Massachusetts Department of Transportation Statement of Sources and Uses

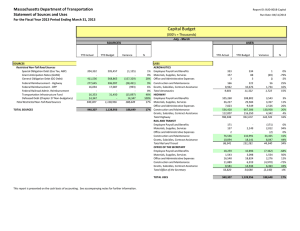

advertisement

Massachusetts Department of Transportation Statement of Sources and Uses For the Fiscal Year 2013 Period Ending December 31, 2012 Report ID: BUD-001-Capital Run Date: 01/23/2013 Capital Budget (000's = Thousands) Year to Date (YTD) July - December YTD Actual YTD Budget 13 Accounting Periods Budget Fiscal Year Variance YTD Actual + Projected Amount % Annual Budget Variance % SOURCES Restricted Non-Toll Road Sources Special Obligation Debt (Gas Tax, ABP) Grant Anticipation Notes (GANS) 133,813 140,576 - 6,763 - 5% 0% 361,510 - 360,451 (1,059) - General Obligation Debt (GO Debt) 299,581 341,872 42,291 12% 802,010 823,809 21,799 3% Federal Reimbursement - Highway 1 Federal Reimbursement - OPP Federal Railroad Admin. Reimbursement Transportation Infrastructure Fund 183,483 7,517 1,419 204,064 12,205 8,090 20,582 4,688 6,671 10% 38% 0% 82% 417,019 20,554 59,030 29,190 485,868 24,410 59,030 48,000 68,849 3,856 18,810 14% 16% 0% 39% 4,249 630,062 706,807 (4,249) 76,745 100% 11% 4,249 1,693,561 1,801,568 (4,249) 108,007 0% 6% 630,062 706,807 76,745 11% 1,693,561 1,801,568 108,007 6% 223 78 2 106 4,210 4,619 226 63 3 150 5,190 5,631 3 (16) 44 979 1,011 1% -25% 7% 30% 19% 0% 18% 461 125 5 300 14,828 15,719 456 125 5 300 14,828 15,713 (5) (5) -1% 0% 0% 0% 0% 0% 0% 71,196 73,873 2,677 4% 147,598 148,882 1,284 1% 15,586 4,155 369,489 61,169 521,596 18,416 6,767 416,019 64,904 579,979 2,830 2,612 46,530 3,735 58,383 15% 39% 11% 6% 0% 10% 35,908 13,532 951,013 202,059 1,350,110 36,833 13,534 1,080,693 201,828 1,481,769 925 2 129,679 (231) 131,660 3% 0% 12% 0% 0% 9% 106 63 2 59,710 6,058 65,940 1,535 68,773 11,831 82,139 (106) 1,472 (2) 9,063 5,773 16,199 0% 96% 0% 13% 49% 0% 20% 301 3,070 2 204,592 32,539 240,504 3,070 196,495 26,291 225,856 (301) (2) (8,096) (6,248) (14,647) 0% 0% 0% -4% -24% 0% -6% - - - 0% 0% 0% 0% 0% 0% 0% - - - 0% 0% 0% 0% 0% 0% 0% 12,199 849 11,307 8,774 4,779 37,907 7,367 2,213 14,706 4,675 10,097 39,058 (4,832) 1,364 3,399 (4,099) 5,318 1,150 -66% 62% 23% -88% 53% 0% 3% 26,354 3,798 29,005 12,648 15,424 87,229 15,797 3,525 29,362 9,350 20,194 78,228 (10,557) (273) 357 (3,298) 4,770 (9,000) -67% -8% 1% -35% 24% 0% -12% 630,062 706,807 76,745 11% 1,693,561 1,801,568 108,007 6% Defeased Debt (Chapter 27 Non-budgetary) Total Restricted Non-Toll Road Sources TOTAL SOURCES 2 0% 0% USES AERONAUTICS Employee Payroll and Benefits Materials, Supplies, Services 3 Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Snow & Ice Total Aeronautics HIGHWAY Employee Payroll and Benefits Materials, Supplies, Services 3 Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Snow & Ice Total Highway RAIL AND TRANSIT Employee Payroll and Benefits Materials, Supplies, Services 3 Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Snow & Ice Total Rail and Transit REGISTRY Employee Payroll and Benefits Materials, Supplies, Services 3 Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Snow & Ice Total Registry OFFICE OF THE SECRETARY Employee Payroll and Benefits Materials, Supplies, Services 3 Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Snow & Ice Total Office of the Secretary TOTAL USES EXCESS (SOURCES - USES) - This report is presented on the cash basis of accounting. See accompanying notes for further information. () Massachusetts Department of Transportation Statement of Sources and Uses Report ID: BUD-001B-Capital Run Date: 01/23/2013 For the Fiscal Year 2013 Period Ending December 31, 2012 Capital Budget (000's = Thousands) July - December SOURCES YTD Actual SOURCES Restricted Non-Toll Road Sources Special Obligation Debt (Gas Tax, ABP) Grant Anticipation Notes (GANS) General Obligation Debt (GO Debt) Federal Reimbursement - Highway Federal Reimbursement - OPP Federal Railroad Admin. Reimbursement Transportation Infrastructure Fund Defeased Debt (Chapter 27 Non-budgetary) Total Restricted Non-Toll Road Sources TOTAL SOURCES YTD Budget USES Variance % YTD Actual 133,813 299,581 140,576 341,872 (6,763) (42,291) 5% 0% 12% 183,483 7,517 1,419 4,249 630,062 204,064 12,205 8,090 706,807 (20,582) (4,688) (6,671) 4,249 76,745 10% 38% 0% 82% 100% 11% 630,062 706,807 76,745 11% USES AERONAUTICS Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Total Aeronautics HIGHWAY Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Total Highway RAIL AND TRANSIT Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Total Rail and Transit OFFICE OF THE SECRETARY Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Total Office of the Secretary TOTAL USES This report is presented on the cash basis of accounting. See accompanying notes for further information. YTD Budget Variance % 223 78 2 226 63 3 3 (16) 1% -25% 7% 106 4,210 4,619 150 5,190 5,631 44 979 1,011 30% 19% 18% 71,196 15,586 4,155 369,489 61,169 521,596 73,873 18,416 6,767 416,019 64,904 579,979 