This article was downloaded by: [132.66.235.218] On: 08 June 2015,... Publisher: Institute for Operations Research and the Management Sciences (INFORMS)

advertisement

![This article was downloaded by: [132.66.235.218] On: 08 June 2015,... Publisher: Institute for Operations Research and the Management Sciences (INFORMS)](http://s2.studylib.net/store/data/013193492_1-d6c6dbc1bb63818ce598316b37b09487-768x994.png)

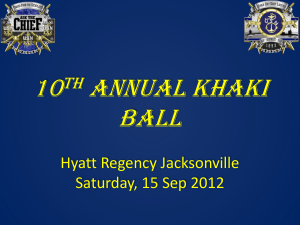

This article was downloaded by: [132.66.235.218] On: 08 June 2015, At: 01:08 Publisher: Institute for Operations Research and the Management Sciences (INFORMS) INFORMS is located in Maryland, USA Management Science Publication details, including instructions for authors and subscription information: http://pubsonline.informs.org Revisiting Almost Second-Degree Stochastic Dominance Larry Y. Tzeng, Rachel J. Huang, Pai-Ta Shih, To cite this article: Larry Y. Tzeng, Rachel J. Huang, Pai-Ta Shih, (2013) Revisiting Almost Second-Degree Stochastic Dominance. Management Science 59(5):1250-1254. http://dx.doi.org/10.1287/mnsc.1120.1616 Full terms and conditions of use: http://pubsonline.informs.org/page/terms-and-conditions This article may be used only for the purposes of research, teaching, and/or private study. Commercial use or systematic downloading (by robots or other automatic processes) is prohibited without explicit Publisher approval, unless otherwise noted. For more information, contact permissions@informs.org. The Publisher does not warrant or guarantee the article’s accuracy, completeness, merchantability, fitness for a particular purpose, or non-infringement. Descriptions of, or references to, products or publications, or inclusion of an advertisement in this article, neither constitutes nor implies a guarantee, endorsement, or support of claims made of that product, publication, or service. Copyright © 2013, INFORMS Please scroll down for article—it is on subsequent pages INFORMS is the largest professional society in the world for professionals in the fields of operations research, management science, and analytics. For more information on INFORMS, its publications, membership, or meetings visit http://www.informs.org MANAGEMENT SCIENCE Vol. 59, No. 5, May 2013, pp. 1250–1254 ISSN 0025-1909 (print) ISSN 1526-5501 (online) http://dx.doi.org/10.1287/mnsc.1120.1616 © 2013 INFORMS Revisiting Almost Second-Degree Stochastic Dominance Downloaded from informs.org by [132.66.235.218] on 08 June 2015, at 01:08 . For personal use only, all rights reserved. Larry Y. Tzeng Department of Finance, National Taiwan University, Taipei 106, Taiwan; and Risk and Insurance Research Center, National Chengchi University, Taipei 116, Taiwan, tzeng@ntu.edu.tw Rachel J. Huang Graduate Institute of Finance, National Taiwan University of Science and Technology, Taipei 106, Taiwan; and Risk and Insurance Research Center, National Chengchi University, Taipei 116, Taiwan, rachel@mail.ntust.edu.tw Pai-Ta Shih Department of Finance, National Taiwan University, Taipei 106, Taiwan, ptshih@management.ntu.edu.tw L eshno and Levy [Leshno M, Levy H (2002) Preferred by “all” and preferred by “most” decision makers: Almost