Presentation to the Company’s Shareholders …Message Box Anil Sardana Managing Director

advertisement

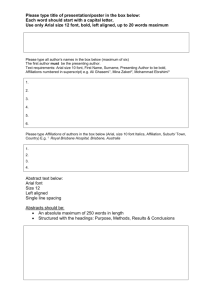

Presentation to the Company’s Shareholders Anil Sardana Managing Director August 16, 2013 …Message Box ( Arial, Font size 18 Bold) Flow of Presentation • Sector Opportunities and Outlook • About Your Company • Company Strategy and Priorities • Financials …Message Box ( Arial, Font size 18 Bold) 2 Sector Opportunities and Outlook …Message Box ( Arial, Font size 18 Bold) Power sector in India has been facing challenges across the value chain (1/2) Challenges in Indian Power Sector Fuel • Lack of sufficient growth in domestic coal production • Regulatory changes in markets such as Indonesia Generation • Shortage of gas supply • Lack of Uniformity in the Land Acquisition Policy Framework • Inordinate delays in environmental clearances • Tightening of norms from financial institutions …Message Box ( Arial, Font size 18 Bold) 4 Power sector in India has been facing challenges across the value chain (2/2) Transmission Challenges in Indian Power Sector • Network not sufficient to meet growth • Several Transmission projects developing slowly • Success of Southern Grid integration and open access depends on expansion of Transmission capacity Distribution • SEBs financial losses • High AT&C losses • Power tariffs artificially kept low • SEBs resorting to load shedding in peak hours …Message Box ( Arial, Font size 18 Bold) 5 About Your Company …Message Box ( Arial, Font size 18 Bold) Tata Power is India’s largest Integrated Power Utility • Founded in 1906 to supply power to Mumbai – First hydro plant commissioned in 1915 – Set up thermal power plants in Mumbai in the 1950s • Expanded in India after private sector reforms in 1990s Fuel Fuel Logistics Generation Transmission Distribution Power Trading Presence across the entire value chain • Thrust on renewable energy sources including hydro, wind, solar and geothermal • Successful Public Private Partnerships in generation, transmission and distribution …Message Box ( Arial, Font size 18 Bold) 7 Integrated play in all key areas of the value chain Play across the entire value chain Fuel Stake in Indonesian mines Two (2) Domestic mines being developed Fuel supply in place for majority of operational and underexecution projects Generation 8,521 MW operational capacity – 7,646 MW of thermal 1,151 MW under build Transmission Mumbai: Distribution & Supply Mumbai distribution network 1,100 circuit km of 220KV/ 110 KV lines – Over 4 lakh retail and 19 receiving consumers stations Delhi distribution Powerlinks: – Over 1.3 million – 1,200 km of line associated with Tala hydro project – Connects Bhutan and Northern Region customers Jamshedpur Distribution Franchise – Consumer base of over 3 lakh …Message Box ( Arial, Font size 18 Bold) 8 Continuously expanding Global Footprint Tata Power – Global presence Hydro Projects Georgia Hydro Projects Bhutan Comprehensive Electricity Management, RAK, UAE Logistics Office Singapore Distribution Assignment Nigeria Technology Investments Australia Hydro PowerZambia JV for Power Projects – South Africa Coal Mines, Geothermal Project – Indonesia Partnerships have been built with several major players worldwide …Message Box ( Arial, Font size 18 Bold) 9 Company’s Priorities …Message Box ( Arial, Font size 18 Bold) CGPL, Mundra: CERC committee deliberation in progress – awaiting an early resolution Highlights • Fifth 800 MW unit commissioned on 22 Mar 2013 • CGPL holds the record of commissioning maximum capacity during a year (3,200 MW) by any Indian utility CGPL PPA Resolution • CERC in its order dated 15 Apr 2013 has given a directive to constitute a committee to recommend a compensatory tariff • Committee deliberating the possible options • Tata Power hopeful of an early resolution …Message Box ( Arial, Font size 18 Bold) 11 MPL, Maithon: stable performance, strengthening fuel logistics and