Default Risk in Adjustable Rate Mortgages: Effects of Changes to... Withdrawal Limits in Singapore Abstract:

Default Risk in Adjustable Rate Mortgages: Effects of Changes to CPF

Withdrawal Limits in Singapore

Brent W. Ambrose @ , Yongqiang Chu *1 , Jay Sa-Aadu # and Tien Foo Sing *2

Revised: July 6, 2004

Abstract:

Adjustable rate mortgages (ARMs), which allows mortgagees to adjust the contracted interest rate to market interest rate at agreed intervals, are the prevailing type of mortgage in Singapore and many Asian countries. Analyzing the default risks in ARMs is difficult because of the path-dependence of the mortgage interest rates. The pricing process for the defaultable ARMs is even more complicated when applied to Singapore housing market, where the use of the Central Provident Fund (CPF) savings and monthly contributions to supplement the housing purchase are indispensable in the home financing system. The paper models the mortgage default options in ARMs taking into consideration the special settings of CPF system, and evaluates the impact of how changes to CPF withdrawal rules will have impact on the mortgage default risks.

Numerical analyses were conducted using the least square Monte Carlo simulation, and the results showed an inverse relationship between the withdrawal cap and default risk premiums in ARMs. When the withdrawal cap is tightened from 150% to 120% of the original house price, default risk premiums increase from 0.42% to 0.86 for the mortgagor; and from 1.10% to 1.51% for the mortgagee. We also observed that the CPF saving interest rates, the house price volatility and interest rate volatility are positively related to the default option premiums in ARMs.

Key Words: Adjustable rate mortgage, Mortgage default option, CPF withdrawal limit

JEL Classification: G12, G21, G23

@ Gatton College of Business and Economics, University of Kentucky, Lexington, KY 40506, USA, ambrose@uky.edu

.

*1 Department of Real Estate, National University of Singapore, 4 Architecture Drive, Singapore

117566. g0202465@nus.edu.sg

# Fiance Department, Henry B. Tippie College of Business, The University of Iowa

S252 Pappajohn Building, Iowa City, IA 52242, USA. Jsa-aadu@uiowa.edu

.

*2 Corresponding author. Department of Real Estate, National University of Singapore, 4 Architecture

Drive, Singapore 117566. rststf@nus.edu.sg

.

This Paper was presented at the 2003 AREUEA International Conference Krakow, Poland. The Authors wish to thank Professor Richard Buttimer and the participants in the conference for their valuable comments.

Default Risk in Adjustable Rate Mortgages: Effects of Changes to CPF

Withdrawal Limits in Singapore

I Introduction

Mortgages are fixed income securities that are embedded with two options that are prepayment and default options (Hendershott and Van Order, 1987). This structure works well in the US mortgage market, which is dominated by fixed rate mortgages.

Option pricing or contingent claim valuation models have been widely applied to price these mortgages and evaluate risk premiums associated with the embedded options

(Foster and Van Order, 1984 and 1985; Hendershott and Van Order, 1987; Kau, Keenan,

Muller and Epperson, 1992 and 1995; and others). House price and term structure of interest rate are two standard stochastic variables in the mortgage models that drive the prepayment and default decisions. Default is a put option which is usually exercised discretely at the date of the mortgage payment, if the house price drops below the outstanding mortgage balance. On the other hands, prepayment usually occurs in a market with downward sloping interest rate term-structure. Prepayment is also automatically triggered in the case of default, where the collateralized house is foreclosed and sold to pay off the outstanding mortgage balances.

Difference between the stochastic term structure of interest rate and the contracted mortgage interest rate will result in prepayment in a fixed rate mortgage (FRM).

However, the prepayment risk is less critical in an adjustable rate mortgage (ARM), where the contracted mortgage rate is adjusted in relation to changes in the term structure of interest rate. The floating rate structure eliminates interest rate risk to lender.

It increases the risk of default, on the other hands, when the monthly mortgage payments escalate beyond the mortgagor’s threshold affordable level as a result of upward revision to the contracted mortgage rate. The uncertain future mortgage payment stream caused by fluctuating mortgage interest rate further complicates the pricing process for ARM. The direct application of the standard two-state option pricing models for defaultable FRMs is not possible, and that explains why limited theoretical models were developed for pricing default risks in ARM in the literature (Kau, Keenan,

Muller and Epperson, 1990 and 1993).

In Singapore and many countries in Asia, ARMs or floating rate mortgages are the prevailing type of mortgage for home buyers. ARMs provide mortgagees an optimal risk sharing mechanism to shift the interest rate volatility to the mortgagors, especially when the expected term structure of interest rate is upward sloping (Brueckner, 1993).

Studies of ARMs in the US focus on analyzing interactions of various components of

ARM, such as teaser rate, interest rate caps and upfront fees (Buser, Hendershott and

Sanders, 1985; Hendershott and Shilling, 1985; Sa-Aadu and Sirmans, 1989; Houston,

Sa-Aadu and Shilling, 1991; and others). Modeling of default risks in ARMs, on the other hand, is not as well explored compared to FRMs. The contingent claim structure for default is more complex in ARM. In addition to the forward interest rate and house

1

price evolution processes, default in ARMs is also a function of mortgage payments and amortization rate, which change corresponding to the forward mortgage interest rates.

This study attempts to theoretically model the default behavior in ARMs taking into consideration the institutional features of housing finance system, in particularly the

Central Provident Fund (CPF) provisions in Singapore.

The Central Provident Fund (CPF) is a compulsory saving scheme for members constituted of employees and self-employed Singaporean residents. Introduced on July

1 st , 1955, CPF has been transformed into a comprehensive social security savings plan, which covers not only the financial needs of members in retirement; it is also expanded into a home financing scheme to support home purchases by members. The success of the public housing financing scheme introduced since 1968 has underpinned the high ownership rate of more than 90% in Singapore.

1 The scheme was subsequently extended to cover the purchase of private houses in 1981 to further help Singaporeans to realize their aspirations of owning private houses (Lum, 1996). The CPF has become an integral part of the housing finance system in Singapore, and studies of mortgage default without considering the CPF features will be incomplete in Singapore.