stochastic dominance. Management Sci. 48(8):1074–1085] established almost stochastic dominance to reveal preferences for most rather than all decision makers with an increasing and concave utility function. In this paper, we first provide a counterexample to the main theorem of Leshno and Levy related to almost seconddegree stochastic dominance. We then redefine this dominance condition and show that the newly defined almost second-degree stochastic dominance is the necessary and sufficient condition to rank distributions for all decision makers excluding the pathological concave preferences. We further extend our results to almost higher-degree stochastic dominance. Key words: stochastic dominance; almost stochastic dominance; risk aversion History: Received November 16, 2011; accepted July 6, 2012, by Peter Wakker, decision analysis. Published online in Articles in Advance November 28, 2012, and updated December 10, 2012. 1. Introduction with utility u4z5 = z if z ≤ 1 and u4z5 = 1 if z > 1 would prefer lottery Y to X. Because this preference does not represent most decision makers, it is ruled out. Roughly speaking, decision makers with extreme preferences, e.g., zero and/or infinite marginal utility, are considered pathological and are eliminated in LL’s set of decision makers. Moreover, LL further showed that almost first-degree stochastic dominance (AFSD) and almost second-degree stochastic dominance (ASSD) are the necessary and sufficient conditions to rank distributions for their defined set of decision makers, respectively. Since Leshno and Levy’s study, several papers have further applied their theorem. For example, Levy et al. (2010) constructed several experiments to show that the almost stochastic dominance (ASD) rule corresponds to sets of nonpathological preferences. Regarding investment strategies, Bali et al. (2009) used data from the United States to show that the ASD approach unambiguously supports the popular practice that suggests a higher stock-to-bond ratio for long investment horizons. Bali et al. (2011) further adopted the ASD rule to examine the practice of investing in stock market anomalies; they found that the ASD rule provides evidence for “the significance of size, short-term reversal, and momentum for short investment horizons and the significance of book-to-market and longterm reversal for longer term horizons” (p. 28). Stochastic dominance has long served as one of the main rules used to rank distributions. This rule can rank the distributions for all utility functions in a certain class. For example, second-degree stochastic dominance (SSD) ranks the distributions for all individuals with increasing and concave utility functions. Hundreds of papers have been devoted to this topic and have applied this rule to various fields of economics, finance, and statistics since the distinguished papers of Hadar and Russell (1969), Hanoch and Levy (1969), and Rothschild and Stiglitz (1970). See Levy (1992, 1998) for a useful survey of stochastic dominance and for further analyses. Yet, in terms of holding for all decision makers with an increasing and concave utility, a small violation of the stochastic dominance rules