2,677 2,830 2,612 46,530 3,735 58,383 4% 15% 39% 11% 6% 10% 106 63 2 59,710 6,058 65,940 1,535 68,773 11,831 82,139 (106) 1,472 (2) 9,063 5,773 16,199 0% 96% 0% 13% 49% 20% 12,199 849 11,307 8,774 4,779 37,907 7,367 2,213 14,706 4,675 10,097 39,058 (4,832) 1,364 3,399 (4,099) 5,318 1,150 -66% 62% 23% -88% 53% 3% 630,062 706,807 76,745 11% Massachusetts Department of Transportation FY 2013 Second Quarter Report (July to December 2012) Capital Budget Statement of Capital Sources and Uses – Actual vs. Budget – for the Fiscal Year 2013 Through Q2 Period Ending December 31, 2012 The attached Statement of Capital Sources and Uses for the period ending December 31, 2012 details line item variances which have resulted in a capital budget underspend of $76.7 million. It should be noted that the Uses variances are what drive the Sources variances. As such, we direct your attention to the Uses of capital for more fulsome explanations for the underspend. It is considered within MassDOT’s capital budget that a variance is significant if it equals or exceeds 5% budget AND is of a magnitude of $5,000,000 or more. Each such variance is explained below. SOURCES: Special Obligation Debt: Special Obligation Debt funds the Accelerated Bridge Program (ABP) and is $6.7 million or 5% under budget due to lower than expected spending in the ABP program. GO Debt: General Obligation (GO) Debt funds the 20% match for federally aided projects and all non federally aided projects. Through the second quarter of the fiscal year, our GO debt funding requirements are $42.3 million or 12% under budget, see notes below under Highway and Rail and Transit Divisions. Federal Highway Reimbursement: Federal Highway Reimbursement was $20.6 million or 10% under budget, due to lower than expected spending in Federally Aided Construction projects. This trend will continue throughout the fiscal year. Transportation Infrastructure Fund: The Transportation Infrastructure Fund was $6.7 million or 82% under budget, due to the uncertainty of claims and settlements related to the Central Artery Project. This trend will continue throughout the fiscal year. 1 USES: Highway Division Construction and Maintenance: Construction and Maintenance spending is a favorable variance of $46.5 million or 11% under budget, due to the effect of a late start in advertising projects. This is due to the delay of the 2012 Transportation Bond bill, as contractors couldn’t bid on contractors without capital funding. Also, a number of our larger construction projects are at the completion phase, thus not generating as much in expenditures as in prior quarters. This trend will continue through the fiscal year leaving a budget balance of $129.7 million. The ABP program is spending lower than expected in the first two quarters for construction and overhead. However, the ABP unit anticipates that spending will escalate over the course of the fiscal year on ABP mega projects. Rail and Transit Division Construction and Maintenance Construction and Maintenance spending is a favorable variance of $9.1 million or 13% under budget due to timing delays for South Station expansion and renovation, Knowledge Corridor Rail project between Hartford and Canada, Beverly and Salem Garages, and the Green Line to Medford Extension. The Rail and Transit Division anticipates that spending will escalate throughout the fiscal year and the Green Line to Medford Extension will come in over budget. Grants, Subsidies, and Contract Assistance Grants, Subsidies and Contract Assistance spending is a favorable variance of $5.8 million or 49% under budget due timing delays for the Fairmont Commuter Rail project. The Rail and Transit Division anticipates that spending will escalate throughout the fiscal year and the Fairmont Commuter Rail project will come in over budget. Office of the Secretary Employee Payroll and Benefits Employee Payroll and Benefits is projecting an unfavorable variance of $10.5 million or 67% over budget for the entire fiscal year, due to a delay in the transfer of employees from capital and operating. Grants, Subsidies, Contract Assistance Grants, Subsidies, Contract Assistance has a favorable variance of $5.3 million or 53% at the close of the second quarter. However, that surplus will be reduced as Transportation Planning ramps up spending in the third and fourth quarters. 2 Footnotes: 1. Federal Highway Reimbursement includes ARRA funding. 2. Chapter 27 of the Acts of 2007, Section 12 provided for the defeasance of outstanding bonds of the Commonwealth. The Debt service savings are used as a source of capital expenses. Therefore, the sources are not budgeted because the expenses are not subject to the allocation of bond proceeds. 3. The category "Materials, Supplies, and Services" includes Interdepartmental Service Agreement (ISA) expenses. ISA’s are contracts that MassDOT enters into with other Commonwealth departments to perform services. 3