SMITH BUSINESS App-etite for

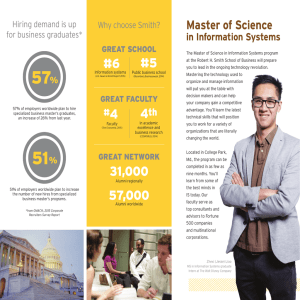

advertisement