S P T -

advertisement

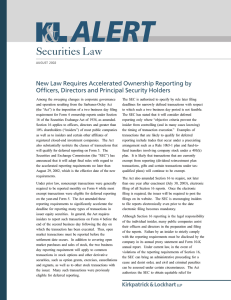

SUMMARY OF SIGNIFICANT PROVISIONS FOR THE SARBANES-OXLEY ACT OF 2002 CERTIFICATIONS OF SEC-FILED FINANCIAL REPORTS ARE REQUIRED • • • Section 906 of the Sarbanes-Oxley Act of 2002 (the “Act”) requires public company CEOs and CFOs to certify that periodic financial reports filed with the SEC fairly present the company’s financial condition and fully comply with the Securities Exchange Act of 1934. This requirement includes specific criminal penalties for making a false certification. Section 302 of the Act requires a second certification with respect to the accuracy and completeness of the company’s financial reports and the effectiveness of its internal control systems. This requirement became effective August 29, 2002. Note: The SEC previously ordered CEOs and CFOs of public companies having revenues of at least $1.2 billion to make a one-time certification of previously filed financial reports. This order is unaffected by the Act. The due date for this certification is the company’s first Form 10-K or Form 10-Q filing made on or after August 14, 2002. August 14, 2002 was the filing date for companies with calendar quarter reporting; September 16, 2002 or October 15, 2002 would be the filing date for most other companies. LOANS TO EXECUTIVE OFFICERS AND DIRECTORS ARE PROHIBITED • Public companies are now prohibited from making a personal loan to directors and executive officers, or from renewing or modifying the terms of an existing loan. There is a limited exception for companies in the lending industry. FORM 4 MUST BE FILED WITHIN TWO BUSINESS DAYS • The due date for Section 16 insiders to file Section 16(a) transaction reports on Form 4 has been shortened to two business days, effective August 29, 2002. This deadline applies to all changes in ownership including option grants, exercises, cancellations and regrants. For transactions in which the reporting person does not select the execution date, such as discretionary transactions involving employee benefit plans and transactions under 10b5-1 plans, up to three days additional time is allowed for the reporting person to receive notification of the execution of the transaction before the 2 day reporting window begins. ACCELERATED ISSUERS • • FILING OF ANNUAL AND QUARTERLY REPORTS FOR CERTAIN On August 27, 2002, the SEC adopted amendments to the Securities Exchange Act of 1934 to accelerate the filing deadlines for quarterly reports on Form 10-Q and annual reports on Form 10-K. The accelerated filing requirements only apply to domestic reporting companies that have a public float of at least $75 million, have been subject to the Exchange Act reporting requirements for at least 12 calendar months and have previously filed at least one annual report. Page 1 of 4 • • • For companies with fiscal years ending on or after December 15, 2003, the due date for filing annual reports on Form 10-K has been shortened to 75 days after the end of the company’s fiscal year and to 60 days after the end of the company’s fiscal year for each following year. For companies with fiscal years ending on or after December 15, 2003, the due date for filing quarterly reports on Form 10-Q has been shortened to 40 days after the end of the company’s first three fiscal quarters and, thereafter, to 35 days. Beginning with reports for fiscal years ending on or after December 15, 2002, companies are required to disclose in the Form 10-K report whether the company provides access, free of charge, to its periodic and current reports on its Internet Web site as soon as practicable after the material is filed with the SEC. ENHANCED REGULATORY ENFORCEMENT INCLUDING DISGORGEMENT UPON RESTATEMENT OF FINANCIALS • The Act also: (i) increases the SEC’s powers to bar “unfit” individuals from serving as officers or directors of public companies, (ii) requires CEO and CFO incentive compensation and profits on sale of the company’s securities to be disgorged following certain accounting restatements, (iii) extends the statute of limitations for prosecuting securities fraud, (iv) enhances “whistleblower” protection, (v) increases penalties for retaliation against informants, and (vi) provides criminal penalties for document destruction. RECOMMENDED ACTIONS Public companies should contact counsel to discuss specific action steps to comply with the new requirements of the Act. These action steps should be developed based upon the particular attributes of the company including its operational characteristics and financial reporting schedule. The review with counsel should address each of the issues discussed below. 