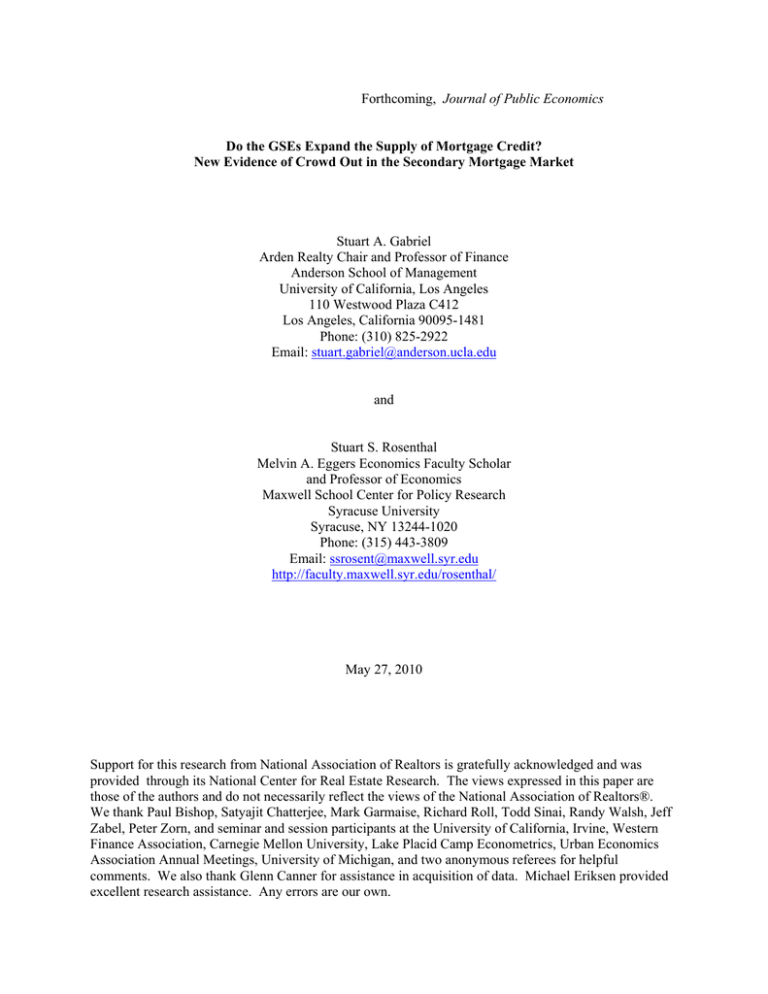

Do the GSEs Expand the Supply of Mortgage Credit?

advertisement