The Deposits Channel of Monetary Policy First draft: November 2014

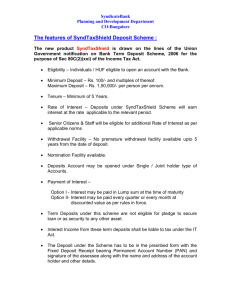

advertisement