment is about 13%. The sizes of the other segments are 0.18, 0.14, and 0.14.

35

Specifically, the viewing probabilities are those of an individual in the largest segment (that with the highest

β Sitcom ) for the first timeslot of Grace Under Fire, conditional on her actual choices in the previous time slot. The

µi,j of ABC is computed as the average of individuals’ µi,j for ABC (i.e., j = 1), for individuals of this segment. This

average µi,j is 0.33 for ABC using its actual programming lineup, and 1.31 if it replaced all its action dramas with

sitcoms.

36

The reported standard errors, therefore, neglect any additional variance due to simulation error in the numerical

integration.

28

5.2.1

Show attributes (βs and ηs)

A meaningful way to illustrate the effects of all the parameters is in terms of probabilities. To do

so, we define a baseline viewer–she is 30 years old, lives alone, in an urban area, and has median

income and education level. Furthermore, she is part of the largest unobserved segment.