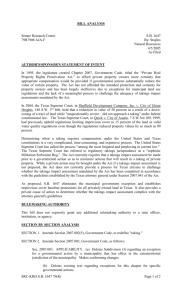

THE CURRENT STATUS OF HISTORICAL PRESERVATION LAW IN REGULATORY PRESERVATION PROGRAMS?

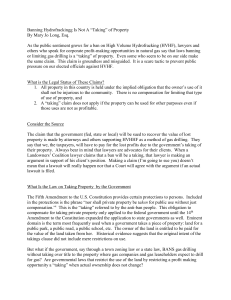

advertisement