S M I

advertisement

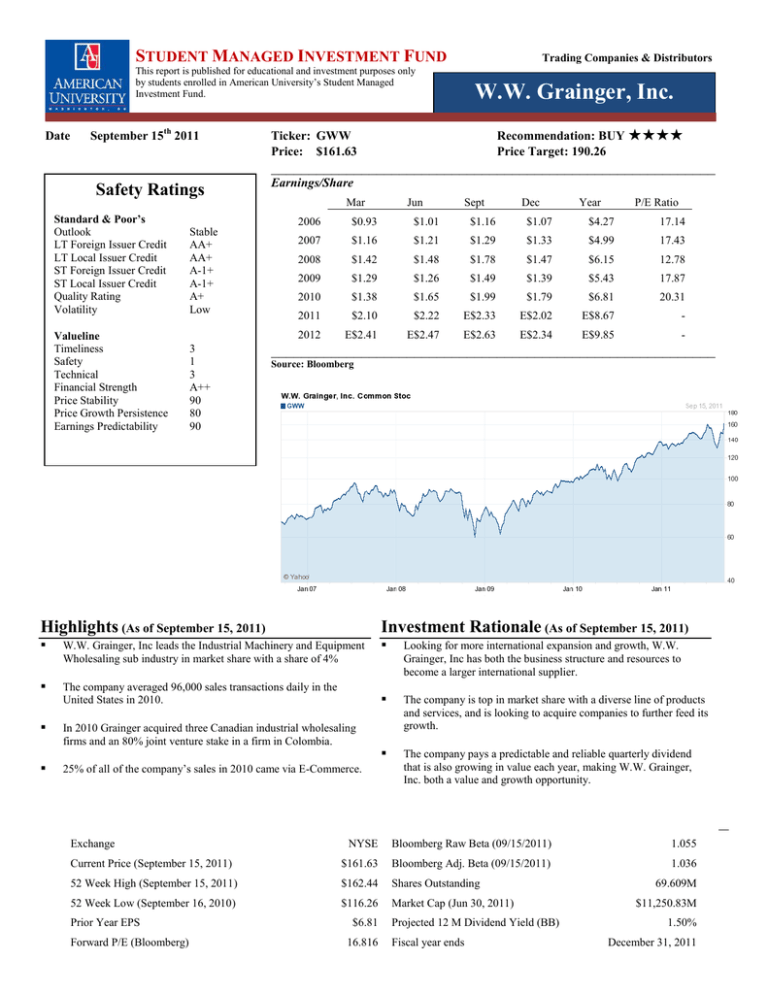

STUDENT MANAGED INVESTMENT FUND Trading Companies & Distributors This report is published for educational and investment purposes only by students enrolled in American University’s Student Managed Investment Fund. Date September 15th 2011 W.W. Grainger, Inc. Recommendation: BUY ★★★★ Price Target: 190.26 Ticker: GWW Price: $161.63 ___________________________________________________________ Safety Ratings Standard & Poor’s Outlook LT Foreign Issuer Credit LT Local Issuer Credit ST Foreign Issuer Credit ST Local Issuer Credit Quality Rating Volatility Stable AA+ AA+ A-1+ A-1+ A+ Low Valueline Timeliness Safety Technical Financial Strength Price Stability Price Growth Persistence Earnings Predictability 3 1 3 A++ 90 80 90 Earnings/Share Mar Jun Sept Dec Year P/E Ratio 2006 $0.93 $1.01 $1.16 $1.07 $4.27 17.14 2007 $1.16 $1.21 $1.29 $1.33 $4.99 17.43 2008 $1.42 $1.48 $1.78 $1.47 $6.15 12.78 2009 $1.29 $1.26 $1.49 $1.39 $5.43 17.87 2010 $1.38 $1.65 $1.99 $1.79 $6.81 20.31 2011 $2.10 $2.22 E$2.33 E$2.02 E$8.67 - 2012 E$2.41 E$2.47 E$2.63 E$2.34 E$9.85 - ___________________________________________________________ Source: Bloomberg Highlights (As of September 15, 2011) Investment Rationale (As of September 15, 2011) W.W. Grainger, Inc leads the Industrial Machinery and Equipment Wholesaling sub industry in market share with a share of 4% Looking for more international expansion and growth, W.W. Grainger, Inc has both the business structure and resources to become a larger international supplier. The company averaged 96,000 sales transactions daily in the United States in 2010. The company is top in market share with a diverse line of products and services, and is looking to acquire companies to further feed its growth. The company pays a predictable and reliable quarterly dividend that is also growing in value each year, making W.W. Grainger, Inc. both a value and growth opportunity. In 2010 Grainger acquired three Canadian industrial wholesaling firms and an 80% joint venture stake in a firm in Colombia. 25% of all of the company’s sales in 2010 came via E-Commerce. Key Statistics Exchange NYSE Bloomberg Raw Beta (09/15/2011) 1.055 Current Price (September 15, 2011) $161.63 Bloomberg Adj. Beta (09/15/2011) 1.036 52 Week High (September 15, 2011) $162.44 Shares Outstanding 52 Week Low (September 16, 2010) $116.26 Market Cap (Jun 30, 2011) Prior Year EPS Forward P/E (Bloomberg) $6.81 16.816 Projected 12 M Dividend Yield (BB) Fiscal year ends 69.609M $11,250.83M 1.50% December 31, 2011 September 15, 2011 W.W. Grainger, Inc. Business Description W.W. Grainger, Inc. is a multi-channel distributor of maintenance, repair, and operating (MRO) supplies mainly in North America, but it is also expanding into Latin America and Asia. Founded in 1928, Grainger is the largest global distributor of both commercial and industrial supplies. Grainger is able to serve its close to 2 million customers by providing a variety of different means to be accessed, such as local branches, catalogs, sales representatives, direct marketing, distribution centers, export services, and multiple websites. Operations Grainger operates in three segments, the United States, Canada, and other international entities being grouped into the third. The United States is by far the largest of these segments, accounting for over 80% of all revenue each of the past three years, and there are around 400 branches covering all 50 states. In the United States, Grainger relies on providing local availability of its products combined with fast delivery and