Rules regulating the use of CPF in financing home purchase are prudently fine-tuned over time to facilitate a smoother functioning of the housing system, and at the same time, eliminate distortion in the market caused by excessive withdrawal of CPF into housing consumption. Two significant changes to CPF rules relating to private housing purchase have taken effect from September 1, 2002, which are likely to have positive impact on the financing of the private house purchases (Neo, Lee and Ong, 2003). The first change imposes a restriction on the quantum of CPF withdrawn for the payment housing loans to 150% of the property value, and this withdrawal cap will gradually be reduced to 120% over 5 year. The second change relaxes the CPF down-payment rule, which allow the home buyer to use the accumulated savings in the CPF account to pay up-to 10% of the initial purchase price. The first CPF rule change will curb the payment ability of the home buyer when the withdrawal limit is reached at 150% level, and in turn increase the default risk of the mortgage. The effect of the second change to CPF down-payment rule is less direct, and it may increase the default risk if home buyers make use of the additional 10% equity in CPF to purchase a property that is beyond their affordability level. The default caused by the second CPF change can be minimized if mortgagees adopt a more prudent underwriting process, and therefore, it would not be examined in this study. We, however, would focus on the CPF withdrawal rule change and analyze how this change will affect the default risk of ARMs in private home purchases.

The remainder of the paper is organized as follows: The next section reviews literature in mortgage valuation and default options. Section III provides a brief description of the

Singapore housing finance system and the CPF rules governing the purchase of

1 Based on the 2000 census statistics of Singapore, about 92.3% of households own their own home, out of which 88% of the households stay in public flats

2

residential property. Section IV lays out the underlying assumptions for the mortgage pricing model that reflect the CPF withdrawal features and develops the analytical framework for the valuation of ARMs and the embedded default options. Section V conducts the numerical analyses of the model and discusses the results of analyses. The last section concludes the findings with highlights of relevant policy implications.

II Literature Review

The advancement of contingent claims theory following the seminar works by researchers like Black and Scholes (1973), Merton (1973), Cox, ingersoll and Ross

(1985a, 1985b) and others, has significant influence on the theoretical and empirical studies of mortgage related risks. Asay (1978), Dunn and McConnell (1981), Buser and

Hendershott (1984), Brennan and Schwartz (1985) are some of the earlier mortgage studies that use continuous time model to analyze prepayment and default options in mortgages with fixed interest rates. In the contingent claims framework, prepayment is modeled as a call option, which is triggered when the current mortgage value based on the contracted interest rate falls below the par value of the mortgage. Whereas, default is a compound put option, upon exercised, allows the mortgagor to sell the house at market value back to lender in exchange for the outstanding mortgage balance (Foster and Van Order, 1984 and 1985; Hedershott and Van Order, 1987). Based on the arbitrage-free perfect-market assumption, many mortgage option models mimic the default-free mortgage cash flows with a risk-free portfolio of Treasury securities. In other words, the mortgage pricing models are independent of the risk preference by using risk-adjusted rates for the state variables.

The FRM default option framework was subsequently expanded by Hedershott and Van

Order, (1987); Schwartz and Torous (1992); Kau, Keenan, Muller and Epperson (1992 and 1995) to include the stochastic house price as the second state variable. The two-state framework has since then become the standard pricing model that jointly analyzes both the prepayment and default options in FRMs. However, the frictionless models have limitations because the default behavior is assumed to be driven solely by financial consideration. Mortgagors will “ruthlessly” default as long as the house price drops below the mortgage value. Foster and Van Order (1984 and 1985), however, found contrary empirical evidence that mortgagors do not default ruthlessly even though the houses are in negative equity situation. They attribute the non-exercise of the

“ in-the-money ” default option to the omission of transaction cost in the standard mortgage default option models. Unlike Foster and Van Order (1984 and 1985) claims, the interaction of the exogenous factors, such as divorce rate and unemployment rate, are important in explaining the default behavior in mortgages (Vandell and Thibodeau,

1985). Search cost and adverse equity factors have also been identified as sources of heterogeneity in the transaction costs (Vandell and Thibodeau, 1985; Vandell, 1995).

Quigley and Van Order (1995) found further evidence in the micro-data on mortgages purchased by Federal Home Mortgage Corporation (Freddie Mac), which suggests that

3

the default probabilities and the loan to value (LTV) relationship is significant, but non-linear. In other words, “ in-the-money ” default option is not exercised immediately in mortgages with low negative equity, whereas the default is almost instantaneous when the level of negative equity is high. Liquidity-constrained households or those beset with exogenous reasons to default may exercise the “ out-of-the-money ” option and sell the house to the mortgagees, when the costs of selling the house in the market are high. They then expanded the earlier definition of transaction costs to include costs of trading house, in addition to the standard default option exercising costs.

Deviating from the risk-neutral framework, Kau, Keenan and Kim (1993 and 1994) use the actual rates of return for interest rate and house prices to derive the probabilities of default, rather than the premiums for the default options. They found that the default probabilities are significantly affected by transaction cost and LTV, but the effect of suboptimal exercise of the “ out-of-the-money ” default option is secondary to the transaction cost. Kau, Keenan and Kim (1994) further explain that the time value of deferring the default options, even in the absence of transaction cost, may cause the under-exercising of default options in negative equity mortgages. Ambrose, Buttimer and Capone (1997), however, found that transaction costs in the form of post-foreclosure deficiency charges and the ability of lender to impose these costs have positive influence on the borrower’s decision to delay default between default and foreclosure. The imperfect market considerations are further analyzed in the frictions-adjusted mortgage model by Kau and Slawson (2002), where three different frictions: transaction cost, non-financial termination and sub-optimal non-termination are explicitly examined. They found that the optimality of financially-induced option default behavior is not compromised in the presence of different frictions. The net effects of the frictions can be represented by the differences in the mortgage value to the mortgagors and the mortgagees.

