Optimal monetary policy revisited: Does considering US real-time data change things?

advertisement

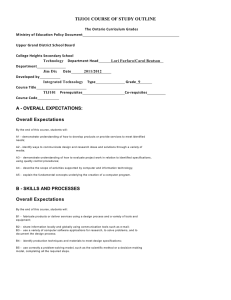

Optimal monetary policy revisited: Does considering US real-time data change things? Steven P. Cassouy Kansas State University Patrick Scottz Missouri State University Jesús Vázquezx Universidad del País Vasco (UPV/EHU) April 3, 2016 Abstract Yes, it does. This paper extends a variant of the asymmetric preference model suggested by Ruge-Murcia (2003a) to investigate the use of real-time data available to policy makers when making their decisions and revised data which more accurately measure economic performance (Croushore, 2011). In our extended model, the central banker targets a weighted average of revised and realtime in‡ation together with a weighted average of revised and real-time output. Moreover, we allow for an asymmetric central bank response to real-time data depending on whether the economy is doing good or not. Our model identi…es several new potential sources of in‡ation bias due to data revisions. Our empirical results suggest that the Federal Reserve focuses on targeting revised in‡ation during good economic times, but it weighs heavily real-time in‡ation during bad economic times. Moreover, the in‡ation bias due to data revisions is comparable in magnitude to the bias from asymmetric monetary planner preferences with the bias being somewhat larger during poor economic times. JEL Classi…cation: C52, E01, E31, E52 Keywords: Monetary policy targets, real-time data, data revisions, in‡ation bias, asymmetric preferences We thank the editor, two anonymous referees and seminar participants at the II Society for Economic Measurement Conference (Paris, France), 90th Annual Conference of the Western Economic Association International (Honolulu, USA) and 40th Symposium of the Spanish Economic Association (Girona, Spain) for helpful comments. Some of this research was supported by the Spanish Ministry of Science and Innovation and the Basque Government (Spain), grant numbers ECO2013-43773P, ECO2010-16970 and IT793-13, respectively. y Department of Economics, 327 Waters Hall, Kansas State University, Manhattan, KS, 66506 (USA), (785) 532-6342, Fax: (785) 532-6919, email: scassou@k-state.edu. z Department of Economics, 367 Strong Hall, Missouri State University, Spring…eld, MO, 65897 (USA), (417) 836-5140, Fax: (417) 836-4236, email: cpscott@missouristate.edu x Corresponding author: Depto. Fundamentos del Análisis Económico II, Facultad de Economía y Empresa, Universidad del País Vasco (UPV/EHU), Av. Lehendakari Aguirre 83, 48015 Bilbao (SPAIN), Phone: +34 946013779, Fax: +34 946017123, email: jesus.vazquez@ehu.es. 1 Introduction Croushore (2011) and others have noted that monetary policy may re‡ect the usage of real-time data available to policy makers at the time their decisions are made as well as revised data which more accurately measure economic performance.1 The dilemma facing policy makers is that they really want to in‡uence the performance of the actual economy, but because of long lags associated with the revised data that most accurately measures this performance, they may be forced to take action based on the most readily available data which arrives in real-time. As noted by Croushore (2011), if the di¤erence between the real-time data and the revised data is small and random, then this distinction would not be an issue. However, this is not the case, as there is some predictability for these di¤erences, and this predictability may induce policy makers to make decisions that di¤er from decisions that simply re‡ect revised data. This paper undertakes a theoretical and empirical investigation of optimal monetary policy in an extended asymmetric preference model of the type suggested by Ruge-Murcia (2003a, 2004) in which policy makers have both real-time and revised data available to base decisions on.2 Our extended model posits that the central banker targets a weighted average of real-time and revised in‡ation as well as a weighted average of real-time and revised output and can be seen as a generaliza1 The impact of the revision process on the empirical evaluation of monetary policy has been well documented in the literature. An early study by Maravall and Pierce (1986) studies how preliminary and incomplete data a¤ect monetary policy. They show that even if revisions to measures of money supply are large, monetary policy would not be much di¤erent if more accurate data were known whenever policymakers are able to optimally extract the signal from the data. More recently, Orphanides (2001), among others, have found that real-time measurement problems of conceptual variables, such as output gap, may induce policymaking errors. By using a VAR approach to analyze monetary policy shocks, Croushore and Evans (2006) have shown evidence that the use of revised data may not be a serious limitation for recursively identi…ed systems. However, their analysis also reveals that many simultaneous VAR systems identi…able when real-time data issues are ignored cannot be completely identi…ed when these measures are considered. These studies have considered US real-time data. More recently, Fernandez, Koening and Nikolsko-Rzhevskyy (2011) have assembled a real-time data set for the OECD countries. In line with US data revision features reported below, they …nd that statistical agencies of OECD countries tend to underestimate both real output growth and in‡ation. 2 Early papers considering central banker asymmetric preferences are Cukierman (2002) and Nobay and Peel (2003). Another approach taken by Surico (2007) focusses on monetary policy rule asymmetries. 1 tion of the variant model suggested by Cassou, Scott and Vázquez (2012). This extended model allows us to empirically test new theoretical hypotheses as well as old hypotheses using a combination of real-time and revised economic data. This paper contributes to the long theoretical literature which investigates the possibility that monetary policy makers may induce an upward bias in in‡ation. Among the earliest works in this literature is Barro and Gordon (1983), which suggests that, because the monetary policy maker is unable to make long term policy commitments, it is possible that instead they pursue policies which create surprise in‡ation. This proposition has generated considerable interest with numerous empirical studies, including Ireland (1999), Ruge-Murcia (2003a, 2003b, 2004) and others, showing mixed results. Papers by Ruge-Murcia (2003a, 2003b, 2004) are particularly noteworthy because these developed a new theory showing that an in‡ation bias may arise from asymmetric preferences on the part of the monetary authority. In the model of Ruge-Murcia (2003a, 2004), the in‡ation bias arises because the monetary authority takes stronger action when unemployment is above the natural rate than when it is below the natural rate. A similar …nding is found by Cassou, Scott and Vázquez (2012) who develop an asymmetric preference model which focuses on an output asymmetry rather than an unemployment asymmetry. In their model, the in‡ation bias arises because the monetary authority takes stronger action when output is below its permanent level than when it is above. The model explored in this paper extends these previous structures by assuming that the central banker targets a weighted average of both revised and real-time in‡ation together with a weighted average of both revised and real-time output.3 We rationalize the inclusion of real-time data in the central banker targets because of the lengthy lag in …nal data revision releases. In particular, …nal revisions of in‡ation 3 We have also analyzed a more straightforward extension of the Ruge-Murcia model where the central banker targets a weighted average of real-time and revised unemployment as well as a weighted average of real-time and revised in‡ation. However, we do not pay attention to this generalization of Ruge-Murcia (2003a, 2004) model since unemployment revisions are rather small and mainly due to statistical adjustments to account for seasonal variations taking place during the …rst year after the …rst release of unemployment data. 2 and output are released around three years later.4 Therefore, market participants’ evaluation of the monetary policy performance, and by the same token the central bank targets, are likely to be based at least partially on real-time data. This idea of real-time central bank targets may also re‡ect the inability of central bankers to make