A I Accelerating Economic Development

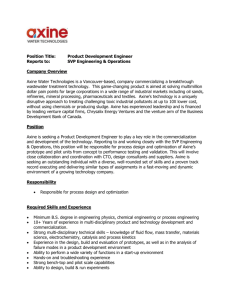

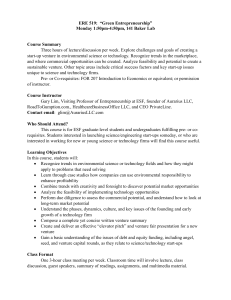

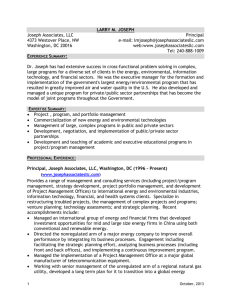

advertisement