Adjustable rate mortgages (ARM) are an alternative type of mortgages that are favored by mortgagees because of the flexibility in adjusting the loan rate function to the future costs of fund. From the seemingly risk-adverse borrower’s perspective, Brueckner

(1993) explains that ARMs is optimal in allocating risk if a loan rate function can be chosen to match the borrower’s future payments expectation. The loan rate function, more specifically the margin of ARMs, is a function of a bundle of ARM features, such as loan caps, adjustment frequency, and margins (Sa-Aadu and Sirmans, 1989). Interest rate cap parameters, however dominate the pricing of the margin. Buser, Hendershott and Sander (1985) simulate the effects of life-of-loan rate cap of a non-teaser 1-month

ARM, and show that a 5-percentage point increase in the cap will result in a corresponding increase in 10-50 basic point in the loan margin. Hendershott and

Shilling (1985) also evaluate how various caps on hypothetical default-free 1-, 3- and

5-year ARMs with teaser rates issued during 1970-76 periods would have had to be priced to earn market returns. Teaser is also another important feature of ARMs, and

Houston, Sa-Aadu and Shilling (1991) found no evidence of incorrect pricing of teaser

ARMs, and borrowers should be indifferent between standard ARM contracts without

4

teaser and teaser ARMs.

Modeling of default risk in ARMs is not as straight forward as in FRMs because of the path dependence of interest rates in ARMs (Kau, Keenan, Muller and Epperson, 1985).

Kau, Keenan, Muller and Epperson (1990, 1993) propose an auxiliary contract rate variable, which is defined as a function of an equivalent yearly interest rate, a margin, a life-of-loan cap, and a yearly cap, to solve the path-dependence problem associated with default behaviors in ARMs. They analyze numerically the sensitivities of ARM features such as teasers, points, life-on-loan cap and year cap on the default premiums.

Cunningham and Capone (1990) examined the termination experience of both fixed- and adjustable-rate mortgage using micro mortgage data of a private mortgage bank in

Houston, Texas. They found that ARMs have greater default risk, but lower prepayment risk than FRMs. The ARM termination is a directly related to the size of rate caps and the length of adjustment period.

ARMs are the predominant financing method for home buyers in Singapore. The use of

CPF accumulated savings and future contributions to the CPF ordinary accounts is an indispensable part of home financing in Singapore. The unique CPF financing feature provides cushion to the default risks for typical house buyers in Singapore. Therefore, modeling default risks without taking consideration the CPF withdrawal facilities will be incomplete. We extend the ARM default risk model with an auxiliary interest rate state variable by Kau, Keenan, Muller and Epperson (1990 and 1993) by incorporating the CPF features and use the proposed model to evaluate the default behavior of rational house buyers in Singapore. The effects of changes to CPF withdrawal policies on the default in ARMs are also analyzed.

III CPF and Housing Finance System in Singapore

Singapore has a two-tier housing market consisting of a public market and a private market. Affordable public housing units of various types are built by the government through the Housing Development Board (HDB) for the mass market at subsidized rates.

2 Private housing units, on the other hands, are sold to Singapore citizens and qualified foreign residents. The private housing units are distinguished from the public housing units by price and variety in the housing options. Based on the census statistics of year 2000, the total housing stock was 923,325 units, and the mix between public and private housing units was approximately 88%:12%.

3

There are two forms of financing for HDB flat owners: concessionary mortgage rate

2 Housing grants for new public housing units are available to Singapore citizens, who met certain income, demographic and ethnic criteria, such as applicant’s household income ceiling must not exceed S$8000 per month, the requirement for the applicant to form a family nucleus, and others.

3 The 2000 census data were published by the Department of Statistics, Singapore. In a speech by the

Minister for National Development, Mr Mah Bow Tan, at the REDAS Annual Dinner, on November

13, 2002, the ratio of public and private housing units has been updated to 81:19.

5

loans and market mortgage rate loans.

4 The concessionary mortgage rate loans are available for eligible HDB flat buyers who meet the requirements set up by the HDB.

Market rate loans offered by commercial banks are the only financing option for private house buyers. Both the private and public house buyers are allowed to use their CPF accumulated savings and their monthly contributions to the ordinary account 5 to make direct payment for the houses and/or pay the monthly loan payments to the banks.

6 This paper focuses only on the CPF financing for private housing units; and the key features of CPF scheme that affect the mortgage analysis will be discussed.

CPF savings earn market-based interest, which is determined based on 12-month fixed deposit and month-end saving rates of major local banks.

7 The CPF savings can be used as equity outlays to reduce the loan quantum and/or as payment for the monthly loan service. The cost of the CPF equity is the foregone saving interest, which would otherwise have been earned should the money is not used to pay for the home purchase.

The maximum loan to value ratio on housing loan imposed by the Monetary Authority of Singapore (MAS), the de-facto central bank, on licensed commercial banks is 80%.

CPF members, who purchase a residential property after September 1, 2002, is allowed to use their savings in the CPF ordinary account to cover not more than 10% of the equity portion of the purchase price as down-payment in the transaction. Next, the home buyers can either choose to use the residual savings in the CPF ordinary account to further reduce the loan quantum, or to stretch their maximum loan limit to a maximum of 80% of the purchase price, subject to meeting the underwriting and credit assessment requirements. This is a leverage decision of the home buyers that is dependent on the difference between the CPF saving rate and the mortgage interest rate. Given the current low first year ARM rate of 1.3% 8 vis-à-vis CPF current ordinary account saving rate of

2.5%, it gives positive leverage benefits for homebuyers to stretch their loan limit up to the maximum of 80%, at least in the first year.

4 The interest rates of mortgage offered by private banks have declined significantly over the past few years to a level, where the gap between the concessionary mortgage rate and the market mortgage rate is insignificant to give economic benefits for taking concessionary rate loans for new buyers.

5 Each CPF member will have three accounts assigned for different purposes: Ordinary, Medisave and

Special accounts. The savings in the ordinary account can be used for housing, education and other investment. The Medisave account is created mainly for medical and healthcare needs, and the special account is intended for the basic needs in retirement.

