Why & How Integrators Can Succeed in Building Automation

advertisement

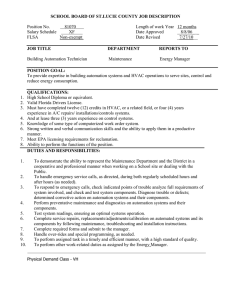

Why & How Integrators Can Succeed in Building Automation Security integrators can gain revenue opportunities and deepen customer relationships when integrating security systems with building automation systems. But there’s a learning curve. By Heather Klotz-Young September 10, 2014 The Perot Museum of Nature & Science is a recently completed project that “took security and building automation to the next level,” according to Steven Turney, security program manager for Schneider Electric, the project’s integrator. “When all was said and done, the system brought security, intercom, access control, fire alarm, building automation, EV charging stations and CCTV into a single, unified system that the customer can control from one location if desired. Other goals included LEED certification, a reduced carbon footprint and an overall energyefficient facility,” Turney notes. The equation 1+1=2 is simple. It is one of the first concepts learned in math. But it is not as straightforward as it would seem, really. The proof for 1+1=2 is more than 300 pages long and it wasn’t conclusively proven until the 20th century by Bertrand Russell. Likewise, building automation systems (BAS) are a very complex manifestation of a simple principle: control. Mastering that complexity takes time, planning and intention for integrators choosing to offer BAS. SDMspoke with several leading integrators about their experiences with BAS, asking about how they are finding success, any stumbling blocks to avoid, resources needed, profit opportunities and more. Although the concept of building automation has been in existence for a long time, growing awareness, new technologies, and a demand for energy-efficient buildings and enhanced security are driving the BAS market forward and creating new opportunities for integrators. “Customers and engineers are starting to see the benefits of truly integrated building solutions. Anyone can plug disparate control panels into the same network switch, but few can provide a holistically integrated solution that leverages the individual capabilities of those disparate control panels to build a system that secures a facility and protects its occupants — but also keeps them comfortable while saving energy at the same time,” observes Steven Turney, security program manager at Carrollton, Texas-based Schneider Electric. Customers benefit from reduced installation and support costs as well as an increased flow of information that allows them to make more informed decisions, he adds. By managing various building systems, the automation system ensures the operational performance of the facility as well as the comfort and safety of building occupants. But it takes time and training to design, install and maintain such a complex system. Every integrator offering BAS has taken a different path to get there, whether through partnerships, acquisition, staff hiring/training, or another route. There is no silver bullet, and every integrator must carefully weigh what works for his or her unique company. Advantech Inc., located in Dover, Del., forged into BAS about eight years ago when it recognized that there was not a suitable product for its end users to easily manage and control the security systems for large facilities. This was especially true for facilities management and custodial staff, who didn’t have access to control rooms or security equipment, shares Eric Schaeffer, the company’s president and this month’s cover subject. Today, Advantech has developed its own customer GUIs and command stations that serve as an intuitive interface for building and facility management. The company is also a Honeywell Integrated Security (HIS) National Dealer of the Year for 2008, 2010 and 2011, utilizing the ProWatch Integration Program, enables integrators and end users of the program to integrate security with building, industrial or enterprise systems, using an open architecture platform. For its first project, the company worked with a high school to develop a customer touch screen controlled graphical user interface (GUI), multiple system integration, and more. But it used the expertise of its current staff, who Schaeffer says had the drive to be successful in developing new solutions for the customer’s challenges. The initial team included Dave Sweeney, director of sales, and John Gampp, director of system support. “Their focus on testing and validating in our test lab prior to customer deployment has made our projects move smoothly and successfully,” Schaeffer says. “Since then we have trained additional existing employees and have also added staff with strong networking and IT skills. A little over a year ago we also hired a sales engineer, Frank Yoder, with more than 20 years in the BAS industry.” “After this initial project we started adding more functionality into the GUIs. We also started deploying these solutions in other vertical markets,” Schaeffer shares. “Initially, the primary focus was on security, but as the capabilities increased these solutions became more and more valuable for operations and facility management. The interfaces Advantech designs greatly simplify control of multiple systems and functions creating significant efficiencies, which greatly reduce man-hours. Schaeffer estimates the efficiencies Avantech offers with its BAS often save customers 100 man-hours a month or more, a huge savings of time and resources. “In many applications the pay back can be achieved in a matter of months,” he says. Other integrators use acquisitions to enter the field. It worked best for Draper, Utah-based Utah Yamas Controls, which acquired a local BAS integrator (see related article on page 67) and Chicago-based System Development Integration LLC (SDI), which acquired i-sys, Charleston, S.C., a veteran BAS provider (see related article on page 64). In addition to acquisitions, establishing relationships with the key vendors and providing training opportunities to the staff to educate them about the products, capabilities and features is a key to success, advises Denny Stover, executive vice president, San