William Salamanca PROFESSIONAL EXPERIENCE

advertisement

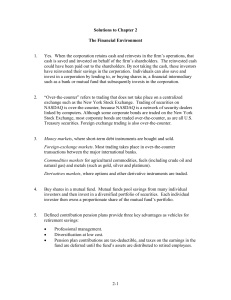

William Salamanca willsalamanca@gmail.com PROFESSIONAL EXPERIENCE Guggenheim Investments, Rockville, MD Vice President Fund Administration December 2008- Present ● ● ● ● Responsible for submitting audited financial statements to shareholders and SEC Analyze and prepare reports for the Board of Directors and the Executive Committee Ensure that expenses are allocated correctly and oversee expense accruals for all funds Disseminate financial information to different departments and answer questions from shareholders or third party providers Monsoon Capital, Bethesda, MD Financial Operations Manager June 2007- December 2008 ● Responsible for all financial operations related to three Indian Hedge Funds and one Indian Private Equity Fund ● Generated monthly risk and performance reports to CEO ● Liaison to the Fund Administrator and Auditors ● Verified that the Funds are correctly accounting for dividends, foreign exchange, and valuation American Capital Strategies, Bethesda, MD September 2006 – June 2007 Financial Operations Manager ● ● ● Responsible for calculating payoff letters of exited investments which include computing IRR, value the equity and determine outstanding cash interest Generate reports which show detail of investments and their performance in multiple periods Responsible for updating private equity valuations in the accounting system Rydex Investments, Rockville, MD Fund Administration Senior/Supervisor February 2003 – September 2006 ● Supervised fund administrators on financial statements: monitoring both status and deadlines ● Prepared Financial Statements for 90+ mutual funds ● Created a more efficient way to distribute mutual fund holdings to third parties using VBA. Rydex Investments, Rockville, MD September 2000 – February 2003 Senior Fund Accountant ● Performed valuation checks for stocks, futures, options, swaps, and short term instruments ● Ensured that daily performance and exposure of mutual funds agreed to its index and net assets ● Instituted and monitored control procedures designed to ensure accurate calculations of net asset values ● Implemented a new way to check for incorrectly priced equities by using Bloomberg EDUCATION James Madison University, Harrisonburg, VA May 2000 B.S. Quantitative Finance and Economics Minor in Mathematics University of Maryland – Robert H Smith School of Business, College Park MBA student with expected graduation in 2016 COMPUTER SKILLS ● Fortran90:Computer language used to solve mathematical and Engineering problems ● Visual Basic: Constructed complex macros to generate Monte Carlo Simulation ● SAS: Used to analyze statistical data