6 The rules regulating the use of CPF savings and monthly contributions to finance the purchase of private and public housing units differ. The Public Housing Scheme was introduced since 1968, whereas the CPF financing for private housing purchase under the Residential Property Scheme was only approved in 1981. The technical details of the CPF financing were not covered in this paper.

7 The current interest rate for CPF Ordinary account for the quarter from 01 July 2004 to 30 September

2004 is 2.5%. The Medisave and Special accounts earn additional interest of 1.5% above the

Ordinary account saving rate.

8 The current quoted rate (based on the June 2004 statistics) for floating rate loan packages offered by three major local banks: DBS Bank, OCBC Bank and UOB Bank was competitive at 1.3% for the first year.

6

There were several significant changes to the CPF rules that have significant impact on the housing market in Singapore. The Residential Property Scheme (RPS) was introduced in 1981 to allow CPF members to use their money in CPF ordinary account to purchase private property. The CPF members can use the savings and future monthly contribution in their ordinary accounts to pay upfront for the property purchase and/or to pay the monthly loan payment up to 100% of the valuation or the purchase price, whichever is the lower at the time of purchase. With effect from October 1, 1993, the

Available Housing Withdrawal Limit (AHWL) was included, which allows the members to draw down further the ordinary account savings after the 100% valuation limit is reached and the loan balance is still outstanding. The AHWL is subject to a maximum of

80% of the gross CPF savings in both ordinary and special accounts after setting aside a mandatory minimum sum of S$80,000 (as in Jun 2004).

9 The AHWL is used to mainly cover the interest expenses over the loan term, which may work out to be approximately

58% of the loan principal for a standard constant payment mortgage with a 25 year term.

The RSP and the AHWL schemes have helped many Singaporeans to realize their dreams of owning private property. By channeling a substantial portion of the CPF savings into housing purchase, they are also exposed their CPF savings to the fluctuation in property prices. Due to the illiquid nature of housing market, many CPF members are trapped in a situation of “ asset-rich and cash-poor ” in retirement, especially when the property market is depressed. An Economic Review Committee set up to review policies on “ taxation, CPF system, wage and land ” has undertaken a thorough review of the CPF rules on housing released its recommendations July 15,

2002. Taking a prudent approach on the withdrawal of CPF savings for housing, the committee recommended that the CPF withdrawal quantum be capped at 150% of the property value at the time of purchase. The CPF withdrawal cap will be gradually tightened to 120% over a period of five years so as not to destabilize the market. The recommendation was endorsed by the government and implemented with effect from

September 1, 2002.

The reliance of the CPF contribution has become an important feature in the housing finance system in Singapore. When there is no limit on the withdrawal of CPF to amortize the mortgage principals, home buyers do not need to folk out additional equity to service the mortgage loan, as long as the future monthly CPF contribution is sufficient to meet the monthly mortgage payments. However, following the change to the CPF rules that restrict the withdrawal to 150% and subsequently to 120%, they face mortgage payment shortfalls prior to the maturity of the loan term. They would have to come out additional equity to cover the shortfalls in loan payments when the CPF withdrawal is reached. The shortfall payment periods, which are computed as the difference between the loan term and the term of which the withdrawal limit is reached,

9 The minimum sum of S$80,000 will be gradually increased over the next 10 year to reach S$120,000 in 2013, and a minimum of S$40,000 of the minimum sum have to be in cash in the CPF account.

7

were found to have positive impact on mortgage rate, loan term and loan principal (Neo,

Lee and Ong, 2003). Moreover, for equity-constrained mortgagor, the above changes to

CPF rules will have significant impact on their ability to meet the mortgage obligations.

This study attempts to examine the implications of this short-fall months on the default risk using a theoretical defaultable ARM model.

IV Defaultable ARM Model with CPF Withdrawal Features a. Assumptions on CPF withdrawal

There are three key features in modeling default behavior of house buyers in Singapore.

Firstly, mortgages in Singapore are predominantly ARMs. Secondly, CPF is an indispensable part of financing for house purchase in Singapore. The use of CPF accrued savings and future monthly contributions to pay for the purchase price and amortize the mortgage implies that the house buyers forgo the interests that will otherwise be earned by the CPF money in the ordinary account. The current saving rates

(July 1 to September 30, 20004) for CPF ordinary account is 2.5% per annum. The lower CPF saving rate vis-à-vis the banks’ board rates for housing mortgage allow home buyers to lever positively by reducing loan principal and monthly loan payments with the use of CPF accrued savings and future monthly contributions. However, there is an opportunity cost attached to the CPF funds, and a member will have to return all the money withdrawn plus interests back to his/her CPF account when they default or dispose of the house in a future date. Path dependence is inherent in the future mortgage values of typical ARMs. Thirdly, in our model, the problem is further complicated when the CPF withdrawal cap is imposed, and we would have to solve the forward to determine when the withdrawal limit is reached given that the forward mortgage interest rate is not fixed.

After projecting forward the mortgage value and also the CPF withdrawal schedule, the default option premiums can be solved in a backward direction from the date of loan maturity using numerical analyses. We extend Kau, Keenan, Muller and Epperson (1990,

1993) model to examine the effects of ARM default risks from the case of uncapped

CPF withdrawal to cases where the CPF withdrawal caps vary from 150% to 120%. For tractability of the proposed default risk model, the following assumptions are made concerning the use of CPF money in typical ARMs in Singapore:

(i) There are sufficient accumulated savings in CPF ordinary account to meet at least 10% of the initial house price;

(ii) Before the CPF withdrawal limit is reached, all the monthly mortgage payments are made using savings and monthly contributions to the CPF ordinary account;

(iii) Prepayment risk is less critical in ARMs where interest rate is adjusted at pre-determined intervals 10 , and prepayment option would not be considered

10 ARMs are not a perfect hedge against prepayment risks. Non-financial exogenous factors like loss of

8

in the model. The only prepayment would only occur when the mortgagors default and the mortgage is terminated;

(iv) CPF accrued savings and monthly contributions that are withdrawn would have to be refunded to the CPF ordinary account together interest accrued.