makes the ranking invalid. Leshno and Levy (2002) (hereafter, LL) offered an example: A lottery X with a 0.01 probability of obtaining 0 and a 0.99 probability of obtaining one million dollars does not stochastically dominate another lottery Y that yields one dollar for sure, and vice versa. Yet it is not surprising that most individuals prefer X to Y . To complement the above drawback of stochastic dominance, LL provided an intriguing way of imposing restrictions on the first and second derivatives of utility so that the preferences that do not represent most decision makers are excluded. LL demonstrated that an individual 1250 Tzeng, Huang, and Shih: Revisiting Almost Second-Degree Stochastic Dominance 1251 Downloaded from informs.org by [132.66.235.218] on 08 June 2015, at 01:08 . For personal use only, all rights reserved. Management Science 59(5), pp. 1250–1254, © 2013 INFORMS Although LL’s theorem has been widely applied, we find that the main theorem of LL related to ASSD is not valid. In this paper, we first provide a counterexample to the main theorem of LL related to ASSD. We then redefine ASSD and show that our defined ASSD is the necessary and sufficient condition for all decision makers excluding the “pathological concave preferences” (Bali et al. 2009, p. 819) used to rank distributions. Finally, we generalize our results to almost N th-degree stochastic dominance (ANSD). We demonstrate the necessary and sufficient conditions on distributions for all individuals excluding the pathological higher-order preferences (defined in §4). 2. Discussion on Leshno and Levy’s Characterization of ASSD where U1 denotes the utility set with u0 ≥ 0, and U2 denotes the utility set with u0 ≥ 0 and u00 ≤ 0; is in the range of 401 12 5. Note that used in Equation (1) could be different from used in Equation (2). The random variable X is in the range of 6 x1 x̄7. Furthermore, LL defined the AFSD and ASSD as follows (see p. 1080). Although the first part of the above theorem is correct, the second part is not. We provide a counterexample to the second part of LL’s theorem in Appendix A. Definition 2 (ASSD). For 0 < < 12 , F dominates G almost45 by -almost SSD (F 2 G) if and only if Z 6F 425 4x5 − G425 4x57 dx ≤ F 425 − G425 1 (8) Ŝ2 and EF 4X5 ≥ EG 4X5, where Z x̄ F 425 − G425 = F 425 4x5 − G425 4x5 dx0 FSD Now, with the new definition of -almost SSD, we can correct the second part of Theorem 2 in LL as follows. (3) Theorem 1 (ASSD). For all u in U2∗ 45, EF 4u5 ≥ EG 4u5 if and only if Z 6F 425 4x5 − G425 4x57 dx ≤ F 425 − G425 1 (9) SSD Ŝ2 (4) and EF 4X5 ≥ EG 4X5. Proof. See Appendix B. S2 and EF 4X5 ≥ EG 4X5, where (5) S1 4F 1 G5 = 8x ∈ 6 x1 x̄72 G4x5 < F 4x591 Z x Z x S2 4F 1 G5 = x ∈ S1 4F 1 G52 G4t5 dt < F 4t5 dt 1 (6) x and F − G = x x̄ Z F 4x5 − G4x5 dx0 x A Characterization of ASSD In this section, we redefine ASSD and further provide the correct necessary and sufficient condition. Note that we do not change the definition of U2∗ 45 in LL. First, let us define the set of Ŝ2 as Ŝ2 4F 1 G5 = x ∈ 6 x1 x̄72 G425 4x5 < F 425 4x5 1 (7) R R x x where F 425 4x5 = x F 4t5 dt and G425 4x5 = x G4t5 dt. It is obvious that Ŝ2 is not necessarily included in S1 and S2 4F 1 G5 ⊂ Ŝ2 4F 1 G5. We can redefine ASSD as follows. x S1 (2) ASSD. F dominates G by -almost almost45 (F 2 G) if and only if Z 6F 4x5 − G4x57 dx ≤ F − G1 Alleged Theorem 1 (LL’s Theorem 1). (1) AFSD. F dominates G by -almost FSD almost45 4F 1 G5 if and only if for all u in U1∗ 45, EF 4u5 ≥ EG 4u5. (2) ASSD. F dominates G by -almost SSD almost45 G5 if and only if for all u in U2∗ 45, EF 4u5 ≥ 4F 2 EG 4u5. 