long term policy commitments as in Barro and Gordon (1983), but the inability studied in this paper is due to a di¤erent issue. In particular, here central bankers might be forced to react quickly to real-time data as a result of short-term pressure coming from other policy makers, economic pundits or public opinion. Moreover, the relative importance of real-time data in central banker decision making may be larger during bad economic times due to political pressures to react quickly to bad news. Thus, political pressures can also induce asymmetric central bank responses to real-time data. As a result, the importance of an in‡ation bias induced from the discrepancies between revised and real-time data, as in the traditional in‡ation bias sources suggested by Barro-Gordon (1983) and Ruge-Murcia (2003a, 2004), is likely to be a consequence of the degree of central bank independence, which can di¤er between countries. Our model with data revisions identi…es several new potential sources for an in‡ation bias that arise due to (i) the lag of revised data measurements of the economy with respect to their initial announcements (i.e. real-time data), and (ii) the asymmetric central bank responses to real-time data depending on whether the economy is doing well or not. We explore this model using reduced form estimation methods and US data. Two groups of empirical results are noteworthy. First, a preliminary empiri- cal investigation shows that an autoregressive process …ts US output revisions well. Moreover, we found that in‡ation revisions are negatively correlated with their initial announcements.5 Moreover, we …nd that US data revision processes show some 4 See Landefeld, Seskin and Fraumeni (2008) for a detail description of the timing associated with the sequence of GDP releases. 5 These results are consistent with …ndings in Aruoba (2008), Vázquez, María-Dolores and Londoño (2013), and Casares and Vázquez (2014), who …nd that US data revisions for these variables are not white noise. 3 asymmetries depending on economic performance. In particular, in‡ation revisions are less correlated with the initial announcements of in‡ation during bad economic times than during good economic times. The fact that output and in‡ation revision processes have an empirical structure is important because, as noted by Croushore (2011), revisions need to have some level of predictability to be important. Because of this predictability for output and in‡ation revisions, these series may produce persistent in‡ation biases as our theoretical model predicts. The second group of empirical results focus on these new, as well as the old, sources for in‡ation bias by estimating a reduced form derived from the theoretical model. This reduced form is similar to others found in the literature because they include several previously described in‡ation bias components. However, they di¤er in that they also contain several additional bias terms due to the data revision process. Estimation results provide evidence for some of these additional sources of in‡ation bias arising from the data revisions. In particular, our empirical results suggest that the Federal Reserve (Fed) focuses on targeting revised in‡ation during good economic times, but it weighs heavily real-time in‡ation during bad economic times, and this induces an important source of new bias. Moreover, the evidence that the Fed mainly waits to react to revised in‡ation during good times rather than reacting quickly to real-time in‡ation provides an alternative explanation of policy inertia to those found in the literature (e.g. Goodfriend, 1991). Second, we …nd somewhat weaker evidence that biases induced by the revision structure for output is also present. In addition, as in Ruge-Murcia (2003a, 2004) and Cassou, Scott and Vázquez (2012) we …nd that the Ruge-Murcia asymmetric preference bias remains signi…cant. Namely, the preferences of the monetary authority are asymmetric with stronger action taken when output is below its permanent level than when it is above. Numerical calculations for the size of the in‡ation bias found several consistent results. Most importantly, we do …nd important biases induced by using real-time data. Moreover, these biases could be comparable in size to those induced by asymmetric preferences on the part of the monetary planner. It was also found that the 4 in‡ation biases induced from the output real-time data are larger than the in‡ation biases induced by the in‡ation real-time data. Finally, for the PCE in‡ation monitored by the Fed, the in‡ation various types of bias are larger during bad times. The rest of the paper is organized as follows. Section 2 goes through the theoretical model describing the asymmetric monetary planner with both revised and real-time data targets. Section 3 shows the estimation results and discusses the implications for in‡ation bias. Section 4 concludes. 2 The Model The theoretical model consists of a monetary planner that weighs in‡ation and output in making their decisions. These decisions are complicated by the fact that accurate short term measurements for their targets are not available. We regard the revised data, that is data that appears in conventional databases such as Federal Reserve Economic Data (FRED), as more accurately measuring in‡ation and output, but because of long lags associated with revising this data, the planner may make use of real-time data in their decision making. Furthermore, the extent to which the planner uses real-time data in their decision making may depend on whether the economy is doing well or not. To address the potential extent to which real-time data is used by policy makers and the possibility that this extent may be di¤erent during good or bad economic times, we investigate an extension of the model in Cassou, Scott and Vázquez (2012) which itself is an extension of the in‡ation-unemployment asymmetric preference model suggested in Ruge-Murcia (2003a, 2004). In this section we focus on a baseline model which implies a simple empirical equation. This equation is found using methods similar to Surico (2007) where second order Taylor approximations to the planner’s …rst order condition are found. This approach has the attraction relative to methods used in Ruge-Murcia (2003a, 2004) in that less structure is required for estimation purposes.6 6 In the Appendix, as part of a robustness exercise, we extend this single equation model to allow a time varying in‡ation target. 5 The model begins with several elements whose structure is una¤ected by the revised data lag issue. Here we use a popular short run supply curve formulation suggested by Lucas (1977) given by Yt = Ytp + (Pt Pte ) + t; where Yt is output produced at time t, Ytp is permanent or potential output at time t, Pt is the price level at time t, Pte is the expected price level at time t based on information at time t 1, t is a supply disturbance and re‡ects the sensitivity of …rm output to unexpected price changes. Variables are expressed in log terms. Adding and subtracting Pt 1 inside the parenthesis term on the right gives yt = ( where yt = Yt e t) t Ytp is the output gap, and + t t; = Pt (1) Pt 1 and e t = Pte Pt 1 are in‡ation and expected in‡ation, respectively. To understand why the structure of these equations are not impacted by the data lag issue, one need only recall the foundations for them. In Lucas (1977), the supply derivation comes from aggregating up from individual …rm decision rules where …rms make output decisions based on observed prices for their products relative to some expected price. Because this aggregation of the individual supply curves is just a simple addition process, the structure is una¤ected as are the observed terms Yt and Pt . However, it is possible for the distinction between revised and real-time data to work into the Pte term and then into e t, since this term includes price aspects that lead to misperceptions about what is the true common price change and what is the relative price change for a …rm. So, although the structure of the equation is una¤ected, the actual output level can be impacted by the data revision process and this is incorporated into the central planner’s problem. Since our main objectives are, (i) to sort out the degree to which the monetary authority weighs real-time versus revised data and, (ii) to analyze if the weighting of real-time data depends on whether the economy is doing well or not, we model the 6 in‡ation target as a weighted average of these two data types and use a parameter