Opportunity costs are incurred when the CPF money is used, and the cost of the CPF is measured by the foregone saving interest, which is lower than the cost of loan obtained from banks; and

(v) The saving interest rate for money in the CPF ordinary account is assumed to be constant throughout the mortgage term. b.

Underlying State Variable and Standard Defaultable ARM Model

Like many contingent claim model for mortgage analysis, two state variables are specified in the proposed model. The first state variable defines the term structure of interest rate using the widely use mean-reverting spot interest rate process proposed by

Cox, Ingesoll, and Ross (1985a and 1985b), which is written as follows: d r = γ ( θ − r ) dt + σ

1 r dz

1

(1) where γ is the adjustment speed of the interest rate back to equilibrium, θ is the long term equilibrium spot interest rate, σ

1

is the instantaneous volatility of spot interest rate, and dz

1

is the increment of the standard wiener process.

The second state variable is the house price variable, H, which is modeled to follow the geometric Brownian motion given below: d H / H = ( α − s ) dt + σ

2 dz

2

(2) where α is the expected return of house value, and s is the service cash flow rate from the house, thus ( α - s ) is the expected house value appreciation. σ

2

is the instantaneous house price volatility, and dz

2

is the incremental Wiener process for house price, which has a correlation coefficient of ρ with dz

1

, that is E ( dz

1

, dz

2

) = ρ dt .

Based on a risk neutral assumption, the mortgage value will be independent of the expected house price return. We, therefore, replace the expected growth variable, α , with the risk-adjusted return, r , and redefine the price change process in the following risk-neutral form: d / = ( r − s ) dt + σ

2 dz

2

(3)

Using the Ito’s Lemma process, the standard two-state variable contingent claims model for mortgage value, [V(r t

, H t

, t)], can be defined in the following partial differential equation (see Cox, Ingesoll and Ross 1985a 1985b): job, divorce, and others stress factors may also trigger prepayment. However, in order to focus only on the impact of withdrawal limit on mortgage default, the prepayment behavior of ARM mortgagors is excluded.

9

∂ V

∂ t

+ γ ( θ − r )

∂ V

∂ r

+ ( r − s ) H

∂ V

∂ H

+

1

2 r σ

2

1

∂

2

V

∂ r

2

+

1

2

σ

2

2

H

2

∂

2

H

∂ H

2

+ ρ H r σ

1

σ

2

∂

2

V

∂ r ∂ H

− rV = 0

(4) c. Default Behavior with CPF Withdrawal Features

The need to adjust the contracted interest rate at fixed intervals over the whole mortgage term creates the path dependence of interest rates at any period [ t=i ]. The process of adjusting the interest rate is not an exogenous forward process, but it needs to take into account the interest rates in the last period [ t = (i-1) ]. Kau, Keenan, Muller and

Epperson (1990, 1993) introduce an auxiliary interest rate variable to solve the path dependence problem inherent in the ARM model as represented in equation (4). The auxiliary interest rate variable is defined as a function of the one-period lagged mortgage rate, the life-of-loan and yearly loan caps and floors, the margin and also the index interest rate. On a yearly review interval, the new contracted interest rate at i -th year, r

M

(i) , 11 where [ i = (1, 2,…,n )], and n is the mortgage life, can be defined as follows: r

M

( i ) = max{min[I( i) + m , r

M

( i − 1 ) + c y

, r

M

( 0 ) + c ], r

M

( i − 1 ) − f y

} (5) where,

I(t) = Indexed interest rate that links ARM rate to an independent index.

Default-free bond yield rate can be used as proxy for the equilibrium interest rate at time i ; m = Margin above the indexed interest rate; c = Life of loan cap; c y

= Yearly loan cap; and f y

= Yearly loan floor

Based on the prevailing interest rate reviewed in year i , the monthly payment for j -th month in i -th year, M(i, j) , where [ 1 ≤ i ≤ n; and 1 ≤ j ≤ 12 ], can be computed as if the mortgage interest rate were fixed for the remaining mortgage term, which is written as follow:

M(i, j) =

B(i , 0)[r

M

[ 1 +

( i ) r

M

/ 12

( i )

][

/

1 +

12 ] r

M

12 (

( i n − i )

) / 12 ] 12 ( n − i )

− 1

(7)

The outstanding loan balance after the j-th month payment in year i , B(i, j) , is represented below:

11

Equation (5) represents a simple ARM with no teaser. When teaser, ψ , is offered in the initial years, the interest rate at the origin of mortgage contract can be written as: r

M

( 0 ) = I ( 0 ) + m − ψ

.

10

B(i, j) =

B(i,0){[1 +

[ 1 r(t)/12]

+ r ( t )

12(n i)

/ 12 ] 12 (

− [ 1 n − i )

+

− 1 r ( t ) / 12 ] j

(8)

In the Singapore’s context, the CPF accrued savings and monthly contributions are used to make the monthly payments for the mortgage, C d

. In the month prior to the maximum month D of which the CPF withdrawal limit of [ L*H(0) ] is reached, the mortgage payments consist of cash and CPF contributions, which is given as follow:

C d

+

12

12

(

( i − 1 ) +

∑

i − 1 ) + j = D

M(i, j = 1 j) ≤ L * H(0) (9)

The costs of CPF fund withdrawn to make the monthly mortgage payments can be measured by the foregone saving interests, which would otherwise have been earned if the money is kept in the CPF ordinary account. As the CPF saving interest rate, r c

(t) , is lower than the market interest rates charged by banks, r(t) , the cost of borrowing for home buyers who rely on CPF savings for mortgage installments can be computed as

[ r(t) – r c

(t) ], over the period t = (0, D) . The cash equivalent of the monthly payments made by the CPF savings can be derived as follows: c

( , ) = [ ( , )

∫ 12 n j r t − r t dt

] (10)