competitive prices in order to succeed. The products offered vary from safety and security supplies, to power tools and lighting, to vehicles, to cleaning supplies, showing a broad-line distribution approach. The company also provides inventory management and energy efficiency services, to further add diversity to its offerings. In 2010, Grainger averaged 96,000 transactions a day in the United States, serving around 1.7 million customers. Canada is also a stronghold for Grainger as it has 171 locations in the country, operating under the name Acklands-Grainger. The country provides a good opportunity for profitability due its close location and NAFTA, and Grainger decided to capitalize this in 2010 by acquiring Ranson Industrial and Safety Supplies Inc., Solus Securite Inc., and Wolseley Industrial Products Group, all three being Canadian companies. Daily transactions for Canada were around 14,000 and the company’s February 2011 catalog contained more than 106,000 products. For international exposure outside of North America, Grainger has had average two-year revenue growth of 68.21% from 2008-2010 coming from its non-United States and Canada locations. Furthermore, in 2010, the company acquired an 80% stake in a Colombian joint venture, and has plans to expand into China, as well as further into Japan and Mexico. Additionally, international sales are driven by E-Commerce, and this is becoming more and more visible as the company continues to expand internationally as in 2010 online purchases accounted for 25% of sales. Management James T. Ryan is the Chairman, President, and CEO of W.W. Grainger Inc. He has been a member of the board of directors since February 2007, and the board chairman since April 2009. He has been with the company since 1980, holding many roles until he became President in April 2004, COO in February 2007, and CEO in June 2008. He currently holds 139,603 shares of the company for a .2% stake. The Board collectively owns a 5.88% stake in the company amongst its 12 members, something that is much larger than the average from its peers, whose board members, on average own just 1.06% of the their respective company. David W. Grainger, son of the founder William W. Grainger, is the Board’s Senior Chairman and has sat on the Board since 1953, and holds 5,886,264 shares in company. Source: Bloomberg, Company Filings, IBISWorld, S&P Industry Overview and Competitive Positioning The Trading Companies and Distributors industry and specifically the Industrial Machinery and Equipment Wholesaling sub industry are extremely segmented and competitive, with firms operating at all points of the supply chain. With an extremely large amount of firms providing an equally large amount of different goods and services, there are no dominant firms in terms of market share. This is seen as W.W. Grainger, Inc is the largest player in the Industrial Machinery and Equipment Wholesaling sub industry with a market share of just 4%. Another result of having so many companies in the marketplace is that the vast majority (82.5%) have less than twenty employees. This also leads to many firms in the industry with very tiny market capitalizations. With almost 20,000 firms in such a wide reaching industry there is much competition due to most firms being very specialized and a lot of the smaller firms serving specific niches. One major form of competition is price based competition due to this being a customer driven industry that relies on costs and services. Another metric of competition is variety, as firms in this industry sell a wide variety of products. This leads to