3. Let us first briefly describe the results of LL. They imposed the following restrictions on the utility function (see p. 1079): U1∗ 45 = u ∈ U1 2 u0 4x5 ≤ inf8u0 4x5961/ − 17 ∀ x 1 and (1) U2∗ 45 = u ∈ U2 2 − u00 4x5 ≤ inf8−u00 4x5961/ − 17 ∀ x 1 (2) Definition 1. For 0 < < 12 , (1) AFSD. F dominates G by -almost almost45 (F 1 G) if and only if Z 6F 4x5 − G4x57 dx ≤ F − G0 Let EF 4u5 and EG 4u5 denote the expected utility under distributions F and G, respectively. LL further provided the following theorem. 4. Almost N th-Degree Stochastic Dominance The previous section provides the distribution conditions for all decision makers excluding the pathological concave preferences. Recently, the literature has paid much attention to higher-order preferences (Eeckhoudt and Schlesinger 2006, Denuit and Eeckhoudt 2010). However, the conditions to rank Tzeng, Huang, and Shih: Revisiting Almost Second-Degree Stochastic Dominance Management Science 59(5), pp. 1250–1254, © 2013 INFORMS distributions in the sense of stochastic dominance for individuals with higher-order preferences still suffer the same critiques of LL; i.e., stochastic dominance rules cannot reveal most individuals’ preferences even when there is a very small violation of these rules. This section will generalize our previous results for all individuals excluding the pathological higher-order preferences.1 Let us define UN = u2 4−15n+1 u4n5 ≥ 01 n = 11 21 0 0 0 1 N 1 (10) 4n5 where u denotes the nth derivative of the utility function u, and N > 2.2 Furthermore, let UN∗ 4N 5 = u ∈ UN 2 4−15N +1 u4N 5 4x5 ≤ inf84−15N +1 u4N 5 4x5961/N − 17 ∀ x 0 (11) In other words, an individual with a utility function belonging to UN∗ 4N 5 is the one whose nth derivative of the utility function alters in sign from u0 > 0, n = 11 21 0 0 0 1 N , and the individual’s N th derivative is bounded. The preferences with extreme values of the N th derivative are viewed as the pathological N th-order preferences and are therefore excluded by Equation (11). Let us define N -almost NSD, N > 2, as follows. Definition 3 (ANSD). For 0 < N < 12 , F dominates almost4N 5 G by N -almost NSD (F N G) if Z 6F 4N 5 4x5 − G4N 5 4x57 dx ≤ N F 4N 5 − G4N 5 1 (12) ŜN and G4n5 4x̄5 − F 4n5 4x̄5 ≥ 0, n = 21 31 0 0 0 1 N , N > 2, where Z x F 4n5 4x5 = F 4n−15 4t5 dt1 x Z x G4n−15 4t5 dt1 G4n5 4x5 = x ŜN 4F 1 G5 = x ∈ 6 x1 x̄72 G4N 5 4x5 < F 4N 5 4x5 1 and F 4N 5 − G4N 5 = x̄ Z F 4N 5 4x5 − G4N 5 4x5 dx0 x Following the same argument as in §3, we obtain the following theorem. Acknowledgments The authors thank Michel Denuit, Louis Eeckhoudt, Moshe Leshno, Haim Levy, departmental editor Peter Wakker, and the anonymous referee for the valuable comments and suggestions. Larry Tzeng and Pai-Ta Shih gratefully acknowledge financial