We expect that the cash equivalent of the CPF portion monthly mortgage payments to be smaller than the actual payments based on the market interest rate, that is

[ M c

( i , j ) < M ( i , j )] . From a mortgagor’s perspective, the value of the default-free mortgage can be computed by discounting the mortgage payments over two different periods, as represented by the period before the CPF limit is reached and the period after

D :

V

1

0 ( i , j ) =

E

E

12 ( k k

− 1 ) +

∑

= i , l = l = 12 n j

M ( k , l ) e 12

12

(

( i

∫

− 1 )

− 1

−

)

+ l

+

( r j

( t ) / 12 ) dt

;

12 ( k k − 1 + l

∑

= i , l = j

= D

M ( k , l )

12 e 12

(

( i k − 1 )

∫

− 1 )

− (

+ l

+ j r ( t ) / 12 ) dt

+

12 (

12 ( k k

− 1 ) + l = 12 n

∑

− 1 ) + l = D

M c

( k , l )

12 e 12

(

( i k − 1 )

∫

− 1 )

− (

+ l

+ j r ( t ) / 12 ) dt

;

12 ( i − 1 ) + otherwise j > D

(11)

However, for the mortgagee, he is indifferent whether the mortgage payments are made by CPF fund or by mortgagor’s equity. The default-free mortgage value to the lender is computed as follows:

2

( , ) =

12( k 1) 12

∑

= , = n

M k l e

− ∫ 12( k 1) l

− + j dt

) (12)

By comparing the default-free mortgage value in equation (11) and the defaultable mortgage value, V

1

(i, j) and V

2

(i, j) , given in partial differential equation (PDE) (5), we

11

can estimate the default option premiums by solving the two sets of value simultaneously:

D

1

( i , j ) = V

1

0 ( i , j ) − V

1

( i , j )

(13a)

D

2

( i , j ) = V

2

0 ( i , j ) − V

1

( i , j )

(13b)

To solve the PDE in equation (5), we set up the triggering condition, which suggests that default occurs ruthlessly as soon as the house value drops below the mortgage value, i.e. the house equity value is negative:

V

1

(r(t), H, t) ≤ H(t)

(14)

At the optimal triggering house price, H * (t), the free-boundary conditions, which consist of the following value-matching and smooth-pasting boundaries, are defined as follows:

( ( ), * ( ), ) = ( ) ; and ( ( ), * ( ), ) = ( ) (15a&b)

dV

1 dH

H = H *

= 1 ; and

dV

2 dH

H = H *

= 1 (15c&d)

We also define the end-point conditions when the mortgage is fully amortized at the end mortgage life, [ T = n ]:

V p

( r ( T ), H ( T ), T ) = 0 ; where (p = 1,2) (16)

The other two end-points are defined when the house value approaches infinity, [H(t) =

∞ ] . Under these conditions, the probability of default is zero, and the mortgage value will correspond to the value of the default free mortgage:

V

1

(r(t), ∞ , t) = V

1

0 ( t ) (17a)

V

2

(r(t), ∞ , t) = V

2

0 ( t ) (17b)

Based on the above free and end-point boundary conditions as defined in equations (14) to (17), we could numerically solve the PDE system in equation (5) and derive at the value of the defaultable ARM mortgages that are partially financed by CPF savings.

V Numerical Result

After setting up the ARM framework and necessary boundary conditions in the earlier section, we solve the PDE numerically to derive at the default option value. The path-dependence process complicates the numerical computation. We use the least square Monte Carlo simulation method proposed by Longstaff and Schwartz (2001) to numerically solve the PDE (equation 5) for the ARM incorporated with CPF features.

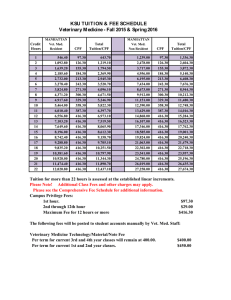

The base case scenario is specified in Table 1. The numerical analyses are extended to examine the impact of changes to CPF withdrawal limit, CPF saving interest rate, house price and interest rate volatilities on the default option value.

12

Table 1: Input Assumptions for a Base Case Scenario

House price, H(t=0) S$600,000

Yearly loan cap & floor, c y

= f y

2%

Life of loan cap, c

Housing service flow, s

Current spot interest rate, r(t=0)

Steady state spot interest rate, θ

Reversion coefficient for spot interest rate, γ

4%

3%

5.5%

8%

25% a. Effects of CPF withdrawal Cap

Table 2 shows the impact of changes to the CPF withdrawal policies on the default risk of ARMs that are partially funded by CPF money. The upper panel (A) represents the mortgage values and default option value estimates for mortgagors, and the panel (B) consists of the respective estimates from the mortgagee’s perspective. The results show that there is an inverse relationship between CPF withdrawal cap and the default value of ARMs. When the government restricts the use of CPF to pay for the mortgage payments, the default risk increases, which is shown in the increases in the mortgage value with embedded default option in both mortgagor’s and mortgagee’s valuation. By restraining the withdrawal of CPF to 150% or lower, the mortgagor is cut off of the supply of lower cost CPF fund to finance the home purchase. The mortgage service ability of the mortgagor is strained when the withdrawal limit is reached. This will indirectly increase the default probability. The mortgagee may be indifferent whether the mortgage payments are made through cash or CPF account. Therefore, the default-free mortgage value remains unchanged regardless of the changes to the CPF withdrawal cap. The risk of early termination of the mortgage is critical as a result of possible default by the mortgagor, the mortgage values of the mortgagee will increase because of higher corresponding default premiums.

The above results imply that there are significant increases to the default risk premium when the unrestricted CPF withdrawal for housing purchase is curbed by the government. As a percentage of the original loan principal, which assumes a maximum

80% loan to value ratio is granted, the default risk premiums increase from 0.34% to

0.42% and subsequently to 0.86%, when 150% and 120% caps are imposed on the mortgagor’s use of CPF savings. The risk premiums were even higher for the mortgagee, which increase from 0.99% to 1.10% and 1.51% respectively (Table 2). In anticipation of the potential increase in default risk associated with changes to the CPF withdrawal rules, mortgagees may have to consider options like imposing looser caps, and/or increasing the margin of interest rates so as to protect the ARMs against increasing default risks.