j 2 [0; 1] for j = b, g to index whether the economy is in a good condition (j = g) or is in a bad condition (j = b). To be more speci…c, when the economy is in regime j, j = 0 indicates that the policy target is entirely a real-time data target, indicates that the policy target is entirely a revised data target and j j =1 2 (0; 1) indicates that the two data types are averaged in determining the target. Under this formulation one can interpret (1 j) as a measure of the short-term pressure the central bank gets from the government and other economic agents to react to real-time in‡ation data when the economy is in regime j. One reasonable prior is that the monetary authority weights real-time data more heavily than revised data in bad economic times (i.e. (1 b) > (1 g) or g > b) because during bad economic times it feels a greater degree of short-term pressure from other policy makers, economic pundits or public opinion. In our empirical analysis below, we investigate this as well as many other hypotheses. We use the weighting structure outlined above to extend the policy structure in Ruge-Murcia (2003a, 2004). In particular, rather than simply choosing the policy variable it to target next period’s in‡ation, the central bank chooses the policy variable to target a weighted average of next period’s revised and real-time in‡ation.7 Furthermore, also as noted above, we allow the degree to which these two in‡ation measures are weighted to di¤er depending on whether the economy is currently in good economic times or currently in bad economic times. This means our modi…ed equation linking the policy variable and the in‡ation target is given by It b t + (1 r b ) t;t+1 + (1 It ) g t + (1 r g ) t;t+1 = it + "t ; (2) where "t is a serially uncorrelated disturbance with mean zero and standard deviation " and It is a dummy indicating the strength of the economy at period t given by It = 0 1 for ut uT ; for ut > uT ; 7 (3) Note, we adopt the Ruge-Murcia (2003a, 2004) policy timing structure in which the policy variable it is chosen at time t 1. So when we say, “next period’s,” we mean period t. 7 where ut is the indicator variable showing whether the economy is doing well or badly and uT is referred to as the threshold value for the indicator variable.8 In our empirical estimation below, we use the unemployment rate as the indicator variable (which explains the notation ut used for this indicator). Thus, the dummy variable takes value 1 during bad economic times and 0 otherwise. Also, note that our two subscript notation for r t;t+1 indicates that date t real-time in‡ation is …rst observed immediately after the period ends, which is date t + 1.9 Similarly, we assume that the central banker wants to monitor a weighted average of revised and real-time output data given by Y b Yt It Y j where that j 6= + (1 r Y b )Yt;t+1 + (1 It ) Y g Yt + (1 Y r g )Yt;t+1 ; (4) 2 [0; 1] for j = b, g, and for the sake of generality, we allow the possibility Y j for j = b, g. The di¤erent weights associated with real-time in‡ation and real-time output (i.e. (1 j) and (1 Y ), j respectively) may capture the di¤erent ability of the initial releases of in‡ation and output to forecast …nal revised in‡ation and output, respectively. Here, on real-time output under regime j, on revised output under regime j and Y j Y j = 0 indicates that policy focuses entirely = 1 indicates that policy focuses entirely Y j 2 (0; 1) indicates that policy focuses on an average of the two data types under regime j. Again, we use the two subscript notation on the real time data to indicate that date t real time data is not observed until date t + 1. We model the relationship between the real-time data and the revised data by 8 Although more complicated, equation (2) does follow the conventional functional notations in Ruge Murcia (2003a, 2004) and says that the left hand side variable is a function of the choice variable it and a policy error "t . 9 One could consider a similar two subscript notation for revised in‡ation such as t;t+s which would indicate that date t revised (actual) in‡ation is …rst observed s periods after date t at date t + s. Although this notation does provide greater clarity on the timing of the data release, it may also introduce confusion that somehow this variable might be di¤erent than the standard variable. To avoid this potential confusion, we choose to stick with the more conventional notation using a single subscript. 8 two simple identities, = r t;t+1 + rt;t+s ; (5) r Y Yt = Yt;t+1 + rt;t+s ; (6) t Y where rt;t+s and rt;t+s denote the …nal revision of the date t output data and date t in‡ation data, which are released s periods later (i.e. date t + s). Using (5) and (6), equations (2) and (4) can be written as (1 t b )It rt;t+s (1 g ) (1 It ) rt;t+s = it + "t ; (7) and Yt (1 Y Y b )It rt;t+s (1 Y g ) (1 Y It ) rt;t+s ; (8) respectively. These two expressions show that the weighted averages of revised and real-time data monitored by the central banker can alternatively be expressed as linear functions of revised data ( t Y ). and Yt ) and data revisions (rt;t+s and rt;t+s These expressions are used repeatedly in some of the algebra below. The central banker objective function is a simple extension to the type used in Ruge-Murcia (2003a, 2004) and Cassou, Scott and Vázquez (2012). In particular, the policy maker selects it in an e¤ort to minimize a loss function that penalizes variations between the weighted averages given in (2) and (4) and policy target values according to min Et it 1 where Et 8 > > > > > < > > > > > : 1 1 2 It + t b 2 r r It ) g t + (1 + (1 g ) t;t+1 b ) t;t+1 + (1 0 r Y Y (Y t I t b Yt + (1 b )Yt;t+1 Y Y r B exp (1 It ) g Yt + (1 g )Yt;t+1 ) B Y Y r @ Yt I t b Yt + (1 b )Yt;t+1 1 Y Y )Y r (1 It ) g Yt + (1 g t;t+1 2 1 t C C A denotes the expectation at the beginning of period t, or, equivalently, at the end of period t 1 and > 0 are preference parameters.10 As in 6= 0 and 10 The linex function was introduced by Varian (1974) in the context of Bayesian econometric analysis. More recently, Nobay and Peel (2003) introduced it in the optimal monetary policy analysis. As is standard in this literature, a linex function allows the researcher to identify asymmetric preferences on output deviations from target by using a linear-quadratic speci…cation for in‡ation preferences. Alternatively, Ruge-Murcia (2003b) analyzes the case of asymmetric preferences for in‡ation assuming a linear-quadratic formulation for the preferences of the level of economic activity (measured in his paper by the rate of unemployment). 9 9 > > > > > = > > > > > ; ; Ireland (1999) and Ruge-Murcia (2003a), we start by assuming that and denote it by t is constant .11 Using routine optimization methods, the key …rst order condition can be shown to be Et 1 [it ] +E t 1 ["t ] Et 1 exp( ( y t +(1 Y Y b )It rt;t+s + (1 Y g )(1 Y It )rt;t+s ))) 1 = 0; (9) where (8) has been used and we assume that the central banker targets permanent output (i.e. Yt = Ytp ) and we use the notation yt = Yt Yt to indicate the revised output gap.12;13 Following methods use in Surico (2007), we take a second order Taylor approxiY = 0 to get mation of (9) around yt = 0 and rt;t+s it (10) Et 2 6 14 Y Y Y Y I t ) rt;t+s b )I t rt;t+s + (1 g ) (1 2 2 2 (1 Y) 2 (1 Y) 2 2 2 g 2 Y Y b It rt;t+s + (1 I t )rt;t+s 2 yt + 2 2 2 Y )y (1 Y )y I r Y I t )rYt;t+s + 2 (1 g b t t t;t+s + (1 t y t + (1 + 3 7 +R2 ( )5 = 0; where R2 ( ) denotes the remainder term for our second order approximation. To get a regression equation one substitutes it = t (1 b )It rt;t+s (1 g ) (1 It ) rt;t+s "t 11 In the Appendix we modify this assumption and investigate the implications of a time-varying in‡ation target. Estimation results for the usage of revised data and real-time data are largely robust to this change. Also of note is that the time varying in‡ation target estimates show a highly persistent target. So, although the target does change, it changes very slowly. 12 Some of the details of this derivation, as well as several other lengthy mathematical derivations for other parts of the paper, can be obtained from the authors upon request. 13 In a preliminary version of the paper, we also estimated a model where the central banker is allowed to targeting a level of output higher than its potential level, which create surprise in‡ation à la Barro-Gordon (1983). In line with Ruge-Murcia (2003a, 2004) and Cassou, Scott and Vázquez (2012), we found that the monetary authority targets permanent output rather than some higher level of the weighted average of revised and real-time output which would be required in a version of the Barro-Gordon model with data revisions. 