Offsetting Behavior and Compensation Reform N. K. Chidambaran Graduate School of Business

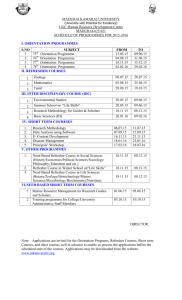

advertisement