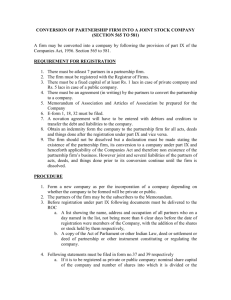

Accounting Financial Accounting: Published Final

advertisement