Diego and Northern California, Universal Protection Security Systems, Santa Ana, Calif. “It takes patience and finding the right partners and the right products to create the right solution, he adds. “You can’t take any shortcuts in this industry,” he told SDM. Major BAS Industry Drivers Operational costs savings and energy efficiency are major drivers of BAS installations and retrofits. Industry surveys have determined that building owners and managers are realizing the many financial benefits of intelligent technologies, such as lower energy costs, lower maintenance costs and lower repair and replacement costs, says Rawlson O’Neil King, communications director, Continental Automated Buildings Association (CABA), Ottawa, Ontario, Canada, an international not-for-profit industry association with more than 400 members dedicated to the advancement of intelligent home and intelligent building technologies. “Energy costs represent about 30 percent of an office building’s total operating costs, providing enormous opportunity for building owners not only to reduce operating costs, but also to make significant improvements in the overall environmental performance of their properties. By changing energy management practices and instituting intelligent building technologies that enhance energy efficiency, building owners and managers can reduce energy consumption by up to 35 percent,” King estimates. The ability to demonstrate the savings grabs end users’ interest more quickly. “If you look at security in many phases, there are intangible benefits. Security systems meet insurance requirements, they provide protection for possible events, and the value, while real, is less tangible on what you get back from a building automation system that brings in some very measurable benefits. When the HVAC system is turned off or the lights are turned out after everyone has left for the day, you save a measurable amount of money,” explains Chris Koetsier, director, product marketing, Honeywell Security, Melville, N.Y. “You can show the savings. But one of the challenges for integrators actually is that building automation is a different sale. You are talking about a very objective model.” In addition to the different sales model, there are regulations to master. Building automation is driven by regulation, especially in Europe and Japan, and this is growing in the United States. “While regulation is lower in North America right now due to the nature of our economy and the way the free market trumps government directives, this is changing. You will start to see more and more regulations grow that demand an increase in energy efficiency,” King says. Mirroring the Home The awareness and expectation for automation in general is growing, making building managers more receptive to BAS. It’s important to remember that facility managers are consumers like the rest of us, says Alan Stoddard, senior director, marketing at Honeywell Security. “They go home and manage their lives with their smartphones. If they see that adding a smart thermostat to a security system saves money on their home electrical bills, then it would stand to reason they would want the same benefits and intuitive user experience for their buildings as well,” he adds. Integrators are able to succeed in building automation by capitalizing on commercial property owners’ needs, empowering business owners to take control of their building systems, and helping commercial end users optimize their systems to save the most money over time, Stoddard says. “Much like we’re seeing in the connected home space, security technology is ideal to serve as the core for these types of building systems because it knows when the building is occupied, who is in the building, and where they are within the facility.” BAS By Numbers Between rising energy costs, looming regulations and automation awareness, the numbers predicted for BAS growth are impressive, making the efforts of mastering the offering easier to accept. The U.S. market for building automation equipment is set to grow by more than 40 percent within a five-year period ending in 2017, spurred by the need in commercial buildings for more efficient energy consumption, according to a report from IHS Inc. released in late 2013. Solid growth ranging from 7 to 9 percent is expected in the next four years, with industry revenue forecast to hit $2.24 billion by 2017, equivalent to a 43 percent increase from 2012. Research and Markets predicts that the market for global intelligent building automation technologies will increase to $74.8 billion by 2019. Among all the technologies discussed, energy management technologies are registering a high growth rate followed by emergency response and commercial lighting control. North America is leading the global intelligent building automation technologies market with a share of more than 40 percent in 2014, followed by Europe. The spiraling cost of electricity is a major factor in the operational efficiency of a commercial building structure, which explains why building automation systems could play an important role. “With budgets cut and many large companies struggling to grow at more than 5 percent on an annual basis, the higher cost of electricity could prove to be a major headache for commercial and government building owners,” said Sam Grinter, market analyst for the Building Technologies group at IHS. “Making buildings as efficient as possible is crucial to driving down energy consumption. And one way to increase energy efficiency is to install an integrated building automation system,” he says. BAS solves myriad end user needs, which attracts more integrators to it in order to provide a comprehensive, needs-focused solution. Also, while the integration and control possibilities do continue to grow more complex, technology developments such as wireless and auto-discovery IP devices are providing a counterbalance, allowing more companies into the arena. BAS knowledge once seemed to be the exclusive domain of the ‘wizard-behind-the-curtain,’ but those days are long gone,” says Kevin McKeegan, building operations manager, SDI. More integrators are successfully learning what really makes 1+1=2.