power sale About the Plant • Unit 1 (525 MW) achieved commercial operation on 1 Sep 2011 and Unit 2 (525 MW) on 24 Jul 2012 • 900 MW tied up through long term PPA Priorities going forward • Strengthening coal logistics by completion of railway siding • Pursuing PPA arrangements for balance 150 MW • Finalization of tariff with CERC …Message Box ( Arial, Font size 18 Bold) 12 Mumbai Operations – strong sustained performance across Generation, Transmission & Distribution • Availability levels higher than previous year – powering Mumbai with high quality reliable supply • Increased generation units due owing to growing power demand • Grid availability at 99.56% against MERC norm of 98% • Retail consumer base of ~4 lakh • Remote operation of receiving stations from Power System Control Centre • Focus on low end consumers (<300 unit consumption per month) • Network upgrade and capacity expansion projects are being carried out • Continued support to infrastructure in Mumbai …Message Box ( Arial, Font size 18 Bold) 13 Trombay: Unit 6 Coal Conversion Uniqueness of Mumbai generation • Full scale operation of Trombay Power Station critical for Mumbai’s islanding concept • Trombay Thermal Power Station provides power only to the city of Mumbai (embedded generation) • Mumbai power demand expected to grow from ~3.5 GW today to over 6 GW by 2020 • Transmission System constraints pose a challenge to import additional power in Mumbai …Message Box ( Arial, Font size 18 Bold) 14 Benefits from Unit-6 Coal Conversion Reduction in ground level concentration 4.58 4.43 3.91 3.85 • Coal conversion to result in lower cost of power for consumers 2.24 1.94 SPM SO2 Existing (ug/m3) NOX After Coal Conversion (ug/m3) Ambient Air Quality at Trombay • Coal Conversion of 500 MW Unit will help to reduce ground level concentration of pollutants in view of significant investment in pollution control equipment 100 80 80 57 17 2.24 SPM (PM 10) AAQM Std. SO2 Existing Level • The modified Unit-6 will use imported coal which has significantly less amount of Ash and Sulphur, which are the main cause of air pollution, as compared to Indian coal 21 4.58 3.91 NOX Contribution by Trombay Plant • Company responsible to handle 100% of Ash being generated in benign applications …Message Box ( Arial, Font size 18 Bold) 15 Key Subsidiaries Tata Power Delhi Distribution Ltd. • High degree of reliability (ASAI > 99%) • Consistently over-achieved AT&C Loss Reduction Targets • TPDDL Call Centers are global benchmark Powerlinks • India’s first private sector inter-state transmission project on a BOOT basis • Grid availability maintained at 98.49% (Eastern Region) and 99.95% (Northern Region) against stipulated norm of 98% Wind • Assets across Maharashtra, Gujarat, Tamil Nadu, Rajasthan and Karnataka Tata Power Renewable Energy Ltd. • Wind based projects of over 160 MW currently being developed across the country (Aggregated Tata Power operational wind power is now about 400 MW) Solar • Installed capacities: 29 MW • Land acquisition for new projects in progress • New projects being developed in Maharashtra, Gujarat and Rajasthan …Message Box ( Arial, Font size 18 Bold) 16 Kalinganagar, Odisha CPP-1: 202.5 MW (3 X 67.5 MW) Highlights • Project being executed through IEL, a JV of Tata Power (74%) and Tata Steel (26%) • Power supply to Tata Steel plant in Kalinganagar, Odisha Project Status • EPC contract awarded • All clearances for the project in place • On-ground execution in advanced stages …Message Box ( Arial, Font size 18 Bold) 17 Domestic Captive Coal Block Projects Mandakini Captive Coal Block • Being developed through JV of Tata Power, Monnet Ispat and Jindal Photo Film • Expected yield of 7.5 MTPA • Land acquisition completed • Vendor for mine development and operation under finalization Tubed Captive Coal Block • Coal block being developed through JV of Tata Power (40%) and Hindalco (60%) • Expected annual yield of 6.0 MTPA • Tata Power’s share of