madslkfamsdlkfjmalsdkjfmadksjfmlkjasmlcrjmsaeiorj,malsierjxmalksjerxmlaksje,mxalkjrmj- fùasdlkfùlaskmf clkajsemlrijasm,elrij,maslier,jxmalzkr,maslkrx,amslekrjvmn<slekrjcmw-

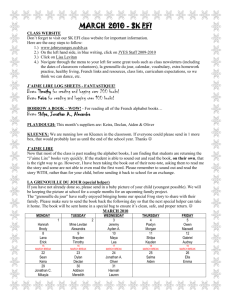

advertisement