the larger firms in the industry, like Grainger, offering an extremely broad product line as to attract as many Analyst: Jesse Golaszewski AU SMIF Page 2 September 15, 2011 W.W. Grainger, Inc. different customers as possible. Additionally, existing contracts and brand reputations come into part as two of the largest barriers to entry as new entrants may find it difficult to acquire a customer base when customers are already loyal to specific brands, and that suppliers may already have long-term distribution contracts. Source: Yahoo Finance Competitive Position within Industry W.W. Grainger, Inc. has an extremely strong position in the industry first and foremost due to its large market share and market capitalization. This allows Grainger to be a large player in acquiring the smaller firms in the industry, as it did in 2010 when it acquired three Canadian companies. Additionally, having such vast size in comparison to others in the industry allows the firm to produce many different products and be spread amongst 599 branches worldwide. Grainger is also in a strong position as it provides goods and services to others firms with many different distribution channels to varying parts of the supply chain. This allows Grainger to sell to other distributors, wholesalers, and even direct customers. When coupling this with the fact that Grainger does not partake in product research and development, it allows the firm’s vast product lines to be customer demand driven. The combination of large size and a high variety of products and customers allows Grainger to be very secure in its market position and allows room for growth; especially as the company has shown previous it wants to expand internationally via joint ventures, and by acquiring a country’s home companies. Source: Bloomberg, Company Filings, IBISWorld, S&P Comparables Name Ticker Last Px YTD Return Mkt Cap TTM P/E Average TTM Debt/Common 2011 Proj P/E PEG P/B P/S EPS Equity Current Profit Ratio Margin Dividend Yield 62.85 0.09 4.53B 18.58 14.18 1.10 3.25 1.33 3.77 0.31 3.14 0.07 2.50% WW GRAINGER INC GWW 161.63 18.59 11.25B 19.95 16.44 1.33 4.54 1.48 8.59 0.20 2.57 0.08 1.41% FASTENAL CO FAST 35.90 21.74 10.59B 33.71 25.03 1.54 7.82 4.20 1.07 0.00 6.69 0.13 2.59% MSC INDUSTRIAL DIRECT CO-A MSM 62.54 -2.37 4.08B 19.42 14.79 1.03 3.96 2.01 3.20 0.00 3.56 0.12 3.01% SNAP-ON INC SNA 51.75 -6.91 3.01B 13.30 10.33 1.21 1.92 1.05 4.10 0.75 2.00 0.10 2.43% WESCO INTERNATIONAL INC WCC 43.71 -17.22 2.08B 13.53 9.45 1.01 1.51 0.34 3.54 0.63 2.14 0.03 0.00% ANIXTER INTERNATIONAL INC AXE 58.61 -1.88 2.05B 12.55 9.09 0.76 1.81 0.34 4.78 0.85 2.13 0.03 5.55% WATSCO INC WSO 59.02 -4.06 1.94B 22.88 16.74 1.08 2.47 0.63 2.58 0.08 3.15 0.04 2.64% 29.62 -7.20 1.26B 13.28 11.56 0.84 1.99 0.57 2.29 0.00 2.88 0.05 2.36% APPLIED INDUSTRIAL TECH INC AIT Source: Bloomberg Due to the high variety of goods and services that W.W. Grainger, Inc provides, and its distribution channels to many different suppliers up and down the supply chain, it has a diverse mixture of competitors. Additionally, since Grainger is larger company, many of its comparables only compete with a certain section of what Grainger does, as opposed to across the board. The relative competition can explain why Grainger has the largest market capitalization, of all its comparables. Grainger also is one of two equities to have a positive year to date return. Furthermore, Grainger has the second lowest dividend yield and the lowest of those who pay a dividend, meaning it is one of the most growth oriented equities. Grainger also has the highest trailing twelve month