10 (i.e. equation (7)) into (10) to get t Y = d0 + d1 yt + db2 It rt;t+s + dg2 (1 Y + db4 It rt;t+s 2 + dg4 (1 Y + db5 yt It rt;t+s + dg5 yt (1 + (1 where t b )It rt;t+s Y It ) rt;t+s + d3 yt2 2 Y It ) rt;t+s Y It ) rt;t+s + (1 g ) (1 It ) rt;t+s + t ; (11) is a linear combination of the forecast errors associated with the predictions at time t 1, control error "t and the higher order terms of the Taylor series ap- proximation. Moreover, the reduced-form coe¢ cients are related to the structural parameters as follows: d0 = db4 = (1 2 Y )2 b , dg4 = (1 2 , d1 = Y )2 g , db2 = , db5 = Y ), b (1 (1 Y) b dg2 = and dg5 = Y ), g (1 (1 d3 = 2 , Y ). g We will call equation (11) the baseline empirical equation of in‡ation because it is quite similar to the reduced-form equation for in‡ation derived by Ruge-Murcia (2003a, 2004) and Cassou, Scott and Vázquez (2012) augmented with a few additional terms due to the presence of data revisions. It is useful to highlight several new sources of in‡ation bias contained in (11) beyond the one implied by output deviations from target, d1 yt , and the asymmetric preference one implied by the Ruge-Murcia model of d3 yt2 . A few of these new sources are related to output revisions and their interactions with the output gap, whereas (1 b )It rt;t+s and (1 g ) (1 It ) rt;t+s , are associated with in‡ation revisions, which depend on whether the economy is doing well or not. Moreover, notice that output and in‡ation revisions need to have some level of predictability for these additional sources of in‡ation bias to be important. Otherwise, if in‡ation and output revisions are unpredictable, then they would be just a component of the disturbance term t and the in‡ation bias induced by data revisions would not be an issue. 3 Empirical Results In this section we discuss the empirical results. To keep things organized and clear, we have broken the section into several subsections. 11 In the …rst we describe the sources of the data and some basic data transformations that were applied to get the data in a usable form. The second subsection studies the data revision series. Here, among other things, we show that the revision processes are predictable which, as noted by Croushore (2011) and emphasized above, is a necessary condition for real-time data to be useful to policymakers. In the third subsection we show the results of the empirical model given by (11). Finally, the last subsection puts the results in context by connecting them to their implications for in‡ation bias. 3.1 Data The empirical model needs revised and real-time data for both output and in‡ation as well as data for the unemployment rate which is our indicator variable for good and bad times. The revised data used here include, quarterly Gross Domestic Product (GDP), the Personal Consumption Expenditure (PCE) price index, the GDP de‡ator and the unemployment rate. We use the PCE price index as our primary in‡ation indicator, but also investigate results that use the GDP de‡ator to determine the robustness of the PCE results.14 These series were obtained from the Federal Reserve Economic Data (FRED) base maintained by the St. Louis Federal Reserve Bank. The real-time data included quarterly GDP, PCE and the GDP de‡ator which were obtained from the real-time data bank maintained by the Philadelphia Federal Reserve Bank. We used the initial release component of the real-time series for our analysis. Because the models require in‡ation rates rather than price indexes, the in‡ation rates were obtained as the …rst di¤erence of the log of the various price indexes which was then multiplied by 4 to obtain annualized rates. The real-time data bank proved to be the binding constraint for the …rst period of the analysis, as this data is only available beginning in the fourth quarter of 1965. On the other hand, the revised data proved to be the binding constraint for the end period of the analysis. Although data that is called revised data was available up to 14 As pointed out by Croushore (2011, p. 94), the Fed’s main indicators of in‡ation are the PCE in‡ation rate and the core PCE in‡ation rate (excluding food and energy prices). A similar comment is put across in Cogley, Primiceri and Sargent (2010, p. 49, footnote 12). 12 2014:1 when we started to carry out our empirical analysis, the earlier end date for the long sample was chosen so as to be consistent with the timing of the last revision for the data, ignoring comprehensive or benchmark revisions that can be carried out in the future. In particular, there is a three-year lag before output data is revised for the last time. This lag means that, only the data up to 2011:1 can be considered as truly revised data. Together these data constraints implied a data set which ran from 1966:2 to 2011:1. One further complication with the real-time data empirical analysis carried out here, relative to an empirical analysis that uses purely revised data or purely realtime data, is that the real-time level data for GDP has several di¤erent construction characteristics than the revised level data for GDP, so computing GDP revisions as in (6) is not a straightforward exercise. Two particularly problematic aspects are that the two series have di¤erent benchmark revision characteristics and di¤erent trends.15 Both of these features mean that a simple di¤erentiation of (the logs of) the two raw series to get the revision series is more likely to re‡ect these construction di¤erences than the revision process itself. To remedy this issue, we recompute the real-time output series using the raw real-time data and a revised data trend base. i h Yr HP YtHP In particular, we compute Ybtr = 1 + ln Y rt 1 where Yt 1 is the trend t 1 component of the revised GDP data, Ytr is the real time output data at date t and Ybtr is our notation for the recomputed real-time GDP data.16 This recomputed real-time data now has the same trend features as the revised data, and thus can be combined with the revised output series to get a revision series of GDP that is not sensitive to di¤erent trends, yet the recomputed series still maintains the same deviation from the trend inherent in the original real-time GDP series. In this application, we considered 15 Apart from data revisions taken place up to three years after the …rst release, US National Accounts are further revised due to benchmark revisions. These benchmark revisions take place every …ve years and involve changing methodologies or statistical changes such as base years. We ignore benchmark revisions because they do not add much valuable information for the monetary policy decision-making process since it mainly focuses on short-term goals. 16 We have left out the second subscript on the real time data variables that was used above to simplify the notation here since the time aspect of that second subscript plays no role in this calculation and using the extra subscript in this discussion is cumbersome. 13 the popular Hodrick and Prescott (1997) …lter to obtain the trend component of GDP, YtHP .17 The upper graph of Figure 1 shows plots of (the logs of) the revised GDP series and the recomputed real-time GDP series and illustrates that by construction they both now share the same trend features. Figure 1 also contains two other plots, with the middle graph plotting the revised in‡ation series and the real-time in‡ation series and the bottom graph plotting the in‡ation revision and output revision series.18 These plots highlight a few important features of the data. First, real-time in‡ation is more volatile than revised in‡ation. Second, the size of the in‡ation revision volatility is comparable with those of revised and real-time in‡ation. Finally, output revisions exhibit more persistence than in‡ation revisions. 3.2 Properties of the data revision processes Before estimating the empirical model, we undertook preliminary investigations of the revision processes in order to determine (i) if revisions of output and in‡ation are white noise, and (ii) if the revision processes look di¤erent depending on whether the economy is doing well or not. This analysis is important because, should the revisions be unpredictable, then, as noted in Croushore (2011) and many others, the distinction between real-time and revised data would not be an issue as long as revisions are not large. 