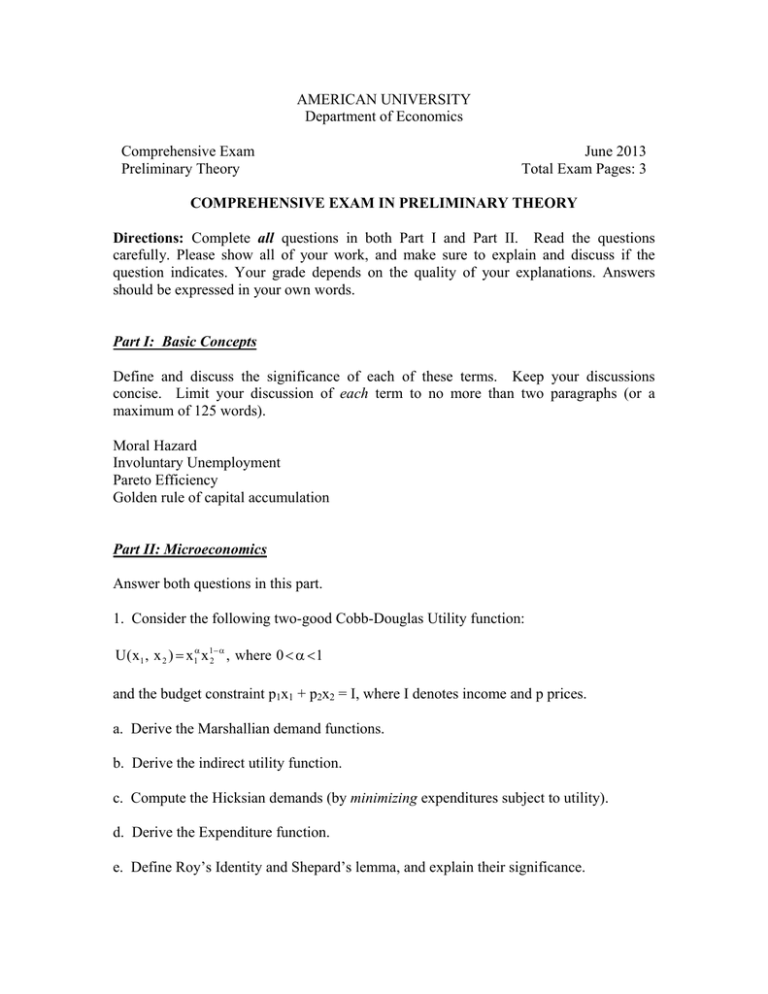

AMERICAN UNIVERSITY Department of Economics Comprehensive Exam

advertisement

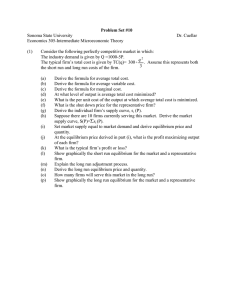

AMERICAN UNIVERSITY Department of Economics Comprehensive Exam Preliminary Theory June 2013 Total Exam Pages: 3 COMPREHENSIVE EXAM IN PRELIMINARY THEORY Directions: Complete all questions in both Part I and Part II. Read the questions carefully. Please show all of your work, and make sure to explain and discuss if the question indicates. Your grade depends on the quality of your explanations. Answers should be expressed in your own words. Part I: Basic Concepts Define and discuss the significance of each of these terms. Keep your discussions concise. Limit your discussion of each term to no more than two paragraphs (or a maximum of 125 words). Moral Hazard Involuntary Unemployment Pareto Efficiency Golden rule of capital accumulation Part II: Microeconomics Answer both questions in this part. 1. Consider the following two-good Cobb-Douglas Utility function: U(x1 , x 2 ) x1 x12 , where 0 1 and the budget constraint p1x1 + p2x2 = I, where I denotes income and p prices. a. Derive the Marshallian demand functions. b. Derive the indirect utility function. c. Compute the Hicksian demands (by minimizing expenditures subject to utility). d. Derive the Expenditure function. e. Define Roy’s Identity and Shepard’s lemma, and explain their significance. 2 2. Suppose the market demand for tablets is given by P = 500 - Q, and that there are only two firms in the world industry, Apple and Samsung, both of which have constant average and marginal costs: AC = MC = 200 dollars. To simplify, assume only one (homogenous) type of tablet. a. Suppose the two firms competed as Cournot duopolists. Derive the two firms’ reaction functions and find the equilibrium output per firm, price, and profits per firm. b. If Apple were a Stackelberg leader, what would be the equilibrium output per firm, price, and profits per firm? c. If Apple and Samsung were to merge as one company, what would be the equilibrium output produced, price, and profits? d. If the two firms competed as price takers, what would be the equilibrium output per firm, price, and profits per firm? e. Suppose Apple and Samsung competed as Bertrand duopolists. Characterize the two firms’ reaction functions and find the equilibrium output per firm, price, and profits. f. Summarize the above results by ranking the different models according to the total output produced. Part III: Macroeconomics Answer both questions in this part. 3. Consider the following closed-economy Keynesian model: Y=C+I+G C = C(Y), I = I(r), (M/P) = L(r, Y), 0 < CY < 1 Ir < 0 Lr < 0, LY > 0 where Y denotes output, C consumption, I investment, L liquidity preference, and r the interest rate. Government spending G, money supply M, and the price level P are exogenously given. a. Derive the IS curve and LM curve. b. Linearize the IS and LM curves, and rewrite the system of equations in 2 x 2 matrix form; namely, AX = B, where “X” is a vector of endogenous variables (dY and dr), “A” a matrix of coefficients, and “B” a vector of exogenous changes (dM, dG, and dP). 3 c. Using Cramer’s rule, derive the following comparative static effects (holding other factors constant): Y/G, Y/M, r/G, and r/M. Discuss how the efficacy of monetary and fiscal policies depends on the interest elasticities of investment and money demand. Illustrate graphically. 4. Suppose that a consumer maximizes: U e t ln c t dt 0 subject to : a t ra t w t c t where c denotes consumption, a financial assets, w wage income, r the real interest rate, and the time preference rate. Do not assume r = (yet). a. Use the method of Hamiltonian to derive the optimal path of consumption (i.e. the Euler equation). b. Solve the flow budget constraint forward by the method of integrating factors, and apply the transversality condition to derive the intertemporal budget constraint. c. Solve the Euler equation to derive the level of consumption at time t as function of consumption at time 0. (Again, do not assume r = yet). Combine your result with the result in part b to derive the permanent income hypothesis (PIH) consumption function. Concisely explain the PIH. What does the marginal propensity to consume depend on? d. Now assume that, in the aggregate economy, r = . Why would consumption follow a random walk? Discuss using the discrete-time counterpart of the Euler equation. What would cause changes in consumption over time? e. Discuss the testable implications of the PIH. How should consumption react to lagged, current income? If u represents innovation in permanent income, which is greater: the variance of consumption changes or the variance of u, and why? f. Are the empirical findings consistent with the theoretical predictions? Explain what might cause the PIH model to fail empirically. g. From a policy perspective, why should it matter whether consumption follows the PIH or the Keynesian model?