support from E.SUN Commercial Bank. Appendix A. A Counterexample to the Second Part of LL’s Theorem 1 Let x ∈ 601 57. Assume that tions where 0 F 4x5 = 43 1 and G4x5 = and G4n5 4x̄5 − F 4n5 4x̄5 ≥ 0, n = 21 31 0 0 0 1 N . Proof. See Appendix C. 1 if 0 ≤ x < 21 if 2 ≤ x < 51 if x = 51 (A1) if 0 ≤ x < 11 if 1 ≤ x < 31 if 3 ≤ x ≤ 51 (A2) S1 4F 1 G5 = 8x2 G4x5 < F 4x59 = 8x2 x ∈ 621 3791 (A3) and Z S2 4F 1 G5 = x ∈ S1 4F 1 G52 x G4t5 dt < 0 x Z F 4t5 dt 0 = x2 x ∈ 6 52 1 37 0 (A4) Thus, according to the above definition of ASSD, it is obvious that F dominates G at -almost SSD, where R 6F 4x5 − G4x57 dx 1/4 1 S ≥ 2 = = 0 F − G 5/4 5 Theorem 2 predicts that all individuals with preferences u ∈ U2∗ 4∗ 5, where ∗ ∈ 6 51 1 21 5 would prefer F to G; i.e., EF 4u5 ≥ EG 4u5. In the following, we will construct a utility function that belongs to U2∗ 4∗ 5 and show that the decision maker would strictly prefer G to F ; i.e., EF 4u5 < EG 4u5. Let a marginal utility function u0 satisfy 21 if 0 ≤ x ≤ 52 1 2 −x 0 u 4x5 = 18 − 4x if 52 ≤ x ≤ 41 6−x if 4 ≤ x ≤ 50 Figure A.1 The Cumulative Distribution of F and G in the Example G 1 +1/2 3/4 F 1 The authors thank Professors Leshno and Levy for their suggestions on the generalization to higher-degree stochastic dominance. 2 1 4 there are two payoff distribu- as shown in Figure A.1. In this example, we have EF 4X5 = 11/4 > EG 4X5 = 5/2, F − G = 5/4, Theorem 2 (ANSD). For all u in UN∗ 4N 5, N > 2, EF 4u5 ≥ EG 4u5 if and only if Z 6F 4N 5 4x5 − G4N 5 4x57 dx ≤ N F 4N 5 − G4N 5 1 (13) ŜN 0 F/G Downloaded from informs.org by [132.66.235.218] on 08 June 2015, at 01:08 . For personal use only, all rights reserved. 1252 Because we have defined ASSD in §3, in this section, we start from N > 2. 1/2 –1/2 1/4 +1/4 0 1 2 3 x 4 5 Tzeng, Huang, and Shih: Revisiting Almost Second-Degree Stochastic Dominance 1253 Management Science 59(5), pp. 1250–1254, © 2013 INFORMS Figure A.2 and G425 4x̄5 − F 425 4x̄5 = EF 4X5 − EG 4X5. Since u0 > 0, according to (B2) and (B3), Z x̄ EF 4u5 − EG 4u5 ≥ 6−u00 4x576G425 4x5 − F 425 4x57 dx x Z = 6−u00 4x576G425 4x5 − F 425 4x57 dx Ŝ2 Z + 6−u00 4x576G425 4x5 − F 425 4x57 dx1 F 425 and G425 in the Example 5/2 G (2) 9/4 +1/8 2 F (2)/G (2) Downloaded from informs.org by [132.66.235.218] on 08 June 2015, at 01:08 . For personal use only, all rights reserved. F (2) 3/2 Ŝ2C where Ŝ2C denotes the complement of Ŝ2 in 6 x1 x̄7. Denote ¯ Thus, inf x∈6 x1 x̄7 8−u00 4x59 = and supx∈6 x1 x̄7 8−u00 4x59 = . we have Z EF 4u5 − EG 4u5 ≥ ¯ 6G425 4x5 − F 425 4x57 dx Ŝ2 Z + 6G425 4x5 − F 425 4x57 dx Ŝ2C Z = 4¯ + 5 6G425 4x5 − F 425 4x57 dx 1 –3/16 1/2 +3/16 1 2 5/2 3 4 5 x Thus, we have u0 ≥ 0 and u00 ≤ 0 and 1 if 0 ≤ x < 52 1 00 −u 4x5 = 4 if 52 ≤ x < 41 1 if 4 ≤ x ≤ 50 + F 0 + 425 6−u 4x576G 4x5 − F 425 5 Z 6−u00 4x576G425 4x5 − F 425 4x57 dx 4 3 3 +4×4− 16 5+1× 18 = 1×4 25 − 49 5+1× 16 3 = − 16 < 00 This example illustrates that the necessary condition for ASSD is not valid. Appendix B. Proof of Theorem 1 EF 4X5 ≥ EG 4X51 x (B5) EF 4X5 < EG 4X5 (B7) It is obvious that u ∈ U2∗ 45, = /4¯ + 5. Since u0 4x̄5 = 0, from (B3), Z x̄ EF 4u5 − EG 4u5 = 6−u00 4x576G425 4x5 − F 425 4x57 dx x Z b 6G425 4x5 − F 425 4x57 dx Z + 