17 As an alternative to the trend component used when recomputing Ybtr , one may consider the lagged value of the revised data, Yt 1 . We disregard this alternative because YtHP 1 , in contrast to Yt 1 , has the advantage of abstracting from the business cycle ‡uctuations present in the revised data, Yt 1 , since these revised output ‡uctuations are not fully re‡ected yet in the real-time output data. This feature is crucial in our analysis since optimal monetary policy aims at smoothing the business cycle, so our recomputed real-time GDP series should not be contaminated with cyclical features only known when revised data are released in the future. Moreover, when computing YtHP , we consider the whole sample period 1966:2-2014:1 because, on the one hand, the presence of non fully revised data is likely to have a small e¤ect on the estimated GDP trend, but, on the other hand, by using only the time series YtHP corresponding to the sample period ending at 2011:1, we overcome the well-known problems in estimating the end-of-period data associated with the HP …lter. 18 The output revision series was multiplied by 100 to obtain a comparable unit of measurement to those of in‡ation and in‡ation revisions, which are measured in percentage points. 14 1 0 .0 0 Natural logarithm 9 .5 0 9 .0 0 8 .5 0 8 .0 0 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011 2014 2002 2005 2008 2011 2014 2005 2008 2011 2014 Tim e R e v is ed GD P R e al- time G D P 1 2 .5 Percent 7 .5 2 .5 - 2 .5 - 7 .5 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 Tim e PC EPIOBS PC EPIR 4 Percent 2 0 -2 -4 1966 1969 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 Tim e Inf. R ev is ions GD P R ev is ions Figure 1: U.S. real-time and revised output and in‡ation 15 Table 1. Estimation of revision processes output in‡ation linear non-linear linear non-linear constant 0.001 0.001 0.495 0.482 (0.013) (0.013) (0.131) (0.129) AR(1) 0.347 0.347 (0.070) (0.072) AR(2)- good 0.252 0.341 (0.070) (0.099) AR(2) - bad 0.173y (0.096) real-time variable - good -0.000 -0.142 -0.169 (0.013) (0.028) (0.030) real-time variable - bad -0.087 (0.036) R2 0.268 0.276 0.130 0.154 Durbin-Watson statistic 2.016 2.014 1.758 1.704 Note: standard errors are in parentheses. We use the convention that tests that are signi…cant at the 10 percent level only have a y while those that are signi…cant at the 5 percent (and 10 percent) level have an . In order to save space, the coe¢ cients associated with the linear models are displayed in the same row as the coe¢ cients associated with good economic times regime in the piecewise (nonlinear) model. Table 1 shows the results of this investigation into whether the various revisions processes are predictable. The models that are presented are the best …tting models among many that were studied in a preliminary investigation that is not presented here to save space. This preliminary investigation suggested an AR(2) model …t the revision process for output best and the in‡ation revisions were best …t using the initial real-time announcement. The results for this output model are presented in the second column of Table 1 while the results for the in‡ation revision process are presented in the fourth column. In addition, to investigate whether these structures demonstrate di¤erent predictability features during good and bad times, the third column shows the results of extending the column two model to include a piecewise linear autoregressive process while the …fth column shows the results of extending the column four model to include a piecewise linear structure in the real-time in‡ation 16 rate, where in both cases the switching structure is de…ned by (3) with uT = 6:5.19 Note, to save space, the coe¢ cients associated with the linear models without a good and bad times component are displayed in the same row as the coe¢ cients associated with good economic times regime in the piecewise models. Both the column two model and the column four model show that output and in‡ation revisions are predictable. In particular, column two shows that output revisions are signi…cantly predicted by its own …rst and second period lags while the in‡ation revisions are related in a signi…cant negative way to the real-time observation. These results clearly reject the null hypothesis that revisions of output and in‡ation are white noise, which means that data revisions for output and in‡ation are predictable and thus may matter in the analysis of central banker preference asymmetries. Moreover, columns three and …ve show that there are di¤erences in the predictability during good and bad economic times. In particular, column three shows that the second lag coe¢ cient is larger and more signi…cant when the economy is doing well than when the economy is doing badly and the column …ve model shows that the negative in‡ation revision result from the column four model is much stronger in good times than in bad times. The column four and …ve result implies that a high real-time value of in‡ation anticipates a negative revision of in‡ation because the real-time release was too high. Put di¤erently, a positive in‡ation revision comes from having real-time in‡ation underestimating the true value. Moreover, the result that in‡ation revisions are more negatively related to real-time in‡ation in good times than in bad times suggests that real-time in‡ation is a better predictor of revised in‡ation during bad times than during good times (i.e. in‡ation revisions add more news than noise during bad times than during good times). 19 We choose the 6.5% threshold because it is often mentioned by the Federal Reserve as an unemployment rate in which they begin to consider policy changes. See for instance, the Federal Open Market Committee minutes from December 2012 which states, "In addition, all but one member agreed to replace the date-based guidance with economic thresholds indicating that the exceptionally low range for the federal funds rate would remain appropriate at least as long as the unemployment rate remains above 6.5 percent, in‡ation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s longer-run goal, and longer-term in‡ation expectations continue to be well anchored." Moreover, the results reported below are not particularly sensitive to this threshold unemployment rate value. Values close to 6.5 tell much the same story. 17 3.3 Empirical equation results We next undertook estimation of the optimal in‡ation model (11) using an instrumental variables (IV) estimation routine for the two measures of the in‡ation rate.20 This is the method used in Surico (2007) because it controls for potential endogeneity of one of the regressors. Ordinary least squares estimates were only marginally di¤erent and are available from the authors upon request. Table 2 presents two panels containing these results, with the left panel showing results for three di¤erent versions of (11) using the PCE in‡ation measure and the right panel showing the results for the same versions of (11) using the GDP in‡ation measure. In each panel, the leftmost column results are for unrestricted models, while the middle column restricts coe¢ cients in such a way so as to investigate whether the planner does not use real-time output data, while the rightmost column restricts parameters so as to investigate whether the planner does not use real-time in‡ation data. These restricted models are more fully described below. The two unrestricted models show …ve noteworthy conclusions can be drawn from this analysis. First, the estimate of d0 (= ) suggests that the annual in‡ation target is around 3%. Second, the null hypothesis H0 : d3 = 0 is rejected, which is consistent with the hypothesis that the monetary authority has asymmetric preferences, indicating that the monetary authority takes stronger action when output is below its permanent level than when it is above (i.e. a positive and signi…cant estimate of d3 = 2 implies that the asymmetric preference parameter is also positive). This …nding is in line with the results in Ruge-Murcia (2003a) and Cassou, Scott and Vázquez (2012). Third, the di¤erent estimated values for 1 g and 1 b indicate there is also an asymmetric response to real-time in‡ation data which depends on the state of the economy. Furthermore, the in‡ation revision parameter (and thus the real-time in‡ation targeting parameter) is only signi…cant during bad economic 20 Standard deviations are corrected to account for heteroskedastic and autocorrelated residuals. In the Appendix, we also estimate a bivariate version of the model, which imposes much more