Table 2: Effects of CPF Withdrawal Cap on ARM Default Risk

13

CPF withdrawal limit

Mortgage value adjusted for default risk premiums, V i

A) For Mortgagor

No limit 243,240

Default free mortgage value, V 0 i

244,850

Value of default risk, D i

1,610

Default Risk premium (%) *

0.34%

B) For Mortgagee

No limit 467,230 472,000 4,763 0.99%

* The default risk premium is computed as a ratio of the default value to the original loan principal, which is computed as LTV*H(0)=$480,000, where LTV is set at the maximum of 80%. b. Effects of CPF Saving Interest Rate Changes

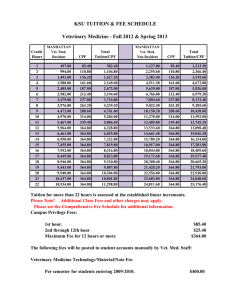

CPF saving interest rates measure the opportunity costs of using the CPF fund for the monthly mortgage payments. The increase of the CPF saving interest rates will have a positive effect on the cost of CPF fund, which is then translated into a higher cash equivalent for the CPF portion of the mortgage payment. As a result, the mortgage value adjusted for default risk increases, which correspondingly increases the default risk premium. Figure 1 shows a positive relationship between the CPF saving rates and the default risk premiums. Given that the default-free mortgage value is independent of the use of CPF fund for the mortgagees, increases in default risk premium have a negative effect on the mortgage values. c. Changes in the Volatilities of House Price and Interest Rate

The predictions of contingent claim mortgage valuation models that the default premiums are positively related to the volatilities of both house prices and the term structure of interest rate are observed in our findings as shown in Figures 2 and 3. The elasticity of default risk premium with respect to the house price volatility differs for the mortgagor and the mortgagee. The mortgagee’s risk premium increases from 0.98% to

8.18% of the original loan value when the house price volatility changes from 15% to

25%. Within the same house price volatility range, the default risk premium in mortgage value increases only from 0.48% to 5.28% for the mortgagor’s ARM. The elasticity of default risk premium with respect to interest rate volatility is flatter. The mortgage

14

values change from 0.44% to 0.58% for the mortgagor, whereas the value for the mortgagee’s mortgage changes from 0.83% to 1.31%, when the interest rate volatility increases from 5% to 20%.

VI Conclusion

ARMs are the prevailing mortgage financing option in Singapore and other Asian countries. The use of CPF accumulated savings and future monthly contributions to fund housing purchase and to service mortgage loans are an indispensable feature of housing finance in Singapore. Therefore, changes relating to the CPF rules have significant implications for the house financing and mortgage pricing. Using the auxiliary state variable to keep tracked of the path dependence in floating interest rate changes in ARMs, the mortgage default risks can be modeled in the standard two-state contingent claim model as proposed in Kau, Keenan, Muller and Epperson (1990 and

1993). We extended the model to incorporate the withdrawal of CPF funds to pay for the monthly mortgage installments.

This paper applied the defaultable ARM model to analyze how the CPF withdrawal features affect the pricing of mortgages in Singapore. The cash equivalent approach is used to convert the lost of CPF saving interests, which will otherwise have been earned, to the costs of mortgage in the study. By combining the two different streams of cash flows by CPF contributions and cash in the mortgage, mortgage values adjusted for default risk premiums were estimated for both the mortgagor and the mortgagee. The impact of the change to CPF withdrawal policy, which restricts use of CPF funds to

150% of the original purchase price and subsequently to a lower limit of 120% in five years, on default option premiums in ARMs was examined.

Based on a reasonable set of parameter inputs, the least-square Monte-Carlo simulation method of Longstaff and Schwartz (2001) was used to solve the PDE of the mortgage pricing model. The results show an inverse relationship between CPF withdrawal cap and the default value of ARMs. The effects of government’s move to restrict the use of

CPF savings for housing finance are significant and positive on the default risk of

ARMs. When the CPF withdrawal cap is tightened from 150% to 120% of the original house price, the default risk premiums for ARMs are expected to increase from 0.42% to 0.86 for the mortgagor; and from 1.10% to 1.51% for the mortgagee. We also observed that the CPF saving interest rates, the house price volatility and interest rate volatility are positively related to the default option premiums in ARMs. The positive effects of the two volatility terms on the default risk premiums were consistent with the predictions of contingent claim mortgage valuation models.

The implication of the findings for private mortgagees, mortgagors and policy makers cannot be under-estimated. In anticipation of the potential increase in default risk associated with changes to the CPF withdrawal rules, mortgagees may have to consider options like imposing looser caps, and/or increasing the margin of interest rates so as to

15

protect the ARMs against increasing default risks. If the secondary mortgage market were to be developed in Singapore, the dynamics of the government policy concerning the CPF system will have to be carefully evaluated.

References:

Ambrose, B.W, Buttimer, R.J. and Capone C.A. “Pricing Mortgage Default and

Foreclosure Delay.” Journal of Money, Credit and Banking 29(3) (1997), 314-325

Asay, M.R. Rational Mortgage Pricing . Ph.D dissertation, Univ. of Southern California,

1978.

Black, F. and Scholes, M. “The Pricing of Options and Corporate Liabilities.” Journal of Political Economy 81 (1973), 637-654.

Brennan, M.J. and Schwartz, E.S. “Determinants of GNMA Mortgage Prices.” AREUEA

Journal 13 (1985), 209-228.

Brueckner, J.K. “Why Do We Have ARMs?” Journal of the American Real Estate and

Urban Economics Association 21(3) (1993), 333-345.

Buser, S.A. and Hendershott, P.H. “Pricing Default-Free Fixed Rate Mortgages.”