coal to be used for Tiruldih project • Land acquisition currently in progress Representative picture …Message Box ( Arial, Font size 18 Bold) 18 Tata Power Jamshedpur Distribution Limited Highlights • Distribution Franchisee agreement signed with JSEB on 5 Dec 2012 for a period of 15 years for power distribution in the Jamshedpur Circle in Jharkhand • Coverage area of approximately 3,600 sq. km • Consumer base of approximately 3 lakh • Expected date of takeover is around Oct 2013 With takeover of power supply for Jamshedpur, distribution retail consumer base of Tata Power will cross 2 million …Message Box ( Arial, Font size 18 Bold) 19 Dagacchu Hydroelectric Power Project, Bhutan: 126 MW Highlights • Project being implemented in Bhutan • Project being executed through JV of Tata Power (26%), Druk Green Power (59%) and NPPF, Bhutan (15%) • Civil works progressing as planned • 87% concreting completed • 98% manufacturing of electro mechanical equipment completed • Erection of various electro mechanical components at the dam site and in the Power House under progress …Message Box ( Arial, Font size 18 Bold) 20 Cennergi: 234 MW Highlights • Cennergi formed through 50:50 JV between Tata Power and Exxaro Resources Limited, the second largest coal producer in South Africa • Cennergi will focus on development of power generation projects in South Africa, Botswana, Namibia and other African countries • Steady progress towards financial closure for two wind projects (234 MW) for which it was declared successful by Dept. of Energy, Govt. of South Africa Representative picture …Message Box ( Arial, Font size 18 Bold) 21 Georgia Hydro: 400 MW Highlights • Tata Power in an agreement with Clean Energy Invest AS and IFC InfraVentures for development of hydro power projects in Georgia • 40% stake in the venture implementing three hydro projects aggregating to 400 MW • Power sale primarily to Turkey (85%) and the rest within Georgia (15%) • This project provides Tata Power with a window into the region and leverage Turkish connectivity to European power markets Source: lemill.net …Message Box ( Arial, Font size 18 Bold) 22 Domestic Projects New projects being developed Dugar Hydro: 380 MW Maithon Expansion: 1,320 MW Mundra Expansion: 1,600 MW 400 kV Vikhroli Transmission Coastal Maharashtra, Dehrand: 1,600 MW Begunia: 1,320 MW Tiruldih: 1,980 MW Kalinganagar CPP2: 450 MW Palaswadi, Solar, 28.8 MW Visapur, Wind, 28.8 MW Pethshivapur, Wind, 49.5 MW …Message Box ( Arial, Font size 18 Bold) 23 International Projects Ras Al-Khaimah (RAK) Sorik Marapi Geothermal, Indonesia Representative picture only • Memorandum of Agreement executed with Govt. of RAK for implementing comprehensive electricity management in the Emirate • Opportunity for Tata Power to associate with Generation, Transmission and Distribution systems of the Emirate • Project being executed by a consortium of Tata Power, Origin Energy and PT Supraco Indo. • Project in exploration phase • PPA negotiation in progress with Indonesia’s State Power Off-taker • Exploratory drilling to commence in FY14 …Message Box ( Arial, Font size 18 Bold) 24 Value Added Businesses Tata Power Solar Systems Tata Power Trading • Focused on manufacturing and sale of solar cells & modules, EPC and O&M services • Ranked 2nd largest power trader Tata Power SED Tata Power Services • Revenue of Rs. 293 Cr in FY13 • Leverages company’s capability in power plant O&M, project management, testing etc. • SED’s Software Unit successfully appraised at CMMI Level 5 • Consistent growth (~40% CAGR in 5 years) • Offers customized solutions to Greenfield and existing power plants …Message Box ( Arial, Font size 18 Bold) 25 Financials …Message Box ( Arial, Font size 18 Bold) Standalone Financials Figures in ` Crore FY13 FY12 Revenue from Operations (Net) 9,567.28 8495.84 Operating Expenditure 7,543.22 6,711.21 Operating Profit 2,024.06 1,784.63 Add: Other Income 721.67 983.46 Less: Finance Costs 678.25 