structure, using maximum likelihood methods. The estimation results are rather robust to the estimation approach used. 18 times. Fourth, the implied values of b are positive, but results for tests that the Fed does not target revised in‡ation during bad economic times shows mixed results between the two data types. In particular, H0 : b = 0 has t-statistic of 1.236 for the PCE in‡ation data and 2.014 for the GDP de‡ator in‡ation data. Since both statistics have 5% critical values of 1.974 we see the PCE in‡ation data shows evidence that the Fed does not make use of revised data during bad economic times, while the GDP de‡ator in‡ation shows evidence that the Fed uses revised data during bad economic times. Conversely, g is not signi…cantly di¤erent from one for both data types, indicating that the Fed only targets revised in‡ation during good times. The evidence that the Fed mainly waits to react to revised in‡ation during good times rather than reacting quickly to real-time in‡ation provides an alternative explanation of policy inertia to those found in the literature.21 The fact that the Fed mainly targets real time in‡ation during bad economic times may re‡ect the need to react quickly to the initial announcements of in‡ation in these periods due to political pressures, but may also re‡ect that real-time data is a less noisy predictor of revised in‡ation during bad economic times as shown in Table 1 above. Finally, estimation results are mostly robust across the two in‡ation measures studied. Next focusing on the parameters that include the (1 Y) j for j = b, g components (i.e. focusing on db2 , dg2 , db4 , dg4 , db5 and dg5 ), we see that the role of real-time output cannot be directly tested. However, we can investigate this issue by estimating a restricted version of the model that would be implied when g. Y j = 1 for j = b, This is the purpose of the middle column models in each of the panels. Here we estimated a model that imposes the set of restrictions for the hypothesis H0 : db2 = dg2 = db4 = dg4 = db5 = dg5 = 0. Comparing the middle column estimates with the left column estimates for both the PCE and the GDP de‡ator results show that the 21 These explanations range from the traditional concern of central banks for …nancial market stability (see Goodfriend, 1991) to the more psychological one suggested by Lowe and Ellis (1997), who argue that central bankers are likely to be embarrassed by reversals in the direction of policy changes. On the other hand, Rudebusch (2002) argues that the evidence of policy inertia is due to the existence of relevant omitted variables. 19 remaining parameters are similar to the unrestricted coe¢ cients d0 , d1 , d3 , 1 and 1 g. b This result indicates that in‡ation bias due to in‡ation revisions show up during bad times even when output revisions are fully ignored. More generally, this result indicates that real-time output may not be too important. However, the test that the unrestricted model …ts no better than the restricted model that imposes H0 , as indicated by the row labeled F Statistic, has an F -statistic of 4.050 for the PCE measure of in‡ation and 5.918 for the GDP de‡ator measure of in‡ation. Both of these statistics are larger than the 5% critical value of 2.149, and thus is easily reject this null indicating that real-time output does play a role. It was already noted above that real-time in‡ation data is important to the planner during bad times because of the signi…cant 1 b coe¢ cients. However, we can also investigate the importance of real-time in‡ation using a restricted model fairly easily. To do this, we make use of the results for the restricted model in the right column of each panel. simple test of H0 : 1 These restricted models impose 1 b =1 g b =1 g = 0; so a = 0 can be carried out using an F test. The results of this null are given in the row labeled F Statistic and show F -statistics of 5.559 for the PCE data and 10.158 for the GDP de‡ator data. Both are larger than the 5% critical value of 3.046, and thus easily reject this null, indicating that real-time in‡ation does play a role. 20 Table 2. Instrumental variables PCE in‡ation Y =1 Coe¢ cient Unrestricted i d0 2.800 3.027 (0.451) (0.421) y d1 0.452 0.600 (0.246) (0.210) db2 0.570 0.0 (0.684) dg2 0.463 0.0 (0.382) d3 0.300 0.285 (0.136) (0.070) b d4 1.210 0.0 (0.217) 0.449 0.0 dg4 (0.898) db5 -0.672y 0.0 (0.381) -0.306 0.0 dg5 (0.772) 0.733 0.643 1 b (0.235) (0.192) 1 -0.173 -0.235 g (0.263) (0.293) J(6) p value 0.280 0.126 F-Statistic 4.050 p value 7.8e-04 estimation results of equation (11) GDP de‡ator in‡ation Y =1 = 1 Unrestricted i i i =1 2.808 2.955 3.178 2.974 (0.449) (0.416) (0.414) (0.443) 0.490 0.222 0.432 0.283 (0.235) (0.206) (0.220) (0.207) 0.566 0.775 0.0 0.523 (0.645) (0.624) (0.794) 0.473 0.392 0.0 0.336 (0.392) (0.379) (0.390) 0.311 0.335 0.234 0.289 (0.121) (0.080) (0.060) (0.084) 1.170 1.267 0.0 1.267 (0.236) (0.106) (0.201) 0.503 0.212 0.0 0.187 (0.887) (0.584) (0.606) -0.587y -0.941 0.0 -0.865 (0.335) (0.289) (0.390) -0.369 -0.301 0.0 -0.216 (0.731) (0.479) (0.491) 0.0 0.681 0.577 0.0 (0.142) (0.125) 0.0 -0.016 -0.063 0.0 (0.144) (0.184) 0.090 0.101 0.022 0.337 5.559 5.918 10.158 4.5-03 1.2e-05 6.6e-05 Note: standard errors are in parentheses. We use the convention that tests that are signi…cant at the 10 percent level only have a y while those that are signi…cant at the 5 percent (and 10 percent) level have an . The instrument set includes two lags of output gap, squared output gap, the alternative measure of in‡ation during good and bad times, and the contemporaneous values of all the remaining regressors that involve the dummy variable It . We do not include lagged variables of these regressors involving the dummy variable It because they are poor instruments since they are not much correlated with the contemporaneous regressors when the dummy variable often switches. J(m) denotes the Hansen’s test statistic for m overidentifying restrictions which is distributed as a 2 (m) under the null hypothesis of valid overidentifying restrictions. The value of m shown is the one associated with the unrestricted 21 model. 3.4 Implications for in‡ation bias This section assesses the size of the in‡ation bias induced by the Fed’s ability to use real-time data. This bias is computed in two ways. One used the point estimates for the unrestricted models displayed in columns two and …ve of Table 2 and the other was to impose theoretical lower bound restrictions on the parameters. In this later exercise, we reestimated the models imposing db5 = dg5 = 1 g = 0. These restrictions prevent the parameters from achieving the negative values seen in Table 2, which are inconsistent with theory. The results of these exercises are summarized in Table 3 in four panels, with the upper two panels showing the unrestricted bias results for the two in‡ation measures, and the lower two panels showing the results for the restricted models. In addition, each panel is broken into two columns with the left column showing the in‡ation bias over the full sample while the right column shows the in‡ation bias using only those periods in which economic times are bad. For completeness we show in‡ation bias results for the two measures of in‡ation, but our discussion focuses mostly on PCE in‡ation because this seems to be the in‡ation measure monitored by the Fed as emphasized by Cogley, Primiceri and Sargent (2010) and Croushore (2011). The procedure for computing the in‡ation biases from the various model estimates begins by generating …tted values from the estimated series in which there are no parameter restrictions. Next we impose various restrictions on the parameters and compute …tted values under these restrictions. Column 1 of Table 3 shows the structure for this exercise. So the …rst restriction simply imposes that during good times the Fed only uses revised in‡ation data (i.e. g = 1), the second restriction imposes that at all times the Fed only uses revised in‡ation data (i.e. g = b = 1), the third restriction imposes that at all times the Fed only uses revised in‡ation data and during good times they only use revised output data (i.e. 22 g = b = Y g = 1, which is captured by imposing the following set of restrictions 1 g =1 b = dg2 = dg4 = dg5 = 0) and the fourth restriction imposes that at all times the Fed only uses revised in‡ation and output data (i.e. g = by imposing the following set of restrictions 1 b = g Y g = =1 Y b = 1, which is captured b = dg2 = db2 = dg4 = db4 = dg5 = db5 = 0). For comparison purposes