earnings per share, which is a testament to its strong value. Macroeconomic Drivers within the Industry Economy Analyst: Jesse Golaszewski AU SMIF Page 3 September 15, 2011 W.W. Grainger, Inc. The success of Industrials, specifically on the distribution and wholesale ends, is tied partially to the GDP cycle, as due to utilization rates the Industrials sector is also cyclical. A growing economy will lead to more manufacturing and a down economy should theoretically lead to less manufacturing, so while a recent downturn might dampen the outlooks of firms in this industry, as long as the economy is predicted to have long-term recovery, so should this industry. Federal Government Policy With customers from both the public and private sectors, federal government policies can have great effects on this industry. The federal government in the United States is a large consumer of both goods and services from industrial distributors and wholesalers, so when the government is more willing to spend, the industry gets one more extremely large customer. International Government Policy With a sufficient amount of manufacturing moving overseas the policies of foreign governments should play a large role in how distributors and wholesalers are able to operate. With different government structures and societal norms, firms must be able to assess how they can operate in a foreign setting. Furthermore, they must balance the laws of their home countries, if the two governments are not in accordance. Movement Away From Agrarian Societies in Emerging Markets With emerging market countries striving to strengthen their economies there should be a shift from a more agrarian based society towards a more manufacturing based society and economic structure. With the increase in facilities that would follow, there becomes a need for suppliers of both goods for facilities and services to assist in the management of these services. Date Dividend 12/31/2011 0.66 9/30/2011 0.66 6/30/2011 0.66 3/31/2011 0.54 12/31/2010 0.54 9/30/2010 0.54 6/30/2010 0.54 3/31/2010 0.46 12/31/2009 0.46 9/30/2009 0.46 6/30/2009 0.46 3/31/2009 0.4 12/31/2008 0.4 9/30/2008 0.4 6/30/2008 0.4 3/31/2008 0.35 12/31/2007 0.35 9/28/2007 0.35 6/29/2007 0.35 3/30/2007 0.29 12/29/2006 0.29 9/29/2006 0.29 6/30/2006 0.29 3/31/2006 0.24 Source: Bloomberg, Data in Bold is Forecasted. Multiples Values Forward P/E 16.816 2012 EPS 9.85 Price 165.64 2012 Est. Sales 8673.643M 2012 Est. P/S 1.284 Shares 69.609M Price 159.99 Average 162.82 Source: Bloomberg Analyst: Jesse Golaszewski Investment Summary W.W. Grainger is a strong wholesaler and distributor that has a large market capitalization and potential to bring both value and growth. It pays a quarterly dividend that stays the same amount for four consecutive quarters before increasing, as the trend has been over the past 5 years. As a result of having a long-standing distinct pattern to the dividend, it allows for easier and precise forecasting. As a result, an H-model will be used to initially capture the growth aspect of the equity in the initial state and then capture the value aspect with the long term growth rate. The H-Model resulted in a value of $208.55. Additionally, multiples analysis will be used with Forward P/E and Forward P/S being used and then averaged to get a share price of $162.82, As the H-Model better explains both the growth and value prospects, it received a higher weight, of 60%, while the multiples got a value of 40%, for an overall price target of 190.26, a 17.71% increase. Price DDM MULT Weight 208.55 162.82 0.6 0.4 125.13 65.13 190.26 Valuation Dividend