6G425 4x5 − F 425 4x57 dx a (B1) (B2) then EF 4u5 ≥ EG 4u5 ∀ u ∈ U2∗ 45. By integration by parts, we have EF 4u5 − EG 4u5 = u0 4x̄56G425 4x̄5 − F 425 4x̄57 Z x̄ + 6−u00 4x576G425 4x5 − F 425 4x57 dx1 F 425 − G425 0 ¯ + By (B4) and (B5), we prove that EF 4u5 − EG 4u5 ≥ 0 ∀ u ∈ U2∗ 45. (2) “Only if” part: We show that if Z 6F 425 4x5 − G425 4x57 dx > F 425 − G425 (B6) = ¯ Ŝ2 and ≤ such that EF 4u5 − EG 4u5 < 0. then there exists a Let us first show that if (B6) holds, then ∃u ∈ U2∗ 45 such that EF 4u5 − EG 4u5 < 0. Assume that Ŝ2 = 6a1 b7, where x ≤ a ≤ b ≤ x̄. Define a marginal utility function as follows: ¯ − a5 + 4a − x5 if x ≤ x ≤ a1 4x̄ − b5 + 4b 0 ¯ − x5 u 4x5 = 4x̄ − b5 + 4b if a ≤ x ≤ b1 4x̄ − x5 if b ≤ x ≤ x̄0 4x57 dx (1) “If” part: We show that if Z 6F 425 4x5 − G425 4x57 dx ≤ F 425 − G425 Ŝ2 u ∈ U2∗ 45 5/2 + Since u ∈ by definition, we have ¯ ≤ 61/ − 17; i.e., ≤ /4¯ + 5. By (B1), we have Z 6F 425 4x5 − G425 4x57 dx ≤ F 425 − G425 or 0 00 (B4) Ŝ2 = u0 4556G425 455 − F 425 4557 Z 5/2 + 6−u00 4x576G425 4x5 − F 425 4x57 dx 4 − G425 0 U2∗ 45, It is obvious that u ∈ U2∗ 4 15 5, where 1 1 U2∗ = u2 − u00 4x5 ≤ inf8−u00 4x59 −1 1 ∀x 0 5 1/5 Rx Rx 425 425 Let F 4x5 = 0 F 4t5 dt and G 4x5 = 0 G4t5 dt; F 425 and 425 G are shown in Figure A.2. Thus, we have Z 5 EF 4u5 − EG 4u5 = u0 4x56G4x5 − F 4x57 dx Z Ŝ2 425 (B3) Ŝ2C = 4¯ + 5 + F Z a 425 b 6G425 4x5 − F 425 4x57 dx − G425 0 (B8) Since = /4¯ + 5, (B6) and (B8) imply that the above defined u exhibits EF 4u5 − EG 4u5 < 0. Next, we show that if (B7) holds, then ∃u ∈ U2∗ 45 such that EF 4u5 − EG 4u5 < 0. Define a marginal utility function Tzeng, Huang, and Shih: Revisiting Almost Second-Degree Stochastic Dominance 1254 Management Science 59(5), pp. 1250–1254, © 2013 INFORMS as follows: Downloaded from informs.org by [132.66.235.218] on 08 June 2015, at 01:08 . For personal use only, all rights reserved. u0 4x5 = c − 1 x c + 42 − 1 5x0 − 2 x then following the proof of Theorem 1, we can obtain Z x̄ 64−15N +1 u4N 5 4x576G4N 5 4x5 − F 4N 5 4x57 dx ≥ 0 ∀ u ∈ UN∗ 4N 50 if x ≤ x0 1 if x0 ≤ x1 x where x0 ∈ 4 x1 x̄5; and c, 1 , and 2 are positive constants such that c > 1 x0 , 2 > 1 , and c > 2 x̄ − 42 − 1 5x0 to guarantee u ∈ U2∗ 45, = 1 /41 + 2 5. From Equation (B3), we have 425 EF 4u5 − EG 4u5 = 6c + 42 − 1 5x0 − 2 x̄76G 4x̄5 − F Z x0 + 1 6G425 4x5 − F 425 4x57 dx 425 4x̄57 x + 2 Z x̄ 6G425 4x5 − F 425 4x57 dx x0 ≤ 6c + 42 − 1 5x0 − 2 x̄76G425 4x̄5 − F 425 4x̄57 + 2 F 425 − G425 0 (B9) Since G425 4x̄5 − F 425 4x̄5 = EF 4X5 − EG 4X5 < 0, if c > 2 x̄ − 42 − 1 5x0 + 2 F 425 − G425 1 EG 4X5 − EF 4X5 (B10) Appendix C. Proof of Theorem 2 The proof is similar to the proof of Theorem 1. Integrating EF 4u5 − EG 4u5 by parts yields EF 4u5 − EG 4u5 Z x̄ u0 4x56G4x5 − F 4x57 dx = x Z x̄ = u0 4x̄56G425 4x̄5−F 425 4x̄57+ 6−u00 4x576G425 4x5−F 425 4x57dx x = u0 4x̄56G425 4x̄5 − F 425 4x̄57 + 6−u00 4x̄576G435 4x̄5 − F 435 4x̄57 Z x̄ + 6u000 4x576G435 4x5 − F 435 4x57 dx x = ··· + N X 4−15n u4n−15 4x̄56G4n5 4x̄5 − F 4n5 4x̄57 n=2 x̄ Z 64−15N +1 u4N 5 4x576G4N 5 4x5 − F 4N 5 4x57 dx0 ŜN then we can easily find a utility function u ∈ UN∗ 4N 5 and follow a similar process to the proof of Theorem 1 to show that EF 4u5 < EG 