Housing Finance Review 3(4) (1984), 405-429

Buser, S.A., Hendershott, P.H. and Sanders, A.B. “Pricing Life-of-Loan Rate Caps on

Default-Free Adjustable-Rate Mortgages.” AREUEA Journal 13(3) (1985), 248-260.

Cox, J.C., Ingersoll, J.E., and Ross, S.A. “A Term Structure of Interest Rates.”

Econometrica 53 (2) (1985a) 385-407.

Cox, J.C., Ingersoll, J.E., and Ross, S.A. “An Intertemporal General Equilibrium Model of Asset Pricing.” Econometrica 53(2) (1985b) 363-384.

Cunningham, D.F. and Capone, C.A. “The Relative Termination Experience of

Adjustable to Fixed Rate Mortgages.” The Journal of Finance 45(5) (1990),

1687-1703.

Dunn, K.B. and McConnell, J.J. “Valuation of GNMA Mortgage-Backed Securities.”

Journal of Finance 36 (1981), 599-616.

Foster, C. and Van Order, R. “An Option-based Model of Mortgage Default.” Housing

Financing Review 3 (4) (1984), 351-372.

Foster, C. and Van Order, R. “FHA Terminations: A Prelude to Rational Mortgage

Pricing.” AREUEA Journal 13(3) (1985), 273-291.

Hendershott, P. H. and Shilling, J.D. “Valuing ARM Rate Caps: implications of 1970-84

Interest Rate Behavior.” AREUEA Journal 13(3) (1985), 317-332.

Hendershott, P. and Van Order, R. “Pricing Mortgages: An Interpretation of the Models and Results.” Journal of Financing Service Research 1(1987), 19-55.

Houston, J.F., Sa-Aadu, J. and Shilling, J.D. “Teaser Rates in Conventional

Adjustable-Rate Mortgage (ARM) Markets.” Journal of Real Estate Finance and

Economics 4 (1991), 19-31.

Kau, J.B., Keenan, D.C. and Kim, T. “Transaction Costs, Suboptimal Termination and

Default Probabilities.” Journal of American Real Estate and Urban Economics

Association 21(3) (1993), 247-263.

Kau, J.B., Keenan, D.C. and Kim, T. “Default Probabilities for Mortgages.” Journal of

Urban Economics , 35 (1994), 278-296.

16

Kau, J.B., Keenan, D.C., Muller, W.J. and Epperson J.F. “Rational Pricing of Adjustable

Rate Mortgages.” AREUEA Journal 13 (2) (1985), 117-128.

Kau, J.B., Keenan, D.C., Muller, W.J. and Epperson J.F. “The Valuation and Analysis of

Adjustable Rate Mortgages.” Management Science 36(12) (1990), 1417-1431.

Kau, J.B., Keenan, D.C., Muller, W.J. and Epperson J.F. “A Generalized Valuation

Model for Fixed-Rate Residential Mortgages.” Journal of Money, Credit and

Banking 24(3) (1992), 279-299.

Kau, J.B., Keenan, D.C., Muller, W.J. and Epperson J.F. “Option Theory and

Floating-Rate Securities with a Comparison of Adjustable- and Fixed-Rate

Mortgages.” Journal of Business 66(4) (1993) 595-618.

Kau, J.B., Keenan, D.C., Muller, W.J. and Epperson J.F. “The Valuation at Origination of Fixed-Rate Mortgages with Default and Prepayment.” Journal of Real Estate

Finance and Economics 11 (1995), 5-36.

Kau, J.B. and Slawson, C.V. “Frictions, Heterogeneity and Optimality in Mortgage

Modeling.” Journal of Real Estate Finance and Economics 24(3) (2002), 239-260.

Longstaff, F and Schwartz, E.S. “Valuing American Options by Simulation: A Simple

Least Squares Approach.” Review of Financial Studies 14(1) (2001), 113-147.

Lum, S. K. “The Singapore Private Property Market - Price Trends and Affordability,”

NUS Inter-Faculty Conference on " The Singapore Dream: Private Property, Social

Expectations & Public Policy " (1996).

Merton, R. “Theory of Rational Option Pricing” The Bell Journal of Economics and

Management Science 4 (1) (1973), 141-183.

Neo P. H., Lee N. J. and Ong S. E. “Government Policies and Household Mobility

Behavior,” Urban Studies 40(13) (2003), 2643 - 2660.

Sa-Aadu, J. and Sirmans, C.F. “The Pricing of Adjustable Rate Mortgage Contracts,”

Journal of Real Estate Finance and Economics 2, (1989), 253-266.

Schwartz, E.S. and Torous, W.N. “Prepayment, Default and the Valuation of Mortgage

Pass-Through Securities” Journal of Business 65 (2) (1992), 221-239.

Quigley, J.M. and Van Order, R. “Explicit Tests of Contingent Claims Models of

Mortgage Default.” Journal of Real Estate Finance and Economics 11 (1995),

99-117.

Vandell, K.D. “How Ruthless is Mortgage Default? A Review and Synthesis of the

Evidence.” Journal of Housing Research 6(2) (1995), 245-264.

Vandell, K.D. and Thibodeau, T. “Estimation of Mortgage Default Using Disaggregate

Loan History Data.” AREUEA Journal 13(2) (1985), 292-316.

17

Figure 1: Effects of CPF Saving Interest Rates on Mortgage Default Premiums

8000

7000

6000

5000

4000

3000

2000

1000

0

1% 2% 3% 4% 5% 6%

CPF Saving Interest Rates, r c

Value of default risk for mortgagor Value of default risk for mortgagee

Figure 2: Relationships between House Price Volatility and Default Risk Premiums

$40,000

$30,000

$20,000

$10,000

$0

5% 10% 15% 20%

House Price Volatility, σ

2

Value of default risk for mortgagor

25% 30%

Value of default risk for mortgagee

18

Figure 3: Effects of Interest Rate Volatility on Default Risk Premiums

1.4%

1.2%

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

0% 5% 10%

Default risk premium to mortgagor

15% 20% 25%

Interest Rate Volatility, σ

1

Default risk premium to mortgagee

19