the …fth row imposes a restriction in which the monetary planner’s preferences are symmetric (i.e. d3 = 0). From these …tted values, we compute the average in‡ation under each scenario and subtract it from the average in‡ation under the no restriction case. These di¤erences are interpreted as the in‡ation bias due to each scenario and are reported in Table 3. The purpose for this sequence of restrictions is that it allows us to incrementally investigate what would happen if the Fed was not using real-time data in various situations. By comparing the average in‡ation rate from one …tted model to the next, we can assess how much each increment of real-time data impacts the overall in‡ation bias of the Fed due to data revisions. Furthermore, comparing the biases from this exercise to the bias generated from the asymmetric monetary planning structure introduced by Ruge-Murcia (2003a) allows one to get a sense for the size of the real-time data biases investigated in this paper. Focusing on the top-left panel of Table 3 (i.e. based on the unrestricted PCE in‡ation estimates), we observe that the …rst row bias values are relatively small when compared to other rows. The second row shows the total bias induced if the Fed was not able to use real-time in‡ation data during both good and bad times. These biases are somewhat larger in magnitude than the …rst row numbers, showing biases of 4.47 over the full sample and 8.36 in bad times. Although small relative to some of the other numbers, if one recognizes that the Fed has an overall in‡ation target of 200 basis points (i.e. a 2% in‡ation target) these numbers show bias of 2.24 and 4.18 percent (i.e. 4:47 200 or 8:36 200 ). Moving on to rows three and four, we see that the in‡ation biases induced by using real-time output data are larger than those induced from the the real-time in‡ation data. Finally, looking at the asymmetric preference in‡ation bias value in row …ve, we see that the real-time data in‡ation bias is overall 23 equal to about one third of the in‡ation bias induced from the asymmetric preference in‡ation bias. Table 3. Average in‡ation bias in basis points PCE in‡ation GDP de‡ator in‡ation Whole period Bad times Whole period Bad times Based on unrestricted Table 2 estimates g= 1 b= 1 Y = g b= g = 1 Y Y g= b= g = b = 1 d3 = 0 g= 1.50 4.47 12.78 23.49 73.81 0.00 8.36 8.36 38.48 97.63 0.07 -0.98 -2.71 -3.43 82.54 0.00 -2.94 -2.94 -4.96 109.18 Based on restricted estimates g= 1 = g b= 1 Y g= b= g = 1 Y Y g= b= g = b = 1 d3 = 0 0.00 2.67 25.08 43.54 36.53 0.00 7.50 7.50 59.39 48.32 0.00 -0.99 11.72 21.73 37.28 0.00 -2.79 -2.79 25.38 49.31 Next, we investigate whether the negative estimates for some of the parameters, which are inconsistent with theory, might be impacting these bias results. The lower two panels of Table 3 recompute the in‡ation biases based on reestimated models in which the negative parameters in Table 2 were simply left out of the new regression model (i.e. imposing db5 = dg5 = 1 g = 0). These results do show that those negative values were impacting the results, with the restricted model showing larger biases numbers for all categories of the real-time data restrictions in both the PCE in‡ation models and the GDP de‡ator in‡ation models. Moreover, in‡ation bias results from the two in‡ation measures look much more consistent imposing these nonnegative parameter restrictions, which are much in line with the consistent estimation results shown in Table 2 for the two in‡ation measures. Interestingly, these lower panels also …nd that the asymmetric preference bias is much smaller than in the unrestricted models. 24 In sum, these in‡ation bias calculations show a few relevant results. First, and most importantly, in most cases we do …nd important biases induced by using realtime data. Second, these biases could be comparable in size to those induced by asymmetric preferences on the part of the monetary planner. Third, the in‡ation biases induced from the output real-time data are larger than the in‡ation biases induced by the in‡ation real-time data. Finally, for the PCE in‡ation monitored by the Fed, both sources of in‡ation bias (i.e. real time data and asymmetric central banker preferences) seem to be relatively more important during bad economic times. 4 Conclusion This paper adds to the growing body of literature regarding monetary policy and realtime data analysis. Here, we have shown how to extend the Ruge-Murcia (2003a) type of asymmetric monetary planning models to study real-time issues faced by a central banker. By assuming that the central banker targets a weighted average of both revised and real-time data, our model identi…es a few additional potential sources of in‡ation bias due to data revisions in addition to those featured by asymmetric central bank preferences as suggested by Ruge-Murcia (2003a). The model is estimated using instrumental variables from US data. Our empirical results provide evidence for additional sources of in‡ation bias due to data revisions. In particular, our empirical results show that the Fed focuses on targeting revised in‡ation during good economic times, but it weighs heavily real-time in‡ation during bad economic times, inducing an important source of in‡ation bias. Moreover, the empirical results show that the in‡ation bias induced by asymmetric central banker preferences in our augmented model with data revisions remains signi…cant. These results reinforce those found by Ruge-Murcia (2003a, 2004) using revised unemployment and in‡ation data and Cassou, Scott and Vázquez (2012) using output and in‡ation data. Numerical calculations for the size of the in‡ation bias found several consistent 25 results. Most importantly, we do …nd important sources of in‡ation bias induced by the central banker using real-time data. Moreover, this in‡ation bias could be comparable in size to that induced by asymmetric preferences on the part of the central banker. Our results also suggest that the in‡ation bias induced from the output real-time data is larger than the in‡ation bias induced by the in‡ation realtime data. Finally, for the PCE in‡ation monitored by the Fed, the in‡ation bias is larger during bad times. The asymmetric Fed’s behavior of focusing on revised or real-time in‡ation targeting depending on the state of the economy cannot be generalized to other countries without further scrutiny because data revision features are likely to be di¤erent across countries due to, among other things, di¤erences in the size and quality of resources allocated to country statistical agencies and the degree of central bank independence. As pointed by Fernandez, Koening and Nikolsko-Rzhevskyy (2011) statistical agencies from OECD countries tend on average to underestimate both real output growth and in‡ation. Our empirical evidence suggests, on the one hand, that the optimal monetary policy based also on real-time data tends to be less anti-in‡ationary than the one implied by revised data in many OECD countries. On the other hand, a cross country analysis of monetary policy using revised and real-time data along the lines followed in this paper is warranted. More generally, this paper shows evidence that optimal decisions made by arguably well-informed agents, such as the Fed, are likely to be biased when they face short-term pressures that force them to react quickly to (persistent) inaccurate data. This sort of decision bias is likely to a¤ect not only policy decision making, but private agents’decisions as well. References [1] Aruoba, B.S. 2008. Data revisions are not well-behaved. Journal of Money, Credit and Banking 40, 319-340. 26 [2] Barro, R., and D. Gordon. 1983. A positive theory of monetary policy in a natural rate model. Journal of Political Economy 91, 589-610. [3] Casares, M., and J. Vázquez. 2014. Data revisions in the estimation of DSGE models. Macroeconomic Dynamics (forthcoming). [4] Cassou, S.P., C.P. Scott, and J. Vázquez. 2012. Optimal monetary policy with asymmetric preferences for output. Economics Letters 117, 654-656. [5] Cassou, S.P. and J. Vázquez. 2014. Time Variation in an Optimal Asymmetric Preference Monetary Policy Model. Studies in Nonlinear Dynamics & Econometrics, 18, 41-50. [6] Cogley, T., G.I. Primiceri, and T.J. Sargent. 2010. In‡ation-gap persistence in the US. American Economic Journal: Macroeconomics 2, 43–69. [7] Croushore, D. 2011. Frontiers of real-time data analysis. Journal of Economic Literature 49, 72-100. [8] Croushore, D., and C.L. Evans. 