INSTRUCTIONS FOR APPLYING FOR FEDERAL FINANCIAL AID 1. Begin Application:

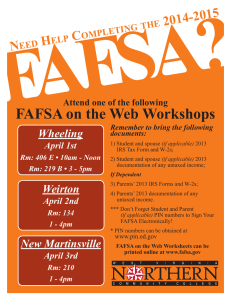

advertisement

INSTRUCTIONS FOR APPLYING FOR FEDERAL FINANCIAL AID Please note: the government web sites listed below may also be reached at: http://www.mji.edu/templates/mji/article_cdo/aid/569728/jewish/Financial-Aid-Links.htm Completing the FAFSA (Free Application for Federal Student Aid) Tip: always use the “previous” and “next” buttons, do not use the arrows at the top of the browser. 1. Begin Application: a. Go to www.fafsa.ed.gov (US Department of Education FAFSA web site) Select “Start a New FAFSA” unless you have already started an application for 2014-2015. Select “Login” to access an already started application. b. Complete student information. No dashes or spaces are to be used in social security number. For date of birth please use two digits for the month, two digits for the day and four digits for the year. c. Select “Start 2014-2015 FAFSA. d. Create password (password is case sensitive) then select “next”. e. You can skip the instructions by selecting “next” if you do not feel that you need them. f. Continue to answer questions – make certain you use student answers for student questions and parent answers for parent questions. g. Use MJI’s school code 032843 when asked which schools are to receive results to allow MJI to receive your results. h. Next indicate your housing plan as off campus or with parents, MJI does not offer student housing. i. Use current information as of the date the FAFSA will be submitted. j. Income earned in a foreign country is treated the same as income earned in U.S. Convert all figures to U.S. dollars using the exchange rate in effect on the day you complete the FAFSA. You can find information on current exchange rates at: www.federalreserve.gov/releases/h10/current 2. Student Demographics a. Begin to answer questions –make certain you use student answers for student’s questions and parent answers for parent questions (see "parent demographics"). b. If you live outside the United States, put "00000" for your zip code, and select "Foreign Country" for your state. c. High school completion status – if you completed high school in Israel, please confirm that your High School is the equivalent of a US High School (contact Admissions) d. Grade level, select one: a. Never attended college/1st year b. Students who attended college before but have less than 30 credits (for example, this may apply to students who are beginning their second year of the "study Abroad" program), are "Attended college before/1st year" c. Students who have between: i. 30 – 59 credits are considered "2nd year/sophomore", ii. 60-89 – "3rd year/junior", iii. 90 and up – "4th year/senior" iv. (MJI does not offer level higher than 4th year) e. High school information – note, if your high school was not in the U.S. don't click the "confirm" button – just put in the information and click "next". v.140622 f. School Selection: a. You may either search for the school by name on the left side of the page, or enter the school code on the right side, to find the school. MJI's Federal School Code is 032843. b. Click "add", and "next". c. Select your housing plans, and click next. g. Household size – Include yourself, your spouse (if married) and any child or other dependent who lives with you and gets more than half of their support from you and/or your spouse. There is a tutorial to assist you if you are unsure who can be included. Click on “Household size” for more information. h. Household members in college – include yourself, and only others in the household who are in a college participating in the U.S. Federal Student Aid program. 3. Dependency Determination a. Answer the dependency questions. b. If the FAFSA determines you are dependent, you must provide parental information. If you are independent DO NOT provide parental information 4. Parent Demographics (The FAFSA will skip this section for independent students) a. If one of your parents is not a U.S citizen please enter all 0s for their social security number. Please DO NOT put your parent's ITIN (Individual Taxpayer Identification Number) instead of a social security number. b. Names should be as exactly written on social security card. For information on how to update or correct the name the Social Security card, call SSA at 1-800-772-1213 or go to their website at www.ssa.gov. c. Household size - Include your parents, yourself and any sibling or other dependent who lives with your parents and gets more than half of their support from your parents. There is a tutorial to assist you if you are unsure who can be included. Click on “Household size” for more information. d. Household members in college – include yourself, and only siblings who are in a college participating in the U.S. Federal Student Aid programs. Do not include your parents, even if they are attending a postsecondary institution. 5. IRS Data Retrieval Tool a. You and your parents (if applicable) will be asked to use the IRS data retrieval tool in the income section of the FAFSA. This enables your (your parents’) information to be transferred from your 2013 US income tax return to your FAFSA. Please note you cannot transfer data until approximately 6 weeks after the tax return has been submitted. If you are completing your FAFSA application prior to completing your tax return you may file the FAFSA and then 6 weeks after your tax return is completed you will have to make the correction to your FAFSA to show that you (and/or your parents) have filed your taxes and choose to utilize the IRS data match. You need to have a copy of your tax return with you to ensure you can respond correctly to the identifying questions required to transfer the information from the IRS to the FAFSA. b. If you choose not to utilize the IRS data match or you are unable to do so, you may be required to request an IRS tax transcript. Do not provide the tax transcript unless requested to do so. Instructions will be provided if a tax transcript is required. c. If you do not file a US tax return please enter the income information from your 2013 foreign tax return, converted to US dollars as of the date the FAFSA is signed, see 1.j above. You may be required to provide a signed copy of your return. v.140622 d. If you are a tax filer selected for Verification, that process can only be completed with an IRS data match on the FAFSA application, an IRS tax transcript or a signed foreign return. 6. Sign the FAFSA (you and your parents, if dependent) a. The FAFSA will ask you how you wish to sign. b. If you are completing a FAFSA for the first time you can apply for a PIN at this time by selecting the “apply for a pin” option at the bottom of the appropriate page. c. You should select a PIN number that you can remember. d. If you previously requested a PIN and do not remember your number please go to the PIN website www.pin.ed.gov and select “request a duplicate PIN”. You will able to view your PIN number if you select “display now”. e. Sign the FAFSA using this PIN number immediately after submitting the PIN request by returning to the FAFSA application which should still be open. f. The FAFSA will ask how your parents wish to sign. Your parents must repeat the above instructions and sign using the parent PIN number. g. Continue until you select “Submit my FAFSA now” to complete the process. h. After completing and transmitting your FAFSA you will receive a confirmation number. If you do not receive a confirmation number your FAFSA has not been submitted. i. Usually MJI will receive your FAFSA results in approximately 3-5 days. If you have any questions or problems in completing the forms please contact the Financial Aid office at Michigan Jewish Institute. Normal office hours are Sunday - Thursday from 10:00am to 6:00pm. Office of Financial Aid: Michigan Jewish Institute E-mail: financialaid@mji.edu US Office: Israel office: Phone: (248) 414-6900 Ext 102 Phone: (972)-2-547-8000 Ext 300 or 248-525-6833 Ext 300 Fax: (248) 414-6907 Fax: 077-470-3893 Tip: Faxes must have a cover sheet with student's name and last 4 digits of their social security number. Emails must also include this identifying information. Never include your full social security number in an email. Do not email any documents with personally identifiable information unless it is encrypted. v.140622