1. Section 906 certification Companies should immediately discuss with counsel procedures to prepare for the Section 906 certification. This review should address the following: • • • • • • The nature of assurances that CEOs, CFOs, and the company’s audit committee should receive from senior managers or other staff in order to provide the required Section 906 certifications. The extent to which supporting reports should be developed by the company and reviewed by the CEO and CFO prior to making the certification. Procedures for collecting data, compiling reports, and assembling supporting information. Procedures for reviewing the financial reports and supporting information. Procedures for memorializing review of the reports. Discussions that should be held with the audit committee, internal auditors, and external auditors prior to the certification. Page 2 of 4 • Procedures for handling information that contradicts the representations to be made in the certification. This would include discussing the consequences that would apply in the event of a failure to make a timely, unqualified certification. 2. Section 302 Certification Companies should prepare for the Section 302 certification by: • • • • Addressing the same issues applicable to the Section 906 certification; Establishing procedures for reviewing existing disclosure controls and procedures; Determining how to implement and memorialize any required improvements to those controls and procedures; and Determining how to report those improvements in the company’s periodic financial reports. “Disclosure controls and procedures” relate to both financial and non-financial information. As such, the new rules are intended to require officers to certify both financial information and material non-financial information. A company making the certification cannot simply rely on an evaluation of systems of internal control that may have been conducted by an independent accountant as part of the financial statement audit. The SEC has not mandated any specific standards for the review of disclosure controls and procedures, but has recommended the creation of a committee that would have responsibility for considering the materiality of information and determining disclosure obligations on a timely basis. The Commission has suggested that committee members should include the principal accounting officer or controller, the company’s general counsel or other senior legal official with responsibility for disclosure matters, the principal risk management officer and the chief investor relations officer. This committee would report to senior management, including the CEO and CFO, who are required to certify under the new rules. 3. Filings on Form 4 Publicly traded companies should immediately inform their insiders of the new filing requirements and implement compliance procedures to ensure that the new two-business-day deadline for Section 16(a) transaction reports is met. Issuers that do not currently have a mandatory pre-clearance policy covering insider trades should consider adopting such a policy. Issuers with existing pre-clearance policies should consider expanding their policies to cover option exercises and benefit plan transactions. Companies should also familiarize themselves with electronic filing of Form 4 reports in advance of the July 30, 2003 deadline as well as the Section 16 power of attorney filing provisions. These procedures can be used to facilitate a filing when the insider is otherwise unable to timely submit his or her Form 4 report. Page 3 of 4 4. Loans to Executive Officers Public companies should immediately: • • • • Issue no new credit to directors or executive officers; Collect any existing credit to directors and executive officers, according to its terms; Not extend, modify, or renew existing credit to directors or executive officers; and Review compensation arrangements and company policies which provide for the extension of credit, in any form, to directors and executive officers. 5. Other Provisions of the Act The Act contains many other important provisions that will take effect in future months, in most cases upon the issuance of new regulations. Some of those provisions will dramatically alter the nature of the relationship between many companies and their independent accountants. Other provisions impose substantial new corporate governance requirements. While not effective immediately, public companies should prepare for: • • • • • A requirement that the auditing services and certain consulting services not be obtained from the same accounting firm; A requirement for “real-time” public disclosures of material events; A prohibition on trades in company stock by directors and officers during pension fund blackout periods; New reporting requirements pertaining to off-balance sheet transactions, related party transactions, and pro forma financial results; and Increased authority, duties, and requirements that will apply to audit committees. Some of these requirements will be clarified by regulations that will be forthcoming from the SEC. In addition, proposals have been made to change certain listing requirements of the NASDAQ and NYSE. These proposed changes would substantially affect corporate governance requirements. The Sarbanes-Oxley Act of 2002 presents many challenges that require careful attention and prompt action. Lane Powell Spears Lubersky LLP is available to advise public issuers on the legal issues involved in meeting those challenges. Page 4 of 4