Discount Model/H-Model Due to the stock paying a dividend and a very predictable one at that, a dividend discount model was used to value the future stock price. As mentioned above, since this is a blend equity, an H-model was used to capture the initial predicted supernormal growth, and then to capture the value aspect of the equity for the long term. The supernormal growth rate was calculated by taking the geometric average of the annual dividend growth rate since 2006, with 2011 being able to be forecasted due to the predictable nature of Grainger’s quarterly dividends. This supernormal growth rate was used with a CAPM for the required rate of return and a long-term dividend growth rate of 10% from Value Line. The dividends were grown out for 5 years, with the growth rate not being used for the first year, as it is still possible to get an accurate forecast of the that dividend, based on previous quarterly dividend declarations. This resulted in a share price of $208.55, a 29% increase. DDM capm super long term d0 year div 0 2.08 PV P0 0.11707944 Rf 0.18127113 MRP 0.1 beta 2.08 0.0207 0.093 1.036 1 2 3 2.52 2.97680325 3.5164 $2.26 $208.55 $2.39 4 5 6 4.15383567 4.90680616 5.39748677 H-Model 340.766246 TV 345.673052 $2.52 $2.67 $198.72 AU SMIF Page 4 September 15, 2011 W.W. Grainger, Inc. Multiples Valuation Due to strong sales and earnings, the multiples valuation will be done by using forward P/E and EPS, and project sales and P/S, all for 2012. When using P/E the share price was $164.64, and when using P/S the price was $159.99. An equally weighted average results in a share price of $162.82, a .074% increase. Risks to Your Price Targets The major risks to my price targets are that short term growth will continue to surge. If growth becomes stagnant then the H-Model loses practicality. Furthermore, it would affect also the value, as dividends might not continue to grow at such a large rate. Many events could stunt growth, such as a natural disaster, or an overall increase in market volatility. It is also important to note that P/S undervalued the share price, and that could be as a result of the company being a small bit overvalued, but also we must take into account that our horizon is more long term, and we are not trying to time the market, so it is not as good as an estimate at the H-Model dividend discount model. Financial Analysis A DuPont Analysis will allow us to further examine our Return on Equity. Field Return on Common Equity Tax Burden Interest Burden EBIT Margin Asset Turnover Financial Leverage FY 2010 FY 2009 22.8692 59.8358 99.2217 11.9807 1.8824 1.7466 20.0365 60.8573 106.3306 10.6915 1.7184 1.7252 FY 2008 FY 2007 FY 2006 23.009 19.6514 17.1674 61.4775 61.6137 63.5795 98.7921 101.6712 104.3164 11.4258 10.4495 9.825 2.0728 2.0905 1.9121 1.5996 1.436 1.3778 The ROE had a slight dip in 2009 and it looks as if it was a result of a higher interest burden and lower EBIT Margin. It seems as if ROE is on its way to recovery though seeing as 2010 is now more similar to 2008/ Earnings Earnings have generally grown over the last 5 years, aside from a 14% dip in 2009 due to overall market weakness. The growth was 11% in 2006, 20% in 2007, 25% in 2008, and 28% in 2010, showing a general upward trend and strong recovery from 2009. Cash Flow Cash Flow has been a bit sporadic as it was negative in 2010 after two years of being positive. The reason for the downturn appears to be a reduced positive cash flow from operating from 2009 to 2010. Also cash outflow from financing increase possibly indication a move for future growth. Balance Sheet & Financing Total