Massachusetts Department of Transportation

advertisement

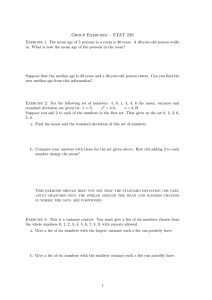

Massachusetts Department of Transportation Statement of Revenue and Expenses - Actual vs. Budget For the Fiscal Year 2013 Through Period Ending December 31, 2012 Report ID: BUD-001B-MTTF Run Date: 01/15/2013 Massachusetts Transportation Trust Fund (000's = Thousands) Year to Date (YTD) July - December Variance Favorable / (Unfavorable) Seasonally Adjusted Budget YTD Actual REVENUE Toll Revenue Pledged - MHS and WT Toll Collections Departmental Rental/Lease Income Unpledged - Tobin Total Toll Revenue Non-Toll Revenue Departmental Rental/Lease Income Total Non-Toll Revenue Commonwealth Trust Fund Transfer Operations funding Metropolitan highway system bonds Central artery operations and maintenance Total Commonwealth Trust Fund Transfer 13 Accounting Periods Budget Fiscal Year YTD Actual + Projected % Variance Favorable / (Unfavorable) Annual Budget % 156,294 6,258 19,309 15,737 197,597 154,707 7,859 17,588 15,733 195,887 1,587 (1,601) 1,721 4 1,710 1% -20% 10% 0% 1% 306,791 16,288 33,280 31,221 387,579 302,308 16,513 32,528 31,283 382,632 4,483 (225) 752 (62) 4,947 1% -1% 2% 0% 1% 11,199 2,118 13,317 12,055 2,695 14,750 (855) (577) (1,432) -7% -21% -10% 16,657 4,483 21,140 18,277 5,390 23,667 (1,620) (907) (2,527) -9% -17% -11% 74,605 50,000 25,000 149,605 74,605 50,000 25,000 149,605 - 0% 0% 0% 0% 124,777 100,000 25,000 249,777 129,655 100,000 25,000 254,655 (4,878) (4,878) -4% 0% 0% -2% 106,135 113,135 (7,000) -6% 115,135 115,135 - 0% 1,509 745 764 103% 2,814 1,490 1,324 89% 15,250 483,413 15,250 489,371 (5,958) 0% -1% 15,250 791,696 15,250 792,829 (1,133) 0% 0% 225 3 38 266 226 5 54 285 1 1 16 18 1% 25% 29% 0% 0% 0% 0% 6% 471 7 90 568 484 7 90 581 13 13 3% 0% 0% 0% 0% 0% 0% 2% 55,910 14,118 11,968 1,918 42,152 10,924 136,990 59,002 18,435 15,995 3,107 39 59,906 21,629 178,113 3,092 4,316 4,028 1,189 39 17,754 10,705 41,124 5% 23% 25% 38% 100% 30% 49% 23% 113,497 40,836 31,869 6,374 45 100,491 60,642 353,755 121,987 39,796 34,987 6,656 84 133,071 45,400 381,982 8,490 (1,040) 3,118 282 39 32,581 (15,242) 28,227 7% -3% 9% 4% 46% 24% -34% 7% 65 1 111,827 111,892 122 1 112,635 112,758 57 - 240 1 121,635 121,877 244 1 121,635 121,881 4 - 808 866 47% 0% 10% 0% 1% 0% 0% 1% 4 2% 0% 5% 0% 0% 0% 0% 0% 19,564 3,570 5,024 28,158 21,327 4,504 5,355 1 31,187 1,763 934 332 1 3,029 8% 21% 6% 100% 0% 0% 0% 10% 40,909 8,893 11,697 1 61,499 42,828 9,008 10,712 1 62,549 1,919 115 (985) 1 1,049 4% 1% -9% 50% 0% 0% 0% 2% 8,993 1,175 8,226 765 944 722 31 20,856 17,567 1,734 10,194 1,204 889 3,251 7 34,845 8,575 559 1,968 439 (55) 2,528 (25) 13,990 49% 32% 19% 36% -6% 78% -366% 40% 22,236 3,048 21,107 4,553 1,905 4,472 61 57,383 37,363 3,751 22,108 4,561 1,926 7,000 23 76,733 15,127 703 1,001 7 21 2,528 (37) 19,350 40% 19% 5% 0% 1% 36% -159% 25% 298,162 357,189 59,026 17% 595,082 643,725 48,643 8% 47,542 47,542 47,078 47,078 (463) (463) 0% -1% 0% -1% 55,045 94,012 149,057 55,045 94,012 149,057 - 0% 0% 0% 0% Total Operating Expenses and Debt Service 345,704 404,267 58,563 14% 744,139 792,782 48,643 6% Net Revenue (Expense) before Transfers 137,709 85,104 47,557 - - - - - 137,709 85,104 47,557 - Commonwealth grants and contract assistance Investment Income Use of Reserves Total Revenues EXPENSES Operating Expenses AERONAUTICS Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Pay Go Maintenance Snow & Ice Total Aeronautics HIGHWAY Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Paygo Maintenance Snow & Ice Total Highway RAIL AND TRANSIT Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Pay Go Maintenance Snow & Ice Total Rail and Transit REGISTRY Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Pay Go Maintenance Snow & Ice Total Registry OFFICE OF THE SECRETARY Employee Payroll and Benefits Materials, Supplies, Services Office and Administrative Expenses Construction and Maintenance Grants, Subsidies, Contract Assistance Paygo Maintenance Snow & Ice Total Office of Programming and Planning Subtotal Operating Expenses Debt Service Principal Interest Cost of issuance Total Debt Service Transfers In Transfers Out Net Revenue (Expense) - Numbers shaded in green denote both a significant variance of more than 5% and a magnitude of dollar amount, more than $500,000. Explanation for variances are on the attached Budget Highlight report. This report is presented on the cash basis of accounting. See accompanying notes for further information. S:\MassHighway\IT\Documentation\BrooksJ\WebWork_Transfer\_InfoCenter\MTTF\[Copy of Operating FY13 FP6 Dec v4 FINAL.xlsx]Report 1 Board Massachusetts Department of Transportation FY 2013 Second Quarter Report (July to December 2012) Massachusetts Transportation Trust Fund Statement of Revenue and Expenses – Actual vs. Budget – for the Fiscal Year 2013 Through Q2 Period Ending December 31, 2012 The attached Statement of Revenue and Expenses through December 31, 2012 details line item variances which have resulted in net revenues of $137.7 million. On a seasonally adjusted basis, we expected an $85.1 million surplus which would be spent down during the last two quarters of the fiscal year. The positive variance by $58.6 million on top of the $85.1 million is primarily