A I Accelerating Economic Development

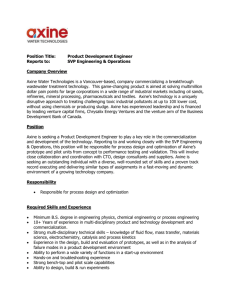

advertisement