4u5. The utility function satisfies the following conditions: (1) u4N −15 4x5 is a piecewise linear function; and (2) u4n−15 4x̄5 = 0, n = 21 31 0 0 0 1 N . On the other hand, if there exists an integer k, 2 ≤ k ≤ N , such that G4k5 4x̄5 − F 4k5 4x̄5 < 0, then, similar to the proof of Theorem 1, we can construct a utility function u ∈ UN∗ 4N 5 such that EF 4u5 < EG 4u5. The constructed utility function satisfies the following conditions: (1) u4N −15 4x5 is a piecewise linear function; (2) u4n−15 4x̄5 = 0 for n 6= k; (3) 4−15k u4k−15 4x̄5 is relatively large; and (4) ∀ x ∈ 6 x1 x̄7, 4−15N +1 u4N 5 4x5 is small enough. References then EF 4u5 − EG 4u5 < 0, which completes the proof. = Thus, the above concludes the sufficiency part. For the necessity part, if Z 6F 4N 5 4x5 − G4N 5 4x57 dx > N F 4N 5 − G4N 5 1 (C1) x Since u ∈ UN∗ 4N 5, we have 4−15n u4n−15 ≥ 0, n = 21 31 0 0 0 1 N . Thus, if G4n5 4x̄5−F 4n5 4x̄5 ≥ 01n = 21310001N , then ∀ u ∈ UN∗ 4N 5, theR first term of Equation (C1) is positive. Furthermore, if ŜN 6F 4N 5 4x5 − G4N 5 4x57 dx ≤ N F 4N 5 − G4N 5 , Bali TG, Brown SJ, Demirtas KO (2011) Investing in stock market anomalies. Working paper, Georgetown University, Washington, DC. Bali TG, Demirtas KO, Levy H, Wolf A (2009) Bonds versus stocks: Investors’ age and risk taking. J. Monetary Econom. 56(6): 817–830. Denuit MM, Eeckhoudt L (2010) A general index of absolute risk attitude. Management Sci. 56(4):712–715. Eeckhoudt L, Schlesinger H (2006) Putting risk in its proper place. Amer. Econom. Rev. 96(1):280–289. Hadar J, Russell WR (1969) Rules for ordering uncertain prospects. Amer. Econom. Rev. 59(1):25–34. Hanoch G, Levy H (1969) The efficiency analysis of choices involving risk. Rev. Econom. Stud. 36(3):335–346. Leshno M, Levy H (2002) Preferred by “all” and preferred by “most” decision makers: Almost stochastic dominance. Management Sci. 48(8):1074–1085. Levy H (1992) Stochastic dominance and expected utility: Survey and analysis. Management Sci. 38(4):555–593. Levy H (1998) Stochastic Dominance: Investment Decision Making Under Uncertainty (Kluwer Academic, Boston). Levy H, Leshno M, Leibovitch B (2010) Economically relevant preferences for all observed epsilon. Ann. Oper. Res. 176(1):153–178. Rothschild M, Stiglitz JE (1970) Increasing risk: I. A definition. J. Econom. Theory 2(3):225–243. CORRECTION In this article, “Revisiting Almost Second-Degree Stochastic Dominance” by Larry Y. Tzeng, Rachel J. Huang, and Pai-Ta Shih (first published in Articles in Advance, November 28, 2012, Management Science, DOI:10.1287/mnsc.1120.1616), the x-axis labels in Figure A.2 have been corrected to read as follows: 1, 2, 5/2, 3, 4, 5; and the sixth, seventh, and ninth displayed equations in Appendix A have been corrected to read as follows: Z 5 EF 4u5 − EG 4u5 = u0 4x56G4x5 − F 4x57 dx 0 0 u 4x5 = 21 2 −x if 0 ≤ x ≤ 52 1 5 2 ≤ x ≤ 41 18 − 4x if 6−x if 4 ≤ x ≤ 50 1 − u 4x5 = 4 1 00 if 0 ≤ x < 52 1 if 5 2 ≤ x < 41 if 4 ≤ x ≤ 50 = u0 4556G425 455 − F 425 4557 Z 5/2 + 6−u00 4x576G425 4x5 − F 425 4x57 dx 0 Z 4 + 6−u00 4x576G425 4x5 − F 425 4x57 dx + Z 5/2 5 4 6−u00 4x576G425 4x5 − F 425 4x57 dx 3 3 = 1×4 52 − 49 5+1× 16 +4×4− 16 5+1× 18 3 = − 16 < 00