the result of both Paygo Maintenance money generated by the tolled roads not being spent as well as under-spending Snow & Ice monies due to a mild winter start. Total revenue, however, is trending to budget. It is considered within MassDOT’s operating budget that a variance is significant if it equals or exceeds 5% budget AND is of a magnitude of $500,000 or more. Each such variance is explained below. REVENUE Toll Revenue-Departmental: Departmental Revenue has an unfavorable variance of $1.6 million or 20% under budget. Departmental revenue is a combination of court fines and other miscellaneous revenues. While court fines through December 2012 of $2.4 million are in line with anticipated revenue, miscellaneous revenues (towing, advertising, permit fees, reducible load permits, special hauling permits, state police details and other miscellaneous revenue items) have been under-collected. While these fees certainly fluctuate throughout the year, as of December 2012, $3.8 million has been collected in miscellaneous revenues, which is well under the anticipated revenue of $5.5 million. Because of the variable nature of the miscellaneous revenues, there is not a predictable revenue stream. However, based on historical trends of monthly revenue receipts, it is likely that the variance will be closed in the third and fourth quarters of the fiscal year. Toll Revenue-Rental/Lease Income: Rental/Lease Income has a favorable variance of $1.7 million or 10% over budget. A portion of the additional revenue is attributable to two large payments by Nextel in September associated with the termination of a wireless communication agreement in the Ted Williams Tunnel ($975,000) and Sumner Tunnel ($618,000). While this variance indeed is favorable in this report, we will make every effort to replace this stream of income, although given the consolidations that have taken place among carriers, this will prove to be difficult. 1 Non-toll Departmental: Departmental revenue has an unfavorable variance of $855,000 or 7% below budget. The variance is due to the late execution of the fee increases for the Ignition Interlock Device Fee and the Irreducible load truck permit fees. The collection of the revised fees are expected to start in February and March. Non-Toll Rental/Lease Income: Rental/Lease Income has an unfavorable variance of $577,000 or 21% below budget. The variance is the result of rental credits owed to McDonalds by MassDOT for environmental clean-up costs incurred and paid for by McDonalds on their MassDOT rental properties located in Newton and Lexington. The credits of $2.3 million due McDonalds will be offset with rental income in FYs’13, ‘14, and ‘15. Commonwealth grants and contract assistance: Commonwealth grants and contract assistance has an unfavorable variance of $7 million or 6% under budget. Included in this category are the allocations to the Massachusetts Transportation Trust Fund from the Motor Vehicle Safety Inspection Trust Fund, which are delayed based on the cash flow needs of the Safety Inspection program. Investment Income: Investment Income is a favorable variance of $764,000 or 103% over budget. The variance in investment income relates to the presentation of interest earnings on the MassDOT financial report. The annual budget of $1.49 million relates to the interest earnings on MassDOT cash balances. The actual investment income through December of $1.5 million includes both interest earnings on MassDOT cash balances as well as interest earnings on debt service accounts held at the fiscal agent, which is restricted to pay debt service. This budget will be corrected in the next fiscal year to include investment income from debt service and cash balances. EXPENSES Highway Division Employee Payroll and Benefits: Employee Payroll and Benefits has a favorable variance of $3.1 million or 5% under budget due to delays in hiring. Materials, Supplies, Services: Materials, Supplies, and Services has a favorable variance of $4.3 million or 23% under budget. This is primarily due to a delay in billing that we receive from the State Police for Troop E charges. As of December 31st we had only processed bills through September of 2012. We are pressing Troop E to send us its bills more quickly going forward. 2 Office and Administrative Expenses: Office and Administrative Expenses has a favorable variance of $4 million or 25% under budget. Utilities are funded out of this spending category, and many of the Highway District offices have large favorable variances at the end of the second quarter. Although generally the Districts are current in processing their utility bills, there are delays in the receipt of the bills following the close of the month. Additionally, utility costs were down because maintenance depots that would normally be open for snow and ice operations, were only open minimally in the first two quarters. Also funded in this category are employee related expenses, which are down due to a delay in the hiring plan. Construction and Maintenance: Construction and Maintenance has a favorable variance of $1.2 million or 38% below budget. The Highway purchased less than anticipated sand and salt for the tolled roads in the first two quarters. Paygo Maintenance: Paygo