514.87 2,067.48 2,253.22 364.10 570.35 1,703.38 1,682.87 678.69 513.14 1,024.69 1,169.73 Profit Before Depreciation and Tax Less: Depreciation/Amortization/Impairment Profit Before Tax Less: Tax Expenses Net Profit/(Loss) After Tax …Message Box ( Arial, Font size 18 Bold) 27 Consolidated Financials Figures in ` Crore FY13 FY12 Revenue from Operations (Net) 33,025.43 26,001.40 Operating Expenditure 26,580.73 21,101.18 6,444.70 4,900.22 369.20 268.76 Less: Finance Costs 2,635.53 1,527.09 Profit Before Depreciation and Tax 4,178.37 3,641.89 Less: Depreciation/Amortization/Impairment 2,901.69 3,134.64 Profit Before Tax 1,276.68 507.25 Less: Tax Expenses 1,177.96 1,475.54 98.72 (968.29) Operating Profit Add: Other Income Net Profit/(Loss) After Tax …Message Box ( Arial, Font size 18 Bold) 28 Q1 FY14 Performance - Standalone Figures in ` Crore Q1FY14 Q1FY13 Revenue from Operations (Net) 2,607.51 2,284.10 Expenses 2,001.53 2,061.74 Profit from operations before other income, finance costs and tax 605.98 222.36 Other Income 179.88 345.59 Profit before finance costs and tax 785.86 567.95 Finance costs 236.27 139.81 Profit before tax 549.59 428.14 Tax expense 192.59 115.84 Net profit after tax 357.00 312.30 …Message Box ( Arial, Font size 18 Bold) 29 Q1 FY14 Performance – Consolidated (Unaudited) Figures in ` Crore Q1FY14 Q1FY13 Revenue from Operations (Net) 9,339.49 7,253.89 Expenses 7,923.45 6,345.73 Profit from operations before other income, finance costs, exceptional item and tax 1,416.04 908.16 Other Income (227.92) 62.58 Profit before finance costs, exceptional item and tax 1,188.12 970.74 Finance costs 902.46 549.32 Profit before exceptional item and tax 285.66 421.42 - - Profit/(Loss) before tax 285.66 421.42 Tax expense 334.64 226.29 Net profit after tax (48.98) 195.13 (114.70) 146.93 Exceptional Item – Provision for impairment Net profit/(loss) after tax, minority interest and share of profit of associates …Message Box ( Arial, Font size 18 Bold) 30 Tata Power Stock Performance April 2011 – till date: normalized chart Apr 2012 value BSE Sensex Power Index Tata Power 17,319 2,012 106 120 110 100 90 80 70 60 …Message Box ( Arial, Font size 18 Bold) 31 Tata Power has undertaken a number of initiatives on Sustainability as a part of ‘Leadership with Care’ Sustainability initiatives Care for Environment Care for Community Renewables, clean/ green Community engagement energy Livelihood, infrastructure and natural resources Efficient technologies Carbon footprint reduction Initiatives Bio-Diversity conservation Fly ash brick manufacturing unit at Jojobera Solar lights – Mundra, Tiruldih, Maval, Mulshi and Maithon Eco-restoration and Ecodevelopment in Western Ghats Support for Uttarakhand – cash donation, solar lanterns, deputation of engineers to rebuild power supply Care for Customers Care for People Energy clubs Safety and health Customer care centers Employee learning & development Demand side management, energy audits 25 customer care centres Continued energy conservation efforts through Club Enerji Developing managers centric, across domains/ functions Association with DuPont for benchmarked safety management practices Special initiatives to address safety and special needs of women employees …Message Box ( Arial, Font size 18 Bold) 32 Uttrakhand – Immediate Support, in areas impacted Tata Power teams mobilized immediate support for impacted areas & residents along with other Tata Cos. …Message Box ( Arial, Font size 18 Bold) 33 Awards and Recognition CII ITC Sustainability Award 2012 for strong commitment to environment Power Line award for ‘Best Performing Renewable IPP’ Power Line ‘Best Performing Private Discom’ award for TPDDL Winner – ‘Infrastructure Excellence Awards 2012 for the project – Ultra Mega Power Project, Mundra’ …Message Box ( Arial, Font size 18 Bold) 34 Website: www.tatapower.com Email ID: md@tatapower.com Contact No: +91 22 6665 8888 …Message Box ( Arial, Font size 18 Bold) 35