Guide to Management of Materiel

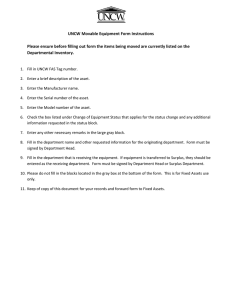

advertisement