2006. Data revisions and the identi…cation of monetary policy shocks. Journal of Monetary Economics 53, 1135-1160. [9] Croushore, D., and T. Stark. 2001. A real-time data set for macroeconomists. Journal of Econometrics 105, 111-130. [10] Cukierman, A. 2002. Are contemporary central banks transparent about economic models and objectives and what di¤erence does it make? Federal Reserve Bank of St. Louis Review 84, No 4, 15-36. [11] Engle, R.F., and K.F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11, 122-150. [12] Fernandez, A.Z., E.F. Koenig, and A. Nikolsko-Rzhevskyy. 2011. A real-time historical database for the OECD. Federal Reserve Bank of Dallas, Globalization and Monetary Policy Institute, Working Paper No 96. 27 [13] Goodfriend, M. 1991. Interest rates and the conduct of monetary policy. Carnegie–Rochester Conference Series on Public Policy 24, 231-274. [14] Hodrick, R.J, and E.C. Prescott. 1997. Postwar U.S. business cycles: an empirical investigation. Journal of Money Credit Banking 29, 1-16. [15] Ireland, P.N. 1999. Does the time-consistency problem explain the behavior of in‡ation in the United States? Journal of Monetary Economics 44, 279-291. [16] Landefeld, J.S., E.P. Seskin, and B.M. Fraumeni 2008. Taking the pulse of the economy: Measuring GDP. Journal of Economic Perspectives 22, 193-216. [17] Lowe, P., and L. Ellis. 1997. The smoothing of o¢ cial interest rates. In: Lowe, P. (Ed.), Monetary Policy and In‡ation Targeting Proceedings of a Conference. Reserve Bank of Australia. [18] Lucas, R.E. Jr. 1977. Understanding business cycles. Carnegie-Rochester Conference on Public Policy 5, 7-29. [19] Maravall, A., and D.A. Pierce. 1986. The transmission of data noise into policy noise in U.S. monetary control. Econometrica 54, 961-979. [20] Nobay, R.A., and D.A. Peel. 2003. Optimal discretionary monetary policy in a model of asymmetric central bank preferences. Economic Journal 113, 657-665. [21] Orphanides, A. 2001. Monetary policy rules based on real-time data. American Economic Review 91, 964-985. [22] Rudebusch, G.D. 2002. Term structure evidence on interest rate smoothing and monetary policy inertia. Journal of Monetary Economics 49, 1161-1187. [23] Ruge-Murcia, F.J. 2003a. Does the Barro-Gordon model explain the behavior of US in‡ation? A reexamination of the empirical evidence. Journal of Monetary Economics 50, 1375-1390. 28 [24] Ruge-Murcia, F.J. 2003b. In‡ation targeting under asymmetric preferences. Journal of Money, Credit and Banking 35, 763-785. [25] Ruge-Murcia, F.J. 2004. The in‡ation bias when the central bank targets the natural rate of unemployment. European Economic Review 48, 91-107. [26] Surico, P. 2007. The Fed’s monetary policy rule and U.S. in‡ation: The case of asymmetric preferences. Journal of Economic Dynamics and Control 31, 3305– 324. [27] Varian, H. 1974. A Bayesian approach to real estate assessment. In: Feinberg, S.E., Zellner, A. (Eds.), Studies in Bayesian Economics in Honour of L. J. Savage. North-Holland: Amsterdam. [28] Vázquez, J., R. María-Dolores, and J.M. Londoño. 2013. On the informational role of term structure in the US. Journal of Economic Dynamics and Control 37, 1852-1871. Appendix - A model with a time varying in‡ation target One concern with the unrestricted in‡ation model (11) is whether the in‡ation target has remained constant over the data interval and whether this might impact the results. Although it is common to make such an assumption, as in Ireland (1999), Ruge-Murcia (2003a, 2004) and Cassou, Scott and Vázquez (2012), work by Cassou and Vázquez (2014) has investigated models with time-varying parameters. To address this question, we augment the in‡ation model to include the possibility that the in‡ation target changes over time according to t = ( t 1 ) + "t ; where "t is an i.i.d. shock with mean zero and standard deviation (12) .22 Equations (11) and (12) can be written in state-space form, so the Kalman …lter can be used to 22 This time variation structure was used in a revised data setting by Cogley, Primiceri and Sargent (2010). 29 estimate the optimal in‡ation model (11) with a time varying in‡ation target using constrained maximum likelihood (ML) methods where we assume that the errors are normally distributed. Moreover, this estimation strategy allows us to estimate most structural parameters by imposing two type of restrictions. First, the restrictions linking reduced-form coe¢ cients in (11) with the structural parameters 1 g, 1 b, 1 Y g and 1 Y .23 b , , , Second, the theoretical restrictions on the real-time data weight parameters given by 1 k j 2 [0; 1] for j = g, b and k = , Y . Identi…cation of the parameters characterizing the process for an unobservable variable such as the in‡ation target is always hard. For this reason, we estimate and calibrate = 0:00065. This calibration value is obtained by averaging the estimates for this parameter from the two samples in Cogley, Primiceri and Sargent (2010) which are reported in their Table 3.24 Table A1 below shows the estimation results from this exercise for the two in‡ation measures. First note that the estimate of the autocorrelation for the in‡ation target shock are very close to one, which indicates that the time-varying in‡ation target mainly captures low-frequency movements in in‡ation.25 This can be interpreted as indicating that the in‡ation target moves very slowly and thus the constant in‡ation target model is not such a bad speci…cation. Next note that the estimation results are rather robust for the two measures of in‡ation and even similar to those found using the baseline estimation procedure discussed above. In particular, the in‡ation target estimate is close to 3% and the positive and signi…cant estimate of the asymmetric 23 Notice that and cannot be identi…ed separately. Cogley, Primiceri and Sargent (2010) do just the opposite. They …x the autoregressive coe¢ cient of the in‡ation target shock process to 0.995 (i.e. restricting t to capture low-frequency movements in in‡ation) and estimate using Bayesian methods. Precisely, the use of a Bayesian approach allowed them to keep small the size of the in‡ation target shock, , relative to the size of the in‡ation equation shock, . Since we are using a classical approach in this paper, we have to calibrate to keep it small, so t captures low-frequency movements in in‡ation. As shown below, our estimate of = 0:99 is close to the calibrated value of = 0:995 considered in Cogley, Primiceri and Sargent (2010). Therefore, our characterization of the in‡ation target process is close to the one identi…ed in their paper. 25 Furthermore, estimation resuts are almost identical if we consider a constant in‡ation target. While it is true that the time-varying in‡ation target process is very persistent, this feature however has almost no impact on the remaining structural parameter estimates of the model. Estimation results assuming a constant in‡ation target are available from the authors upon request. 24 30 preference parameter is consistent with the estimate of d3 . Moreover, the real-time in‡ation targeting parameter, 1 j, is only signi…cant during bad economic times. Furthermore, as in the baseline estimation results, there is a split result between the two in‡ation types regarding the usage of revised data during bad economic times, with the PCE in‡ation data showing that GDP de‡ator in‡ation data showing that the estimate of g b b is positive but insigni…cant while the is positive and signi…cant. Furthermore, hits the upper bound restriction indicating again that the Fed only uses revised in‡ation data during good economic times. Finally, the estimates for the real-time output parameters, 1 Y, j show weaker results than in the baseline model. Here we …nd that in three out of four cases the estimate hits either the upper or the lower bound of the theoretical parameter space and in the remaining case it is not signi…cantly di¤erent from its theoretical upper bound value. Although there is some evidence that the Fed targets real-time output too, the evidence is weaker here. This may be because the two parameters 1 are not well identi…ed. Table A1. Time-varying in‡ation target model estimation results PCE in‡ation GDP de‡ator in‡ation Coe¢ cient Estimate Std. dev. Estimate Std. dev. 3.249 (0.218) 3.352 (0.202) 0.345 (0.092) 0.210 (0.086) 0.715 (0.195) 0.964 (0.389) 0.697 (0.288) 0.590 (0.199) 1 b 1 0.0 : 0.0 : g Y 1 0.978 (0.037) 0.0 : b Y 1 1.0 : 1.0 : g 2.406 (0.187) 2.215 (0.163) 0.990 (0.011) 0.998 (0.008) 100 0.065 calibrated 0.065 calibrated log likelihood -413.474 -398.533 31 Y j