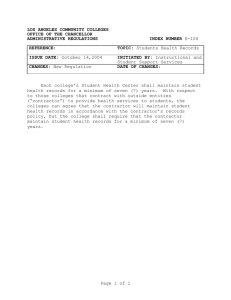

Request for Information

advertisement