assets have been steadily climbing since 2006, with a larger increase coming in gross fixed assets. This could possibly be as more and more distribution centers are opening into new markets. Additionally, total equity has seen an increase in the last year. Other Headings Relevant to Company W.W. Grainger has had previous legal disputes and a settlement with the United State Government. In 2008, the government and W.W. Grainger, Inc settled for $6 million for violations of their contract. Grainger was only allowed to mark up goods 26%, but in some cases marked good up as high as 60%. Additionally, the company was found at fault for selling the government products from countries that the United States lacked fair-trade agreements with.3 Investment Risks Commodity Risk Seeing as W.W. Grainger, Inc. is in the industrial sector, it will experience a high variability in sales and earnings due to its close relationship to industrial metals commodities such as copper, nickel, and zinc, as well as steel, as these commodities have high price volatility. Exchange Rate Risk As W.W. Grainger, Inc has growing international operations, and already a strong footing in Canada, there is moderate exchange rate risk. While the majority of sales still occur stateside (84% in 2010), the company plans on expanding globally, something that will lead to increased exposure to foreign currencies. Analyst: Jesse Golaszewski AU SMIF Page 5 September 15, 2011 W.W. Grainger, Inc. Acquisition Risk In industrial machinery and equipment wholesaling there are many acquisitions, due to mostly all companies not being able to provide needs for the entire spectrum of the industry, and the minuscule market shares that these firms have because of that. W.W. Grainger, Inc, however, does not face this same risk as the others, due to its relatively massive market share and market capitalization for the industry. Market Risk Since W.W. Grainger, Inc. has a large market capitalization it is somewhat protected against market volatility. Additionally, its wide variety of product offerings offers it some security against a down market, as well as it not using R&D but rather customer demand. Regulatory Risk W.W. Grainger, Inc faces little direct regulatory risk; as for wholesalers there are no industry specific taxes, and only either a retail or wholesalers license required for operations from the Department of Revenue. However, one indirect regulatory risk is that of increasing environmental regulations, as a movement towards more sustainable products and factories could result in environmental standards changing nationally, which could also lead to a need for updated products that comply with these standards. Another indirect regulatory risk the firm faces deals with workers’ rights, as the firm had to pay a $0.15 per share charge as a result of new health care legislation. Credit Risk W.W. Grainger, Inc has AA+ and A-1+ credit ratings from Standard & Poor’s, meaning the chance of it defaulting on its credit is extremely low. Source: Bloomberg, Company Filings, IBISWorld, S&P, Business Journal of Milwaukee Figure 1: Income Statement Analyst: Jesse Golaszewski AU SMIF Page 6 September 15, 2011 W.W. Grainger, Inc. Account Revenue - Cost of Revenue Gross Profit - Operating Expenses Operating Income - Interest Expense - Foreign Exchange Losses (Gains) - Net Non-Operating Losses (Gains) Pretax Income - Income Tax Expense Income Before XO Items - Extraordinary Loss Net of Tax - Minority Interests Net Income - Total Cash Preferred Dividends - Other Adjustments Net Inc Avail to Common Shareholders Abnormal Losses (Gains) Tax Effect on Abnormal Items Normalized Income Comprehensive Income Comprehensive Income per Share Basic EPS Before Abnormal Items Basic EPS Before XO Items Basic EPS Basic Weighted Avg Shares Diluted EPS Before Abnormal Items Diluted EPS Before XO Items Diluted EPS Diluted Weighted Avg Shares Source: Bloomberg 12/31/2010 12/31/2009 7182.158 4176.474 3005.684 2145.209 860.475 8.187 0 -1.49 853.778 340.196 513.582 0 2.717 510.865 0 11.294 499.571 -9.3781 #N/A N/A 490.1929 541.442 7.4841 6.92 7.05 7.05 70.8369 6.8 6.93 6.93 72.1389 12/31/2008 6221.991 6850.032 3623.465 4041.81 2598.526 2808.222 1933.302 2025.55 665.224 782.672 8.766 14.485 0 0 -50.879 -5.031 707.337 773.218 276.565 297.863 430.772 475.355 0 0 0.306 0 430.466 475.355 0 0 9.947 0 420.519 475.355 -20.343 10.24 4.991 #N/A N/A 405.167 485.595 481.365 364.659 6.389 4.7618 5.49 6.34 5.7 6.21 5.7 6.21 73.7863 76.5799 5.42 6.17 5.62 6.04 5.62 6.04 74.8919 78.7503 Figure 2: Cash Flow Statement Field Cash From Operating Activities + Net Income + Depreciation & Amortization + Other Non-Cash Adjustments + Changes in Non-Cash Capital Cash From Operations Cash From Investing Activities + Disposal of Fixed Assets + Capital Expenditures + Increase in Investments + Decrease in Investments + Other Investing Activities Cash From Investing Activities Cash from Financing Activities + Dividends Paid + Change in Short-Term Borrowings + Increase in Long-Term Borrowings + Decrease in Long-term Borrowings + Increase in Capital Stocks + Decrease in Capital Stocks + Other Financing Activities Cash from Financing Activities Net Changes in Cash Source: Bloomberg Analyst: Jesse Golaszewski 12/31/2010 12/31/2009 12/31/2008 510.865 149.678 50.623 -114.721 596.445 430.466 147.531 32.627 121.772 732.396 475.355 139.57 58.209 -143.068 530.066 0 -120.616 0 0 -48.543 -169.159 0 -140.73 0 0 -121.833 -262.563 13.62 -182.678 0 0 -33.577 -202.635 -152.338 205.498 0 -239.122 112.178 -504.803 4.884 -573.703 -146.417 -134.684 2.542 0 -18.856 110.195 -372.727 7.278 -406.252 63.581 -121.504 -81.425 500 0 60.366 -394.247 -7.768 -44.578 282.853 AU SMIF Page 7 September 15, 2011 W.W. Grainger, Inc. Figure 3: Balance Sheet Field Assets + Cash & Near Cash Items + Short-Term Investments + Accounts & Notes Receivable + Inventories + Other Current Assets Total Current Assets + LT Investments & LT Receivables + Gross Fixed Assets - Accumulated Depreciation + Net Fixed Assets + Other Long-Term Assets Total Long-Term Assets Total Assets Liabilities & Shareholders' Equity + Accounts Payable + Short-Term Borrowings + Other Short-Term Liabilities Total Current Liabilities + Long-Term Borrowings + Other Long-Term Liabilities Total Long-Term Liabilities Total Liabilities + Total Preferred Equity + Minority Interest + Share Capital & APIC + Retained Earnings & Other Equity Total Equity Total Liabilities & Equity Analyst: Jesse Golaszewski 12/31/2010 12/31/2009 12/31/2008 313.454 0 762.895 991.577 170.145 2238.071 0 2377.76 1414.088 963.672 702.634 1666.306 3904.377 459.871 0 624.91 889.679 157.055 2131.515 0 2266.493 1313.222 953.271 641.546 1594.817 3726.332 396.29 0 589.416 1009.932 148.471 2144.109 0 2131.863 1201.552 930.311 440.997 1371.308 3515.417 344.295 73.828 451.18 869.303 420.446 326.958 747.404 1616.707 0 82.454 692.516 1512.7 2287.67 3904.377 300.791 87.908 388.1 776.799 437.5 284.834 722.334 1499.133 0 63.479 651.188 1512.532 2227.199 3726.332 290.802 41.217 429.715 761.734 488.228 231.65 719.878 1481.612 0 0 619.558 1414.247 2033.805 3515.417 AU SMIF Page 8 September 15, 2011 W.W. Grainger, Inc. Analyst: Jesse Golaszewski AU SMIF Page 9