Maintenance has a favorable variance of $17.8 million or 30% under budget. Western Turnpike and Tobin are spending close to budget as of the second quarter. However, the Metropolitan Highway System (MHS) is significantly under budget due to delays in getting contracts out. Recently, MassDOT transferred 30 employees from the Accelerated Bridge Project to the MHS to assist with putting together bid documents and accelerate the award of contracts. Snow and Ice: As of December 31st, the Snow and Ice budget had a favorable variance of $10.7 million or 49%. Since the beginning of Q3’13 - which is not reflected in this budget report - that positive variance has since been depleted, and as of 2/14/13 we have expended $60.7 million against a budget of $45.4 million. Additionally, MassDOT has been assisting cities and towns with snow removal following the Blizzard of 2013. We have informed Administration and Finance, the Senate and the House of our current deficiency and that MassDOT requires supplemental funding. Registry Employee Payroll and Benefits: Employee Payroll and Benefits has a favorable variance of $1.8 million or 8% due to delays in hiring. As such, and in order to supplement its workforce, the Registry utilized less expensive college interns during the month of December. 3 Materials, Supplies, Services: Materials, Supplies, Services has a favorable variance of $934,000 or 21% as of the second quarter due to delays in billing for credit card fees. Credit card fees related to Registry online transactions are one of the major budgeted items in this spending category. MassDOT has received and processed four months of bills for credit card fees as of December. As of today, we have processed all credit card bills through December. Office of the Secretary Employee Payroll and Benefits: Employee Payroll and Benefits has a favorable variance of $8.6 million or 49% below budget. This is due to the delay in transferring employees from capital to operating. While some employees have been transferred off of capital, not all that are planned to be transferred have actually been transferred. The reason for this is that Fiscal wants to ensure there is adequate non-toll revenue to cover the transferred employees when the transfer takes place. Materials, Supplies, Services: Materials, Supplies, and Services has a favorable variance of $559,000 or 32% under budget. The majority of the variance can be attributed to under-spending by the Fiscal Office for budgeted consultant services. Office and Administrative Expenses: Office and Administrative Expenses has a favorable variance of $2 million or 19% below budget. A major component in this expenditure category is for liquidity fees. Through December, we have paid the first quarter in liquidity fees. The second quarter payment was processed in January which will make this variance less positive in future FY’13 quarters. Paygo Maintenance: PayGo Maintenance has a favorable variance of $2.5 million or 78% below budget. As noted above, the reduced spending is due to the delay in awarding contracts. Full Year Trends and Projections: Total Department-wide revenue for all of FY’13 is projected to be $1.1 million under budget. There are several major contributing factors to the reduction in forecast revenue. First, as noted above we anticipate less revenue for non toll Departmental Revenue because of delays in implementing fee increases for Interlock Devices and Irreducible load permits. Second, due to a rent credit from McDonald’s as described above, we anticipate less non toll Rent/Lease Income. Lastly, a 9C budget 4 reduction of $4.87 million will be imposed in the second half of the fiscal year, reducing our Commonwealth Trust Fund Transfer. These decreases in revenue are offset by an anticipated increase of $4.9 million for toll revenue and $1.3 million for investment income. The increase in toll revenue can be attributed to violations which are considerably higher than last fiscal year. This is likely due to a new program that was implemented at the end of last fiscal year to pursue out of state violations. FY’13 Department-wide operating expenses are projected to be $48.6 million or 6% below budget at year end for the following major reasons. The snow and ice budget is currently forecast to go over by $15.2 million. This forecast will be revised in the next quarter. However, the Paygo Maintenance budget is forecast to be under budget by $35.1 million as the result of delays in advertising and contracting. Employee payroll and benefits is forecast to be under budget by $25.5 million due to delays in hiring and the transfer of employees from capital to operating. At fiscal year end, MassDOT is forecasting net excess revenue over expenses to be $47.6 million. This is the result of operating expenses forecast to be under budget by $48.6 million, as well as revenue projected to be under budget by $1.1 million. The primary reason for projected spending below budget is delays in advertising and contracting for major capital projects, resulting in a lower than anticipated Paygo Maintenance forecast. The year-end net revenue balance is primarily restricted toll funds and will be rolled forward to a reserve account for future use on toll capital projects. 5